Broad-based Gains Are a Welcome Sign of Improvement

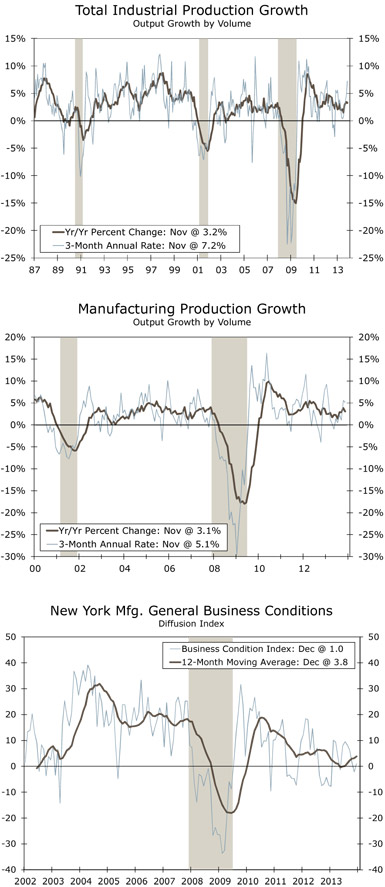

Prior to this morning’s report, orders and production figures had been broadly disappointing in recent months. A gap between multi-year highs in survey data, like the ISM manufacturing index, and hard data on output were confounding efforts to determine which way the winds were blowing in manufacturing.

Though our patience was running thin, our conviction that we would eventually see a modest strengthening in the factory sector was finally justified in what feels like the first unequivocally positive industrial production report in months.

Manufacturing output, which comprises three-quarters of all industrial production, was up 0.6 percent. In terms of the underlying components within manufacturing, production of automobiles and parts was the biggest positive, up 3.4 percent in the month. Gains were not limited to the auto sector, with manufacturing production up 0.5 percent outside of the sometimes volatile auto category. Gains outside of autos were led by a 3.1 percent increase in wood products output and a 1.7 percent increase in production at the country’s textile mills.

Mining production, which has a roughly 15 percent share of output, increased 1.7 percent in November. While that is a healthy gain, it comes on the heels of a 1.5 percent drop in October. So, to some extent this is just a reversal of a bad month in October. Utilities production was up 3.9 percent in November, the largest monthly increase in eight months for this choppy category of production.

What Does This Mean For the Outlook?

There are a few negatives in this report that could have marginally negative implications for GDP, but generally the details of today’s report are much more in-line with the gradually improving outlook we have maintained in the face of disappointing data in recent months. Production of primary metals, computer & electronics components, aerospace & miscellaneous transportation equipment and apparel were all negative. However, the back-to-back increases in manufacturing output and the upward revision to last month’s figures offer a more optimistic assessment of the factory sector. One robin does not make it Spring however, so we will keep a watchful eye on other leading indicators.

Speaking of which, the New York Federal Reserve’s December Empire Manufacturing Index hit the wire earlier this morning and showed that manufacturing in New York and the surrounding area is showing only scant improvement. The headline measure came in at 0.98, and while there were a lot of negative components, the expectations for six months from now are more upbeat.