This profile is enhanced by the fact that over the last five years the U.S. government has decided to manipulate global trade that results in imports into the U.S. by increasing duty rates by a factor of 10. Prior to the Trump administration, the average duty rate in America for most imported goods was 2 percent. After the Trump years, and furthered by the Biden administration, the average duty rate right now for over $4 trillion worth of consumer products and retail goods is standing at around 20 percent. When I say $4 trillion, I’m talking about the sales price you and I pay as American buyers.

Therefore, for companies that must work in the global environment, which is most of our retail brands and our consumer products, and the many parts and suppliers used in manufacturing, the FTZ is now essential. It’s not that everyone has decided to use an FTZ yet, but the rationale for FTZ use has increased by 1,000 percent! Never in the history of the zone program have the FTZ benefits become more of an incentive for relocating, expanding, and helping current businesses compete in the marketplace.

This program provides a federal incentive that impacts fees, federal taxes, and federal costs of importing into the United States. It works just as well for manufacturers, warehouse/distribution companies, third-party logistics operators, and e-commerce players. If you’re involved in any kind of importing, then a foreign-trade zone is a must. If even 10 or 20 percent of a giant warehouse is filled with imported goods, the foreign-trade zone is a perfect way to mitigate those increased tariff rates.

Let me get into the weeds a little bit about the FTZ benefit structure so that it becomes very clear as to how this program is a federal incentive to be used at the local level.

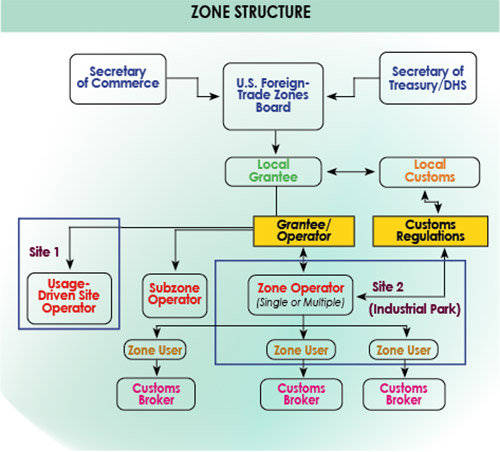

The first thing to notice is that the foreign-trade zone program is built around a local grantee who has been given the approval by the federal government to establish, operate, market, and develop an FTZ in a given region. Every single state in the United States has a foreign-trade zone. There is no excuse now for not utilizing this mechanism.

Knowledge of the program is still very limited as it appears to be a “dark art” or unbelievable benefit. At least that is what I hear when I travel around the country and speak about this program at various seminars and conferences. However, if you can learn the FTZ program benefits structure, how to spot potential FTZ benefits inside your own firm, you will enhance profit, create purchase price variances (PPVs), and get the attention of senior management. This has been proven over and over in zones in Houston, Los Angeles, Fort Worth, western Metro Phoenix, and the Central Valley in California. In just 10 years, a new foreign-trade zone located in the West Valley of Maricopa County, in Greater Metro Phoenix, has delivered a $2.4 billion economic impact annually on the Arizona economy.

For companies that must work in the global environment, the FTZ is now essential. FTZ Benefits

So, what are the benefits of a foreign-trade zone? How are they used by companies to provide additional profits and create PPVs? It’s very simple in principle, but it has nuances and details just like any other tax incentive that you would use.

The first and most important component of whether an FTZ works for a particular company is the evaluation of your level of imports. You can’t have foreign-trade zones benefit (savings) unless a company is importing something. So, the first and most important component of your analysis has to be whether or not you have imports. These can be direct imports or indirect imports, i.e., your firm is the importer of record, or you buy from someone who you know gets the product from imports. Once you determine your import level, then the benefit streams are as follows:

- Duty elimination (from scrap or exports)

- Duty reduction (through the inverted tariff process, only allowed in FTZs)

- Duty deferral (payment of very high duties only when the goods leave the zone, i.e., after they are sold)

- Drastic reduction of merchandise processing fees (MPFs) (see accompanying illustration)

Duty Elimination: Duty elimination occurs under two different scenarios: first, exports, when the exports were part of a manufacturing process; and secondly, through scrap. Imagine a company imports steel in coils and cuts those coils down to size. The average scrap rate is anywhere from 1 percent to 5 percent. When the duty rate on steel was 2 percent to 6 percent, these types of savings really did not matter. However, now the rate ranges greatly with some being 15 percent; and certain steel from certain locations is up to 51 percent duty rate! Now you see we have a huge benefit in not paying the duty on scrap.

This is the same thing as duty not being payable on pink sweaters that got water damaged in the container. If the normal duty rate of the sweaters is 20 percent but is now higher because of the China 301 additional tariffs of 25 percent, the sweater duty rate is now 45 percent! If the whole container worth of water damaged sweaters must be destroyed, you will not only get your insurance to pay for the sweaters (including the duty rate), but you will also get the 45 percent duty back from Customs!

Duty Reduction: This is my favorite form of benefit from FTZs. However, it is more complicated now with the 301 tariffs, but it is also in major use all over the U.S. If you import parts or raw materials into an FTZ (and this is only in a U.S. FTZ because of U.S. tariff laws), there is a very good chance that the duty rate on the parts will be more than the duty rate on the finished product that you are producing in the U.S. This does not make any sense, but tariffs began in 1779 and continue as upside down type tariffs today. So, in the 1950s, Congress amended the FTZ law to allow all those higher duty rates to be lowered to match the finished product rate for U.S. FTZ users!

This is an enormous incentive because it levels the playing field for U.S. manufacturers, assemblers, etc. that compete with foreign-sourced producers. Those foreign competitors are buying those parts duty-free or at lower duty rates and assembling to sell to the USA and now U.S. producers can too. For example, cell phones imported carry a zero percent duty rate. The batteries, which must be imported separately because of fire hazard issues, carry a rate of 4.9 percent. Therefore, if I assemble the finished phone inside of an FTZ, I can lower the battery rate to zero percent. This will allow the producer to greatly save on the imported cost of the phone in total. This happens today for pharma, oil, autos, EVs, refrigerators, electronic doors, chips, Red Bull, for anything you can think of!

Duty elimination, reduction, and deferral are among the benefits gained by using an FTZ. Duty Deferral: This benefit, for the last 20 years, was the least beneficial one inside the FTZ tool kit. However, with duty rates now over 20 percent on average, especially for smaller importers, this is now a significant benefit. For example, if you import $1 million in men’s suits, where the normal duty rate is 25 percent, and now with the 301 duties on men’s suits adding another 25 percent, you are paying 50 percent duty. The $1 million purchase now costs $1.5 million to import. Your costs have gone up tremendously. However, in most consumer goods cases, you’re buying at $1 million and selling at $3 million, so you’ve got some margin to work with.

In an FTZ, you don’t pay the $500,000 in duty until you sell the units out of your warehouse to the buyer. You have “deferred” a ginormous cost until the sale is completed; therefore, the cash flow “hit” is not so badly felt. And the outbound duty payments can be on a single suit, and you still don’t pay the duty on the rest until they are sold. In fact, you can hold that inventory until the units sell for as long as it takes, never having to pay the 50 percent duty until the suits sell. For smaller to medium sized-companies, this cash flow savings is the bomb!!

Using the Program

So, now that you understand the FTZ benefits a little better, how do you use the program to secure these additional profits and/or PPVs for your company?

- Get a cost-benefit analysis performed by your CPA or your import compliance department.

- Understand the operational requirements to manage an FTZ. It’s not rocket science, and there are very sophisticated, cloud-based, leasable software systems today that make the job a lot easier. Again, if you aren’t making a $2 profit for every $1 in cost, don’t pursue an FTZ. But the average savings inside a zone, net of costs, is $7 of profit to $1 in costs.

- Hire a reputable FTZ consulting firm to assist in the upfront application/activation process, and if you prefer to begin the operational process with professional assistance, have them quote you FTZ managed services. It’s much safer, faster, and easier on the enterprise to have professional assistance from day one.