Supply Chain Strategies Require Flexibility and Diversity

Volatility in logistics variables is creating a paradigm shift and making location decisions much more challenging.

July 2011

Signs of an economic recovery abound. The Department of Commerce Bureau of Economic Analysis announced that U.S. GDP grew 1.8 percent in the first quarter of 2011. The Department of Labor reported that unemployment rested at 9.0 percent at the end of April - a year-over-year decrease of 0.8 percent. And the Institute for Supply Management's Report on Business® showed that economic activity in the nonmanufacturing sector grew in April for the 17th consecutive month.

Yet, in context, GDP growth actually slowed from 3.1 percent during the fourth quarter of 2010. Unemployment crept up slightly in April (from 8.8 percent in March 2011), and the ISM nonmanufacturing index registered 52.8 percent in April, 4.5 percentage points lower than in March. The conclusion? Yes, things are improving - but slowly and with some bumps along the way. With this guardedly positive outlook for economic expansion, what is the expected impact on the supply chain, also known as the logistics network?

The supply chain consists of suppliers, manufacturing centers, warehouses, distribution centers, and retail outlets, as well as raw materials, work-in-process inventory, and finished products that flow between the facilities. Fierce competition in today's consumer markets is forcing business enterprises to invest in and focus on these variables. In fact, managing logistics has become a major point of focus and differentiation - and the process is increasingly complex. More demand, more shipments, more jobs and more traffic - these issues must be anticipated, prepared for, and taken advantage of for a company to be successful in today's market. Some would argue that the supply chain is not ready.

Logistics Costs on the Rise

Logistics costs are rising now and sure to rise more in the near term. The cost of the U.S. business logistics system declined 18.2 percent in size in 2009 - the largest drop in the history of the Council on Supply Chain Management Professionals' State of Logistics Report®. Add to that a notable drop in 2008, and total logistics costs declined $300 billion during the recession. In fact, 2009 logistics costs as a percent of the nominal GDP hit a historic low of 7.7 percent. This historic low is unsustainable.

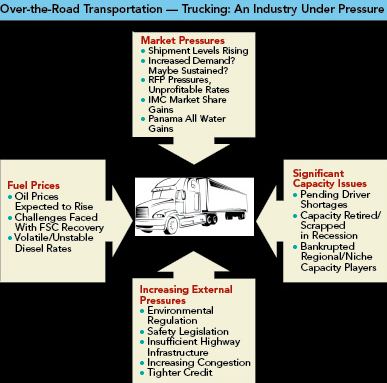

Consider the trucking industry. For domestic distribution, trucking is responsible for 80 percent of all product movement in the United States, followed by rail and then marine transport. Truck freight tonnage in 2010 increased by 6 percent, compared to 2009, while spot market load volume more than doubled.

This "good news" of improvement is accompanied by "bad news." The economic downturn saw load counts for over-the-road shippers reduced by between 30 and 45 percent. By early 2009, carriers were clamoring to compete for limited loads, causing market rates to plummet further, and reducing carrier margins to the point where they could just barely keep their doors open.

As 2009 progressed, many carriers reduced staff and sold excess equipment. Driver capacity was further diminished because many leased operators simply could not afford to pay their bills. As a result, there are 142,000 fewer drivers now than in 2007, according to Con-Way, with a possible net reduction of 400,000 by 2012. Add to that tightening regulations, higher overhead, and increasing highway congestion, and it's easy to see that trucking is an industry under significant pressure.

Now, as demand has started to recover, carriers have been forced to begin increasing rates. By mid-2010, trucking rates in many regions had increased by a factor of 30 to 65 percent over 2009. Currently, we are seeing very tight capacity within the marketplace, with closer to 95 percent of trucks in use. Pricing power will continue to gradually shift from the shipper to the carrier in this new reality.

Fuel prices also will play a key role. Should prices return to the record-breaking levels of 2008, when diesel was $4.78 per gallon and barrel prices were in the $150 range, it could lead to a major jump in transportation costs across the board.

What Happens Next?

The anticipated rise in costs will impact distribution facility networks significantly. On average, the amount of space will increase, the number of distribution centers will rise, and the average distribution center size will be incrementally smaller.

Facilities will be located closer to population centers, overall. Population density will more closely align with distribution square feet density. As networks are defined, average distance to customer will be the most important variable. Many industry experts anticipate that demand will soon outstrip existing inventory supply, which will place upward pressure on rents.

Additionally, with regard to skyrocketing fuel costs, we may see a return to the past in which fuel consumption patterns forced shippers to consider things like bringing more manufacturing operations closer to home - a practice also commonly referred to as near-shoring or near-sourcing.

Recently, in an effort to anticipate the impact of higher transportation costs, Cushman & Wakefield chose the top 82 industrial markets as options in a network model, with population as the proxy for demand. The model "optimized" for a distribution center network servicing the United States. We ran scenarios for anywhere from one to 15 distribution centers, trying to do diligence around the effect of rising transportation costs on networks and industrial markets. We used market-to-market freight rates, meaning they were rate- and equipment-level specific, and we ran the model for outbound shipments only. We did not model other costs, which are significant, such as labor, occupancy, and utilities.

For industrial markets to perform well in this forward-looking exercise, they need to be in more dense markets, have good access to population in an immediate proximity or region, and have expected freight rates that are reasonably beneficial.

Interestingly, Indianapolis was the chosen location for a single-distribution-center model. In this model, this location offers the lowest weighted average distance and freight-rate-based transportation cost to an American household if only one distribution center were allowed.

Increasing the target number of distribution centers, Los Angeles was the most commonly chosen distribution hub, and Sacramento, Newark (NJ), Houston, Seattle, Chicago, Oklahoma City, and Tampa also performed well. As fuel costs increase, these are the markets potentially better positioned to benefit as users shift their distribution center composition.

Project Announcements

Zekelman Industries Expands Blytheville, Arkansas, Operations

04/19/2024

Fibrebond Corporation Expands Webster Parish, Louisiana, Operations

04/19/2024

Master Steel Expands Hardeeville, South Carolina, Operations

04/19/2024

L3Harris Technologies Expands Orange County, Virginia, Operations

04/18/2024

Republic Airways Holdings Plans Tuskegee, Alabama, Training Operations

04/18/2024

South Africa-Based Radel Plans Winston-Salem, North Carolina, Operations

04/18/2024

Most Read

-

2023's Leading Metro Locations: Hotspots of Economic Growth

Q4 2023

-

2023 Top States for Doing Business Meet the Needs of Site Selectors

Q3 2023

-

38th Annual Corporate Survey: Are Unrealized Predictions of an Economic Slump Leading Small to Mid-Size Companies to Put Off Expansion Plans?

Q1 2024

-

Manufacturing Momentum Is Building

Q1 2024

-

Making Hybrid More Human in 2024

Q1 2024

-

20th Annual Consultants Survey: Clients Prioritize Access to Skilled Labor, Responsive State & Local Government

Q1 2024

-

Public-Private Partnerships Incentivize Industrial Development

Q1 2024