Would it be a surprise to find that annual operating costs related to a manufacturing site’s supply chain, labor, and utilities might vary by as much as $5 million or more between U.S. geographies for a $150 million facility? For many businesses, that is the difference between a fundable and a failed project.

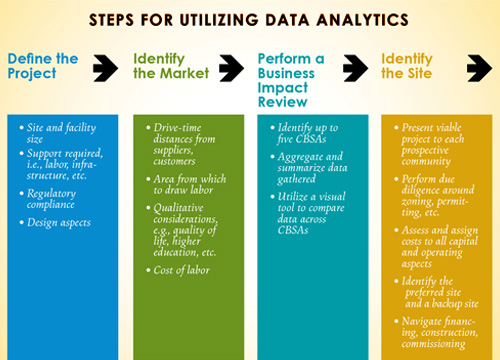

Establishing a sequential (and sometimes iterative) framework to conduct an efficient site selection process informed by data is critical to reducing risk and selecting a location that leads to a successful project. Key metrics to understand are a company’s supply chain and logistics network, labor needs, utility rates, and state and local tax impact. Focusing on quantifiable aspects up front will not only keep the process on a defined schedule but also serve as a defensible decision-making trail rather than a “gut feel” approach that increases risk exposure and sometimes even internal conflict.

Project Definition

By far the most integral stage of the process that will facilitate holding a specific project pre-development timeline is project definition. Involving all necessary stakeholders to develop an agreed upon outline for site and facility design needs is essential.

Would it be a surprise to find that annual operating costs related to a manufacturing site’s supply chain, labor, and utilities might vary by as much as $5 million or more between U.S. geographies for a $150 million facility?

- The following questions must be answered before anything else in the process can happen, even if they include ranges of values supported by subject matter experts:

- What facility size is required at what stages of project development to meet a company’s long-term planning needs?

- What minimum and maximum sized site is required to support initial stage development, yet also allow for future expansion?

- Will distribution center support need to be considered in the selection process?

- What is the labor support required at these stages?

- What utility loadings support this development at these stages?

- What regulatory aspects of the business must be considered that may affect site selection?

Market Identification

With limited information it can be overwhelming to understand where to even begin. The initial analytical stage in the process is focused on significantly reducing potential geographic areas to consider for the project. It is often easier to think about where the project should not go as compared to where the project should go.

GIS data layers and tools can be utilized in mapping drive-time distances from key airports or other transportation access points, proximity to key suppliers, customers, and/or distribution centers — or even access to certain sized qualified labor pools. While the analysis is often highly quantitative in nature, it does not necessarily need to calculate cost impact during this initial filtering effort.

Other factors may be defined that are more subjective in nature, such as access to cultural centers, higher quality of living ratings, proximity to relatable industry hubs, or even potential project partner or higher education institution collaboration opportunities. This geographic narrowing exercise then allows for moving into the next step, which focuses on the operational cost impact of key criteria.

Business Impact Review

The goal of the business impact review stage is to narrow the search from a starting point of up to 30 down to no more than five Core-Based Statistical Areas (CBSAs) before site identification can begin.

Focusing on quantifiable aspects upfront will not only keep the process on a defined schedule but also serve as a defensible decision-making trail rather than a “gut feel” approach that increases risk exposure and sometimes even internal conflict. The key factors include reviewing a company’s supply chain and logistics network, labor needs, and utility rates. These three pillars are often the most impactful cost criteria with the largest potential cost differential from a geographic perspective. Each is quantifiable and can be assessed across larger groupings of areas using available data sets either from internal company sources or external agencies — Bureau of Labor Statistics, Energy Information Administration, or industry-specific organizations.

Check with industry experts to understand what tools have already been developed that aggregate and summarize this information into useful prediction analysis that can be efficiently customized to your project, rather than spending time to develop your own. Not only will this analysis be useful in relative geography comparison, but it can be used as absolute value information to feed a financial model often required in assessing project viability. The result of the combination of data sets is a dynamic, visual tool (Tableau, Power BI, ArcGIS) that compares across CBSAs to allow for decision-makers to narrow choices to a handful of areas before the next stage, site identification.

Site Identification

In too many instances, companies progress directly into this last stage of site identification with little analytic backing to support why and how certain geographies were selected. This often leads to a lengthy and challenging process where project leads jump from one city to the next focusing on subjective criteria with no organized method of reaching final site selection.

The market identification and business impact review process described above provides the confidence in presenting a viable project to each potential community, enlisting their support in identifying qualifying sites, and moving into the site-specific due diligence process in vetting the best options available. Working with local economic development organizations (EDOs), the utility providers, the municipal operational and political leaders, and your engineering support team is essential to successfully finding the best option in the narrowed geographies.

GIS data layers and tools can be utilized in mapping drive time distances from key airports or other transportations access points, proximity to key suppliers, customers, and/or distribution centers — or even access to certain sized qualified labor pools. Once a handful of prospective sites are identified in each geography of interest, due diligence efforts will commence around permitting, ordinance compliance, zoning, utility capacity and rates, land or facility control agreements, community support, worker training, geotechnical or environmental considerations, site access, and all aspects affecting construction cost and timeline. While this level of detail requires numerous parties and their subject expertise, there are analytical tools available that catalog and assess many of these site risk factors via past engineering efforts and/or publicly available land information databases. Assessing and assigning cost implications to all capital and operating aspects of these criteria by common sizing into a net present value analysis will help in making an objective decision around a preferred site.

Once you have completed this process and identified at least one preferred site — ideally with a backup site where your team is running due diligence simultaneously if project budget allows for it — working toward the project’s financial close will be the final step. Federal, state, and local incentives are typically available to assist in filling financial “gaps.” If you do not have internal capacity and experience in aligning these funding mechanisms, then third-party assistance is recommended in order to efficiently and effectively navigate through the complicated process.

All too often significant time and effort is invested into site selection without a parallel strategy for project finance. In order to cross the finish line, you will need to make sure you have the people, process, and tools in place to complete a project through permitting, finance, construction, and commissioning.