Georgia is back on top — again. For the 12th consecutive year, the state has claimed the No. 1 overall ranking in Area Development’s annual Top States for Doing Business survey. While Georgia’s consistency speaks volumes, the real story in 2025 is just how competitive the field has become beneath the surface.

This year’s rankings reflect a rapidly evolving economic development landscape — one shaped by pressure on timelines, power infrastructure, and workforce pipelines. The consultant panel behind the survey made clear that states no longer rise to the top simply by offering low taxes or generous incentives. Today, it’s about execution: how quickly and reliably a state can align land, labor, logistics, and leadership behind a fast-moving project.

That’s a shift from a decade ago, when low costs and business-friendly branding often drove rankings. As the challenges facing manufacturers and logistics companies have grown more complex, the metrics for evaluating a “top state” have evolved in kind. Site selectors today are looking for integrated solutions — energy infrastructure that can scale, workforce systems that deliver talent on demand, and permitting pathways that reduce friction without sacrificing oversight.

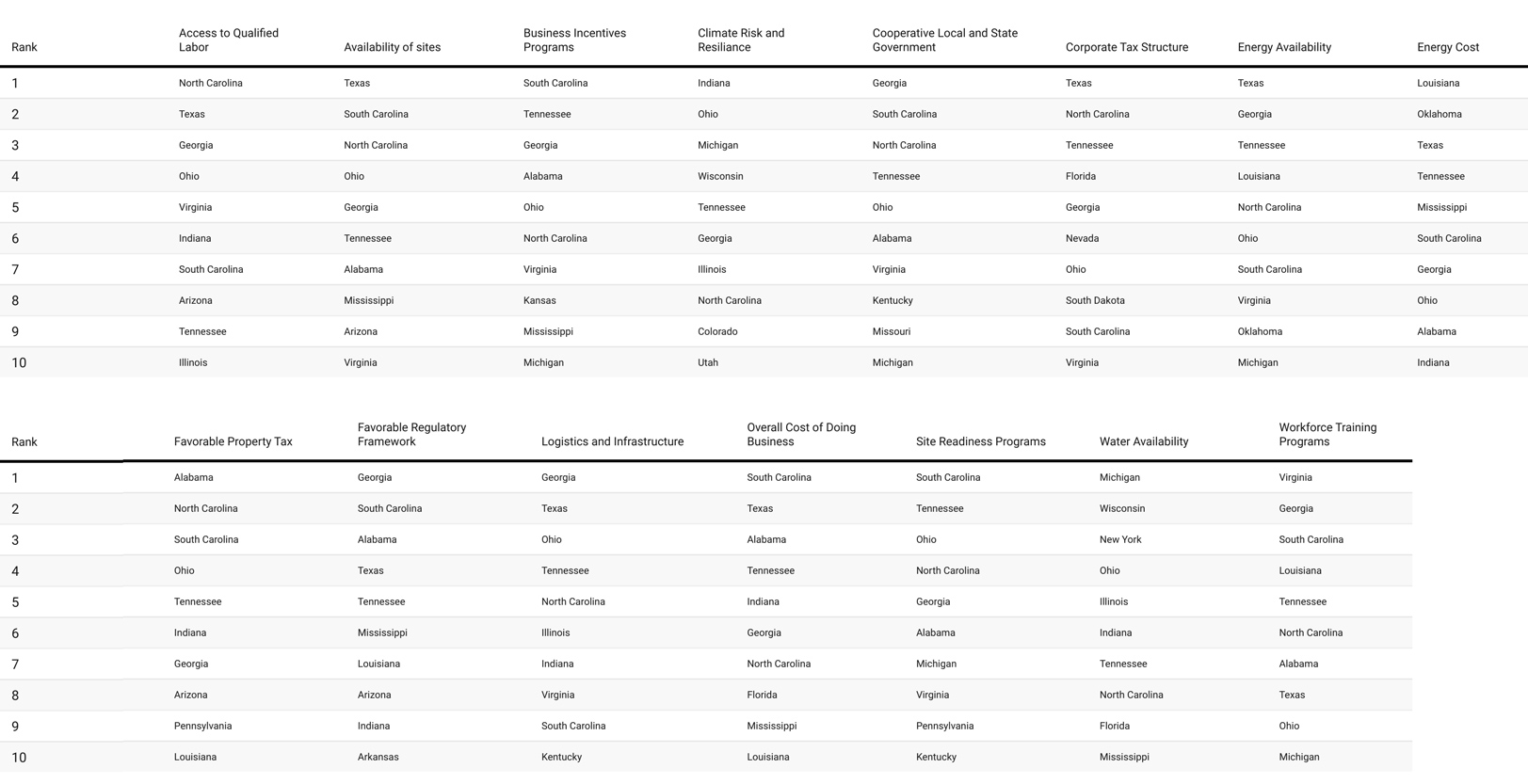

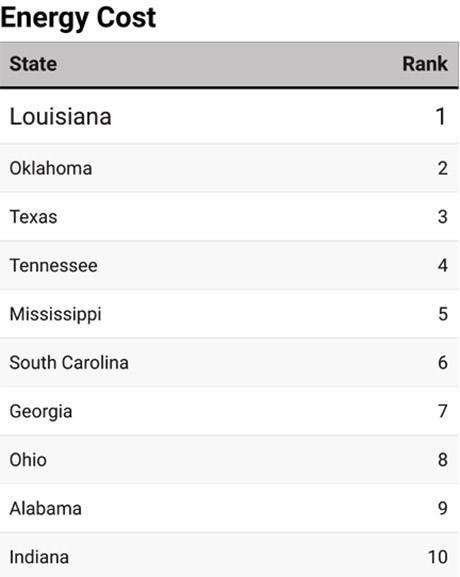

This year’s methodology reflects that evolution. For the first time, we’ve split energy infrastructure into two separate categories — “Energy Availability” and “Energy Cost” — to better capture the unique challenges posed by the modern grid. We also continue to elevate the importance of water access, permitting speed, and site readiness — all increasingly make-or-break factors in large capital investment decisions.

The states that perform well aren’t just “pro-business.” They’re aligned. That word — alignment — came up repeatedly in consultant feedback this year. It’s not enough to have programs on paper. It’s about whether those programs translate into on-the-ground responsiveness across agencies, utilities, and educational institutions. And whether that alignment holds under pressure.

“Our clients’ decisions continue to be guided by three essential pillars: strong access to qualified talent, consistent pro-business policy at both the state and local level, and aggressive site development efforts,” says Alex Miller, manager at KSM Location Advisors.

“The top-ranked states in this year’s list excel in all three areas, offering companies the predictability, speed to market, and scalability they demand in a competitive global landscape.”

The 2025 rankings again reflect the dominance of the Southeast, with South Carolina, Texas, North Carolina, and Ohio rounding out the top five. But they also spotlight rising performers like Virginia, Indiana, and Michigan, and show sharper distinctions within categories that matter most to consultants today: workforce development, energy infrastructure, site readiness, permitting, and long-term resilience.

This year’s package breaks down the 14 ranked categories into four editorial themes: Speed, Sites & Permitting; Workforce Wins; Energy, Infrastructure & Resilience; and Business Climate & Government Support. Within each, we’ve woven direct insights from the consultants who guide capital investment decisions every day — those helping companies answer not just where to grow, but why. While the survey data ranks states based on performance, the commentary reveals something deeper: that even among the top states, the bar is rising.

“In today’s evolving economic landscape, predictability is paramount,” Miller adds. “These fundamentals continue to shape corporate expansion decisions and position top-ranked states as enduring leaders in business climate and competitiveness.”

In the pages ahead, we’ll explore which states are delivering — and what it will take for others to catch up in 2026 and beyond.

Speed, Sites & Permitting

For many corporate expansions, the question is no longer where to go — it’s who can move fast enough. In 2025, speed to market isn’t just an advantage. It’s the baseline. As project timelines compress and permitting hurdles grow more complex, states that offer ready-to-go sites, transparent permitting paths, and aligned local coordination are separating from the pack.

2025’s Top States for Business

2025’s Top States for Business

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

-

Chart 14

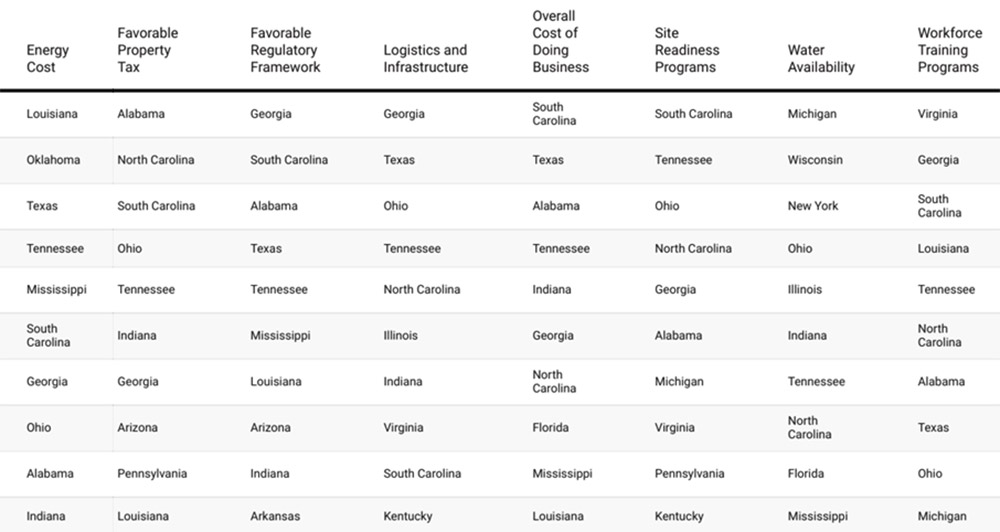

Texas takes the top spot for availability of sites, with South Carolina, Georgia, North Carolina, and Ohio close behind. Each of these states has made deliberate investments in land banking, utility mapping, and statewide inventory systems that help consultants and companies quickly evaluate large parcels.

“Speed to market is a key goal for an increasing number of our clients,” says John Boyd, principal of The Boyd Company. “Government — especially planning and zoning units — needs to be responsive and learn to move at the speed of business.”

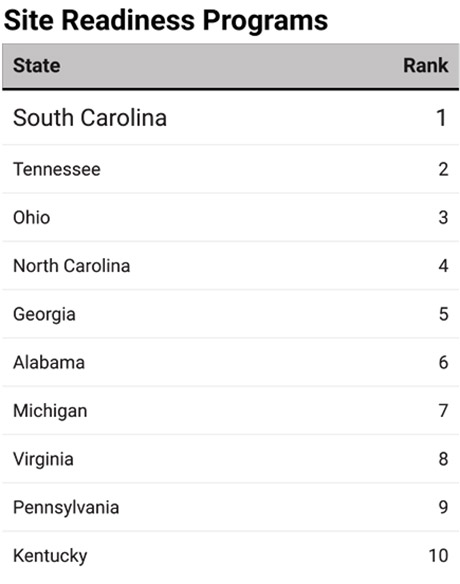

But having land isn’t enough. States that perform well in site readiness programs go further by proactively clearing hurdles like due diligence, environmental review, and utility extension planning. In this category, South Carolina, Georgia, Tennessee, Indiana, and Ohio rank at the top — each known for strong collaboration among state agencies, utilities, and economic development teams.

States at the forefront are also offering standardized site certification programs, with pre-qualified sites that minimize uncertainty for manufacturers. Several consultants noted that projects with high capital intensity — such as EV battery, semiconductor, or biotech facilities — are particularly sensitive to permitting timelines and utility access. That’s led to greater scrutiny not just of current readiness, but of how quickly infrastructure can be extended or scaled on demand. In some cases, the existence of a fast-track permitting protocol or inter-agency strike team can be a deciding factor.

Over the past five years, both site readiness and energy availability have become increasingly important factors in site selection.

“With so many good sites already acquired over the past five years, it is vital for regions and states to identify the next generation of sites to ensure that their areas are prepared for site selection projects,” says Larry Gigerich, executive managing director of Ginovus. “Companies need to move very quickly once a location decision has been made, and the places that are ready will be the big winners in economic development.”

Permitting remains one of the biggest chokepoints in the development process — but some states are finding ways to turn it into an advantage. Georgia leads the 2025 rankings for speed of permitting, followed by South Carolina, Ohio, North Carolina, and Texas. Consultants praise states that streamline review across agencies, offer point-of-contact case management, and demonstrate a culture of responsiveness.

“Over the past five years, both site readiness and energy availability have become increasingly important factors in site selection,” says Jonathan Gemmen, senior director at Austin Consulting. “The remaining sites often present obstacles to becoming development-ready in the near term. As a result, identifying suitable sites for large industrial projects — especially those requiring rail access — is becoming increasingly complex.”

“The start of this year has been slower than anticipated, primarily due to the Administration’s unsteady rollout of new tariffs and uncertainty around U.S. tax policy,” adds Ford Graham, managing director at McGuireWoods Consulting. “Communities who win will be those that have development-ready sites and existing buildings, AND who have been in ongoing communications with target companies despite the natural tendency to wait until things start moving again.”

Across these categories, the strongest performers share one thing: alignment. When agencies, utilities, and local partners work together with urgency, companies notice — and reward that collaboration with investment.

Workforce Wins

In the 2025 rankings, states that win on talent do so in two key ways: by developing a robust pipeline of skilled workers and by helping companies access and train that talent with precision. Workforce is no longer just about population or unemployment rates. It’s about alignment, customization, and delivery.

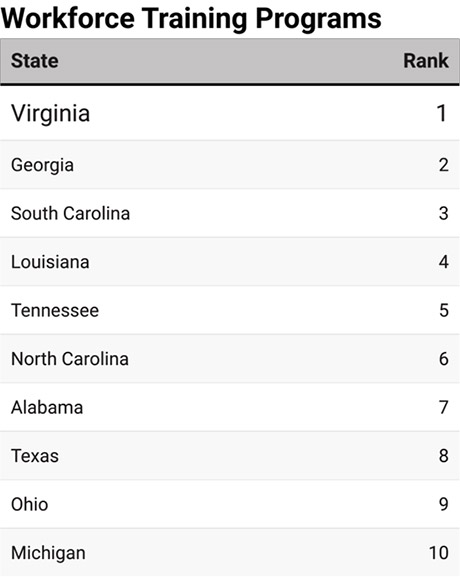

Virginia takes the No. 1 spot in workforce training programs, followed by Georgia, South Carolina, Tennessee, and North Carolina — all states with well-regarded, state-supported programs that align closely with employer needs.

Communities who win will be those that have development-ready sites and existing buildings, AND who have been in ongoing communications with target companies despite the natural tendency to wait.

“Industrial companies increasingly look for existing ecosystems and concentrations of similar businesses — and therefore available talent — in a given location,” says Brooklin Salemi, senior managing director at Newmark. “That’s key, although in some cases it takes a backseat to infrastructure needs like water and power.”

Access to qualified labor, another closely watched category, is led by North Carolina, Texas, Georgia, Ohio, and Virginia — a mix of states that combine high population growth with a growing base of skilled technical and manufacturing workers. Consultants also note that labor availability is now weighed alongside long-term demographic trends, automation adoption, and proximity to training centers.

“The U.S. is experiencing a manufacturing plant building boom due to reshoring, the Inflation Reduction Act, and subsidies to the nation’s EV and semiconductor industries,” says Alexandra Segers, general manager of Tochi Advisors. “But large projects face three main issues: labor shortages, few site options, and power availability. Site inventory is low, and due to changed energy concepts — for example, gas-free production — power demand is much higher nowadays.”

“Although discussions about incentives will never go away, workforce availability, recruitment support, and training programs will be the most important parameter set over the next 12 months,” adds Ford Graham.

Customization is another area of growing importance. Increasingly, states are judged not just by the presence of training programs but by their ability to tailor those programs to new and emerging sectors. Life sciences, advanced manufacturing, clean tech, and AI-driven industries often require specialized skill sets that aren’t easily sourced from generic training pipelines. That’s led some states to offer “concierge-style” workforce solutions — forming partnerships with companies pre-announcement to co-develop curricula, fast-track credentialing, and coordinate with local school systems and community colleges.

Moreover, the most successful workforce ecosystems don’t just serve new employers; they support career progression for local residents. States that invest in stackable credential programs, apprenticeships, and adult re-skilling pathways are building resilience into their labor markets, which consultants say can be just as important as current headcount.

“Despite the recent economic turbulence that brings a degree of uncertainty to investment projects, the fundamentals remain relatively unchanged for an investor,” says Marc Beauchamp, president of SCI Global. “From a Canadian site selector’s perspective, workforce readiness, site availability, and business-friendly policies are increasingly relevant for manufacturers seeking U.S. expansion options.”

In short, workforce wins aren’t won on size alone. They’re won on strategy.

Workforce Enablement: Housing, Childcare, and Beyond

While workforce development rightly focuses on training and recruitment, top-tier states are also addressing the barriers that keep workers from showing up. In 2025, that means looking beyond classrooms and into the community.

12

Affordable housing, reliable childcare, and transportation access are fast becoming factors in site selection conversations. Executives are asking not just where they can find talent, but where that talent can live and thrive. States like Georgia, Virginia, and Texas are beginning to incorporate workforce enablement into their economic development strategies — partnering with housing authorities, childcare providers, and transit agencies.

Incentives tied to workforce housing, investments in early education infrastructure, and collaborations with employers on flexible scheduling are now viewed as strategic moves — not social programs. Consultants say the next wave of competitive states will be those who connect the dots between workforce readiness and worker stability.

Energy, Infrastructure & Resilience

f there’s one factor that has surged to the top of site selection checklists in 2025, it’s power — both its cost and availability. As demand rises from electric vehicles, semiconductors, AI, and data centers, the grid is feeling the strain. More than ever, states that can deliver reliable, affordable, and scalable energy are winning projects.

Consultants now draw a sharp line between energy cost and energy availability, and so do our rankings. In energy cost, Louisiana and Oklahoma lead the way, followed by Texas, Mississippi, and Tennessee. These states offer businesses access to affordable electricity, which can significantly tip the scales in high-consumption sectors like manufacturing, food processing, and logistics.

But low cost isn’t enough if a site can’t power up on time. That’s why our new energy availability ranking matters. Here, Texas, Georgia, Tennessee, North Carolina, and Ohio are out in front — all with strong utility coordination and a track record of supporting large-scale industrial growth.

“With the surge in large project announcements, many of the most desirable large industrial sites have already been claimed,” says Jonathan Gemmen of Austin Consulting. “Compounding this challenge is the reduced availability of electric capacity on the grid and longer lead times for transmission and substation equipment.”

Topics which ranked high in former years, like corporate tax structure or favorable property tax frameworks, are now at the end of the decision list.

In some cases, power constraints are the defining limitation. “We’ve seen multiple scenarios where projects were ready to go from a labor and logistics standpoint, but couldn’t proceed because there simply wasn’t enough electricity available in the right time frame,” says one site consultant. “The utility is now in the driver’s seat.”

It’s not just the grid that’s under pressure. Water availability and climate risk are also climbing the priority list for site selectors. Michigan, Wisconsin, Ohio, New York, and North Carolina top this year’s water availability ranking — with Great Lakes states seeing renewed interest from manufacturers looking to future-proof operations.

Climate risk, meanwhile, is drawing new scrutiny. Companies are evaluating whether a region is prone to flooding, fire, extreme heat, or drought — and insurers are joining the conversation. In our climate risk and resilience category, Indiana, Ohio, Michigan, Tennessee, and Georgia lead.

“Due to changed energy concepts for plants — for example, gas-free production — the power demand is much higher nowadays,” notes Alexandra Segers of Tochi Advisors. “As data centers also use a lot of power, energy availability is one of the most important topics. Lead time for transformers is between 24 and 32 months.”

More companies are requesting direct engagement with utilities earlier in the site selection process. Several states — including Georgia, North Carolina, and Tennessee — are earning praise for embedding utility partners directly into economic development teams, offering site selectors real-time capacity information and power deployment timelines.

What used to be considered infrastructure planning is now risk mitigation. In 2025, states that stay ahead of these challenges — with long-term grid investment, diversified generation, and regional coordination — are better positioned to land the next generation of capital investment.

Business Climate & Government Support

In a year defined by uncertainty — from shifting federal policies to global trade tensions — business leaders are doubling down on one thing they can still control: where they operate. And in 2025, the best-performing states are those offering not just low taxes or incentives, but consistency, communication, and a forward-leaning business environment.

Incentives still matter. South Carolina, Tennessee, Georgia, Ohio, and Alabama lead this year’s rankings in business incentive programs. But consultants caution that even the most generous packages can’t make up for weak fundamentals or slow execution.

24–32

“Incentives may help close the deal, but they aren’t what start the conversation anymore,” says Brooklin Salemi of Newmark. “For office projects in particular, I see states playing a larger role through programs that incentivize headcount and wages. In the last year, I worked two back-office projects that prioritized expansions at existing facilities because the incentives there were more lucrative.”

The reliability of policy — not just its friendliness — is rising in importance. Executives are looking for regions that can offer clarity on taxes, labor policy, and energy regulation over the long term. Political and administrative whiplash can stall or even derail capital planning.

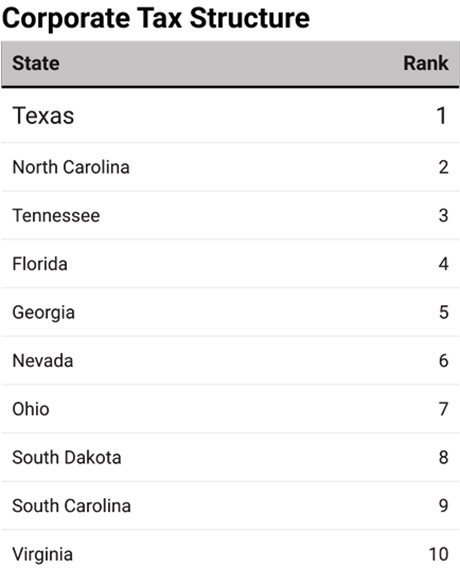

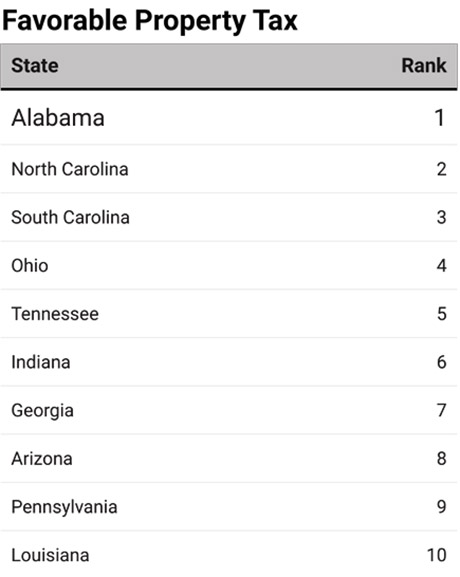

That sentiment is echoed across the rankings. In corporate tax structure and favorable property tax, traditional low-tax states like Texas, North Carolina, and Tennessee remain strong. But these factors now rank lower on consultants’ decision lists than in previous years.

“The start of this year has been slower than anticipated, primarily due to the administration’s unsteady rollout of new tariffs and uncertainty around U.S. tax policy,” says Ford Graham of McGuireWoods Consulting. “Should tariff parameters be solidified by September 1, the incertitude in the markets as well as in global supply chains will give way to a surge in activity the last four months of the year and into 2026.”

The states most prepared for that expected surge will be those that haven’t let relationships go dormant. “Communities who win will be those that have development-ready sites and existing buildings, AND who have been in ongoing communications with target companies despite the natural tendency to wait until things start moving again,” Graham adds.

Cooperation remains a major differentiator. In this year’s ranking for cooperative state and local government, Georgia, South Carolina, North Carolina, Tennessee, and Virginia come out on top — all states known for proactive communication, transparent permitting, and economic development teams that act as strategic partners.

These states consistently deliver what consultants describe as “white glove” service — project shepherds who cut through red tape and act as long-term partners beyond the groundbreaking. That responsiveness builds credibility — and confidence.

“From a Canadian site selector’s perspective, workforce readiness, site availability, and business-friendly policies are increasingly relevant,” says Marc Beauchamp of SCI Global. “The fundamentals remain relatively unchanged for an investor.”

Business climate is about more than headline rankings — it’s about trust, responsiveness, and the confidence companies feel when making multimillion-dollar decisions. In that sense, the winning states are the ones who act not just like regulators, but like collaborators.

Companies need to move very quickly once a location decision has been made, and the places that are ready will be the big winners.

Technology & Innovation Focus

Across the top-performing states, a growing differentiator is their ability to support innovation — not just in R&D labs, but on the factory floor. Whether it’s advanced manufacturing, clean energy, semiconductors, or life sciences, today’s site selectors are looking for locations that are leaning into the industries of the future.

States like Texas, Georgia, North Carolina, and Arizona are investing heavily in innovation districts, university partnerships, and incentives tied to IP generation and commercialization. Consultant feedback indicates that clients are increasingly influenced by proximity to innovation hubs — not for access to capital, but for access to talent and ideas.

R&D tax credits, prototyping support, and cluster-aligned training programs also play a growing role. And while some of these advantages are still concentrated in large metros, we’re beginning to see rural and suburban areas market themselves as innovation-ready — with broadband, grants, and anchor employers as proof points.

What to Watch in 2026

If the 2025 rankings tell us anything, it’s that the rules of the game have changed. States can no longer rely solely on traditional selling points like tax credits or cheap land. The next wave of investment is going to places that deliver execution, not just enticement.

The consultants behind this year’s rankings emphasized that how a state performs — on speed, certainty, and alignment — now matters more than what it offers on paper. States that are winning today are those with development-ready sites, transparent permitting pathways, reliable energy infrastructure, and customizable workforce programs that align closely with private-sector timelines.

“Should tariff parameters be solidified by September 1, the incertitude in the markets as well as in global supply chains will give way to a surge in activity,” says Ford Graham, managing director at McGuireWoods Consulting. “The communities who win will be those that didn’t wait.”

That’s especially true as many large projects — in EVs, semiconductors, clean tech, and food processing — continue to face bottlenecks in energy and labor. Power grid capacity, transformer lead times, water availability, and housing for workers are quickly becoming make-or-break issues in site selection. States preparing for this pressure now will be best positioned when macroeconomic conditions shift.

The race among top states is intensifying, and the stakes have never been higher. In a market where large-scale manufacturing projects are reshaping local economies, consultants say the fundamental site selection criteria are shifting — and only the most adaptable states will keep pace.

3

Alexandra Segers notes that demand for energy has surged as more projects move toward gas-free or electrified production models, and lead times for essential grid equipment like transformers can now stretch beyond 30 months. These infrastructure realities, once secondary concerns, are now front and center in site evaluations — on par with labor and cost factors.

Power is not the only constraint. Site scarcity continues to challenge large projects, especially those needing rail, water, and expansive parcels. “The remaining sites often present obstacles to becoming development-ready in the near term,” says Jonathan Gemmen, senior director at Austin Consulting. “Identifying suitable sites for large industrial projects — especially those requiring rail access — is becoming increasingly complex.”

Expect more companies to weigh climate risk and water access with growing seriousness. States that can demonstrate long-term resilience — not just shovel-readiness — are winning a second look.

Meanwhile, even traditional strengths like tax incentives and regulatory friendliness are taking a backseat to real-time availability and delivery. “Site inventory is very low,” Segers adds. “Topics which ranked high in former years, like corporate tax structure or favorable property tax frameworks, are now at the end of the decision list.”

Brooklin Salemi of Newmark sees a distinction between state-level and local readiness: “Admittedly, I think it’s less about the state’s role and more about the local municipality’s access to key infrastructure needed to support projects. Access to power and water currently reign supreme.”

Taken together, these insights suggest that 2026 will reward states that are not only proactive, but precise. No longer is it enough to be broadly “business-friendly.” The new mandate is alignment — across utilities, workforce systems, permitting authorities, and regional partners.

States that can execute consistently across these domains — and tell that story clearly — will define the next generation of winning locations.