Power - cost per kWh, carbon footprint, fuel mix, and infrastructure

Telecom - fiber providers, latency

Geography - proximity to headquarters or airport locations, population size, labor force, water

Climate - Environmental risk (i.e., hurricanes, tornadoes, earthquakes, etc.), free cooling

After solving for these primary drivers, communities will remain on the short list based on real estate availability and cost. This holds true for existing colocation facilities or greenfield sites for new construction. When the box is checked for real estate, taxes and incentives end up swaying the business case or leveling the playing field for communities on a data center’s short list. Taxes and incentives are the only tools a state or community has control over in order to win data center facilities. With this in mind, 17 states have customized incentive programs for the data center industry. Typically, the larger the project investment, the more important role incentives tend to play in the overall site evaluation.

A Quick Primer on Data Center Taxes

When developing a Total Cost of Occupancy (TCO) model, one-time and recurring taxes will have a significant impact on long-term costs for a data center. The capital-intensive nature of a data center will trigger relatively high sales taxes and property taxes. Property taxes are typically payable for both real estate and personal property (or equipment).

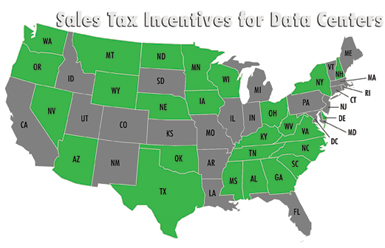

Sales (or use) taxes are incurred on a one-time basis for purchases of building materials, mechanical and electrical equipment, IT equipment, and, in some cases, software. Sales taxes on building materials are due based on the location of purchase, whereas sales taxes on equipment are due based on the location of delivery. For example, $10 million of IT equipment delivered to a data center in Columbus, Ohio, would incur about $700,000 in sales taxes.

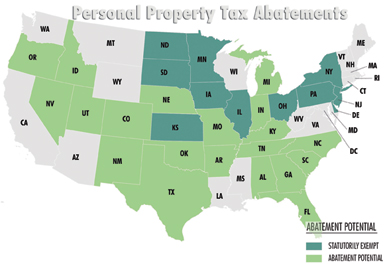

Personal property taxes are payable on IT equipment, furniture, or other equipment that is not bolted to the real estate and can be removed. These taxes are paid each year based on original purchase price, depreciation, and the local effective tax rate. For example, $200 million in IT equipment in suburban Dallas, Texas, would yield about $17 million over a five-year period. It should be noted that personal property taxes would be due for each cycle of equipment purchases. That is, purchases in 2013 would incur personal property taxes from 2013–2017, and purchases in 2017 would have taxes due between 2017 and 2021.

Data Center Incentives

Since 2005, about 17 states have passed legislation to provide customized incentives for data centers. These states provide full or partial exemption of sales taxes for various investment types. The exemptions commonly cover computer (or IT) equipment across the board. Construction, mechanical and electrical equipment, cooling systems, power infrastructure, electricity, and backup fuel are covered to varying degrees by this group of states.

Minimum Thresholds - State incentive benefits for data centers are not necessarily automatic and have certain hurdles or minimum thresholds, which are related to capital investment, direct jobs, payroll or salary, and time period. Following are a few examples:

- Nebraska provides an enhanced level of incentives for data centers with a minimum of $200 million in capital investment and 30 direct jobs. The investment minimum can include construction, equipment, and capitalized software. The minimum jobs are direct or “badged” employees. Contractors are generally not allowed in the calculation. It should be noted the jobs and capital investment targets must be achieved within seven years in order for a company to earn the incentives benefits. The state has an alternative level of incentives with a lower investment threshold of $37 million.

- North Carolina requires a minimum of $250 million for Internet data centers and $150 million to $225 million for enterprise data centers within five years. The minimum for enterprise users depends on the county where the data center is located. There is no minimum jobs target.

The past two years saw activity in the following eight states that either created new incentives programs or tweaked existing programs to lure data centers.

- Georgia’s data center incentive program was passed in 2005. The program provided a 100 percent exemption of sales taxes on computer equipment as long as a $15 million investment was made each year. During 2012, the exemption was expanded to cover sales taxes on construction materials.

- Virginia’s incentive program for data centers was created in 2008 and amended during 2012. The program allows for a 100 percent exemption of sales taxes on computer equipment as well as mechanical and electrical equipment. The minimum thresholds include $150 million in capital investment and 50 new jobs. The 2012 amendments allow for tenants and owners to be qualified data center users. This means that tenants of a colocation facility would be allowed to earn the incentive.

- In 2009, South Carolina created a data center incentive. This program provided a 100 percent exemption of sales taxes on computer equipment. In 2012, the state made three enhancements including (1) reducing minimum jobs to 25 from 100; (2) lowering capital investment to $50 million from $300 million; and (3) allowing exemption of sales taxes on electricity.

- A new data center incentive program was created in Alabama during 2012. This program could potentially provide a 100 percent exemption of sales on computer equipment, mechanical and electrical equipment, cooling systems, and power infrastructure. The minimum thresholds include 20 new jobs and $200 million of capital investment.

- The Nebraska Advantage program was enhanced to include a large data center option (or tier). The large data center tier requires a minimum of 30 new jobs and $200 million of capital investment. If these minimums are attained, the program allows for 100 percent refund of sales taxes on equipment, construction, and capitalized software. Other benefits include a limited refund of employee personal income taxes, 100 percent refund of real estate taxes paid to the locality, and 100 percent exemption of personal property.

- The state of Arizona entered the data center competition during 2013. The program allows for a 100 percent exemption of sales taxes on computer equipment, mechanical and electrical equipment, and construction materials. The minimum thresholds include $50 million of capital investment or $25 million in smaller counties in the state. In addition, tenants or owners of colocation facilities are eligible for the data center incentive. Eligibility for colocation is based on a minimum investment of $250 million between 2007 and 2013.

- A new data center incentive program was passed by the Texas legislature in 2013. The program provides a 100 percent exemption of sales taxes on computer equipment, mechanical and electrical equipment, cooling systems, power infrastructure, electricity, backup fuel, and software. The minimum thresholds include 20 new jobs and $200 million of capital investment. The sales tax exemption is limited to data center facilities that are 100,000 square feet or larger. Tenants of colocation facilities are eligible for the incentive program.

- As of this writing, the state of Ohio is evaluating amendments to its data center incentive originally created in 2011. The amendments include (a) allowing tenants of colocation facilities to be eligible; (b) lowering payroll threshold to $1.5 million from $5 million; and (c) allowing minimum thresholds to be covered by tenants and owner of a colocation facility. Ohio’s data center incentive can be up to 100 percent of sales taxes on construction materials, computer equipment, mechanical and electrical equipment, cooling systems, and power infrastructure. In addition to the minimum payroll, eligible data center users are required to invest at least $100 million.

Over the past eight years, states have increasingly jumped onto the data center bandwagon. States and communities alike want to increase tax revenues, and policymakers are realizing that data centers can be a significant source of new revenue — sometimes even more so than typical economic development projects like headquarters, manufacturing, or distribution centers. While data centers do not directly create large employment opportunities, they do create a significant amount of high-end construction employment for a period that typically runs around 24 months. Additionally, these assets, once built, are a key component of a company’s overall operating environment and can create a long-term investment in a community. Lastly, data centers tend to group together, and it is likely that once a certain geography attracts a big-name user, others will follow (e.g., in Colorado Springs, Raleigh, Des Moines, etc).

Data center owner/operators can see sales tax breaks from select states, property tax abatements covering the facility and equipment, and cash grants to offset public infrastructure improvements. As demand for colocation facilities has increased over the years, some states are starting to allow these facilities and tenants to benefit from incentives that otherwise were only available to enterprise users. Companies are using incentives to help lower the long-term total cost of occupancy, which only helps secure capital approval for projects. Developers are using incentives in certain markets to help lower the rent structure to compete with colocation facilities throughout the United States.