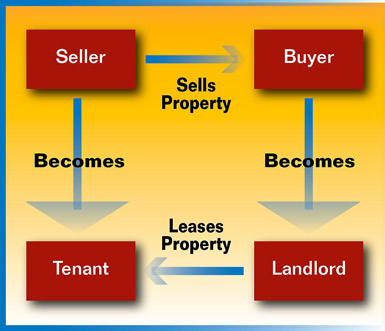

Sale-Leasebacks Allow Companies to Redeploy Capital

Q2 2016

One recent example was Smithfield Foods Inc.’s $43 million sale and leaseback of a new, 419,052-square-foot cold storage distribution center in Greenfield, Ind. Centurion Investments, LLC, a private real estate investment firm based in Arlington, Va., acquired the property and is leasing it back to a subsidiary of Smithfield.

When the deal was announced earlier this year, Smithfield’s Vice President and Corporate Treasurer Tim Dykstra said the sale-leaseback would allow the company to “redeploy capital and fund strategic initiatives to further enrich our core business offerings” — in other words, use the money where it would do the most good.

When Smithfield built the facility, the company was unsure whether it wanted to keep it long-term or sell it, according to Cushman & Wakefield Vice Chairman Scott Goldman, who helped with the deal. But, the current low-interest-rate environment, combined with strong investor demand for state-of-the-art facilities occupied by solid credit tenants, made for an “excellent” opportunity for Smithfield, Goldman says. Along with freeing up capital, a lease transfers the risk associated with ownership to the investor/owner, according to Goldman.

Investors and institutions consider corporate real estate that is leased back to the seller a solid investment. Unique Challenges

The Smithfield deal was not without challenges, Goldman says, noting, “every major project presents unique issues and challenges. Before closing, we had to negotiate easement rights over a nearby water tower. However, there weren’t any monumental setbacks that prohibited Smithfield and Cushman & Wakefield from executing the transaction as planned.“

According to Goldman, the sale-leaseback strategy is suitable for credit-worthy corporate users that occupy high-quality, state-of-the-art facilities and are interested in redeploying capital toward expansion and other higher-return projects. It’s also an excellent exit strategy for companies, he notes.

Investors and institutions consider corporate real estate that is leased back to the seller a solid investment. In the single-tenant, sale-leaseback market there are a number of significantly funded institutional, public, and private groups that exclusively purchase and own single-tenant assets. “It’s a very ‘niche’ market,” Goldman says. Buyers include private and public REITS, private investors, and institutional and foreign investors.

Creative Deal Structuring

In some situations, however, more creativity in deal structuring is required due to specific factors. One example of flexible, creative deal structuring is development financing, which occurs when the sale-leaseback of an existing building that was already under construction is executed. This is a more inclusive approach for a seller and involves a hands-on investor that can buy the land, develop it into a tailored asset, and lease it back to the seller.

Another example of a creative deal structure includes earn-out security deposits; this is a credit-based agreement that eliminates uncertainty for the buyer by linking the risk and return directly to the performance and earnings of the tenant.

Project Announcements

DDP Specialty Electronic Materials US Expands Midland, Michigan, Manufacturing Operations

01/30/2026

Aerospace Lubricants Expands Columbus, Ohio, Production Operations

01/30/2026

Radical AI Plans Brooklyn, New York, Materials Science Operations

01/28/2026

Germany-Based KettenWulf Plans Auburn, Alabama, Production Operations

01/28/2026

Frontieras North America Plans Mason County, West Virginia, Operations

01/28/2026

North Wind Plans Rosemount, Minnesota, Research Operations

01/27/2026

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025