Despite the steep losses from the Great Recession, manufacturing remains a mainstay of the Ohio economy, accounting for 16.7 percent of the state’s GDP. “The fact is, if Ohio stops being a manufacturing state, we’re going to become a bankrupt state,” notes Dr. Edward W. (Ned) Hill, dean of the Maxine Goodman Levin College of Urban Affairs at Cleveland State University. “It’s what we do,” says Hill. “It’s what our competitive advantage is. But realize that being a manufacturing state is a very different set of skills and opportunities than it was 10 years ago.”

Advanced Manufacturing

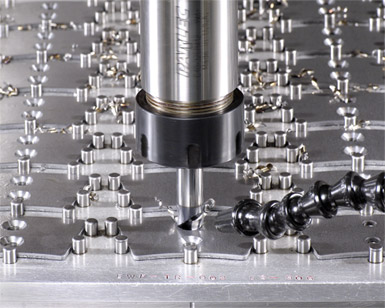

Bronson Jones, VP & general manager of Banner Metals Group in Columbus, couldn’t agree more. What started as a tool and die shop in 1921 is thriving today as an example of Ohio’s robust advanced manufacturing capabilities. Banner makes metal parts for diverse industries ranging from construction and lawn care to aircraft brakes, with Boeing and Airbus as major customers.

The company employs 52 in a 72,000-square-foot building tucked into the rapidly gentrifying Grandview suburb. To stay competitive, Banner recently added three robotic weld cells to its lineup of large presses, CNC, and stamping machines.

Banner is a member of the Edison Welding Institute (EWI) located just a few blocks away. EWI is the largest engineering and technology organization in North America dedicated to materials joining. In 2012, Banner teamed with EWI to use simulation to develop thick material applications and improve its welding operations. In March of this year, the company accepted EWI’s Edison Center Innovation Award at Ohio’s Advanced Manufacturing Luncheon.

“Manufacturing is much more automated, much more sophisticated,” says Jones. “The safety requirements are top-notch.” The Banner Metals general manager says it is time to dispel old perceptions about manufacturing. “It’s not dirty. It’s a clean, air-conditioned environment. Companies that have stayed up with the times and kept current — they’re the ones that are doing well.”

To stay current, Jones has taken advantage of Ohio’s Incumbent Workforce Training Program that pays half the cost for existing employees to upgrade their skills. Banner is sending several employees to robotic and CNC training utilizing state grants. Statewide, the first $20 million was spoken for the first day the grants were available. The Ohio Development Services Agency (DSA) is offering another $30 million this year. “It’s a huge investment in our existing work force,” says DSA Director David Goodman.

Banner’s success has been a case study in the judicious use of state programs. The training grants and low-interest loans the company received for technology purchases have helped Banner win growing aerospace business. Sales have increased 75 percent in the last three years, according to Jones. Banner is just one of the state’s metals companies that keep Ohio ranked first in ferroalloy output (59.4 percent of U.S. production) and products made from purchased steel such as pipes, tubes, and stampings and assemblies.

But metals and advanced manufacturing are just one piece of a complex web that is Ohio’s economy, says Cleveland State’s Professor Hill. “Ohio is very much a ‘portfolio’ economy. It’s not one-size-fits-all because we’re so big and so diverse as a state. The things that work well for Columbus or well for Cleveland aren’t going to work well for Marion or Dayton.”

Banner Metals Group, Columbus, which started as a tool and die shop in 1921, provides an example of Ohio’s robust advanced manufacturing capabilities. Banner makes metal parts for diverse industries ranging from construction and lawn care to aircraft brakes, with Boeing and Airbus as major customers.

Automotive

Ohioans built 1.4 million light trucks and cars in six assembly plants during 2012. The number looks to increase significantly in 2013. Honda, GM, Chrysler, and Ford account for the 13 models produced in the state. Over 85,000 Ohioans are employed making vehicles or parts for them. Honda, alone, accounts for 16 percent of Ohio’s automotive work force — 13,500 people are employed making Accords, Civics, and CRVs — not to mention thousands more making fuel tanks, seats, brake assemblies, and the other parts required in a modern automobile. Fifty-seven of Ohio’s 88 counties claim at least one Honda supplier plant. Ohio is ranked second nationally in Tier 1 automotive suppliers.

Ohio’s automotive industry is supported by robust research and development. In fact, the new Accura NSX super car was designed entirely at Honda’s R&D facilities near Marysville, Ohio. It will be produced in a new $70 million assembly plant nearby.

Nearly every U.S. carmaker utilizes the unique 7.5-mile oval in Union County, northwest of Columbus, that is the Ohio Transportation Research Center. In a public-private partnership, the state of Ohio and Honda earlier this year completed a $16 million repaving project, allowing for test speeds of up to 200 miles per hour.

Down the road, in the center of Columbus, Ohio State University’s Center for Automotive Research is breaking new ground, producing the “Buckeye Bullet,” the world’s fastest electric-powered land vehicle with a top speed of nearly 315 miles per hour. The Buckeye Bullet project is led by Dr. Giorgio Rizzoni and is a joint effort with Monaco’s Venturi Automobiles. The team of Ohio State engineering students hopes improvements in design and power components will send the new Buckeye Bullet 3 beyond the 400 mph mark on the Bonneville Salt Flats in September 2013.

Aerospace and Aviation

Just over a century ago, from their Dayton bicycle shop, Orville and Wilbur Wright produced the world’s first successful airplane. Ohioans have been about the business of “slipping the surly bonds of earth” ever since — among them, astronauts John Glenn and Neil Armstrong. Over 100,000 Ohioans are employed in the aerospace industry today. They include those building the world’s most sophisticated jet engines in Cincinnati’s GE Aviation plant to the aerospace engineers at the Air Force Research Laboratory housed at Wright-Patterson Air Force Base near Dayton.

Six hundred companies spread across the state manufacture aerospace and defense products, many of them supplying Boeing and Airbus, which makes Ohio the top state supplying the two major aircraft manufacturers.

Aerospace manufacturing is coupled with research in Ohio. Cleveland’s NASA Glenn Research Center boasts 33 specialized testing facilities, from hypersonic wind tunnels to the 152,000-square-foot engine research plant. Twenty Ohio colleges and universities have aerospace engineering and research programs. Recently, for example, Ohio State University won a $2.5 million award from the Air Force’s Aerospace Systems Directorate to develop computational technologies that will be used in designing what the Air Force calls low-speed, long-endurance, highly maneuverable vehicles as well as hypersonic flight and space vehicles.

The Ohio Department of Transportation is leading a teamed effort with Indiana to become one of six test sites across the country for unmanned aircraft. Research would be conducted at a Springfield, Ohio, facility, while drones would be tested in restricted airspace over Indiana. The center, if approved by the FAA, would study how unmanned aircraft as big as airliners to as small as model airplanes can mix with the nation’s air traffic.

Energy

Ohio has been in the energy business since its founding in 1803, building mills, digging coal, finding ways to shape the raw energy above and below ground into systems that could fuel the agricultural and industrial revolutions of the past — as well as today’s information technology and advanced manufacturing economies. It was Ohioan Thomas Edison, after all, who pioneered the mass distribution of electricity. Today, that spirit of innovation continues to thrive throughout Ohio.

Quietly, day in and day out, the 159,200 solar panels positioned on 83 acres adjacent to the Wyandot County Airport emit enough electricity, when the sun shines, to power over 9,000 homes. They do it without burning anything or creating a carbon footprint. PSEG Solar Source based in Newark, N.J., owns the 12-megawatt solar farm that began operations in 2010 and sells the power to Columbus-based American Electric Power. The photovoltaic cells were made by First Solar in Perrysburg, Ohio.

The 159,200 solar panels positioned on 83 acres adjacent to the Wyandot County Airport emit enough electricity, when the sun shines, to power over 9,000 homes.

It was Charles Brush of Cleveland who designed one of the world’s first electricity-generating wind turbines in 1886. Today, 127 years later, hundreds of modern wind turbines spin in Northwest Ohio, generating 426 megawatts of electricity with another thousand megawatts under construction.

In Ohio’s eastern and southeastern counties, the oil and gas play in Ohio’s Marcellus and Utica shale deposits is generating income and excitement. In 2012, 625 new wells were drilled, providing 4.85 million barrels of oil and over 73 billion cubic feet of natural gas. The shale play is bringing new wealth to landowners and jobs to many Ohio companies, such as engineering firms and steel tubing manufacturers.

Agribusiness and Food Processing

Campbell’s soup, Bob Evans sausage, Orville Redenbacher popcorn, Smucker’s jam, and Dannon yogurt are just a few of the iconic food products made in Ohio. Food processing is a $9.5 billion industry across the state.

With 14.5 million acres in agriculture, it is the combination of that rich farmland coupled with proximity to the eastern U.S. market and a dense web of rail, waterways, and highways that allows agribusiness and food processing to thrive in Ohio. Close to 60,000 Ohioans are employed in the sector.

Ohio’s low tax structure makes the state attractive to food processors. The corporate franchise tax has been eliminated. Under the broader-based commercial activities tax, products shipped outside the state (a significant portion of Ohio food production) aren’t taxed at all. Recent additions to Ohio’s food processing sector include an $88 million, 100-job expansion to Dannon’s yogurt plant in Minster. The company claims it is the largest yogurt manufacturing plant in the world. And, Daisy Brand announced in June that the company’s third sour cream manufacturing plant would be built in the Northeast Ohio town of Wooster. The $116 million, 200,000-square-foot investment creates 89 jobs. The new plant will serve the company’s East Coast markets when it opens in 2015.

Information Technology

Ohio is rich with colleges, both private and public. The 80,000 graduates who emerge from those schools each year are an intelligent and creative work force for Ohio’s growing IT sector.

The presence of Ohio State University and the school’s willingness to leverage multiple disciplines into a data analytics curriculum was a key factor in IBM’s recent decision to locate its global data analytics center in Columbus. The tech giant expects to employ 500 in the new center. IBM found a ready customer base for its “Big Data” solutions in companies like Cardinal Health, Limited Brands, and Nationwide Insurance headquartered in Columbus.

Ohio-born companies such as CompuServe, LexisNexis, and CheckFree paved the way for IBM’s investment in the state. Collaboration among IT professionals is fostered through local organizations such as Cincinnati Tech, TechColumbus, Global Cleveland, and the Northeast Ohio Software Association.

Cleveland State University economist Ned Hill says Northeast Ohio has had a data analytics cluster for many years centered around the insurance companies located in the Cleveland area. “Allstate has a massive data center here, as well as Progressive and a few others,” says Hill.

Next: Ohio's Biomedical, Polymers and Chemicals and Financial Services Sectors

{{RELATEDLINKS}}Biomedical

Cleveland, once known mostly as a steel town, is becoming much more diverse. A major catalyst for that is the Cleveland Clinic — Ohio’s second-largest employer (behind Wal-Mart).

Richard Vedder, the Ohio University economist, is well aware of the influence of the world-class medical institution. “We all know about the growth of the healthcare industry,” explains Vedder. “That’s something of a national phenomenon, though Ohio has done better than the average state in that. The Cleveland Clinic is rated by U.S. News and World Report as the best medical place in the United States for [its heart program]. You know, when the king of Saudi Arabia needs an operation, he stops in Cleveland. He doesn’t go to New York or London — he goes to Cleveland.”

Not surprisingly, the Global Center for Health Innovation is located next to Cleveland’s Convention Center, showcasing the latest in healthcare technology, education, and commerce.

South on I-71, biomedical innovation is happening in Columbus as well, particularly in and around Ohio State’s construction of a billion-dollar addition to its medical center.

Ohio conducts 17 percent of all U.S. clinical trials, ranking the state first in the Midwest and seventh nationally. One of those trials is generating lots of excitement at Ohio State: thus far, 900 leukemia patients have been tested at Ohio State’s Comprehensive Cancer Center with the drug Ibrutinib. So far, says the center’s Dr. John Byrd, every patient tested has seen his/her leukemia go into remission. “It causes the cells to regress and stop growing,” he notes. The FDA is fast-tracking Ibrutinib for approval based in part on the OSU trials.

Ohio’s Third Frontier innovation funding is also a major catalyst to biomedical research and commercialization. At the University of Cincinnati (UC), for example, $5.9 million from Ohio’s Third Frontier Wright Projects Program has established the Ohio Center for Microfluidic Innovation. Microfluidics involve the manipulation of tiny amounts of fluids inside polymer-microchips. Applications include biosensors and medical devices.

UC is also home to an Ohio Center of Excellence in Nanoscale Sensor Technology. UC microfluidics and nanoscale research has led to dramatic breakthroughs in the speed and sensitivity of immunoassay diagnostics. Cincinnati-based Siloam Biosciences is commercializing the UC research through a “lab-on-a-chip based Point-of-Care test platform” that it expects will revolutionize bedside diagnostic abilities.

Polymers and Chemicals

In 1870, when the city fathers of Akron enticed Benjamin Franklin Goodrich to bring his rubber company to their town, the die was cast for Ohio to become a leader in the rubber, polymer, and chemical industries. While tire-making has moved to other locales, its legacy is seen in the 1,300 polymer and chemical firms calling Ohio home and the nearly 90,000 people who work in them.

The industry is supported by robust research. The University of Akron’s College of Polymer Science and Polymer Engineering is globally known and ranked among the United States’ top five graduate programs in the field. Battelle Memorial Institute in Columbus, Ohio State’s Center for Advanced Polymer and Composite Engineering, Bowling Green State University’s Center for Photochemical Sciences, and Kent State’s Liquid Crystal Institute are among the research centers developing the next generation of advanced materials.

Financial Services

In reality, it is a small city, perched on the northern edge of Columbus in southern Delaware County. If it had a name, it might be Chaseville. It is 10,000 people who converge daily to form JPMorgan Chase’s back office operations center in what is known as Polaris — a highly successful mixed-use shopping, restaurant, housing, and office complex.

Statewide, Chase employs 23,000 — it’s Ohio’s third-largest private-sector employer. The financial services sector is one of Ohio’s largest, employing 173,000 people and adding $34 billion to Ohio’s gross state product. The 230 banks, 350 credit unions, and 250 insurance companies in Ohio make the state one of the most concentrated centers for insurance and financial services in the nation.