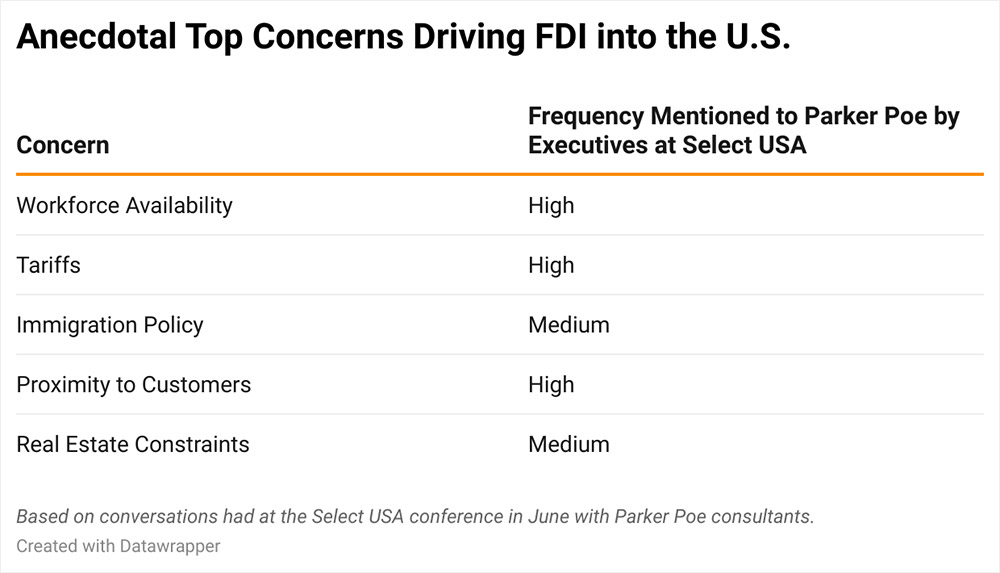

Access to a qualified workforce, proximity to customers, unique real estate solutions, immigration hurdles, cultural fit, and yes — tariffs — are on the minds of executives considering foreign direct investment (FDI) in the U.S. right now.

Those takeaways come from recent conversations we have had with dozens of business leaders from around the globe, including at the SelectUSA Investment Summit in Washington, D.C. Hosted by the U.S. Department of Commerce, the summit brought together more than 5,500 professionals from over 100 international markets. (Our Business Expansion + Location Solutions team has a long history of helping executives explore U.S. investment opportunities at SelectUSA.)

Tariffs Create Both Hesitation and Urgency

You will not be surprised to hear that tariffs were a frequent topic of conversation. But you may be surprised by the range of responses from international businesses to the rapidly changing tariff framework. While some are taking a wait-and-see approach (such as several executives from Latin American countries), many from around the world had a sense of urgency about their U.S. expansion plans. Some European and Asian executives said the tariffs were in fact accelerating their investment decisions. However, having a framework and set of rules in place that won’t keep changing is a key requirement for most companies to move forward with their investment. Furthermore, it is crucial to consider that specific industry sectors will experience varying degrees of impact.

Executives say the complexity of the global marketplace and the whiplash pace of policy change are making it more important than ever to receive collaborative, seamless support from their advisors.

The bottom line for many executives, though, was that the sheer size of the market opportunity in the U.S. is the primary justification for undertaking an expansion in the country. While some begrudge the need to accelerate expansion plans due to ever-evolving U.S. trade and investment policies under the current administration, they still consider the U.S. a critical market for footprint expansion.

One executive, for example, shared how his company had long relied on a U.S. contract manufacturer. But after that relationship deteriorated, the company decided establishing a direct U.S. footprint was no longer optional — it was necessary for growth. Some other executives are considering entering the U.S. market indirectly through other countries such as Mexico, which is a practical choice due to its proximity and abundant qualified labor force.

One thing was consistent among those pushing forward and exercising patience: They want fully integrated legal and site selection advice from professionals who understand their culture, and they want it fast. Executives say the complexity of the global marketplace and the whiplash pace of policy change are making it more important than ever to receive collaborative, seamless support from their advisors.

Access to Workforce Is the Gatekeeping Factor

Across nearly every conversation, access to a qualified workforce emerged as the number one gatekeeping issue influencing FDI decisions. The need spans industries, and companies are looking at both local and international labor pipelines to meet demand.

5,500

Some businesses expressed concern about the current state of U.S. immigration policy. While not always rooted in firm policy changes, these concerns are influencing expansion strategies. For instance, one oil and gas services firm based in Houston hires highly skilled engineers, many of whom are located in Central and South America. The company’s ability to quickly deploy this talent to U.S. energy operations hinges on timely visa processing and immigration support.

Location Strategy: Proximity to Customers Drives Site Selection

Another top-of-mind issue for international businesses is proximity to customers, especially in highly technical supply chains. Nowhere is this more evident than in the semiconductor sector.

Taiwanese companies, for example, are under pressure to be within an eight-hour response time to TSMC’s massive manufacturing operation in Arizona. This has led to a flurry of site searches across the Southwest, driven not by low-cost labor or incentives, but by logistics precision and customer proximity.

This need for responsiveness and integration is influencing site selection priorities across industries — from automotive to advanced electronics — and is driving investment to new regions that weren’t previously on the radar for some global companies.

Real Estate Requirements Are Shifting

Gone are the days when most international companies entering the U.S. market were simply looking for large, generic distribution facilities. Increasingly, companies are seeking specialized buildings and custom real estate solutions to support their manufacturing and R&D operations.

Some current searches can fairly be described as “needle-in-a-haystack” efforts — looking for facilities with highly specific infrastructure or the right balance of proximity, zoning, utilities, and talent. These demands reflect a shift toward long-term, operations-heavy investments rather than distribution-led market entry.

As a result, companies are relying more heavily on local partners who can navigate the intricacies of regional permitting, real estate availability, and incentives. The complexity of these searches further underscores the need for early and ongoing collaboration between site selection advisors, legal teams, and real estate professionals.

Shifting Political Landscape Shapes State-by-State Opportunities

Not all states are equally open to international investment when it comes from specific countries. A Chinese industrial firm shared a common refrain: Most Southern states are currently less receptive to Chinese FDI. However, exceptions remain.

The U.S. remains a market of unmatched scale and strategic importance.

These geographic and political nuances are shaping FDI strategy in new ways. For international businesses, success now depends not only on choosing the right market — but on understanding state-level policy dynamics, stakeholder relationships, and the competitive positioning of each potential location.

Practical Tips for Navigating FDI

Global executives entering the U.S. market today face a mix of opportunity and volatility. Those who succeed tend to take proactive steps to mitigate uncertainty.

Some are pursuing tariff engineering evaluations to reduce duties through product design, supply chain sources, or classification changes. Others are building flexible contract provisions into their agreements that allow for adjustments in risk allocation, sourcing, or pricing. In addition, many companies are engaging in targeted lobbying efforts in collaboration with trade associations and industry groups to influence policy and protect their interests.

On the financial side, incentive packages from states and local governments are helping to offset capital and operating costs. Meanwhile, firms relying on imported components are exploring foreign trade zone (FTZ) designations to defer or reduce tariffs wherever possible.

Gone are the days when most international companies entering the U.S. market were simply looking for large, generic distribution facilities.

Final Takeaway for Global Executives

Despite ongoing uncertainty around trade policy, immigration, and supply chain regulation, the U.S. remains a market of unmatched scale and strategic importance. For international businesses seeking sustainable growth, expanding in the U.S. is often not a matter of “if,” but “when and how.”

To navigate this environment, companies need more than just answers — they need partnerships. The most successful global companies are working with multicultural professionals who can deliver site selection, legal, and strategic planning in one cohesive process.

Whether you are actively planning your next U.S. investment or just beginning to explore options, the time to evaluate your strategy — and your support team — is now.

Hector Ibarra is a former assistant general counsel for the Mexican Federal Senate who is on Parker Poe’s Business Expansion + Location Solutions (BELS) Team. He has approximately 30 years of experience in international business transactions and economic development.

Hector Ibarra is a former assistant general counsel for the Mexican Federal Senate who is on Parker Poe’s Business Expansion + Location Solutions (BELS) Team. He has approximately 30 years of experience in international business transactions and economic development.

Azad Khan is a site selection consultant on Parker Poe’s BELS Team. He advises clients on all facets of their site selection and economic development initiatives.

Azad Khan is a site selection consultant on Parker Poe’s BELS Team. He advises clients on all facets of their site selection and economic development initiatives.

Sven Gerzer is a site selection consultant on Parker Poe’s BELS Team. He has over 20 years of experience helping international businesses and economic development organizations achieve their goals.

Sven Gerzer is a site selection consultant on Parker Poe’s BELS Team. He has over 20 years of experience helping international businesses and economic development organizations achieve their goals.