In the current political climate in the U.S., companies face significant challenges choosing manufacturing locations. The ever-changing Trump trade policies and tariffs have sown doubt and uncertainty around costs, currency fluctuations, regulations, and sourcing and sales strategies. Multinational firms, in particular, must carefully review their current and projected global operations to stay competitive.

At the time of writing, tariffs have been instituted, modified, re-instituted, and now paused for 90 days, with the exception of tariffs on China. A long-term — or even near-term — trade policy is practically impossible to predict, and the ensuing uncertainty hovers over many manufacturers and suppliers like a modern-day sword of Damocles. The U.S. auto industry offers a concrete example. For decades, automakers have relied on cross-border trade with Mexico and Canada, first under the North American Free Trade Agreement (NAFTA) and now under the United States-Mexico-Canada Agreement (USMCA), negotiated during the Trump administration. While manufacturing in the U.S. may avoid tariffs, it also brings significantly higher labor costs than in Mexico.

In Mexico, exported products that comply with USMCA regulations are exempt from tariffs, corresponding to approximately half of Mexico’s exports to the United States. Products that do not qualify under USMCA provisions are subject to a 25 percent tariff, pursuant to an executive order issued by President Trump under the International Emergency Economic Powers Act. The administration cited drug trafficking as a threat to U.S. national security to justify the move.

Companies that built factories in the U.S. are in a more secure position, as their operations remain unaffected by potential cross-border disruptions. However, manufacturers that depend on imported vehicles or components from Mexico and Canada will likely struggle with higher costs resulting from unfavorable tariff structures.

Automakers with U.S.-based production facilities — including Hyundai, Kia, Volvo, BMW, and Daimler — serve the North American market and are largely unaffected. By contrast, companies with significant Mexico and Canada operations — including the Big Three and large overseas manufacturers such as Toyota, Nissan, Volkswagen, and Honda — face severe impacts from the tariffs.

$150B

The Trump administration also canceled the “electric vehicle mandate,” a rule from the Environmental Protection Agency that would have required auto manufacturers to cut greenhouse gas emissions by half in new light- and medium-duty vehicles beginning in 2027. The EPA had estimated the rule would compel manufacturers to make electric vehicles account for about 30 to 56 percent of new light-duty vehicles by 2032, and 20 to 32 percent of new medium-duty vehicles.

Trade wars have added a new layer of complexity to corporate site selection, forcing companies to rethink their global footprint.

EV-focused manufacturers such as Tesla, Hyundai, and Volkswagen, which have invested heavily in electric vehicle plants, could now face challenges as combustion-reliant companies gain flexibility to meet customer demand. The Trump administration has also scaled back support for renewable energy and electric vehicles — including infrastructure funding for charging stations — while promoting fossil fuel production and combustion engine vehicles.

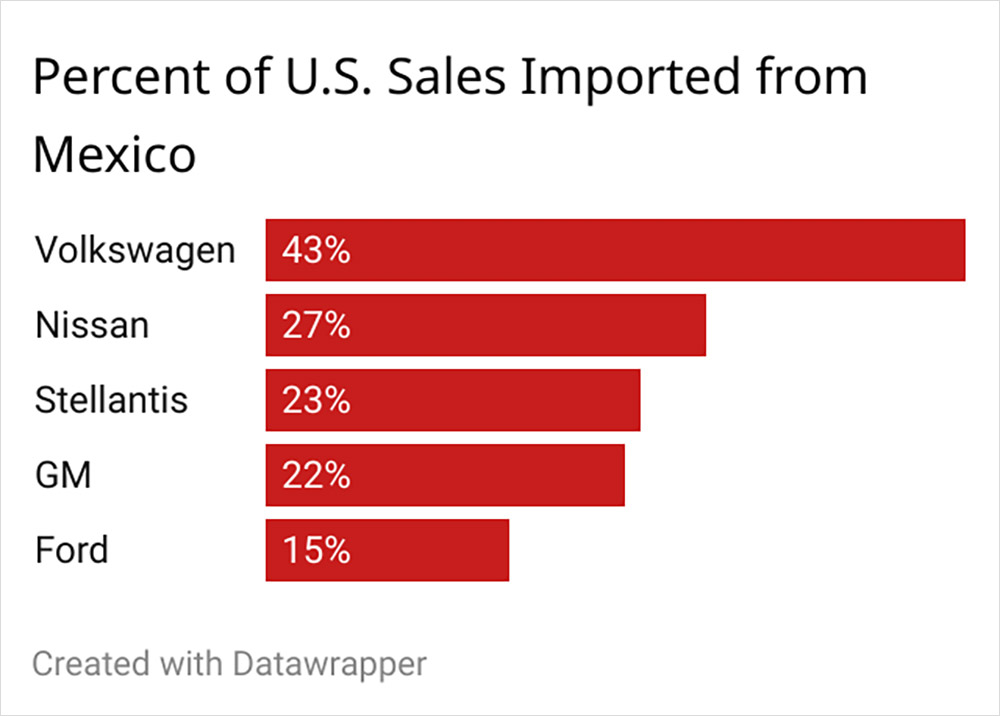

According to S&P Global Mobility, Stellantis imported around 23 percent of its U.S. new vehicle sales from Mexico, compared with 22 percent for GM and 15 percent for Ford. Only Nissan, at 27 percent, and Volkswagen, at 43 percent, have greater exposure. The Volkswagen plant in Puebla, covering 740 acres, is the largest automobile factory in Mexico and one of the largest in the Volkswagen Group. The U.S. VW plant in Chattanooga manufactured 85 percent of all North American Passat vehicles, sourcing 85 percent of content from NAFTA countries. Overall, 43 percent of components purchased by the U.S. globally are sourced from Mexico.

If automakers pass on higher costs caused by import tariffs from Canada and Mexico, consumers will likely face higher prices on U.S.-built vehicles. The extent of price increases will depend on inventory levels, sourcing strategies, and the duration of the tariffs.

This new era of trade wars, characterized by tariffs and other restrictive measures, carries profound implications for corporate site selection strategies. The recent escalation in trade tensions — particularly involving the United States, Canada, Mexico, China, and the European Union — is forcing companies to rethink their global manufacturing footprints. For manufacturing and logistics firms, uncertain and unpredictable policies will heavily influence future site selection decisions.

Successful site selection today requires balancing risk management, cost optimization, and long-term growth planning.

U.S. companies will likely consider onshoring to shorten lead times and accelerate time-to-market, though higher labor costs and a shortage of skilled workers remain challenges. Mexico remains attractive as a nearshoring option, offering lower labor costs despite tariff risks, and benefiting from multiple international trade agreements. Steel and aluminum tariffs, in particular, have caused substantial disruptions. Calculating the value of aluminum and steel in a given product — especially when subcomponents also contain plastic, rubber, or other metals — is complex. Nearly $150 billion in goods are subject to steel and aluminum derivative tariffs across 289 product categories, from screws and bolts to furniture. These tariffs also affect approximately $25.7 billion in annual imports of aluminum vehicle parts, $7.1 billion in iron and steel wire, stampings, and forgings, and $6.5 billion in iron and steel screws, bolts, and nuts.

Some companies are considering relocating production to countries not impacted by Chinese import tariffs, such as India and Vietnam. Corporate site selection will increasingly focus on regions with stable trade agreements, such as the European Union’s free trade agreements and USMCA — at least until its 2026 review. If the three parties fail to agree on an extension, the USMCA will terminate in 2036. In the meantime, special economic zones, bonded warehouses, and free trade zones may offer advantages by providing tax deferrals and tariff relief.

25%

Despite the uncertainty and disruption caused by the current trade wars, key factors in site selection remain consistent: access to skilled labor, strong training programs, reliable infrastructure, and political and economic stability.

Several industries are particularly affected. Automotive, aerospace, and steel processing companies are reevaluating their global production locations. Semiconductor and chip manufacturers are shifting operations toward Taiwan and India to avoid U.S.–China trade tensions. E-commerce fulfillment and distribution centers are increasingly seeking locations in neutral trade zones. U.S. renewable energy firms, which often import solar panels and wind turbines, are contending with rising costs, while Canadian energy companies are searching for new export markets to avoid U.S. tariffs.

Manufacturers must now navigate a world where tariffs, labor shortages, and shifting alliances are the new normal.

As trade policies fluctuate, successful site selection will require a balance of risk management, cost optimization, and long-term growth planning. Companies must diversify operations, closely monitor geopolitical developments, and invest in new technologies to reduce risk and locate production in cost-effective regions.

The impacts on active projects vary. One large European confectionary company, initially planning to produce in the U.S. and ship products to Canada, canceled its American project and expanded operations in Europe after the imposition of tariffs. Conversely, an Asian auto firm, currently navigating U.S. site selection, expanded its investment after learning about the tariffs. Originally planning to ship raw materials from Asia, the company will now source materials domestically and find local suppliers to complete its project.

Trade wars have added a new layer of complexity to corporate site selection, forcing companies to rethink their global footprints. Companies are working to understand the effects of tariffs, manage supply chain disruptions, and develop long-term strategies that allow them to operate profitably despite rising risks.