First Quarter Growth – Not a Boom

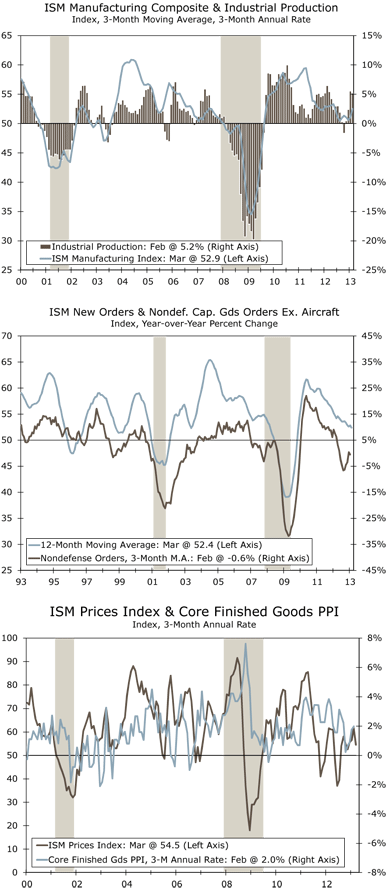

The below consensus ISM reading was disappointing; however, the March ISM index at 51.3 suggests continued growth but not the boom typical of the early recoveries of 2004 and 2009 (top graph). Sustained, subpar economic growth remains the theme for the economy. March’s ISM reading also indicates little impact on the manufacturing sector of the budget cuts associated with the federal budget sequester.

In March, industries with expansion readings (over 50) were production, new orders, and employment, illustrating that the positive report also had breadth to the gains. As we have indicated before, it is tempting to view some recent data as an indication that the factory sector is poised to shift from slow growth into a somewhat faster pace of expansion; we support the case for growth but are not yet convinced that business spending and industrial production are poised to take off. Instead, we anticipate continued moderate growth of 2-2.5 percent for 2013.

New Orders and Export Orders Both Still Positive

In recent months the gain in new orders has been reassuring to our growth outlook. New orders slowed to 51.4 in March but remain in expansion mode (middle graph). Twelve industries reported a gain in orders, including paper, machinery, fabricated metals and electrical equipment for the second straight month. This also seems to be a manifestation of the sense of relief in the absence of a fiscal cliff. Businesses are hunkering down and drawing down inventories, but first quarter orders reflect a greater level of confidence in future economic growth.

Export orders, meanwhile, rose for the fourth consecutive month to 56.0. Industries seeing the fastest expansion are: wood products, apparel, leather & allied, electrical equipment, appliances & components and petroleum & coal products.

Input Price Pressures –Temporary Relief for Profits?

The prices paid component moderated in March (bottom graph). Of 18 industries, 10 reported higher input prices thereby suggesting that the relief in cost pressures is not widespread. Higher input prices were reported for plastics, electrical equipment and chemical industries. Many commodity prices have trended higher in recent months. For example, polypropylene (used in packaging and labeling/textiles) prices have risen for the past five months. Prices for corrugated boxes (used in shipping) have been up for the last eight months. These price increases will put some upward pressure on PPI inflation in the coming months and given only modest increases in consumer prices, suggest profit pressures for many companies, although certainly more modest than we would have projected based on the rise in input prices posted last month.