The first step is to understand that you’re not alone on the road to digital enlightenment — and senior executives are developing a new appreciation for facilities data. New research shows that 75 percent of corporate real estate (CRE) leaders view facilities and real estate data as an integral part of an enterprise data analytics strategy, according to Mind the Gap: Aspiration Vs. Reality in Corporate Real Estate, a Forrester Consulting survey commissioned by JLL.

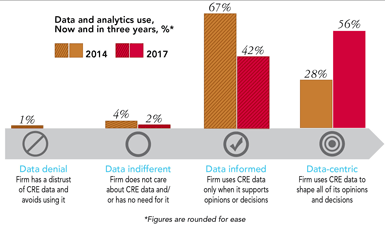

More than half of CRE executives say they aim to become “data-centric” by 2017. In this context, “data-centric” means that they plan to use CRE data not just to support opinions or decisions, but also to actually shape opinions and corporate strategy.

Many CRE departments are already using data and analytics at the tactical level to a significant extent. Forty-one percent have invested in data storage systems, for instance, while 37 percent have created a standardized process for data generation, and another 37 percent engage in data gathering.

We have access to more sophisticated real estate data than ever before and the possibilities are endless. Three industry experts reveal what we need to do to make that data drive meaningful business results.

Want the Facts? Analyze the Data.

Connecting the dots between IT, HR, financial, and real estate data can yield impressive business insights that will make you a data-driven CRE guru:

- Sophisticated site selection: Rich location data is a game-changer in strategic site selection. By overlaying real-time maps on diverse CRE data — from demographics to access roads to leasing costs — you can better identify specific-use cases for any given site or compare multiple locations on the basis of multiple criteria, such as tax burdens and expense projections. These insights can play a critical role in corporate strategy by pinpointing where competitive advantage can be gained in terms of lower operating costs, access to talent, and other factors.

For example, retailers rely on the analysis of multiple data sets, including such demographics data as per-capita income, to determine the potential sales opportunity in a particular trade area when making location decisions. Companies can use similar algorithms to assess how factors such as the quality of amenities (restaurants, childcare, gyms, etc.) and proximity to transport options make a location attractive to potential employees. Analytics can generate a detailed statistical picture of the surrounding environment that can be compared with other locations and benchmarked against indicators such as employee satisfaction scores, creating a model that reveals the success or potential of different location choices.

With dynamic geo-spatial intelligence, you can look beyond square footage and real estate costs. You can use a host of data input possibilities encompassing census data, population income, and even psychographics — data concerning how consumers make life decisions, whether buying furniture or voting in elections — for real-time and futuristic insights on any site in question. Want a comprehensive look at the best sites in any given region? Turn a time-sucking, two-day trip into a targeted half-hour virtual tour, with tools that “fly-around” and zoom, providing more depth of knowledge than you’d get physically leaving the office. - High-performing workplaces: Today’s data and analytics technologies allow CRE teams to work much more closely with HR than in the past to identify the emotional drivers affecting productivity and employee engagement. You might invest in high-tech on-site meeting rooms, for example, only to learn that employees prefer to meet in the cafeteria or at the coffee shop across the street.

Many companies are adopting innovative workplace strategies to improve employee and business productivity. However, these companies often lack the data and analysis required to support these strategies and, instead, rely on reduced cost-per-square-foot or increased utilization rates as measures of success. Analytics can be used to combine input from different data streams, correlating new workplace initiatives with value drivers such as employee attraction and retention, client satisfaction, speed to market, or other relevant performance indicators. Although there isn’t a consistent methodology to define employee engagement or worker and workplace productivity today, there is a huge opportunity for analytics to help measure and optimize productivity initiatives.

Cutting-edge workplace sensors and mapping technology can be used to see, in real time, how and why employees are using — or avoiding — particular facilities. These insights, in turn, can be used to repurpose or reconfigure underused space and inform the design of workspaces that inspire productivity and innovation. Understanding where and why employees are most engaged and productive can also help companies shape talent recruitment and retention programs that are responsive to employees’ work styles and preferences. - Improved building performance and operating efficiency: Advanced building technologies offer tremendous energy-savings potential based on the data generated by today’s computer-controlled “smart” systems. With real-time smart building management and control software, the CRE team can prevent costly and disruptive equipment failure, optimize building performance, and manage resources across a huge property portfolio with a single highly efficient dashboard. Combined with financial and legal inputs, this portfolio data becomes an invaluable tool for long-term strategic planning.

Bumps in the Road

No path to ‘enlightenment’ is ever without challenges, but knowing that others are facing similar obstacles can be helpful. The study reveals some common impediments to integrating CRE into overall business strategy — and some ways to surmount them.

- Weak data governance policies - Only 30 percent of CRE teams have standardized governance policies, suggesting fundamental risks for data integrity. A robust data governance framework frames policies across several areas, from data collection and warehousing to access and privacy, ensuring data integrity even as diverse contributors access it.

- Lack of accountability to the business - Only 26 percent of CRE teams have established key performance indicators (KPIs) that align CRE data and analytics activities with overall business goals. For example, a company might establish that investment in a data and analytics platform should enable it to reduce underused workspace by 20 percent in 18 months. Without KPIs, it can be difficult to measure the return on data and analytics investments.

- Talent and technology gaps - Only 36 percent of CRE teams effectively utilize the data they collected. No wonder, then, that 33 percent of CRE executives say their teams needs training to fully understand data and analytics. Training can help overcome this knowledge gap.

- Fragmented data initiatives - More than 60 percent of CRE executives note that their organization’s data and analytics strategy is driven and funded by individual business groups. Only 9 percent strongly agree that they constantly gather and exchange information across departments to proactively manage shared workspaces and other resources. This fragmented model of departmental ownership creates information silos that can undermine the use of data and analytics to shape corporate strategy.

To turn general interest in CRE data into strong, decisive action, it’s crucial to provide clear illustrations of how aligning corporate real estate data with other departmental data creates greater business value and fuels better business decisions. Enlightened corporate real estate involves more than instinct — it means sophisticated data and analytics that reveal meaningful insights on where corporations should locate and when that makes sense.