What does that mean for corporate leaders, as they chart a path forward in 2024? What kind of story are they expecting to see, and how are they going to write their chapters in that story?

As it does every year, Area Development surveyed its corporate executive readers at the end of last year, inquiring about their plans and priorities for 2024, particularly those that will impact how and where their companies grow. We’ll get to the results in a minute, but here are two spoilers. First, the top site selection factor on our survey respondents’ minds is the same one that they were thinking about a year earlier, and a year before that. But second, a lot of what they’re pondering right now is markedly different from a year earlier.

A Profile of the Respondents

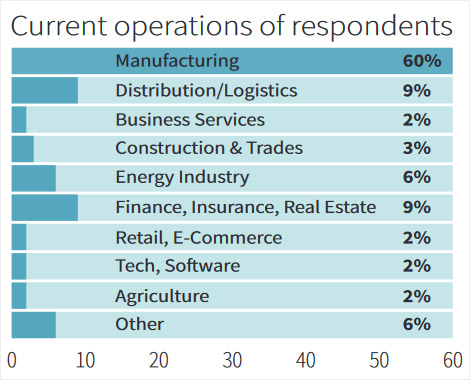

The corporate executives who answered our questions this year are heavily involved in making or delivering things. Fully 60 percent represent manufacturers, and another 9 percent are involved in distribution and logistics. The finance, insurance, and real estate sector employs 9 percent of our respondents, 6 percent are in energy, and the rest are spread among such sectors as construction, business services, retailing/e-commerce, technology, and agriculture.

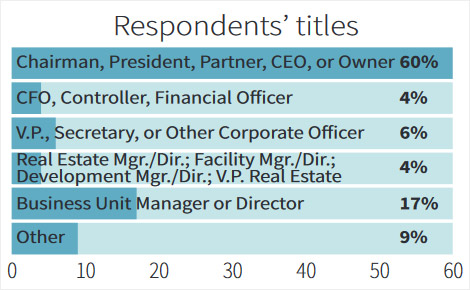

Of those who took part in the survey, three-fifths are the top dog: chairman, president, CEO, owner or partner. Almost a fifth are manager or director of a business unit. Other respondents hold a variety of high-level titles, from CFO or controller to vice president or secretary or other corporate officer. Still others are on the real estate side, including real estate VPs and managers and directors, as well as leaders in facilities and development. In short, they lead from different angles, but they’re all highly influential in their enterprises’ future direction.

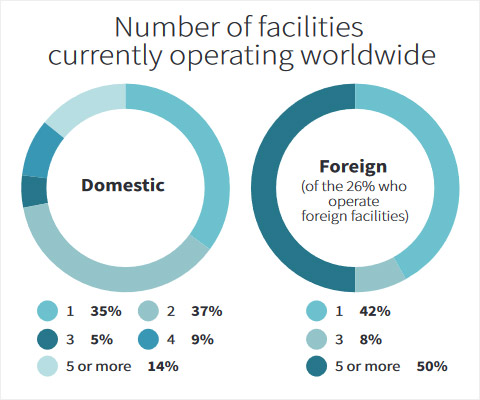

As for the breadth of their operations, nearly two-thirds have two or more facilities operating, and about a quarter have at least one facility in another country. About a third of the respondents work for companies employing between 100 and 499 people. A little over a third represent smaller companies with payrolls under 100, and the remainder are from companies employing 500 or more people.

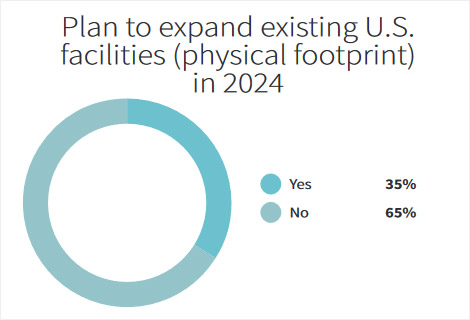

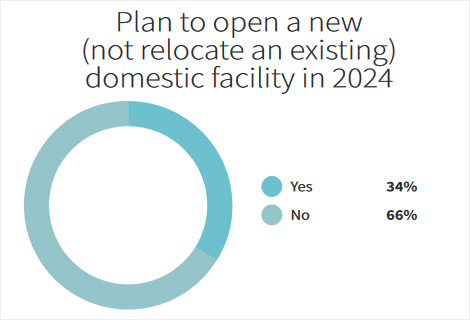

Clearly, not every company takes on a physical expansion in any given year. Two-thirds of this group of corporate respondents say they don’t expect their company will expand the physical footprint of their existing facilities in 2024, and two-thirds are not planning to open a new domestic facility.

But it’s not being a Pollyanna to see the bright side in those numbers, by looking at the flipside. Of the respondents, 35 percent say they plan a physical expansion of their U.S. facilities this year. To that good news, add the fact that 34 percent are planning to open a new domestic facility this year.

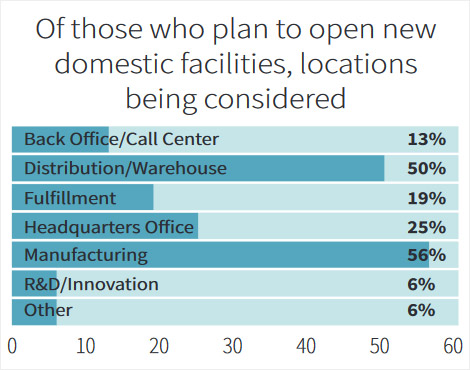

The corporate executives who answered our questions this year are heavily involved in making or delivering things. The respondents who said they have plans for a new domestic facility were asked for more details. What kind of facility, for example? Some picked more than one kind — 56 percent said a new manufacturing operation is in the works, half have plans for a new distribution center or warehouse, another fifth are planning a fulfillment center. A headquarters facility is in the cards for a quarter of those with projects in mind, and 13 percent are planning a back office or call center.

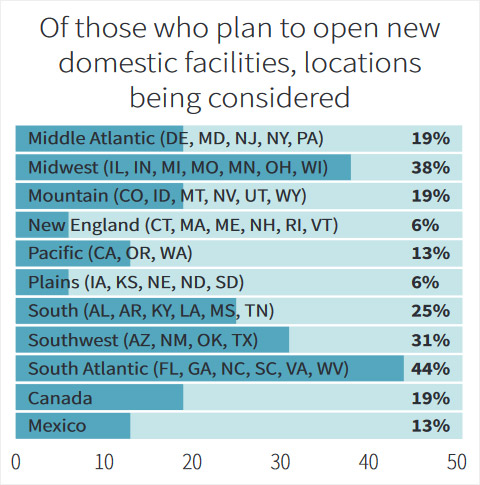

What inquiring minds really want to know, of course, is where those facilities will be located. The Midwest states are high on the list for 38 percent of the respondents. That said, the warm and business-friendly states of the South are highest on this list, with 44 percent of the respondents naming South Atlantic states, 31 percent with eyes on the Southwest, and a quarter pondering locations in other Southern states. About a fifth are looking in the Middle Atlantic region and a similar percent in Mountain states, as well as in Canada.

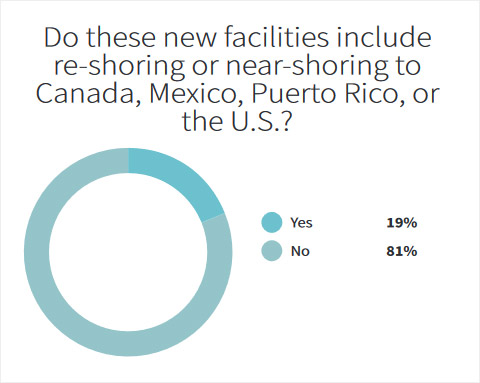

There’s been a lot of talk about re-shoring and near-shoring operations back to the U.S. or Puerto Rico, or to places such as Canada or Mexico. Of those planning new facilities, 19 percent say that’s what they’re doing in 2024, which is about as many as were re-shoring or near-shoring in 2023.

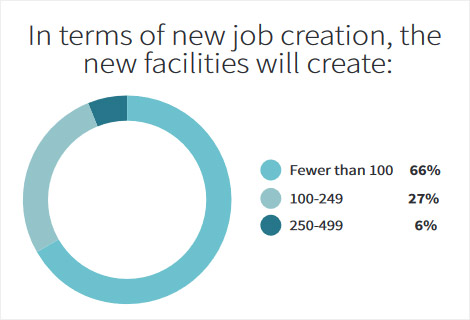

Additionally, since more than 70 percent of the survey respondents say they employ fewer than 500 people, it’s expected that their new facilities will also only create fewer than 500 jobs.

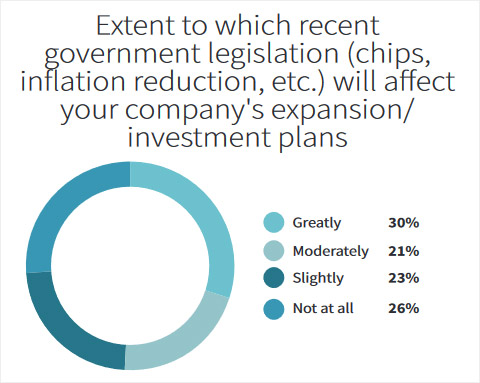

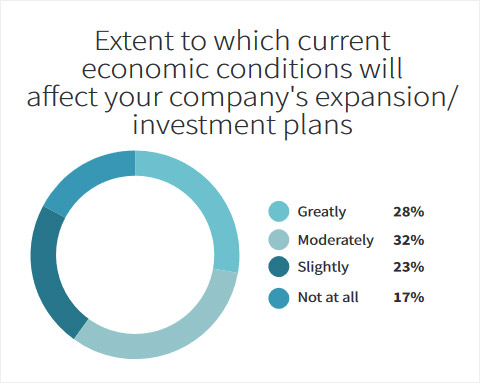

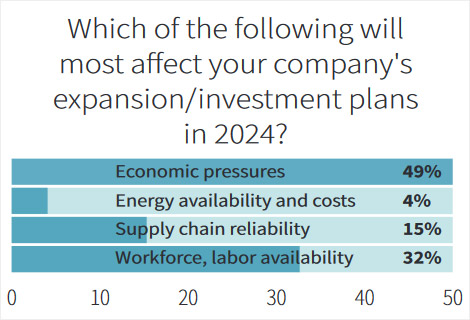

Also barely changing from 2023 to 2024 are the factors influencing overall expansion or investment plans. Roughly half say their 2024 plans are either greatly or moderately influenced by government initiatives, such as the CHIPS and Science Act or the Inflation Reduction Act. That’s about the same as 2023. Current economic conditions are greatly or moderately influencing expansion or investment plans in 2024 for 60 percent of respondents, same as last time around. In fact, about half say economic pressures are the factor most affecting expansion and investment plans in 2024 — again, same as for 2023, and that’s a fair amount more than those pointing to labor availability or supply chain issues.

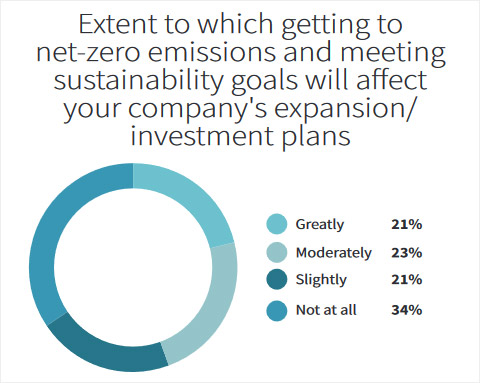

Interestingly, it should come as no surprise that two thirds of our Corporate Survey respondents say their investment plans are influenced by getting to net-zero emissions and meeting sustainability goals.

38th Annual Corporate Survey

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

-

Chart 14

-

Chart 15

-

Chart 16

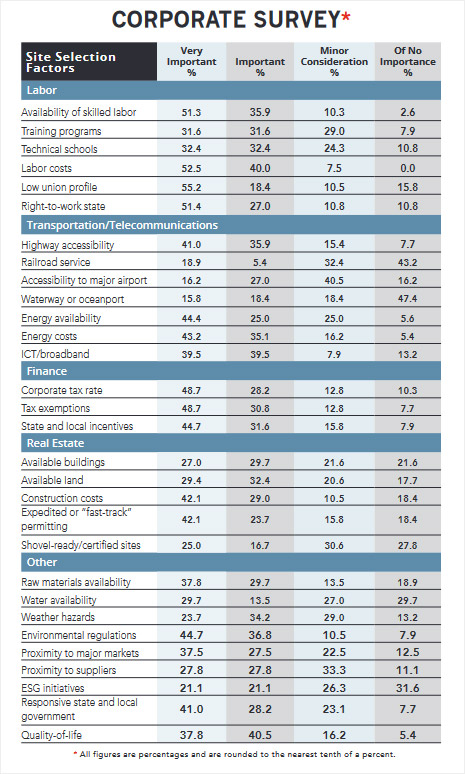

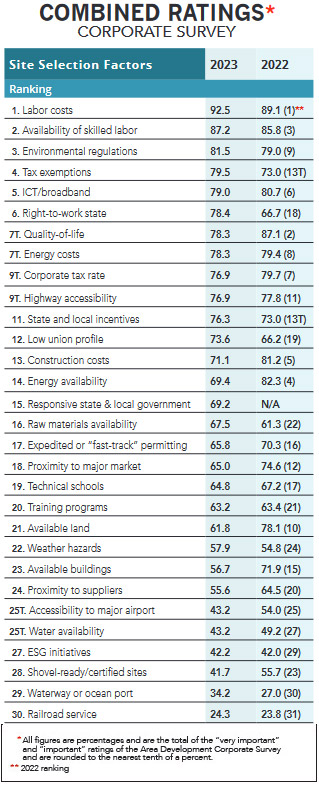

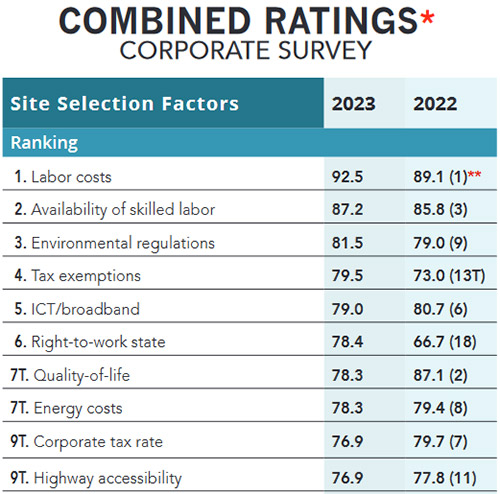

In a world filled with change, here’s something that doesn’t seem to vary much from year to year: labor costs and availability of skilled labor are high on the priority list when corporate executives are considering future plans for their business. The top site selection factor in the most recent survey was the cost of labor, just as it was the year before, and before that, too.

More than 90 percent of the respondents say this factor is “very important” or “important.” That’s not particularly surprising, given the labor cost trends. Average compensation by the end of 2023 was rising at an 12-month-average rate of just over 4 percent, according to the U.S. Bureau of Labor Statistics, which in fairness is a whole point lower than the year before, but still more than a percentage point above what it had been averaging before the metric shot skyward in 2022.

Moving up from third to second on the list is the availability of skilled labor, with just under 90 percent placing this factor among the highest priorities. Again, no surprise, given that unemployment has headed downward ever since 2010, other than a couple years of pandemic pain that had fully eased by 2022. Forty-four percent of the respondents name South Atlantic states, 31 percent with eyes on the Southwest, and a quarter pondering locations in other southern states [for new facilities].

Here’s where the story starts to diverge a bit from prior years. The third-most-important priority on the latest Corporate Survey ranking is the impact of environmental regulations, up from ninth place a year earlier. But perhaps that is also hardly surprising — with climate change in the headlines more and more, executives probably are rightly wondering how governmental regulation might evolve in response.

Tax exemptions also shot up the list, from 13th to fourth, cited as a “very important” or “important” factor by four-fifths of the respondents. With global electronic connections of ever-increasing importance, the quality and availability of information and computer technology bumped up a notch to fifth place. Making a major upward move on the priority list for corporate executives is whether a potential site is in a right-to-work state. That could be a reflection of the political climate and questions of whether change might be in the air in this area. Half the states have passed right-to-work laws since the 1940s. But the most recent move has been in the opposite direction — as of 2024, Michigan has reversed course and repealed its law. Along similar lines, nearly three-quarters of respondents are keeping a strong eye on a location’s low union profile, helping that factor move from 19th to 12th.

With so many things moving up the list, something had to move down. Quality of life was a second-place factor last survey and dropped to seventh in the current Corporate Survey. Energy availability was previously ranked fourth but dropped to 14th, though energy costs are still in the top 10, as they were last survey. Construction costs fell from fifth to 13th, though about 70 percent still think that’s a “very important” or “important” consideration.

Corporate tax rates retain a key place within the top 10, with about 77 percent of respondents seeing them as “very important” or “important.” Highway accessibility gets the same level of interest, climbing into the top 10 from the 11th spot before. Governmental officials will be interested to know that state and local incentives are of significant importance to about 74 percent of corporate executives, and nearly 70 percent say the same about the importance of a responsive state and local government.

To a certain extent, economic optimism — or lack thereof — can be a self-fulfilling prophecy. People and companies worried about the days ahead may pull back spending, and if they do, the results end up reflecting and reinforcing their jitters. It doesn’t always turn out that way, though. A year ago, we reported that 60 percent of those responding to the National Association of Manufacturers optimism survey were expecting a recession in 2023, and we all know how that turned out.

Current economic conditions are greatly or moderately influencing expansion or investment plans in 2024 for 60 percent of respondents. Nevertheless, manufacturers are still down in the dumps, according to the NAM’s survey from the fourth quarter of 2023. The optimism rates for small and mid-size firms were 65.9 and 63 percent, which NAM counts as historically low levels. Why so glum? Nearly 90 percent expect higher tax burdens that’ll make it tough to expand facilities or their workforce or invest in equipment. And it’s still a tough challenge attracting and retaining employees in this sector.

On the other hand, the 2024 Business Leaders Outlook from J.P. Morgan finds more than 80 percent of innovation economy business leaders confident about how their company and industry will fare in the year ahead. They are keeping a cautious eye on interest rates, cybersecurity issues, and the impacts of artificial intelligence, but they nevertheless have growth in mind.

And it certainly doesn’t hurt that consumers are feeling upbeat going into 2024, according to The Conference Board, whose Consumer Confidence Index hit a two-year high in January, up for the third straight month. According to its economic experts, consumer pessimism is “receding.”