As the U.S. works to alleviate national security concerns and prime the country’s future with clean, reliable power, utilities and influential private industry leaders are collaborating to develop next-generation nuclear energy. While it is difficult to forecast exactly which reactor technology will dominate the market in the coming decades, investors increasingly view advanced nuclear technology as a path to maintaining economic leadership on the world stage.

First commercialized in the late 1950s, nuclear power has long served as a clean, scalable source of baseload energy to support regional growth strategies. With more than 50 nuclear power plants and nearly 100 nuclear reactors, the U.S. remains one of the world’s largest producers of nuclear energy.

Today, the nuclear industry is closely monitoring government support for advanced nuclear technology, including further guidance from the U.S. Department of the Treasury and the IRS. Meanwhile, clean energy subsidies and electricity credits are fueling interest in new zero-emission technologies. As power delays and regional electricity shortages highlight the potential of nuclear energy as a reliable alternative, the case for investment grows stronger.

Nuclear Site Selection

Developing nuclear energy projects is a major undertaking that requires weighing a complex and unique set of location determinants. New reactor designs offer improved safeguards, modular construction techniques, advanced fuels, improved waste management strategies, and other modern features that meet regulatory requirements and reshape the traditional site selection model.

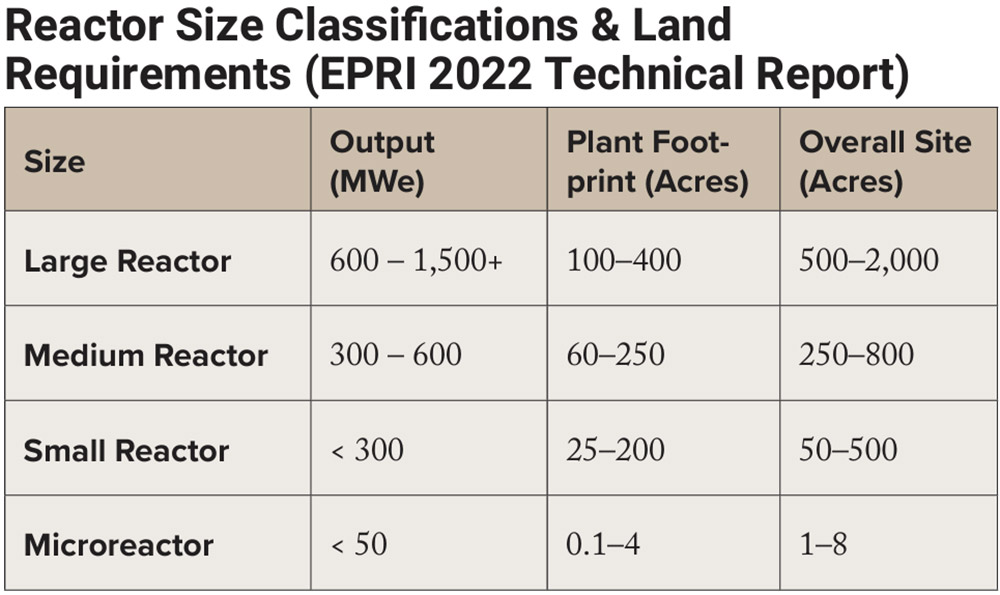

Evolved from their large reactor predecessors, modern designs require smaller sites, reduced water needs, and, in some cases, relaxed geotechnical conditions. Notably, most advanced reactor designs have a lower likelihood of accidents and can tolerate closer proximity to population centers, opening the door to previously ineligible locations. Last year, the Nuclear Regulatory Commission published a set of alternative approaches to the population-density criterion for both non-light-water and light-water small modular reactors (SMRs), suggesting that safety features associated with advanced reactor designs warrant specific provisions in the siting process.

60–95

Still, most advanced nuclear projects announced to date are evaluating land on or near existing energy assets or brownfield locations with supporting infrastructure. An analysis last year from the Department of Energy showed the potential to install 60-95 gigawatts of additional nuclear capacity at existing and retired nuclear sites. Siting nuclear assets under these conditions creates a foundation for public acceptance and political feasibility—valuable factors given the high costs of due diligence.

Additionally, siting multiple advanced nuclear reactors in one location offers significant economies of scale, allowing for reduced infrastructure development and workforce efficiencies.

Subsidy-eligible census tracts outlined in the Inflation Reduction Act—including brownfield sites, former coal mine communities, and energy-dependent employment areas—help bridge funding gaps. Other factors influencing levelized costs include cooling sources, surrounding land uses, hazardous weather conditions, transportation logistics, and water availability.

SMRs: Promise & Challenges

Conservative estimates from the National Renewable Energy Laboratory (NREL) suggest SMR construction timelines are 54 months shorter than those of large reactors. Their heat applications, enhanced safety features, and reduced land needs are reshaping nuclear site selection. Land requirements range from 25 to 200 acres for the plant itself—potentially doubling in size when buffer areas are included.

However, SMR site selection depends on reactor technology, future phases, and site characteristics, and big challenges remain. Despite a more standardized design, upfront costs are steep. In many cases, the levelized costs of SMR energy—the average cost of producing one unit of energy over the asset’s lifetime—remain two to five times higher per megawatt-hour than other energy types, including renewables.

While many critical systems are factory-assembled (modular) and offer significant economies of scale, these projects are not “plug-and-play.” Their feasibility often hinges on leveraging existing infrastructure. Under a stringent and often unpredictable regulatory environment, many reactor designs face an uphill climb toward profitability.

54

Regional Leadership & Economic Impact

A study released last year by the Southeast Nuclear Advisory Council found that the nuclear energy industry in the Southeast—encompassing Georgia, North Carolina, South Carolina, Tennessee, and Virginia—has the largest nuclear workforce in the U.S., generating an annual economic impact of $42.9 billion. The average employment multiplier across the five-state region is 2.8, meaning for every 10 jobs directly created by the nuclear industry, an additional 18 jobs are generated elsewhere—a significantly higher multiplier than the regional average across industries.

Moreover, the study found that nuclear projects frequently source raw materials from local vendors, reinforcing the economic benefits for surrounding communities.

With an established regulatory framework, skilled workforce, supporting infrastructure, and access to potential subsidies, the Southeast continues to lead in advanced nuclear innovation.

Energy infrastructure investments often serve as a bellwether for economic change, with capital and innovation riding on the winds of strong energy policies.

- Tennessee: Kairos Power is developing an NRC-approved non-light-water demonstration reactor near TVA’s 1,200-acre Clinch River Site, where an early site permit for an SMR has already been obtained.

- Virginia: Amazon is partnering with Dominion Energy to develop an SMR at the North Anna Power Station to support its growing cloud computing operations. Commonwealth Fusion Systems plans to build a commercial fusion power plant in Chesterfield County, marking a notable development in the emerging fusion energy sector.

Nuclear as an Economic Bellwether

While estimates vary, analysts project that U.S. advanced nuclear capacity will expand rapidly over the next decade. The DOE forecasts that U.S. nuclear capacity could triple to 300 gigawatts by 2050, signaling a major transformation in the nation’s energy landscape.For those involved in industrial real estate and site selection, the siting of advanced nuclear projects should be of particular interest. History shows that energy infrastructure investments often serve as a bellwether for economic change, with capital and innovation following strong energy policies. As both a catalyst and predictor of transformational economic development, nuclear energy remains a key factor in shaping the future of industrial site selection.