Recessionary Forces

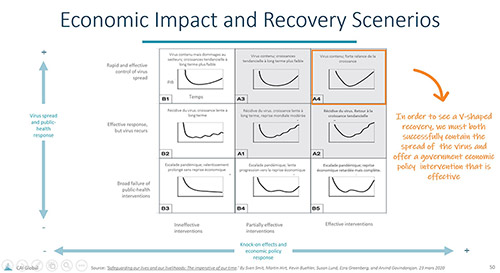

The level of damage to the economy will depend on the spread of the virus, the healthcare response to the virus, and the effectiveness of the government stimulus and aid programs. This was clearly exemplified in the analysis and research completed by McKinsey & Company in “Safeguarding our lives and our livelihoods: The imperative of our time.” The accompanying graphic contains the group’s projection of the recovery and what we see is that even the most optimistic scenarios show a shock to our economy that far exceeds anything we have experienced since WWII.

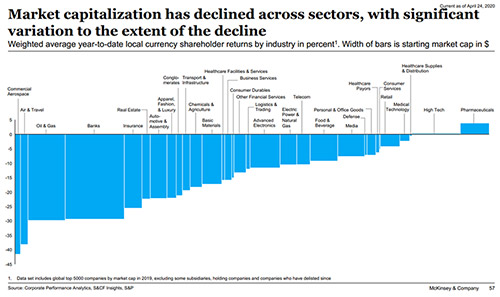

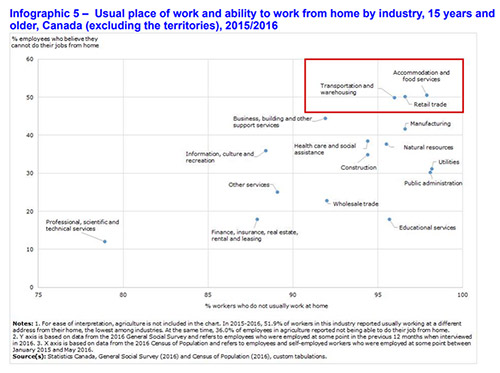

The industries that were quickly hit the hardest are accommodation and food services and retail trade. Those also happen to be the two industries with the largest percentage of employees that don’t and cannot work from home.

We knew that April would be worst than march and the numbers don’t lie. The unemployment rate in the U.S. jumped to 14.7 percent in April 2020 compared to 3.7 percent in 2019. In Canada, it jumped to from 5.7 percent in 2019 to 17.8 percent in April 2020 (including those who had stopped looking for work). The question is, will that solve the workforce shortage issues?

The answer is unclear especially since the crisis has also affected the educational system and ability to recruit seasonal workers. Brick and mortar universities across North America will have to rethink how they can continue to attract international students and how to deal with a reduction in registrations this fall. In certain industries, seasonal workers from overseas and South America are extremely important and will affect their operations.

The COVID-19 crisis is also resulting in acceleration of digital transformation. Manufacturing companies that were late adopters of 4.0 technologies are now more open than ever as they face production challenges linked to new health and security standards. Some companies are planning for an increase in sick leave for the next 12 months, which could reduce their workforce by 10 percent to 5 percent. Given all the uncertainty surrounding the workforce issues, it is too soon to say if the crisis will solve the workforce shortage.

Incentives

Government incentives at the federal and local levels have changed significantly in the last two months. CAI Global has noted three main ways that governments across North America have changed their efforts:

- Provide direct relief to local businesses that have been the most suddenly and intensively impacted by the crisis, either as a direct result of the lockdown or because of the shift in consumer demand;

- Provide incentives to ramp up the much-needed PPE by incentivizing manufacturers to retool, invest in new production equipment, or ramp up production of an existing PPE; and

- Prioritize investment projects in the pipeline that are vital to the economic recovery.

- Supply Chain/Reshoring

In comparison to SRAS and MERS, this novel coronavirus has influenced the global industrial ecosystems in unprecedented ways. Its lower death rate and higher infection rate created a perfect storm that hit China first, sending ripple effects through various global industries that were dependent on international suppliers in Asia. Companies today are rethinking their sourcing strategies and — as the virus continues to hit important economies on the global scale — it is becoming more and more clear that companies will start thinking about replacing just-in-time with just-in-case inventory management. - FDI

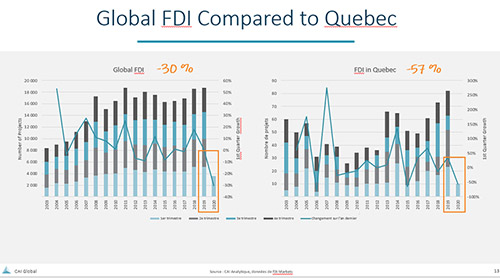

Global FDI in Q1 of 2020 saw a 30 percent decline in projects compared to the same period last year. This trend can be explained by the effect of the crisis on the capital markets, supply chain disruptions, a reduction in business travel, in addition to the economic development efforts focused on maintaining local businesses. The decrease in FDI differs from one region to another. For example, in the Canadian province of Quebec, FDI decreased by almost double (57 percent) that of the global trend.