The evolution of commercial real estate (CRE) has accelerated over the past five years, yet what was old is new again. Priorities are shifting back to basics. The best-performing, or at least most stable, CRE subsectors over the recent cycle have been properties tied to food-related tenants. From investor interest in cold storage to retail growth dominated by limited-service restaurants, properties connected to food, with its status as the most essential consumer good, have shown resilience and steady demand.

Uncertain trade policy, alongside the looming threat or reality of high tariffs on imported goods, has dented consumer sentiment. This raises immediate concern around the pass-through effects to retail and industrial, particularly warehouse and distribution properties that power e-commerce distribution. To that end, consumer concerns about prices and inflation persisting above the 2 percent policy target have led to changes in consumer spending habits.

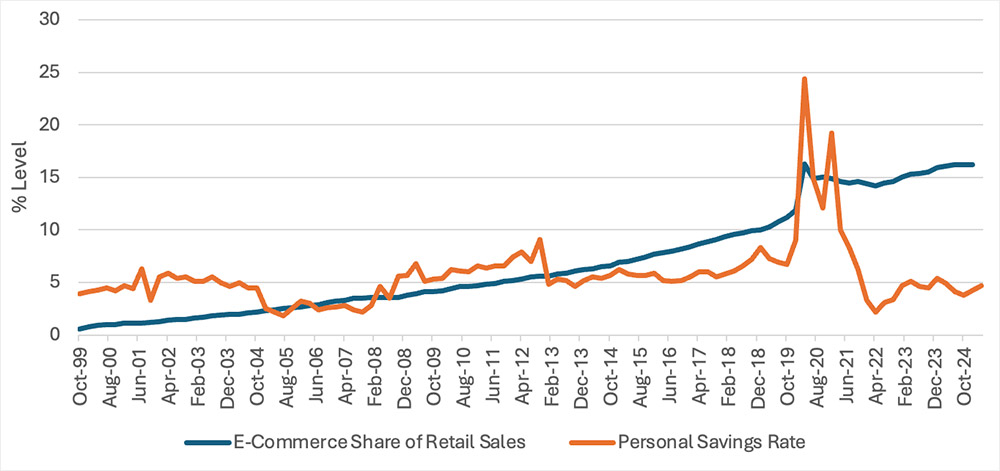

The personal savings rate, while well below its pre-2020 average of 8.5 percent (and historic average of 8.4 percent), reached 4.5 percent as of June 2025, more than double the trough of June 2022, when consumers were in a phase of “revenge spending,” ranging from discretionary goods and experiences to travel. Now, inflation fatigue has set in as concerns over accelerating consumer price growth reemerge, prompting consumers to engage in the opposite behavior: revenge saving.

Not only is there a flight to quality in CRE, but increasingly, a flight to safety.

While the current personal savings rate is not particularly impressive in the broader context, its upward trend since the start of the year suggests that households, facing high prices and tariff uncertainty that have eroded discretionary income, are reexamining spending and hedging against further increases. In May and June 2025, the savings rate held steady at 4.5 percent, slipping from a year-to-date high of 5 percent in April as many consumers front-loaded purchases in anticipation of higher costs tied to trade policy uncertainty.

This shift in consumer behavior has made its way into data that reflects one of the most crucial warehouse and distribution demand drivers: the e-commerce share of retail sales. At 16.2 percent, the figure is just shy of the artificial pandemic-era record of 16.3 percent set in Q2 2020, which was brought about because of necessity. The fact that the rate has plateaued for the past three quarters, the first time in the history of the series where it has remained unchanged for more than two quarters in a row, combined with the higher personal savings rate, signals a potentially longer-lasting change in consumer behavior.

So, what does this mean for commercial real estate dependent on retail consumer spending—namely, retail and industrial subtypes such as warehouse and distribution? In volatile periods when the outlook is uncertain, the prudent approach is to focus on property types with enduring demand and room for stable growth. Increasingly, that means investment in CRE tied to essentials like food and medicine. Cold storage facilities serve as critical distribution hubs for both, while grocery-anchored neighborhood and community shopping centers represent their primary points of sale. Thus, not only is there a flight to quality in CRE, but increasingly, a flight to safety.

4.5%

Cold storage is essential for food, pharmaceuticals, and even flowers, whether sourced locally or imported. Grocery-anchored retail, meanwhile, benefits from both inelastic demand for food and the enduring preference for in-person grocery shopping. This foot traffic spills over to surrounding tenants, boosting leasing activity and sales at adjacent businesses.

One of the most compelling CRE opportunities today lies in grocery-anchored retail, particularly in markets with limited competition or in densely populated areas underserved by supermarkets—so-called food deserts. Aldi, for example, has successfully targeted these areas, often revitalizing surrounding retail as increased foot traffic drives business for existing tenants and attracts new ones. This revitalization effect stems not only from food’s status as a consumer staple with relatively inelastic demand, but also from the fact that grocery shopping remains a largely in-person activity, still resistant to e-commerce.

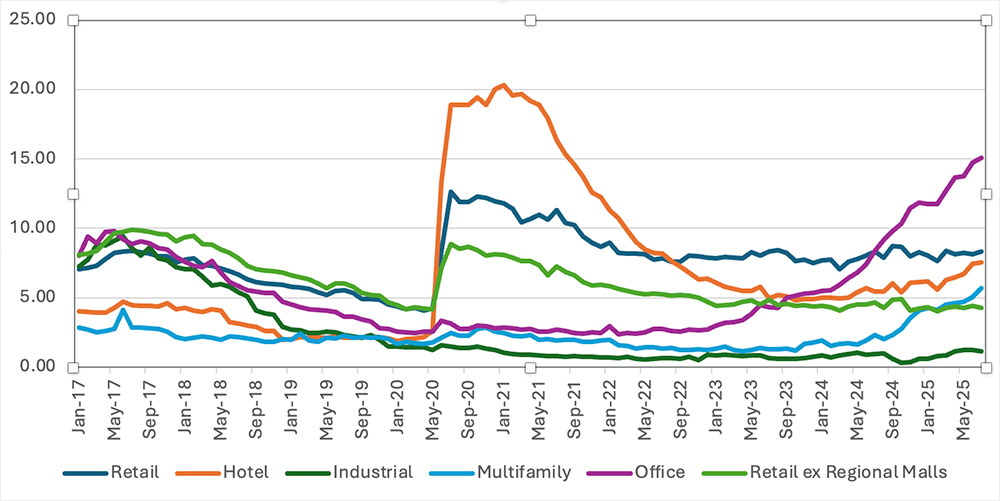

This is evidenced by CRE capital markets data, which shows comparatively robust performance for retail and industrial properties when compared with other sectors. The loan delinquency rate for retail, excluding regional malls, is the second lowest across the core five property types. However, at 4.3 percent as of July 2025, it is still substantially higher than that of industrial’s 1.2 percent for the same period. The latter has consistently had the lowest delinquency rate of any property type since November 2019.

For investors navigating an uncertain CRE cycle, food remains more than just a consumer staple—it is a real estate safe haven.

Payoff rates reflect a similar pattern. At year-end 2024, retail excluding malls posted an 80 percent payoff rate, which was double that of malls and about 1.5 times higher than the overall retail average. Among the core five property types, it ranked second only to industrial, which recorded a 96.3 percent payoff rate.

Despite mounting macroeconomic headwinds on both the fiscal and monetary fronts, pockets of opportunity remain. In population centers, demand for grocery-anchored retail and cold storage is expected to persist, and as populations grow, so too will the need for these properties. For investors navigating an uncertain CRE cycle, food remains more than just a consumer staple—it is a real estate safe haven.