The potential for new, good-paying jobs from investing in a clean energy ecosystem has long been highlighted by proponents of expanding clean energy in America. John Kerry, President Biden’s former Envoy for Climate, famously predicted the energy transition would be the “new industrial revolution.”

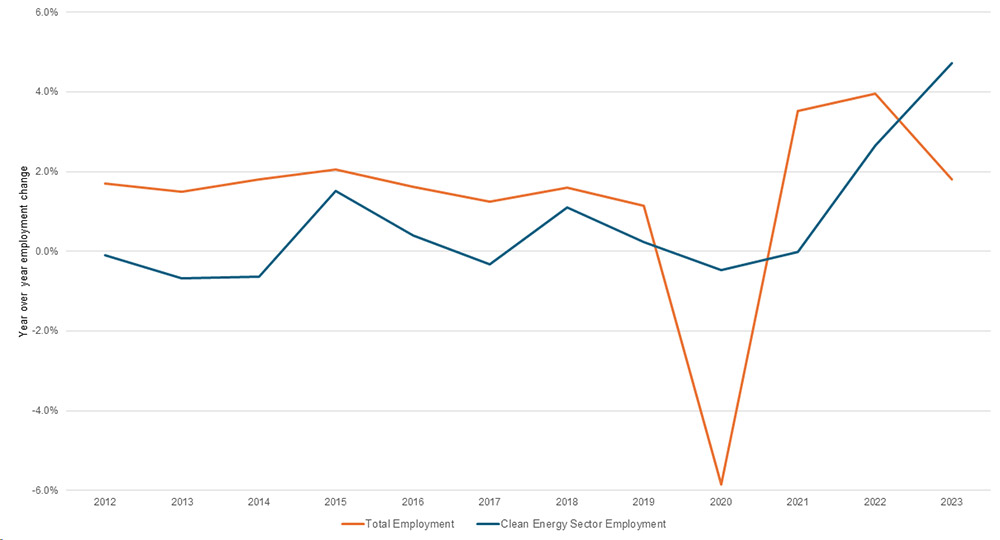

While clean energy production and related industries steadily grew in the United States over the past decade, the growth was far from a “new industrial revolution.” Green jobs in the energy sector underperformed the growth of the wider economy in all but two of the last ten years – those being during the COVID lockdowns, and now as of 2023. As of the end of 2023, clean energy jobs grew year over year by 4.7%, compared to 1.8% employment growth for the overall economy. The figure below shows jobs directly involved in clean energy production and transmission/distribution. Other “green” jobs like battery manufacturing for electric vehicles also grew over the past few years.

Where is the growth?

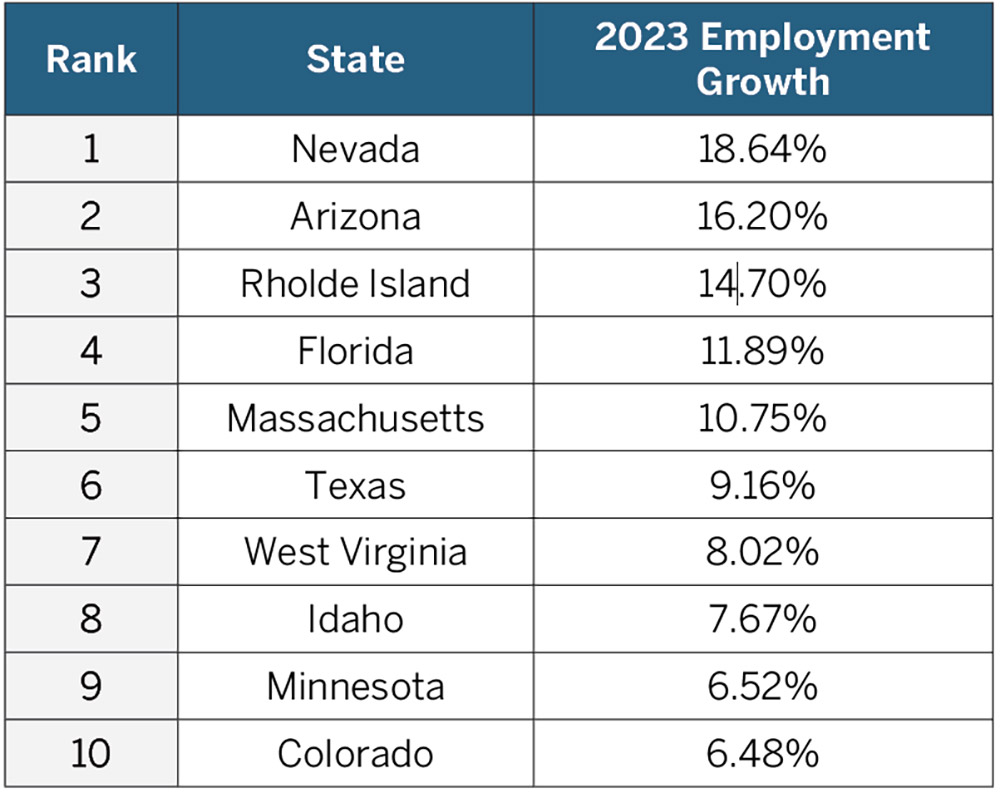

Using Chmura’s JobsEQ software to dig into these trends, we notice distinct differences between geographies, with a unique mix of states leading the way. Two New England states (Rhode Island and Massachusetts) place in the top 5. These states recently expanded solar and wind projects with the new Vineyard Offshore Wind project beginning construction in late 2021, and the solar market (especially in Massachusetts) continuing its steady growth. Also taking advantage of the fast-growing solar market are southwestern states such as Nevada, Arizona, Colorado, and Texas— all of which made the top 10 for 2023 clean energy job growth. Interestingly, West Virginia was the number 7 state for clean energy growth in 2023, although most of this job growth seems to be concentrated in clean energy support functions rather than in generation.

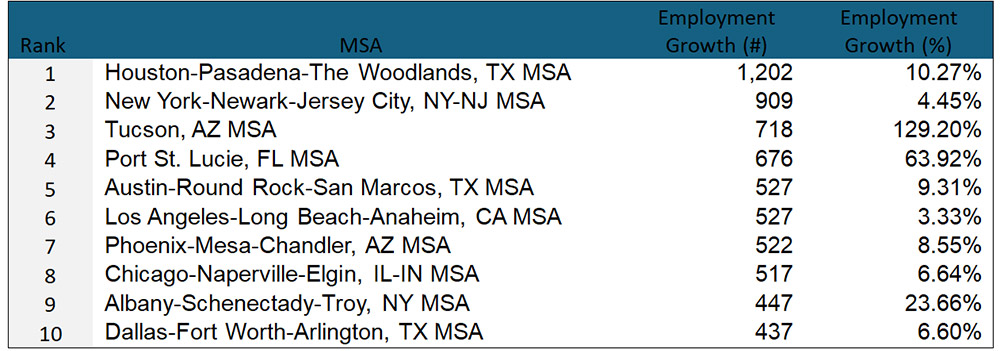

Breaking this out further by MSA, Table 2 shows the top 10 MSAs for cumulative green energy job growth in 2023. Houston, TX led the way in total job creation, with a net gain of 1,202 clean energy jobs in 2023. Tucson, AZ also had an explosive growth year for clean energy jobs – more than doubling their total. Other large metropolitan areas, like New York and Chicago, round out the top 10, joining Florida, California, Arizona, and Texas metros.

We also see that, within these metropolitan areas, business leaders and researchers credit the IRA with some of these job increases. For example, in their 2023 report, Climate Power found 13 clean energy projects that advanced after the IRA passage in Arizona, with many business leaders crediting the IRA for spurring the investment. Among these projects, LG Energy Solutions resumed plans for its previously paused Arizona gigafactory, the American Battery Foundation announced a $1.2 billion investment for a new gigafactory in Tucson, and after the passage of the IRA, Longroad Energy finally completed financing for a solar generation project. Similar stories are seen in other states and cities across the country. In Houston, TX (top MSA for clean energy job growth in 2023), SEG Solar and PV Hardware announced new solar projects to meet the demand driven by the IRA., SEG Solar specifically mentioned that they would be looking to create even more jobs using savings from the IRA tax credits. Overall, since the passage of the IRA,Climate Power finds that more than $278 billion in new clean-energy related projects were announced nation-wide.

$278 billion

What is contributing to the growth?

While this “boom” in the green energy economy is welcome news, it is intriguing to question what is fueling this growth and if it is sustainable. On August 16, 2022, President Biden signed into law the Inflation Reduction Act (IRA), which among other features, provided $369 billion in direct grants and tax credits for green and sustainable energy initiatives. These include clean energy production and electric vehicle tax credits all the way down to rebates for new and efficient personal appliances. On top of the surface-level benefits, the President promised these tax credits would “create thousands of good-paying jobs." A year after the IRA’s integration into official U.S. federal regulation, we are already seeing above-average job growth in the green energy sector. Green energy jobs also pay much more than other industries, with the annual wages for green energy jobs averaging almost twice as much as the national average ($130,441 versus $70,183). Other government incentives for green energy include initiatives like the Bipartisan Infrastructure Law (BIL).

IRA

Do we have the IRA and other federal incentive programs provided through legislation like the BIL to thank for all this recent growth? Well, given other key drivers in the clean energy space are not improving, perhaps the IRA is driving a large portion of the boost. Those in the energy industry often cite the decreasing cost of green energy and the increase in Environmental, Social, and Governance (ESG)14 as promising developments for the proliferation of zero-carbon energy. However, as discussed below, improvements in these metrics have stagnated at best.

Clean energy jobs grew year over year by 4.7%, compared to 1.8% employment growth for the overall economy.

Cost of Electricity

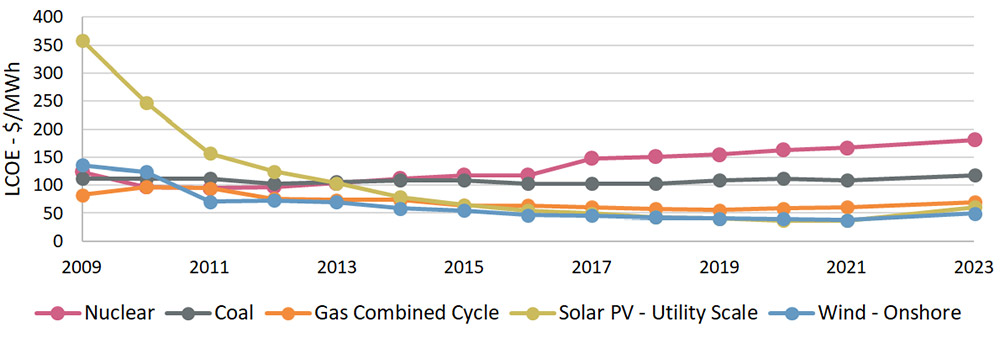

For economic feasibility, cost is king, and the cost difference between separate energy technologies is typically measured by the Levelized Cost of Electricity (LCOE). Simply put, LCOE is the average cost to produce one MWh of electricity using a specific technology. The lower the LCOE, the cheaper it is to produce electricity. Over the past decade, core green energy production methods have significantly decreased in price (see figure 2). This decrease includes large-scale solar and wind, which on average has been cheaper to use than natural gas since at least 2016,15 However, these cost decreases have stagnated recently, with LCOE estimates indicating increases in price for 2023. While low LCOE for green energy is helpful to industry prospects, it is likely not the core driver of the recent employment surge as costs have stagnated recently.

ESG Investing

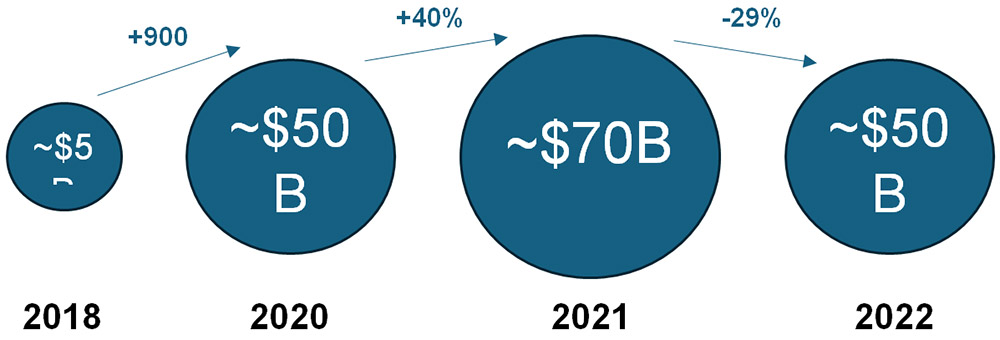

As for ESG investing, trends here also fail to paint a clear picture for its positive impact on green energy employment. While ESG investing increased 14-fold from 2018 to 2021 in the United States, a down-market year in 2022 decreased the assets under management of ESG funds by 29%. Yet, in that same year, green energy employment grew contrary to what we would expect if ESG investing was a primary factor. While ESG assets under management likely increased along with the overall market in 2023, it is still unlikely this investing trend is a primary driving growth factor.

Conclusion and Look Ahead

Ultimately, very few changes in the economy can be attributed to one simple causal factor. Of the three factors discussed above (IRA, LCOE decreases, ESG investment), however, only one is trending in a direction which can explain the increase in green jobs – that being the IRA. In reality, it is likely a combination of a solid economic baseline (aided by low LCOE and a willingness in corporate America to expand green operations) along with the extra financial and regulatory boost which the IRA has provided that is driving the recent above-average employment growth in green energy clusters.

One must question if this employment growth is sustainable. While the majority of IRA funds allocated to green energy have yet to be distributed, it may still be too early to definitively declare the IRA a success for the green energy sector. Nonetheless, the early signs are quite promising.

3 “Clean Energy Sector Employment” defined as energy sector jobs in transmission, distribution, and any “clean” (including nuclear) energy production. This grouping does not include green technology manufacturing or other related fields.14 “Environmental, Social, and Governance” – refers to an investing practice in which funds are set aside for businesses/industries that excel in all 3 categories.

15 This depends on specific application and geography and is not true for all solar and wind projects.