The construction industry is navigating an increasingly complex economic landscape marked by persistent high costs and evolving market dynamics. Coupled with rising labor expenses, these economic and geopolitical pressures are further compounded by supply chain disruptions and fluctuating tariffs and inflation rates, which can dramatically affect project timelines and budgets. In this context, strategic planning and early contractor involvement have emerged as vital strategies to manage these complexities effectively.

Project stakeholders today face a delicate balancing act between meeting deadlines, fulfilling client expectations and navigating escalating costs. Successfully emerging from this challenging environment requires a thorough understanding of the factors driving costs and deploying forward-looking strategies that go beyond temporary fixes.

Key Factors Shaping Rising Construction Costs

Recent data paints an uncertain picture for stakeholders in the construction industry. According to FMI’s 2025 North American Engineering and Construction Outlook, total construction spending in early 2025 is projected to increase by 2 percent over 2024, with the manufacturing sector expected to see an increase of 6 percent year over year, driven by legislation such as the CHIPS and Science Act, IRA and IIJA. The commercial sector, however, is expected to contract by 9 percent in 2025, due to the slowdown in the warehouse subsector.

Early contractor involvement allows owners to better align budgets with reality.

Talent shortages, supply chain disruptions and input volatility continue to strain resource availability across multiple industries. The impact on spending from sweeping tariffs and efforts to bring back domestic manufacturing remains to be seen. The policies could either strain the construction industry’s capacity to meet demand, leading to higher prices, or induce a recession with reduced demand for construction.

The costs for labor and materials are also fluctuating, with labor costs outpacing material costs as the primary driver of rising construction costs. Even so, material prices seem to be trending upward, having already jumped higher in the first part of this year. This is in contrast to the stability seen in material prices in 2024. The dual pressure on materials and labor contributes to an overall challenging environment for cost management.

Material volatility. Despite some previous stabilization in raw material prices, the costs of essentials such as steel, concrete and lumber are primarily driven by global economic conditions, geopolitical events and lingering supply chain disruptions. For instance, steel pricing continues to shift frequently based on evolving tariff policies, international demand, shipping availability and production bottlenecks at key manufacturing hubs.

Additionally, supply chain issues have been exacerbated by labor shortages, compounding material production delays in certain industries. This frequently results in project slowdowns, increased logistical expenses and higher procurement costs for time-sensitive construction timelines.

Labor shortages and wage inflation. Construction labor markets are grappling with severe workforce shortages, leading to decreased productivity and extended project durations for many construction firms. These workforce gaps push companies into a bidding war for skilled talent, driving wages sharply higher. Increasing labor expenses compel businesses to either accept reduced profits or decline new projects they would typically pursue. Urban areas are hit hardest, with firms finding themselves unable to meet labor demand for large-scale projects.

6

Compounding the issue, the industry’s workforce demographic is aging, and new entrants—especially younger workers entering skilled trades—remain insufficient to offset those retiring. This imbalance forces teams into longer project timelines, leading to potential penalties, reputational risk and higher operational costs. The shrinking pool of available workers is causing strain for unions and smaller companies, in particular. Smaller companies often bear the brunt of these issues, with limited resources forcing tough decisions, such as scaling down the number of projects they bid on.

Economic drivers. Macroeconomic variables including inflation, interest rates and government policy further complicate the equation. Although inflation has moderated in recent years, construction-specific inflation remains a notable concern. The Federal Reserve's periodic interest rate hikes continue to increase borrowing costs for projects reliant on financed capital, whether owner-funded or developer-led.

Meanwhile, federal funding initiatives have ramped up new construction demand in areas like infrastructure and renewable energy projects. While providing opportunities, heightened demand places additional stress on labor and materials markets, further raising prices in the short term.

Strategic Cost Management Approaches

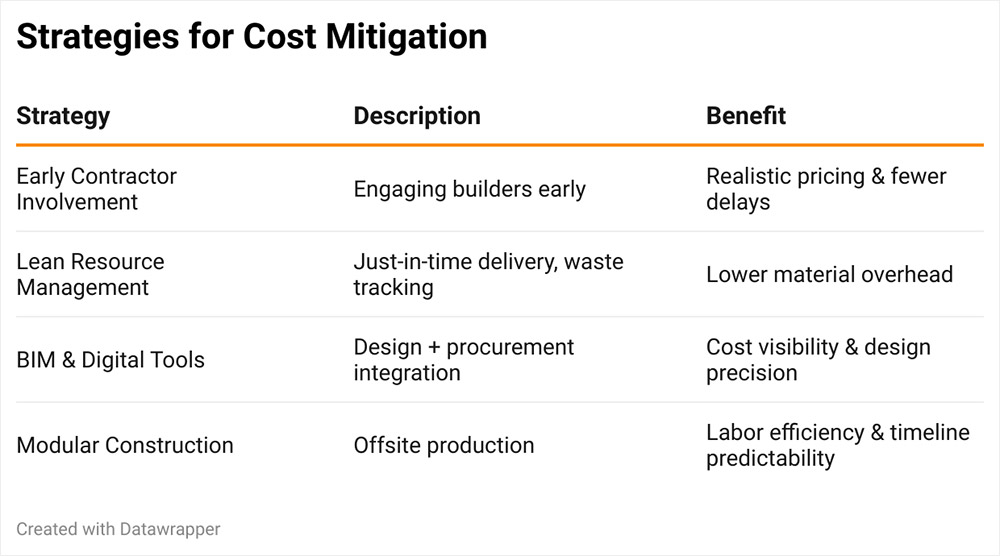

Navigating the above challenges requires advanced planning, innovative thinking and a collaborative effort among stakeholders. Clear strategies can help mitigate cost overruns and establish efficiencies throughout the construction process.

Early contractor involvement (ECI). One of the most effective ways to limit unpredictable costs is through ECI. Bringing contractors into the planning phase and engaging them in preconstruction. Contractors’ current market knowledge on costs, constructability concerns and resource allocation allows owners and design teams to better align on realistic project budgets and schedules.

For example, contractors can provide real-time pricing insight on raw materials and mitigate surprises by suggesting alternative materials or working with suppliers to secure long-lead items early. This proactive collaboration minimizes delays, avoids design conflicts and reduces unnecessary expenditures.

Integrated design workshops can be a useful tool, involving all stakeholders to define priorities, refine designs and assess cost-vs.-value trade-offs systematically. These sessions help to align goals and establish a robust framework where both cost and performance targets are achievable.

Material and labor costs are hitting at the same time — and it’s shaking confidence in project timelines.

Technological integration. Investing in construction technologies also offers clear opportunities for cost savings. For instance, the adoption of building information modeling (BIM) can help reduce inefficiencies during the construction process. BIM allows teams to visualize projects virtually, detecting clashes and optimizing layouts prior to breaking ground.

Digital tools also enable agile procurement. Platforms for real-time supply chain management track the movement and availability of materials, preventing costly last-minute sourcing issues or delays. Similarly, cost-estimation software captures nuanced shifts in labor and material pricing, ensuring budgets reflect current market conditions and not outdated assumptions.

Lean resource management. A Lean approach to managing resources can significantly mitigate waste and inefficiency. By standardizing practices, such as just-in-time material delivery, firms can reduce onsite storage costs, limit material overordering and streamline logistics. Waste tracking systems supported by digital technology further ensure fewer delays caused by mismanagement or excess scrap onsite.

Alternative solutions for labor challenges. To combat skilled labor shortages, firms are increasingly turning to modular construction and prefabrication techniques. These methodologies not only reduce labor dependency but also improve project predictability by producing building components in controlled factory settings.

Without long-term labor solutions, even well-funded projects may stall or shrink.

Additionally, firms investing in workforce training programs that upskill existing workers or expand apprenticeship programs can bridge the skill gap over the long term. Providing enhanced training in both traditional trades and emerging technologies ensures companies build a reliable, more versatile labor pool.

The Path Forward

While some pressures may ease over time, many of the core drivers of today’s cost challenges are expected to persist. Construction costs will remain a dominant concern for industry stakeholders, with little breathing room for complacency. Yet, innovative thinking, collaborative stakeholder involvement and strategic technology adoption offer a way forward. Successful firms will not only focus on mitigating today’s cost challenges but also invest in systems and planning practices that create long-term efficiencies.

While the immediate pressures may be daunting, the industry has always thrived on its ability to adapt and innovate. By approaching these cost challenges with proactive strategies and investment in the future, stakeholders across the board can contribute to a more resilient and prosperous construction industry.