Rodriguez: The U.S. ranks among the top of the list globally in terms of current manufacturing competitiveness, according to the Global Manufacturing Competitiveness Index study that Deloitte conducted in conjunction with the Council on Competitiveness, providing insight from more than 500 manufacturing CEOs and executives around the globe. Moreover, the U.S. is expected to overtake China for the No. 1 position — to become the top country in terms of manufacturing competitiveness — by 2020. The U.S. has consistently improved its ranking on global manufacturing competitiveness over the years — from its 4th position in 2010, to 3rd in 2013, and then to 2nd in 2016.

AD: What are some of the reasons manufacturing executives have continuously increased U.S. rankings on manufacturing competitiveness?

Rodriguez: The reasons include:

- Talent — Executives rank talent as the #1 driver of manufacturing competitiveness. The U.S. is home to many of the top universities in the world as well as world-class research institutes — all of which creates a strong pipeline of future talent needed to compete in the global manufacturing landscape.

- Innovation ecosystem and entrepreneurial spirit — Our strong collaborative innovation ecosystem connects people, resources, policies, and organizations to efficiently translate new ideas into commercialized products and services.

- Technology — The U.S. has strong capabilities and investments (including basic and applied R&D) in developing and commercializing advanced manufacturing technologies like predictive analytics, the Internet-of-Things (IoT), and advanced materials, which are seen as critical to future manufacturing competitiveness.

Multinational trade agreements can be beneficial to participating countries, provided the terms are negotiated properly. AD: What is the projection for the future global competitiveness of this sector?

Rodriguez: Strong global demand and production growth in manufacturing signals optimism in the global manufacturing sector. The U.S., Japan, Germany, and many other manufacturing powerhouse nations have shown strong manufacturing production activities and steady growth over the last year. The majority of experts project the steady growth to continue and have a favorable outlook on the future competitiveness of manufacturing.

Manufacturing earnings and exports are stimulating economic prosperity causing many nations to increase their strategy focus on developing advanced manufacturing capabilities. These advanced manufacturing capabilities are the fuel for advanced industries (which employ a high percentage of STEM workers and have high R&D intensity) and drive a substantial portion of patents generated, R&D conducted, high-skilled jobs created, and high-technology products exported. Therefore, strengthening advanced manufacturing industries is a critical factor in increasing the future competitiveness and economic prosperity of a nation.

AD: How does today’s U.S. legislative uncertainty with regard to trade agreements, regulations, taxes, etc. fit into the picture?

Rodriguez: An overarching concern expressed by executives is policy, legislative, and regulatory uncertainty. Many suggest that this uncertainty directly impacts both short- and long-term decision-making. When business leaders are developing strategic business plans and making investments with a 10–15-year-plus time horizon — yet are faced with a reality in which policies do not provide enough long-term clarity or stability — it makes it incredibly difficult to make key decisions. Through interviews we have conducted, many executives indicate uncertainty is a huge inhibitor and creates barriers to investment. When uncertainty is high, companies typically delay major decisions and/or investments.

According to our Advanced Technologies Initiative, a dramatic increase in the number of regulations has resulted in higher compliance costs, which have grown at a sharper rate than inflation-adjusted GDP and manufacturing output. Manufacturing executives also indicate excessive regulation disproportionately hurts smaller manufacturing firms, hampering their ability to invest in R&D, reducing their profitability, and causing some companies to move their operations abroad.

Free trade agreements (FTAs) do play a role in increasing the manufacturing competitiveness of a nation. For example, Mexico has FTAs with the United States and Canada, but also with 42 other countries. This is significantly higher even when compared to the United States at 20 and China at 18. The presence of such FTAs gives Mexican goods unrestricted access to current and future potential demand markets. However, uncertainty on the future viability of trade agreements can be a downside to companies that are looking forward to invest in new markets and geographies. Uncertainties do eventually rise up with the increase in the number of parties participating in a trade agreement, with each party bringing its own demands to the table. That being said, multinational trade agreements like the Trans-Pacific Partnership (TPP), which the U.S. recently pulled out of, can be beneficial to participating countries, provided the terms and conditions are negotiated properly.

Talent, technology, and transformation are going to be three huge players in the battleground for the future manufacturing competitiveness landscape. AD: According to the skills gap study conducted by Deloitte and the Manufacturing Institute, two million skilled jobs will go unfilled over the next decade. Do you see any progress in closing that gap?

Rodriguez: Good question. In the short-term, many manufacturers are indicating the skills gap issue is only becoming more acute and pervasive across their entire operations. Manufacturers are also well aware of the looming skills gap that is not only affecting their own industry but also other industries and nations. Everyone is competing for top talent. High-skilled technicians, engineers, and workers are in great demand. According to the skills gap study, it takes an average of 94 days to recruit employees in the engineer /researcher/scientist fields and an average of 70 days to recruit skilled production workers in the U.S. However, in the longer run, due to the increasing proliferation of advanced technologies in manufacturing, there is the potential for technology to help address the gap.

So how do manufacturers address the skills gap we have in the here and now? They will likely need to rethink their talent sourcing and recruiting strategies to attract new employees, improve candidate screening practices, define clear competency models and role-based skills requirements, and invest in internal training and development. U.S. manufacturing would also benefit from more robust public outreach programs to increase the interest in manufacturing — like the newer ads manufacturers are positioning to attract millennials. These public outreach programs should also inform and educate parents — who are the key career influencers for their children — about how a modern manufacturing job career is high-tech and innovative, and a high-paying alternative to other career options.

AD: What impact will women have in closing the skills gap?

Rodriguez: Underrepresented and relatively untapped demographic groups like women have a greater role to play in fixing the skills gap. Women constituted about 47 percent of the U.S. labor force in 2016, but only 29 percent of the manufacturing workforce. If manufacturers can get their fair share of women into the industry, it will go a long way in closing the skills gap.

Research also shows that According to the gender diversity benefits a manufacturing firm through improved ability to innovate, higher return on equity (ROE), and increased profitability. So, in addition to helping address the looming skills gap issue, recruiting and retaining women professionals can also be highly beneficial for manufacturing firms from a bottom-line perspective.

According to our 2017 women in manufacturing study, opportunities for challenging assignments, work life balance, and attractive income are often the most important aspects of a women’s career. So manufacturers should pay close attention to these details if they want to plug the skills gap by hiring women professionals.

AD: Are apprenticeship programs making any significant headway?

Rodriguez: According to the U.S. Department of Labor, the number of active apprenticeship programs has increased in recent years from 19,260 in 2014 to 21,339 in 2016. There has also been a steady increase in active participants in these programs — from 357,692 in 2011 to 505,371 in 2016.

But compared to other developed nations, the U.S. is challenged in the quality and quantity of these apprenticeship programs. Germany, France, and England have model apprenticeship programs that efficiently fuse formal education with on-the-job training and certification programs. In these nations, the absolute number for apprenticeship starts — the number of individuals who enter an apprenticeship program in a year — is way ahead of the U.S. In fact, on a per capita basis, the U.S. lags far behind in terms of apprenticeship starts. This indicates that apprenticeship programs are highly underutilized in the United States.

AD: How are manufacturers attempting to change perceptions about today’s advanced manufacturing careers?

Rodriguez: Manufacturers are participating in greater numbers in awareness raising programs such as Manufacturing Day in which thousands of manufacturers across the nation open their door and help students, teachers, and the public see firsthand how cool and interesting modern manufacturing is today. There are also lots of grass root efforts, like supporting and mentoring student led competitions — such as FIRST Robotics and Girls Who Code.

There are also initiatives at the state-level that aim to raise awareness about modern manufacturing. For instance, the Illinois Manufacturers’ Association’s Education Foundation hosted 127 events statewide for students and their parents “to explore manufacturing facilities near their school districts.”

AD: How does the use of robots and artificial intelligence (AI) fit into the scheme of things? Will the use of AI in manufacturing eliminate more jobs than it creates?

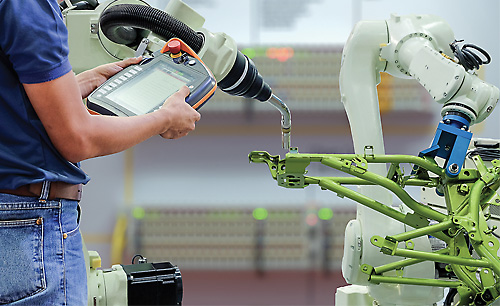

Rodriguez: The use of robotics and AI is only slated to increase in the future. In fact, they are just one set of a group of technologies we refer to as exponential technologies. These technologies are growing and enabling change at an accelerating pace — an exponential pace — which is difficult to grasp by our linear-thinking human minds. As these technologies become more advanced, the rate of their advancement also increases (speed doubles, costs halve), thus ushering in sudden change and disruption in end-applications and industries.

The use of such exponential technologies will require a significant number of highly-skilled workers. The time traditionally spent on some of most repetitive and manual elements will be replaced by new, value-add elements that are hard for us to predict today. The future of work in manufacturing will be a collaboration between man and machine, not the replacement of one for the other. Totally new jobs will be created with titles like digital twin architect, collaborative robotics specialist, predictive maintenance system specialist, etc.

AD: What other challenges are faced by today’s advanced manufacturers?

Rodriguez: Talent, technology, and transformation are going to be three huge players in the battleground for the future manufacturing competitiveness landscape. Those companies that attract the best and brightest are responsive and flexible enough to adapt to the changing head winds and strategically use technology to become more agile, and digital will be at the head of the pack.