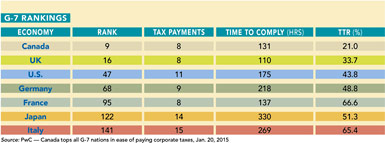

The federal government’s 2015–2016 budget delivers tax cuts for corporate and small business income rates. According to numbers for 2015, Canada ranks as the second-lowest corporate income tax rate for OECD members, behind only Switzerland, at 15 percent. In the 2015–2016 budget, the federal small business rate decreased from 13.12 percent to 11 percent. Moreover, Canada ranks first in the G-7 countries for ease of tax payment and ninth in the world, according to a joint PwC-World Bank study.

Additionally, starting in 2017, the government will implement the seven-year break-even Employment Insurance (EI) premium rate-setting mechanism, which will ensure that EI premiums are no higher than needed to pay for the EI program over time. Under the proposal, any cumulative surplus recorded in the EI Operating Account will be returned to employers and employees through lower EI premium rates once the new mechanism takes effect.

Trade Agreements and Tariff-Free Zones

Once CETA comes into force, foreign investors in Canada will have guaranteed preferential access to both the European and North American markets; this represents nearly 980 million consumers with a combined GDP of US$37 trillion, or nearly one half of the world’s output of goods and services. Canada’s major free-trade negotiations, with the Trans-Pacific Partnership and bilaterally with India and Japan, mean further enhanced market access is on the way for firms investing in Canada. Through tax and tariff export-related programs, Canada provides benefits to businesses comparable to those found in foreign trade zones (FTZ) in other countries, while having the advantages of not being site-specific.

The implementation of the FTZ as of January 1st offers corporations the ability to establish their facilities anywhere across Canada, not only in specific FTZs as in other countries. This creates an undeniable advantage for Canadian site location for FDI.

A Manufacturing Investment Destination

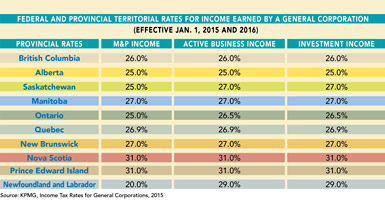

Canada’s combined federal and provincial income tax rates are lower than in the U.S. And, along with zero percent tariffs on equipment and machinery as of 2015 with the implementation of the national tariff-free zone, Canada has established its leadership as an investment destination for the manufacturing industries.

In order to support continued investment in machinery and equipment and help bolster productivity, the government of Canada’s Economic Action Plan 2015 proposes to provide manufacturers with an accelerated capital cost allowance (CCA) at a rate of 50 percent on a declining-balance basis for eligible assets acquired after 2015 and before 2026. Providing the new incentive for this extended period of time will help to provide businesses with planning certainty for larger projects, where the investment may not be completed until several years after the investment decision is made, and for longer-term investments with multiple phases.

By allowing a substantially faster write-off of eligible investments than the usual 30 percent declining-balance rate, this measure will defer taxes and allow businesses to recover the cost of capital assets more quickly. After four taxation years, more than 90 percent of the cost of the asset will have been deducted. In the absence of the accelerated CCA, lower annual deductions would have meant that it would take seven taxation years to deduct 90 percent of the cost of the asset. The deferral of tax associated with this new accelerated CCA is expected to reduce federal taxes for manufacturers by $1.1 billion over the period from 2016–17 to 2019–20.

The Automotive Supplier Innovation Program will complement existing initiatives supporting the automotive sector, such as the Automotive Innovation Fund, by strengthening Canada’s parts supply base and creating a favorable environment for automotive research and development, while providing firms with new opportunities to enter global supply chains.

Provincial Strategies

The three largest provinces — Ontario, Quebec, and British Columbia — account for an important part of FDI into Canada. They offer many new investment perspectives for the coming years with updated or recently launched strategies for FDI attraction including the following:

Ontario — Ontario’s Jobs and Prosperity Fund was launched in 2015. It is a 10-year, $2.7 billion fund to support a dynamic and innovative business climate, and improve productivity and market access for Ontario companies and sectors. The Jobs and Prosperity Fund includes three streams:

- New Economy Stream is available for projects with at least $10 million in eligible project costs. It is aimed at projects in Ontario’s key sectors, including advanced manufacturing, life sciences, forestry, and information and communications technologies.

- Food and Beverage Growth Fund is available for food, beverage, and bioproduct processing projects across the province with more than $5 million in eligible costs.

- Strategic Partnerships Stream provides funding for industry partners that develop enabling technologies for Ontario’s priority sectors. This stream is available for partnerships with at least $10 million in eligible costs. It focuses on technologies with the potential to transform multiple industries across Ontario.

Quebec has also made changes to its business tax rate for corporations and small businesses in its latest budget. The general tax rate will be gradually reduced by 0.4 percentage points from 2017 to 2020. These rate reductions will come into force on January 1 of each of these years.

British Columbia — The province’s 2015–2016 budget does not change corporate tax rates; however, certain business tax credits were extended or enhanced, including entertainment and media industry tax incentives, training tax credits, the small business venture capital tax credit, and the BC Mining Flow-Through Share Tax Credit. Additional incentives have been created or extended for the aerospace, agriculture, and maritime industries.

The budget provides a one-year increase of $3 million to the small business venture capital tax credit program. This will allow for up to $10 million in additional equity financing for qualifying new corporations in 2015.

The British Columbia budget also extends the new mine allowance for four years to Dec. 31, 2019. The new mine allowance is intended to encourage investment and new mine development in BC, and permits an operator to claim an additional allowance equal to one third of the capital cost of a new mine or an expansion of an existing mine commencing production in reasonable commercial quantities after 1994 and before 2016. The budget also extends the new mine allowance by four years to include eligible expenditures incurred before 2020.

Canada, a Leader in Manufacturing FDI for Years to Come

The level of foreign direct investment in Canada advanced by $40.3 billion to $732.3 billion in 2014. U.S. direct investors increased their holdings by $19.5 billion to $361.4 billion, accounting for almost half of all direct investment in Canada. Furthermore, the foreign direct investment position in the Canadian manufacturing sector was up from $11.2 billion to $215.7 billion in 2014.

Moreover, in the last year, the value of the Canadian dollar has gone from 0.93 USD to 0.79 USD as of July 10th, representing a 15 percent drop. This has made Canada more attractive for multinationals, as some manufacturing costs have reduced proportionately. Attracted by its advantages in fiscal policy, taxation, exchange rates, as well as availability of skilled workers among other factors, investors have viewed Canada as an optimal choice for industrial FDI in equipment, machinery, and structures. Now, with a lower currency value and new investment programs, Canada is bound to continue as a leader in FDI for years to come.