{{RELATEDLINKS}} A key provision of the TCJA reduced the federal corporate income tax rate from 35 percent to 21 percent, which is significant given that prior to the TCJA, the United States held the title of having the highest statutory corporate income tax rate in the industrialized world and fourth overall. Using federal corporate income tax rates published in September 2017 by the Tax Foundation, the 21 percent rate places the United States just below the worldwide average of 22.96 percent, and lower than many of the world’s leading industrialized countries like China (25 percent), France (33 percent), Germany (30 percent), Japan (31 percent), and Spain (25 percent). The United States, however, still trails the United Kingdom’s corporate income tax rate of 10 percent. The TCJA also incorporates provisions to reduce the tax rate for businesses organized as partnerships, limited liability companies, and S corporations. Both incorporated and unincorporated businesses will also be able to immediately expense the full cost of equipment bought before 2023 and repatriate future profits earned abroad tax free.

Despite historically having one of the world’s highest federal corporate income tax rates, the United States has led the world in inbound FDI for a long time. According to the World Bank, in 2016 the United States ranked highest in net FDI with $479.4 billion, followed by the United Kingdom with $292.9 and China with $170.6 billion.2 Foreign investors and businesses have historically designated the United States as one of the safest places in the world to invest for several reasons, including the size of its consumer market, established legal system, defined business regulations, labor force, infrastructure, and overall economic stability.

The federal corporate income tax rate, however, has long been labeled as a disadvantage to domestic and inbound FDI alike. The referenced reasons represent certain macro-level location strategy variables that are supplemented with business-specific micro-level location strategy variables used by businesses to justify FDI activity into the United States.

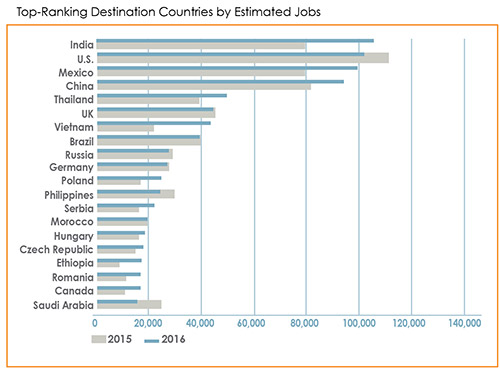

Notwithstanding the foregoing, perhaps a more politically sensitive FDI metric to consider, in lieu of pure net investment, is measuring FDI by jobs created. After all, a key provision of the TCJA is increasing American jobs. The 2017 IBM Global Locations Trends Annual Report lists India as being the leader in 2016 FDI measured by job creation with ~103,000, followed by the United States with ~101,000, Mexico with ~99,000, China with ~97,000, and Thailand with ~50,000.

The war for talent will likely become ever more competitive. The TCJA legislation does not include mechanisms to increase the availability and sustainability of qualified labor, which is generally a top concern of business executives across all industries. Whether measured by net investment or job creation, the United States has been one of the leaders in FDI and is unlikely to change in the foreseeable future. The TCJA could certainly be a trigger driving increased FDI over historical levels based on the assumption that increased business capital will result in businesses spending more capital in lieu of a paying a large tax bill. The success of the TCJA on job creation, however, will be the public. Finding qualified labor today is already a challenge for many businesses, so if even more jobs will be needed to support increased FDI, where will the qualified candidates come from?

The War for Talent

The war for talent will likely become ever more competitive. The TCJA legislation does not include mechanisms to increase the availability and sustainability of qualified labor, which is generally a top concern of business executives across all industries. Without complementing federal legislation specific to the development of a qualified labor force, the burden will remain on state and local governments and businesses themselves.

To combat the highly competitive and tight labor market, state and local governments are adopting creative practices to develop talent pools. For instance, in some proactive states and communities, workforce development efforts focus on bringing businesses and education partners together to collaborate on closing skills gaps and preparing the workforce of the future. Specifically, select programs include career pathway fairs designed to help middle school students make a more informed choice on which career and technical education pathway they plan to study during high school; high school internship programs whereby employers offer students productive and meaningful work assignments with a learning component ideally related to their area of interest; senior hiring events where employers market summer, part-time, and full-time positions to graduating high school seniors; summer camps; teacher externship programs; and tech-ready conferences.

Foreign Labor

Despite state and local efforts to provide a qualified pipeline of labor, businesses often still need to turn to foreign labor to make up job skills gaps, especially for highly-skilled occupations. The size of the foreign labor market in the United States is significant, and without it, many businesses would struggle to remain operational.

For example, based on statistics gathered from the U.S. Department of State, the total number of immigrant visas issued has increased year-over-year since 2000. The number of immigrant and nonimmigrant visas reached 10.3 million in 2017. Based on this data, one can see that the amount of foreign labor in the workforce is in the millions. Should U.S. immigration policies continue to become more restrictive, then a comprehensive federal strategy will need to be developed to find a way to replace the historical role of foreign labor.

Despite state and local efforts to provide a qualified pipeline of labor, businesses often still need to turn to foreign labor to make up job skills gaps, especially for highly-skilled occupations. Placing this additional burden on state and local governments, which are already struggling to find ways to remain competitive, is not the solution. Without a qualified labor supply, inbound FDI will not experience the growth set out by the TCJA. Should businesses not find the labor needed to remain relevant globally, then locations outside of the United States will need to be evaluated, which goes against the main intent of the TCJA.

That said, certain conditions of the TCJA could make investment outside of the United States financially appealing. For example, income earned by a subsidiary of an American business could be subject to taxes that are lower than those of a business earning income in the United States. Beyond the lower rate, businesses will not have to pay U.S. taxes on the money they earn from plants or equipment located abroad if those earnings amount to 10 percent or less of the total investment.

Due Diligence

The measures taken by the TCJA focus on federal corporate tax structure; however, just picking a location anywhere in the United States alone will not translate into automatic success. A robust due diligence process driving any location strategy will need to be implemented with a focus on the availability and sustainability of the labor force. Labor can account for up to 80 percent of a facility’s operating expenses, and the cost of labor can vary significantly across geographies. Other typical location strategy categories like infrastructure, regulation, business incentives, utilities, and access to clients and suppliers should also be investigated in detail. The location of a business has — and will continue to have — a significant impact on its overall success.

While TCJA made several significant changes to the federal tax structure, it also created a great deal of uncertainty moving forward. What happens over the next eight years as vast portions of the legislation are set to expire? If the TCJA does indeed lead to an increase in FDI locating or expanding in the United States, how will the labor be supplied, or the infrastructure developed? How will state policymakers respond to these large tax changes and their impact on both taxpayers and state revenue? The ramifications will play out over years to come and we will be watching.