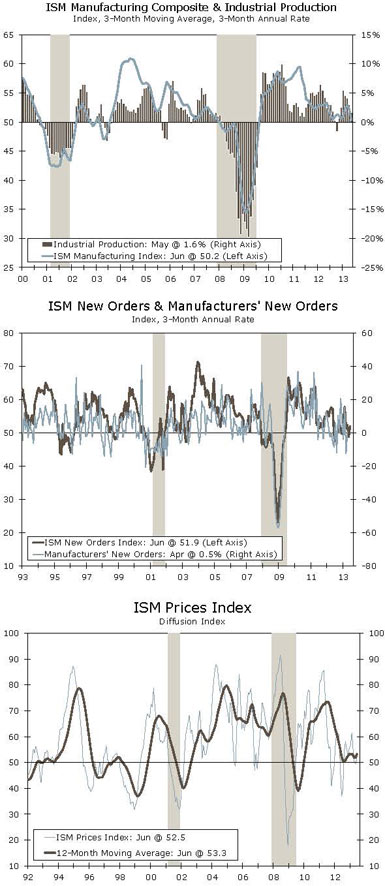

At 50.9 the ISM reading reinforces the theme of modest, subpar growth that has been the expectation for this year. This economic expansion continues, but without the boom typical of the early recoveries of 2004 and 2009 (top graph) for example.

In June, eleven of fourteen industries recorded growth in production including electrical equipment, appliances, furniture, fabricated metals and computers/electronics. These data are an indication that the factory sector will continue its modest growth path, but there is no suggestion of a shift from slow growth into a somewhat faster pace of expansion; we support the case for growth but are not yet convinced that business spending and industrial production are poised to take off.

New Orders and Export Orders Both Still Positive

For June, the gain in new orders and export orders has been reassuring to our growth outlook. New orders rose to 51.9 from 48.8 and are once again in expansion mode (middle graph). Eleven of sixteen industries reported a gain in orders, including paper, machinery, fabricated metals and electrical equipment. Export orders, meanwhile, rose for the seventh consecutive month with a June reading at 54.5. Seven of nine industries reported a gain in export orders including paper, primary metals electrical equipment and computers and electronics.

Despite the concerns of fiscal sequestration, weakness in emerging markets and continued recession in Europe, firms are seeing modest gains in both domestic and export orders and, since orders are a leading economic indicator, this suggests the outlook remains for modest growth going forward into the second half of this year.

Input Price Pressures–Temporary Relief for Profits?

The prices paid component rose back above the 50 breakeven level in June after a dip below 50 in May. This index had been above 50 each month of the year except for May (bottom graph). Of eighteen industries, nine reported higher input prices, thereby suggesting that there are some modest input cost pressures in certain industries. Higher input prices were reported for paper, plastics, textiles and computer/electronics.

A modest amount of commodity prices have trended higher in recent months and these include caustic soda, corrugated boxes (used in shipping) and lumber. These price increases will put some upward pressure on PPI inflation in the coming months and given only modest increases in consumer prices, suggest profit pressures for many companies, although certainly more modest than we would have projected based on historical patterns in earlier economic expansions.