Profile of the Responding Consultants

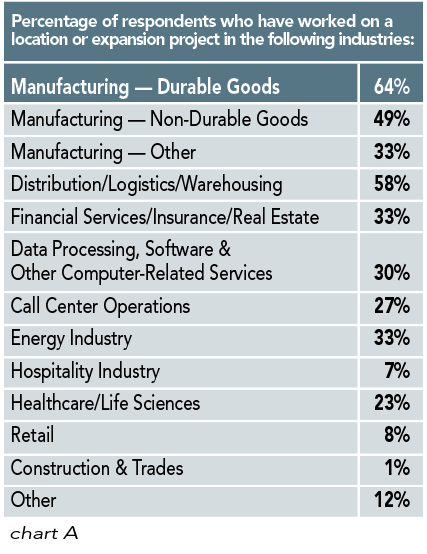

Nearly two thirds of those responding to our 11th Annual Consultants Survey have worked on location or expansion projects in the durable goods manufacturing sector and half in the nondurable goods manufacturing sector. Nearly 60 percent have assisted distribution/logistics/warehousing firms with their plans, and fully a third have worked with firms in financial services/insurance/real estate as well as the energy industry (chart A).

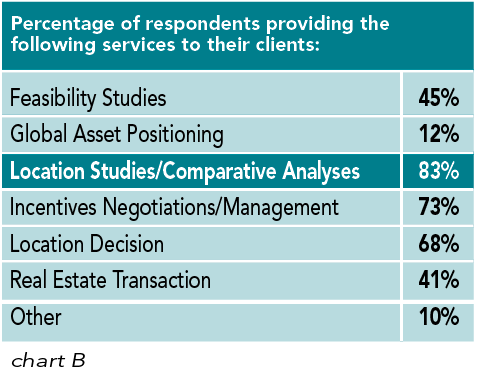

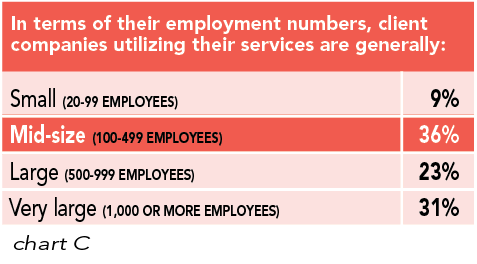

More than 80 percent of the responding consultants say they have helped their clients with location studies/comparative analyses, and nearly three quarters handle incentives negotiation and management for their clients. Interestingly, 68 percent claim to assistant in their clients’ location decisions (chart B). In terms of their employment numbers, 90 percent of the companies using the consultants’ services are mid-size to very large (100 to 1,000+ workers) (chart C). Since 32 percent of those responding to our Corporate Survey are with companies with fewer than 100 employees, we can see why the responses to our Corporate and Consultants surveys would differ.

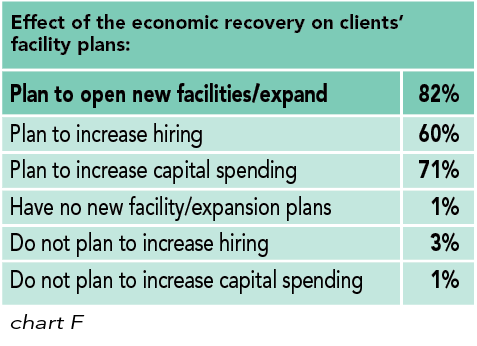

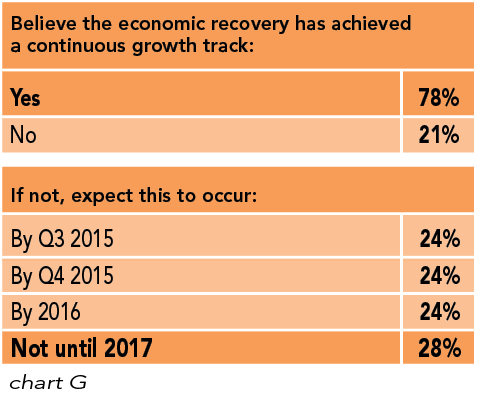

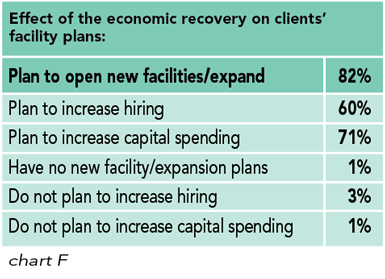

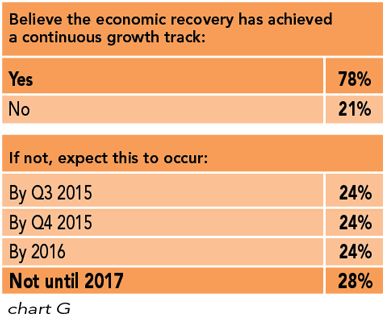

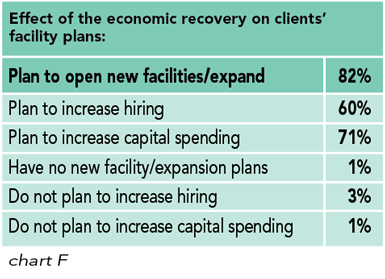

Since consultants are utilized by their clients once they’ve already initiated the location process, it follows that nearly all of the responding consultants say the economic recovery has had a positive effect on their clients’ facility plans: 82 percent claim their clients plan to open new facilities; 71 percent say they plan to increase capital spending; and 60 percent say their clients will also increase hiring (chart F). In fact, more than three quarters of those responding to our Annual Consultants Survey believe the economy has achieved a continuous growth track — twice the percentage of Corporate Survey respondents who hold that belief — and of those consultants who feel it has not, nearly half expect this to occur by year’s end (chart G).

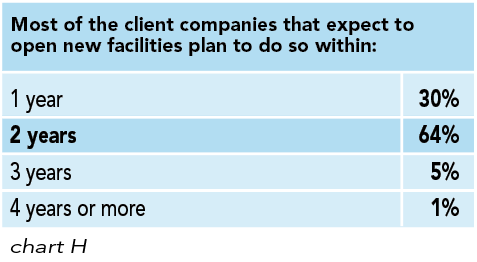

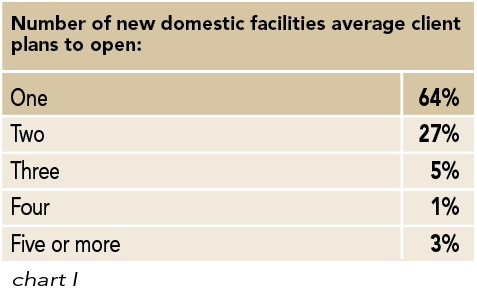

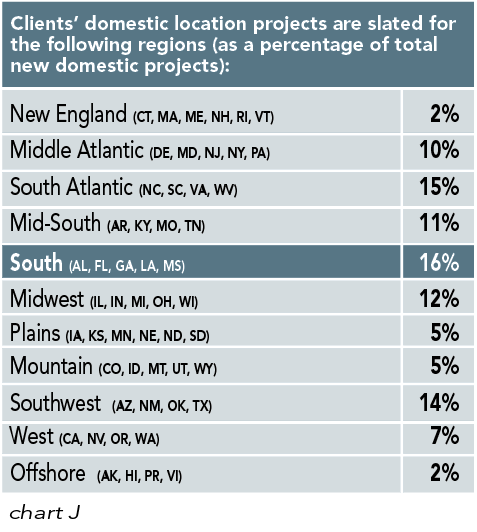

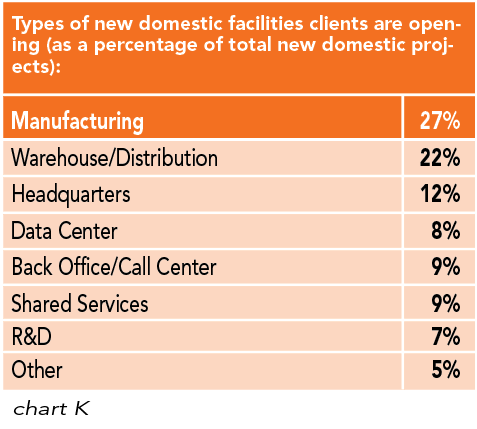

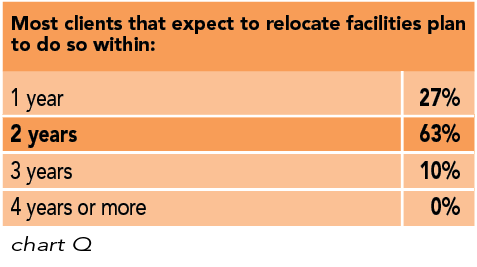

It also follows that most (94 percent) of the consultants say their client companies expect to open new facilities within one to two years (chart H). Of those, nearly two thirds say their clients will open just one domestic facility, and a quarter of the respondents claim these organizations will open two (chart I). The location of clients’ domestic projects differs somewhat from that reported by the respondents to our Annual Corporate Survey. The largest share of projects (16 percent) that the responding consultants are working on is slated for the South (Alabama, Florida, Georgia, Louisiana, Mississippi) and the South Atlantic (North Carolina, South Carolina, Virginia, West Virginia) (15 percent). Only 12 percent of their clients’ projects are to be located in the Midwest (Illinois, Indiana, Michigan, Ohio, Wisconsin), whereas our Corporate Survey respondents have slated 20 percent — the largest share — of their projects for that region (chart J). Roughly a quarter of the consultants’ client organizations’ projects are destined to house manufacturing operations, and more than 20 percent will be warehouse/distribution centers (chart K).

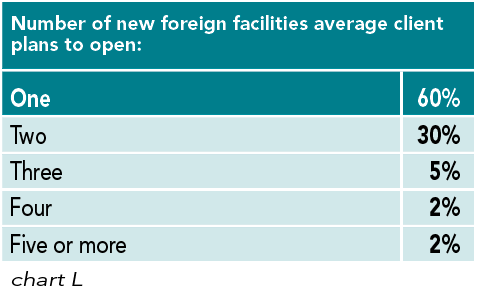

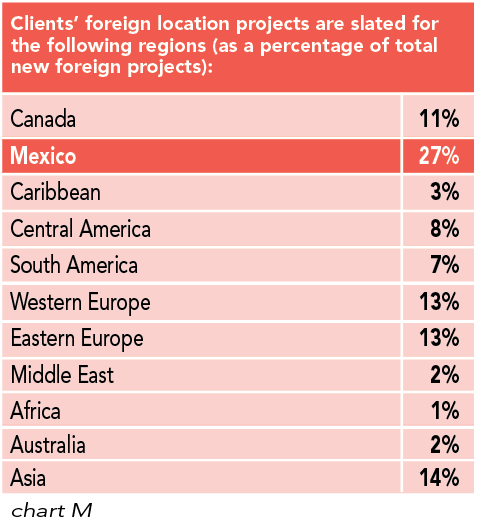

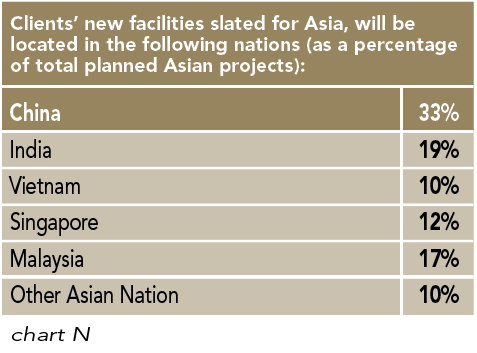

Sixty percent of those responding to the 11th Annual Consultants Survey say that, on average, their clients will open just one new foreign facility, while 30 percent claim they will open two (chart L). By comparison, nearly 40 percent of our Corporate Survey respondents claim they will open three or more foreign facilities. And while our Corporate Survey respondents say a quarter of their new foreign facilities are slated for Canada and 9 percent for Mexico, those responding to our Consultants Survey say only 11 percent of their clients’ projects will go to Canada and 27 percent to Mexico. The consultants are also working on many more projects for Eastern and Western Europe — 13 percent for each region — and fewer for Asia — just 14 percent as compared with 25 percent of those planned by the Corporate Survey respondents (chart M). When it comes to new Asian facilities, the consultants’ clients plan a third for China, 19 percent for India, and 17 percent for Malaysia, with the rest going to Vietnam, Singapore, or other Asian nations (chart N). The corporate respondents more heavily favored China and India.

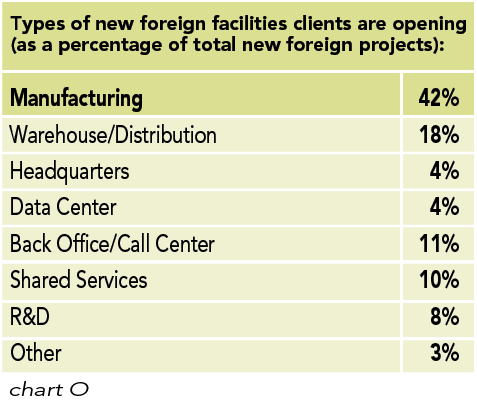

The responding consultants say that more than 40 percent of the new foreign facilities will be manufacturing plants and nearly a fifth are slated to serve as distribution/warehouse centers (chart O).

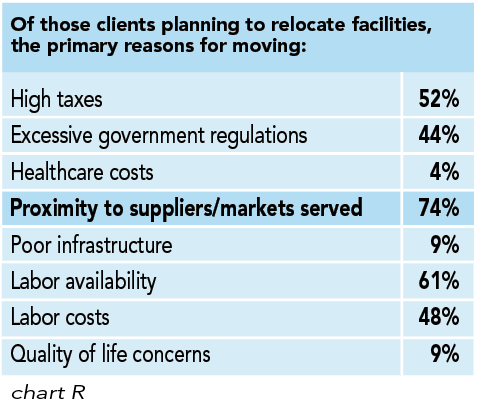

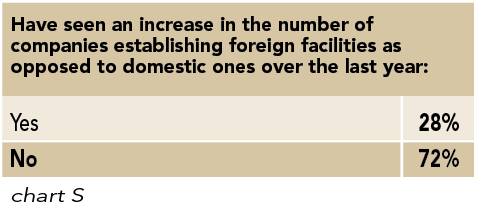

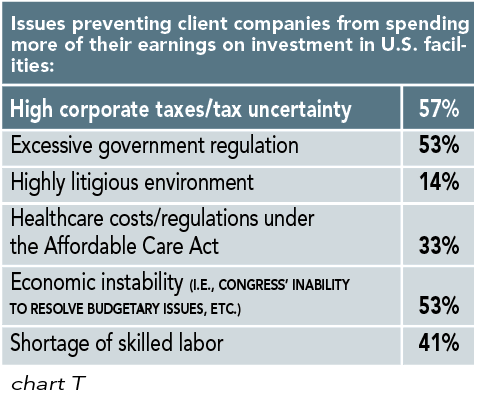

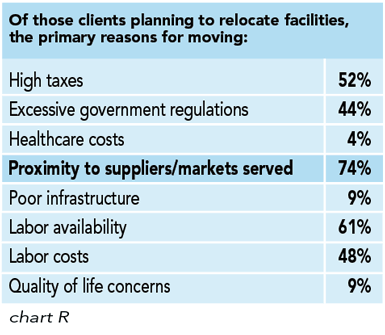

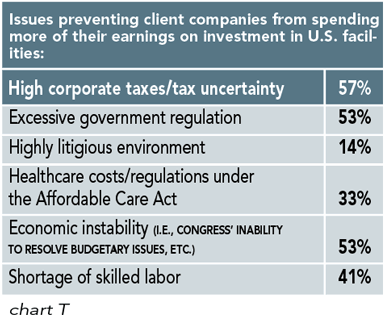

Although nearly all of the respondents to our Corporate Survey say they have no plans to relocate a domestic facility to offshore, a quarter of those responding to our Consultants Survey say they have seen an increase in the number of companies establishing foreign facilities as opposed to domestic ones in the last year (chart S). More than half of the consultants cite high corporate taxes, excessive government regulation, and economic instability (i.e., congressional budget woes) as the reasons preventing their client companies from spending more of their earnings on investment in U.S. facilities (chart T).

Next:Consultants’ Clients’ Location Priorities

{{RELATEDLINKS}}Consultants’ Clients’ Location Priorities

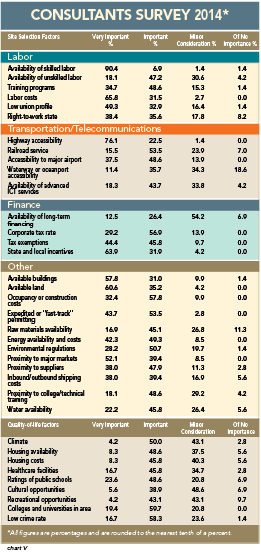

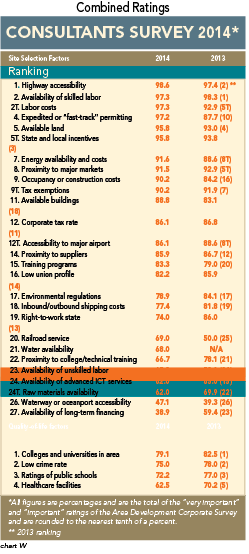

Similar to our request to the Corporate Survey takers, we asked the consultants to rate the site selection and quality-of-life factors on which their clients base their location and expansion decisions as “very important,” “important,” “minor consideration,” or “of no importance” (chart V). We then added the “very important” and “important” ratings together to rank the factors (chart W).

Unlike our corporate respondents, the respondents to our 11th Annual Consultants Survey put much more stress on the importance of the top-10 factors — all are considered “very important” or “important” by more than 90 percent of the responding consultants. Both groups do agree on the #1 factor — highway accessibility, which has a 98.6 percent combined importance rating in the Consultants Survey. It follows that proximity to major markets ranks as #8 with a combined 91.5 percent importance rating. And another transportation-related factor, railroad service, had the largest percentage increase (19 points). It jumped five spots in the consultants’ rankings to #20 with a combined importance rating of 69 percent.

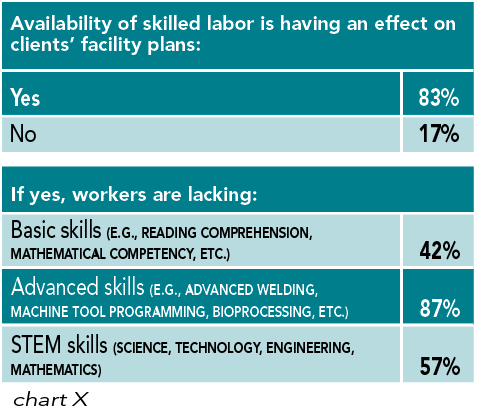

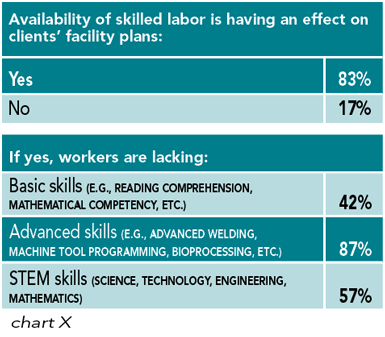

As expected, the consultants give much more importance to availability of skilled labor and labor costs, which are tied for the #2 spot with a combined importance rating of 97.3 percent. It should be noted that availability of skilled labor holds the top spot, however, in the separate “very important” category — more than 90 percent of the consultants rated it as such.

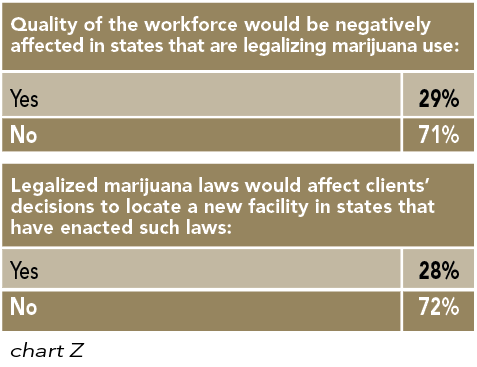

On a workforce related note, the respondents to our Annual Consultants Survey do not believe (71 percent) the quality of the workforce will be negatively affected in states that are legalizing marijuana, and roughly the same percentage say such laws will have no effect on clients’ location decisions (chart Z). This is in contrast to what our Corporate Survey respondents noted: more than 60 percent say it will affect the quality of the workforce, and nearly half the corporate respondents say legalization of marijuana will affect their decisions to locate in states that have such laws on the books.

Available land follows at #5 with a 95.8 percent combined importance rating. It was noted earlier that the consultants are working on projects that will house a large number of employees so suitable parcels of land for large facilities may be reflected in the high rating of available land.

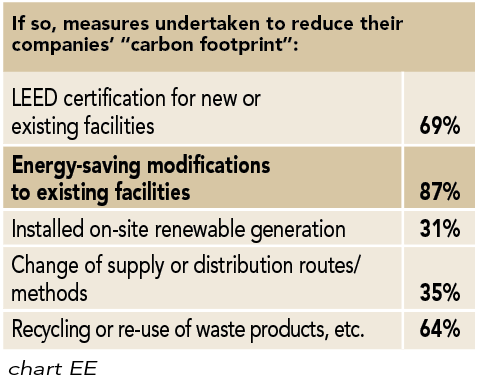

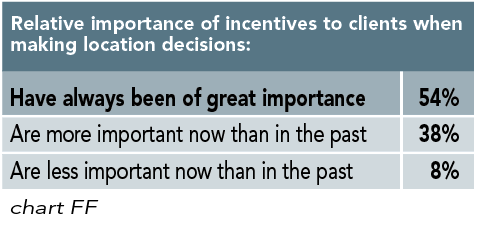

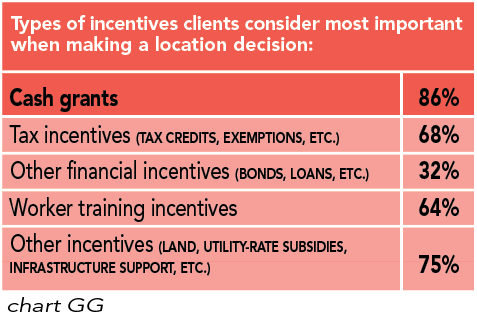

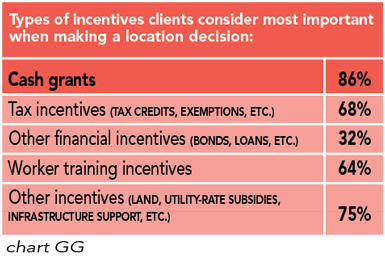

Tied for #5 with the same importance rating of 95.8 percent is the state and local incentives factor. This is logical considering the fact that three quarters of the responding consultants say they handle incentives negotiation and management for their clients. And a related factor, tax exemptions, ties for the #9 spot. Nearly two fifths of the responding consultants say incentives are more important to their clients now than in the past (chart FF). Furthermore, the majority of those responding to our Annual Consultants Survey (86 percent) believe their clients consider cash grants the most important incentive when making location decisions, followed by incentives such as free land, utility rate subsidies, and infrastructure support (75 percent) (chart GG).

Occupancy and construction costs, which was ranked #2 by the Corporate Survey respondents, is ranked #9 by the respondents to our Annual Consultants Survey — 90.2 percent consider this factor as “very important” or “important.”

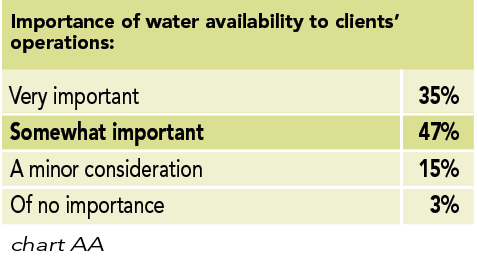

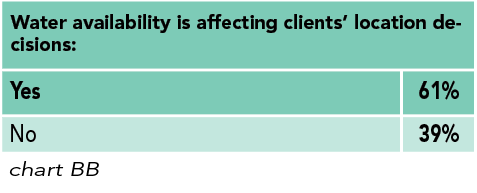

We also asked the consultants about water availability’s importance to their clients’ operations; 82 percent say it is very or somewhat important, and more than 60 percent say it is affecting their clients’ location decisions (charts AA and BB). Meanwhile, only 49 percent of those responding to our Corporate Survey say water availability is very or somewhat important.

The quality-of-life factors are ranked separately, and the consultants’ ranking of these factors has not changed significantly over the prior year’s survey. Similar to last year, the consultants rank colleges and universities in area as the #1 quality-of-life factor, followed by low crime rate in the #2 spot.

Consultants’ Information Sources

Fully three quarters of the respondents to our Annual Consultants Survey say they have used magazines like Area Development as sources of site selection information over the past two years. More than three quarters also say they use websites like AreaDevelopment.com as well as economic data aggregators. Three fifths of the respondents actually maintain their own site selection databases.

It’s to be expected that nearly all the responding consultants (93 percent) search the Internet for site and facility planning information. Nearly all are seeking data on specific locations as well as contact information for economic development agencies online. Three quarters are also looking for listings of available sites and buildings.

Eighty percent of the responding consultants say between one and five locations make their clients’ “short list,” with nearly 90 percent saying their clients visit the same number before making a final location decision. More than 80 percent also say that once their services have been engaged, turnaround time on a location decision is fairly quick — from three months to a year. It seems our corporate respondents follow the same time frame, whether they engage the services of consultants or not.