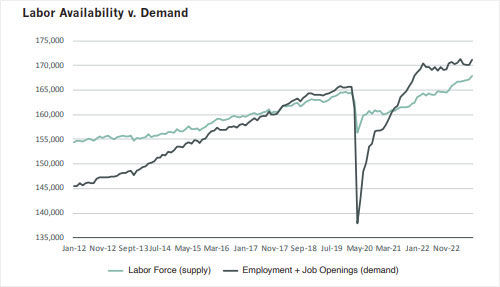

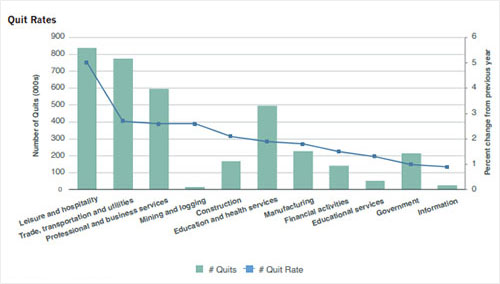

The industrial workforce, in particular, has faced talent constraints over the past several years. Not only has the industrial labor market been tight but the struggle to retain a stable entry-level workforce has proved to be an obstacle. While quit rates have calmed from their peaks in the past two years, the entry-level workforce for operations like distribution centers are still reporting elevated quit levels. Additionally, other industries like Leisure and Hospitality are fighting for similar entry-level talent. Leisure and Hospitality combined with Trade, Transportation & Utilities accounted for roughly 1.6 million quits for the month of August in 2023. As industrial employers navigate these choppy labor waters there are several areas of focus that can offset risk for long-term staffing success. Looking at critical areas surrounding talent depth, recruiting reach, and assessing wage pressures can assist in understanding the risk outlook for industrial occupiers.

Long-Term Talent Depth

It is common to concentrate on the “now” in site selection. The talent pool that resides in markets and the current cost of the labor are always important but other factors can influence the long-term viability of a market from a talent perspective.

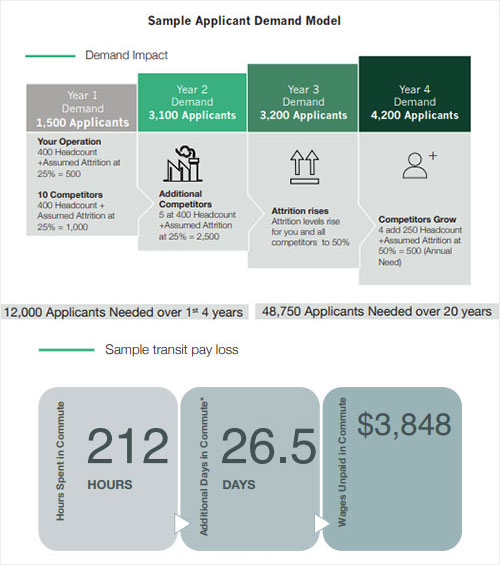

In understanding labor environment risks, supply is still king. Regardless of other conditions, if the talent pool in a market is insufficient it can lead to ongoing operational and financial struggles. Looking at the supply in a market to only understand if it can accommodate initial headcounts is risky. To understand the market’s ability to provide the needed talent over many years, it is helpful to anticipate future disruptive conditions. For example, as illustrated in the accompanying graphic, demand on a market can increase significantly through unanticipated events such as competition entering the market or turnover creating a need for more applicants.

The sample demand illustration contemplates just a few of the areas that assist in understanding how much supply is needed to sustain industrial operations in a market. It should be noted that the actual supply needed in this example can be much higher depending on additional areas considered.

Looking at the supply in a market to only understand if it can accommodate initial headcounts is risky. Know Your Recruiting Radius

In further understanding the depth of talent in markets, another critical aspect to review is the recruitment radius. Influences such as virtual work and cost of transportation have made the workforce more sensitive to drive times.

A survey conducted by thezebra.com showed that 35 percent of the people surveyed would take a pay cut in exchange for a shorter commute. The survey also broke down the average commute time spent over a year, which was 212 hours. This amounts to roughly 26.5 workdays (assuming a 40-hour work week) added to an employee’s year spent away from home due to work. Taking these calculations and applying the average entry-level wage for a machine operator across the United States, the hours spent commuting would amount to $3,848 in unpaid time. In most markets, applicants have options, and if an individual can save time and reduce their expenses, they likely will.

When evaluating a new market for a new operation, it is best to understand the market’s transportation dynamics so that an accurate measurement of supply can be assessed. If this recruiting radius is not fully understood before entering a new market, the projections could be too rosy, leading to an inflated outlook.

A survey conducted by thezebra.com showed that 35 percent of the people surveyed would take a pay cut in exchange for a shorter commute. Additionally, looking at areas like public transportation can assist in understanding how much talent is accessible. However, it is also worth reviewing the adoption rates of local public transportation. Just because the infrastructure exists to transport people near an industrial site does not mean that the public utilizes it.

Projecting an accurate supply in a market is crucial to understanding the sustainability of operations in that market. Along with these forward-looking supply considerations, evaluating cost pressures can assist in determining if the environment poses future risks due to what it will cost to access the local talent pool.

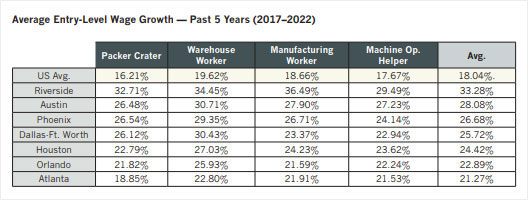

Wage positioning for talent has always been an area of focus in site selection. However, often the due diligence focuses on current pay disparity between markets. While it is important to understand what it takes to competitively enter a market, combining it with an outlook on wage trajectories and pressures can help to determine how much a market is susceptible to future higher talent costs.

Industrial talent wages have been on the rise for several years, but certain markets have significantly outpaced others. The Sun Belt region has benefitted from employers looking for deep talent and large-market demographics that offer a wage positioning opportunity. The growth in demand for these areas has put pressure on industrial wages, as shown in the accompanying table.

An outlook on wage trajectories and pressures can help to determine how much a market is susceptible to future higher talent costs. Along with the competitive environment pushing wages up in these markets, many of the markets have seen housing costs rise significantly over the past decade. Just over the last five years, based on redfin.com, the median sales price across the U.S. went from $281,000 to $412,000 (August 2018-August 2023, seasonally adjusted). Redfin.com also reported that inventory for all homes was down 15.8 percent year-over-year from September 2023. This low residential supply could keep housing prices high even though interest rates have risen notably. Additionally, rents across the country went from $1,637 to $2,052 over a four-year period (August 2019-August 2023), according to rent.com. Since housing costs are often the largest expense for cost-of-living, the housing conditions can influence the trajectory of wage expectations in established and emerging industrial markets.

In evaluating a market for an industrial site, these wage pressure conditions should be considered to understand the potential cost of labor for the long-term and how to be competitive in the market in future years.

Look Ahead for Success

Each employer has to consider their own strategic priorities. In conjunction with these priorities, evaluating for the long-term talent pipeline, knowing the recruiting reach, and understanding potential wage pressures can help prevent staffing complications in the future.