- Intermodal rail carload movements have grown faster than other types of rail freight movements, partly due to growing container/trailer volumes and partly due to declining coal shipments.

- East Coast ports’ share of international container volumes, imports in particular, have increased, supported by East Coast railroads. This may force West Coast ports and railroads to rethink their strategies, as this trend may be extended due to the Panama Canal expansion to accommodate larger ships.

- Investments in inland logistics centers, such as the Logistics Park in Kansas City, are increasing. The most recent announcement came from the Georgia Ports Authority regarding its Appalachian Regional Port to be located in Northwest Georgia.

Intermodal rail volumes have grown faster than other types of rail carload freight. Intermodal rail volumes consist of international containers carried on vessels, domestic containers, and containers on trailers driven onto railcars. International containers come in 20-, 40-, and 45-foot lengths, while domestic containers drayed on truck trailers are 53 feet long. At major container port gateways, cargo owners often transfer the contents of international containers to domestic containers — called transloading — at facilities near the container ports. Transloading the contents of three 40-foot international containers to two domestic 53-foot containers reduces the cost of shipping imported goods to inland locations by a third, less the cost of the transloading activity.

A looming capacity shortage in the trucking industry — coupled with rail’s high efficiency — is causing logistics suppliers and transportation providers to turn their focus to intermodal solutions. Rich Thompson, International Director, Keith Stauber, Managing Director, JLL Intermodal railcar movements include both cargo with domestic and international origins. However, intermodal volumes have grown in line with imported container volumes at U.S. ports. Non-intermodal carloads have been trending down. The downward trend in non-intermodal carloads is primarily due to declining coal shipments. Natural gas prices have declined and, along with increasingly restrictive environmental regulations that negatively impact the demand for coal as a fuel for electricity production, have resulted in declining coal shipments. Until a few years ago, coal was over half of the volumes hauled by railroads and the largest source of revenues and profits. Intermodal volumes have therefore become more important to railroads.

Which Ports Are Seeing Increased Activity?

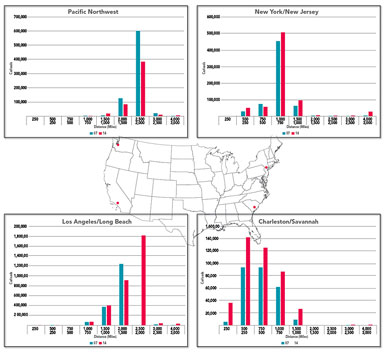

The benefits from growing intermodal shipments have not been uniform between U.S. coasts. Imported international container volumes handled by U.S. ports peaked in 2008 when the Great Recession began and did not recover to that level until 2014. East Coast ports recovered faster than West Coast ports, and the ports of Los Angeles and Long Beach have not yet seen their volumes recover to the pre-recession level.

Some of this is due to the fact that compared to East Coast ports, West Coast ports are more oriented toward trade with China, Japan, and Korea and to commodities where demand is driven by residential real estate activity. Given that U.S. residential real estate market activity remains well below the peak levels seen before the recession, it is not surprising that West Coast port volumes are still below their previous peak levels. This is also evident in rail volumes. Intermodal volumes from the West Coast ports to inland destinations greater than 1,500 miles away have declined, while those from the East Coast ports have increased. Both East Coast ports and railroads have gained share of imported container volumes and, in particular, gained share of volumes imported to the Midwest. (See charts focusing on ports in the four corners of Seattle/Tacoma, Los Angeles/Long Beach, Savannah/Charleston, and New York/New Jersey.)

It is likely that East Coast ports will hold on to their gains now that the third set of locks at the Panama Canal are operational. These larger locks will allow container vessels of up to 12,500 TEU capacity to cross between the oceans, compared to 4,500 TEU capacity vessels prior to the June 26 opening. East Coast ports have been investing in terminal upgrades and clearing navigation channels for larger vessels.

It is, however, too soon to predict that East Coast ports will continue to gain share of U.S. container volumes. Ocean carriers are increasingly deploying vessels that are too large to fit through the larger locks recently opened at the Panama Canal. Long Beach and Los Angeles will be able to handle vessels with capacity greater than 18,000 TEUs. Larger vessels have lower per container average costs and this would improve the cost competitiveness of West Coast ports.

Railroad Investment

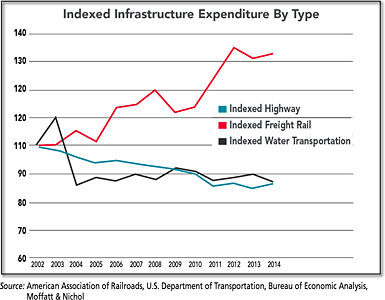

Railroads have also been investing in infrastructure, averaging about $25 billion per year over the last several years, according to the American Association of Railroads. This includes rolling stock and improvements to their networks such as double-tracking so as to improve two-way directional traffic capacity.

Intermodal rail volumes consist of international containers carried on vessels, domestic containers, and containers on trailers driven onto railcars. As railroad investment has increased over the last 20 years, investment in highways and waterways, mostly by the public sector, has been decreasing. One has to be careful in interpreting the data — while there has been a decline in inland waterway systems, investments by ports has been increasing. However, the message is clear: railroads are investing and their efforts are supporting the movement of freight via U.S. ports.

Industrial Real Estate Trends

Growth in international container volume trade is stressing the freight movement supply chain. Increasing congestion issues have accompanied the recovery and the sustained growth of container volumes at U.S. ports. Navigation channels have been deepened to accommodate larger vessels. Bridges restricting air draft of the larger vessels are being raised. Terminals are investing in larger ship-to-shore cranes and reinforcing quay walls to hold the larger and heavier freight movement equipment.

However, there has been little progress in increasing roadway capacity. Growing volumes of containers on larger ships are creating congestion issues. It is not surprising that railroads are seeing growing intermodal volumes since they are an increasingly important alternative to trucks due to roadway congestion and chronic truck driver shortages.

These factors are also evident in industrial real estate trends. According to JLL research, in the second quarter of 2016:

- Nationwide net absorption and construction in most markets was in line, keeping pace as new deliveries came online.

- Total net absorption increased by 18.9 percent from the previous quarter, posting 62 million square feet (compared to 52.3 million square feet).

- Overall vacancy fell by 20 basis points to 6 percent.