A Changing Landscape for Corporate Investment

The corporate site selection process has grown increasingly complex in recent years, as businesses face rising costs, evolving regulatory pressures, and shifting workforce dynamics. The 39th Annual Corporate Survey and 21st Annual Consultants Survey highlight key trends shaping location and expansion decisions for 2025. Corporate leaders and site selection consultants alike report that economic conditions, labor availability, and incentive programs remain at the forefront of their decision-making processes.Let’s take a look at the results of both surveys.

21st Annual Consultants Survey:

Consultants report that economic factors, workforce constraints, and sustainability goals are shaping location decisions, with companies focusing on the South and Midwest for new projects.

For site selection consultants, helping businesses expand and establish new locations is a daily responsibility. Their insights provide a unique perspective on the evolving priorities and challenges companies face when choosing where to invest. The 21st Annual Consultants Survey sheds light on how consultants are dealing with economic uncertainty, labor shortages, and shifting corporate priorities to secure optimal locations for their clients.

21st Annual Consultants Survey

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

Who the Consultants Are Working With

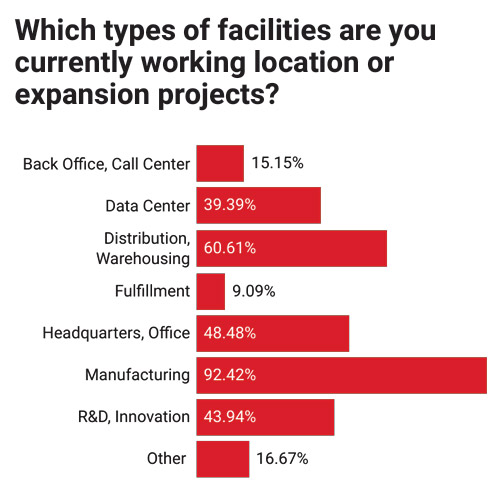

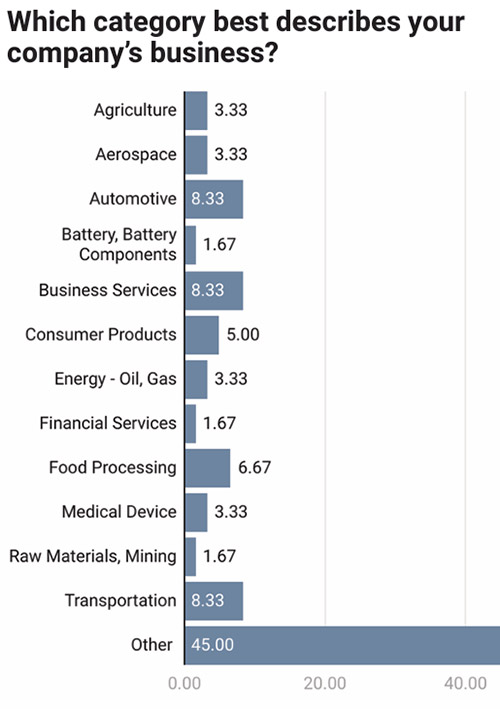

The consultants responding to this year’s survey represent a wide range of industries. Nearly all (92 percent) are working on manufacturing projects, underscoring the continued strength of industrial investment. Distribution and warehousing projects rank second, with more than 60 percent of consultants assisting clients in logistics and supply chain expansion.

Compared to the last year’s Consultants Survey, headquarters (41-->48) and data centers (30-->40) have seen a noticeable increase, perhaps indicating renewed investment in corporate expansion beyond industrial facilities.

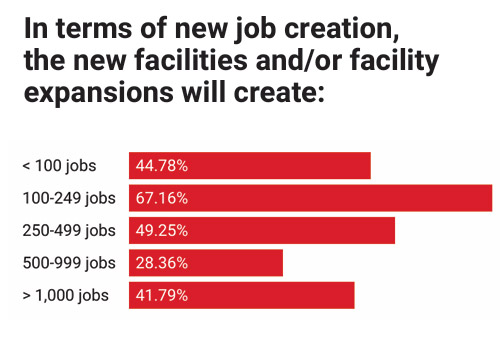

The scale of projects varies widely, with three-quarters of consultants working on projects involving 500 or more employees. Notably, more than half of the respondents are working on deals that will create over 1,000 jobs, a slight increase from last year’s survey, suggesting larger-scale investments despite economic caution.

Expansion Timelines and Regional Preferences

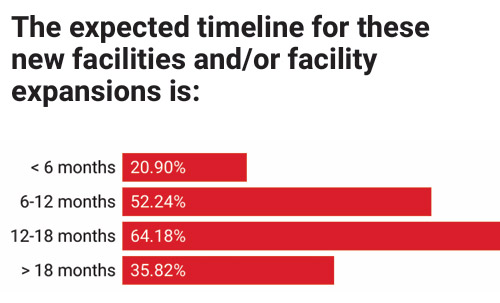

Most projects remain on a six-to-18-month timeline, though a growing number of consultants report even shorter turnaround times as companies seek to fast-track their expansions to capitalize on incentives and favorable economic conditions.

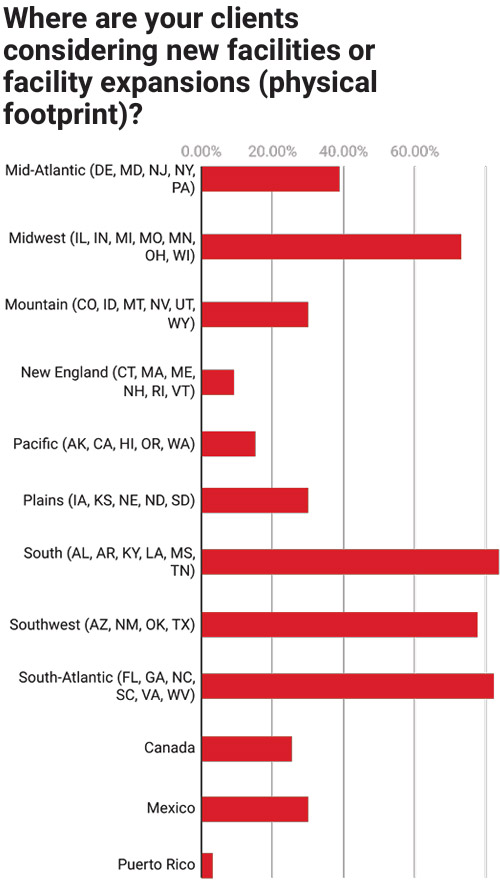

The South and Midwest continue to dominate site selection activity. Nearly all consultants are actively working on projects in the South Atlantic and Southwest regions, citing business-friendly policies, strong labor markets, and available land. However, the Midwest has seen an increase in consultant-led projects compared to last year, reflecting the region’s competitive workforce programs and growing investment in advanced manufacturing and battery production.

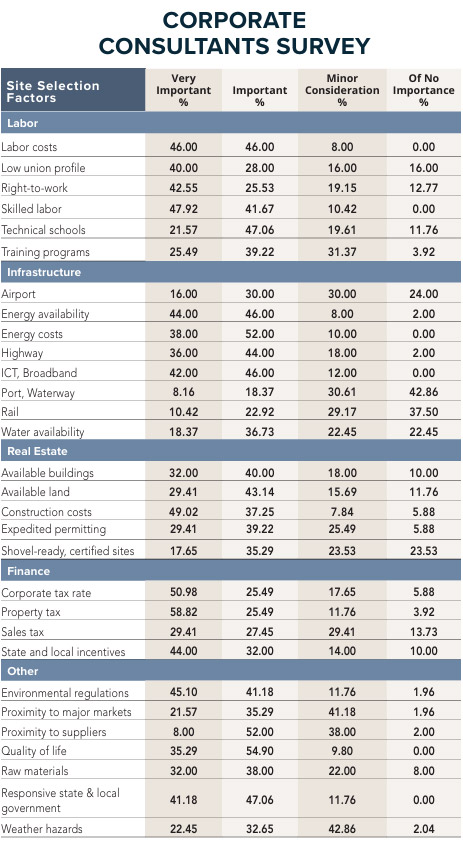

Top Site Selection Priorities: Workforce and Incentives Drive Decision-Making

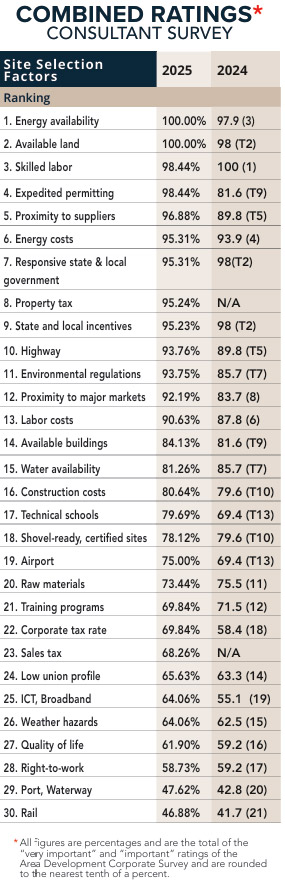

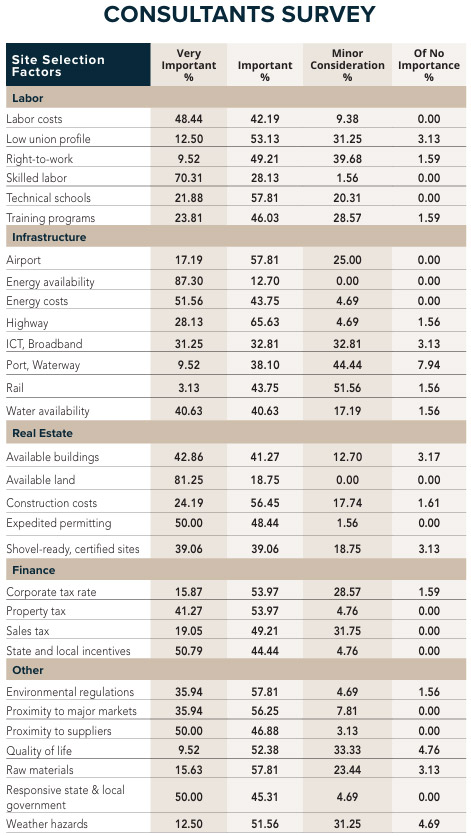

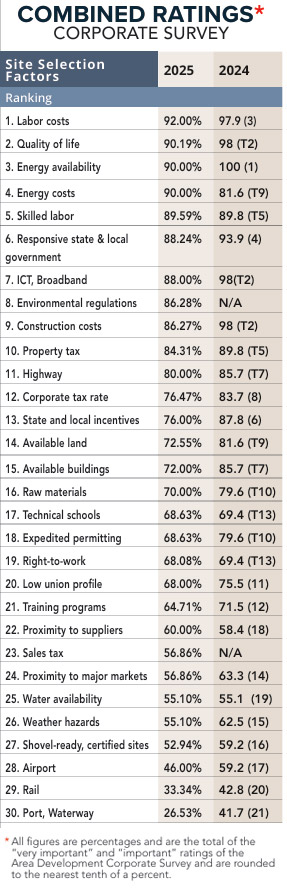

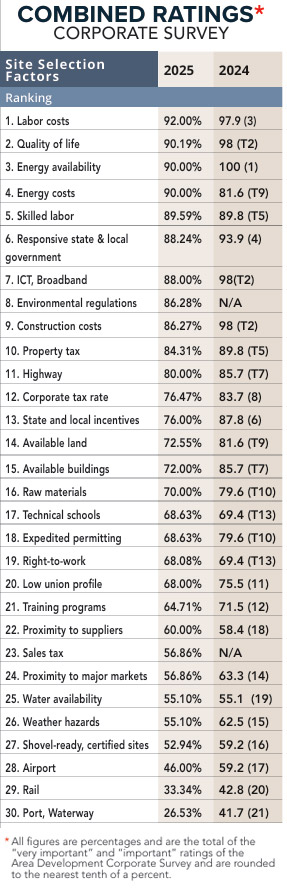

For yet another year, the availability of skilled labor remains the number one site selection factor, rated “very important” or “important” by nearly all respondents. This aligns with corporate executives’ priorities and reflects ongoing labor shortages across multiple industries.

However, state and local incentives have declined in importance, with 50 percent of consultants rating them as a very important factor—a noticeable decrease from the previous year’s 66 percent. This shift suggests that companies are relying less on incentive packages to offset rising operating costs and capital expenditures.

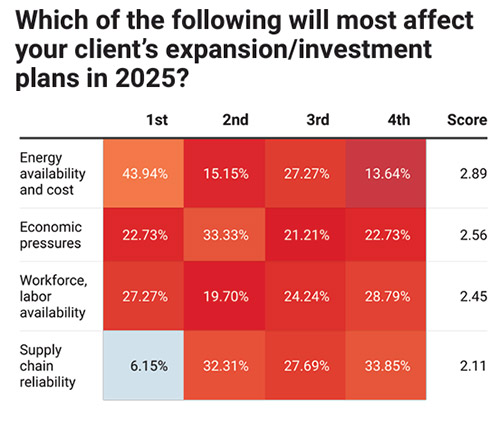

Another notable shift in this year’s rankings is the increased concern over energy costs and availability as a chief concern. In last year’s survey, energy availability and cost (20%) ranked behind economic pressures (46%) and workforce (26%) as a concern. This mirrors broader concerns about grid reliability, industrial power demand, and the rising costs of energy in high-consumption sectors.

Available land continues to be a huge concern for consultants. Fast-track permitting and the availability of shovel-ready sites continue to rank higher in the Consultants Survey than in the Corporate Survey, demonstrating the importance of speed-to-market considerations when selecting locations.

Sustainability and ESG Considerations Grow in Importance

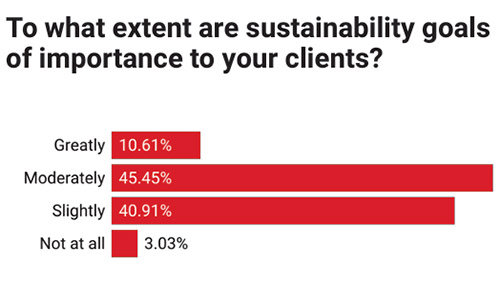

Half of the consultants surveyed report that environmental, social, and governance (ESG) factors are now a consideration in site selection decisions, a significant jump from last year’s survey. While sustainability has long been a talking point in corporate strategy, it is increasingly becoming a hard requirement for many companies looking to meet carbon neutrality and emissions reduction goals.

Similarly, environmental regulations have climbed in the rankings, reflecting growing scrutiny over permitting, emissions standards, and compliance with state and federal sustainability mandates.

Foreign Direct Investment and International Influence

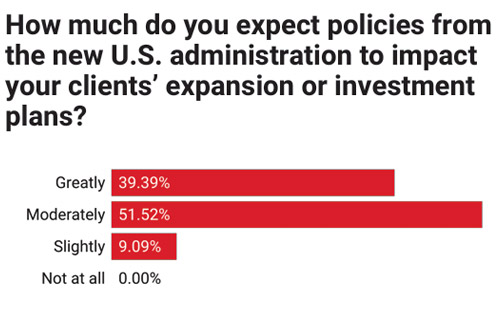

Global economic trends continue to shape site selection. Four out of five consultants are currently working on projects involving foreign direct investment (FDI), a percentage that has remained stable over the past three years. The CHIPS and Science Act and Inflation Reduction Act have driven renewed international interest in U.S. site selection, particularly in semiconductor, clean energy, and EV battery production, but questions about those programs loom under the Trump administration regime. To wit, consultants are generally worried about new administration policies.

Nearshoring and reshoring are also key themes in 2025. Many consultants reported assisting clients in relocating supply chain operations from Asia to Mexico, Canada, or the U.S., reflecting continued supply chain diversification efforts.

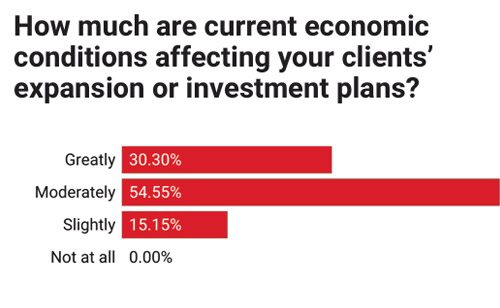

Consultants widely agree that economic conditions continue to be the biggest variable influencing site selection. More than 85 percent report that inflation, interest rates, and recession concerns are either greatly or moderately affecting their clients’ expansion plans.

Yet, despite these concerns, the volume of projects has remained steady, with a growing focus on strategic investments in manufacturing, logistics, and corporate headquarters.

As companies navigate cost pressures, workforce constraints, and shifting regulations, consultants remain focused on identifying competitive locations that offer the right mix of talent, incentives, and infrastructure to support long-term success.

39th Annual Corporate Survey

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

39th Annual Corporate Survey

The past few years have presented an evolving economic landscape for corporate decision-makers. From inflationary pressures and supply chain disruptions to federal legislative incentives and shifting workforce expectations, businesses are continuously recalibrating their expansion and investment strategies. The 39th Annual Corporate Survey provides an in-depth look at how corporate leaders are adapting to these changes and what priorities are shaping their site selection decisions heading into 2025.

Corporate Respondents: Who They Are and What They Need

The composition of survey respondents reflects a strong manufacturing presence, with nearly half of all corporate executives representing manufacturing firms. This continues a trend observed in prior surveys, where industrial sectors dominated site selection and expansion activities. Additionally, business services, transportation, and food processing companies represent significant portions of the respondents, underscoring the broad industry reach of this survey.

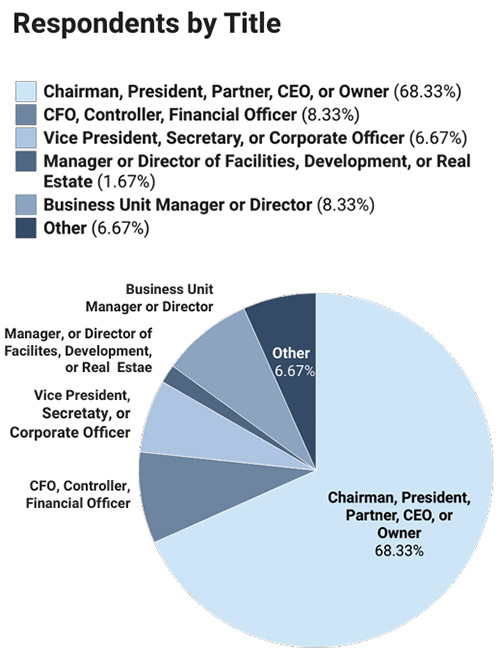

Ownership and decision-making authority remain consistent with past results: nearly 60 percent of respondents are either CEOs, presidents, or partners, giving weight to the insights captured in this year’s survey.

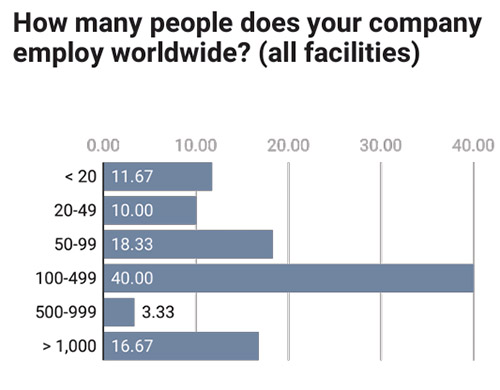

In terms of company size, small and mid-sized businesses continue to dominate the survey results, with nearly 70 percent of respondents working for companies that employ fewer than 500 people. While larger corporations are still making major investment decisions, small and mid-size firms are demonstrating more caution in expanding their physical footprints.

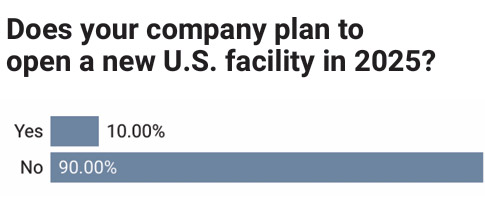

Expansion Plans: Holding Steady Amid Economic Caution

Corporate leaders remain measured in their approach to expansion. Only about one out 10 of our respondents plan to open a new domestic facility in 2025, a big change from last year when 1/3 of respondents planned to open a new facility.

This cautious stance aligns with the economic pressures that continue to weigh on investment decisions. However, companies that are expanding are primarily focusing on manufacturing, distribution, and warehousing operations—a trend that has held steady over the past three years.

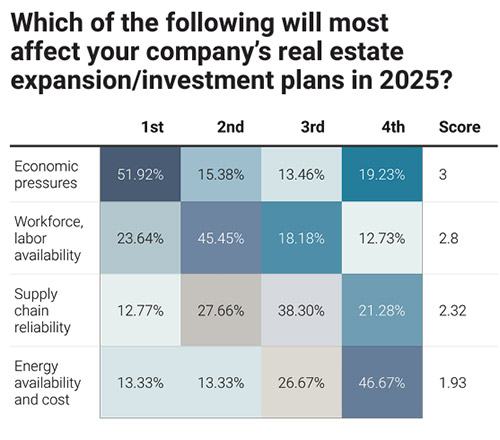

Top Site Selection Factors: It’s the Economy

For yet another consecutive year, economic pressures and labor costs rank as the most critical site selection factors.

More than percent of respondents rated economic pressures as "very important” reflecting the ongoing struggle to attract and retain skilled workers in an increasingly competitive labor market. Energy availability and cost, while not as big of a concern as for the consultants, is notably higher among the corporate respondents this year, too.

Construction costs have business leaders giving pause, too. It’s the number one real estate factor for corporate respondents in terms of making a site selection decision.

In terms of infrastructure requirements, it’s all about energy and energy cost, like last year. Projects nowadays require enormous amounts of power.

Property taxes are top of mind for corporate respondents this year. Interest in tax exemptions and state/local incentives remained high as well. Companies are placing greater emphasis on incentives that can offset capital expenditures and long-term operating costs.

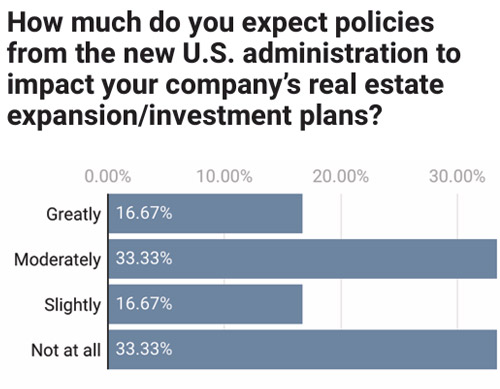

Policies

Contrary to the results of the Consultants Survey, corporate leaders don’t seem to think the election of Donald Trump will have too much of an effect on their site selection decisions. More than 30 percent of those surveyed said it would have no impact at all.

Perhaps surprisingly, the same cohort is leaning into the importance of environmental regulations. This increase suggests that businesses are growing more aware of sustainability mandates, emissions reduction requirements, and the impact of evolving government policies on their site selection choices. Similarly, these same respondents said that sustainability goals were more important this year than last year.

In terms of labor, corporate leaders still prioritize labor costs and access to skilled labor above all. But they continue to show a strong preference for right-to-work areas and low union profiles.

Looking Ahead: Confidence and Uncertainty Coexist

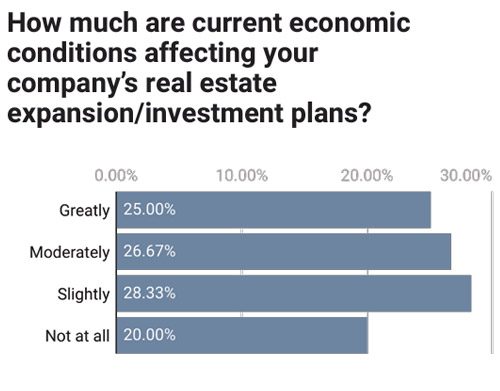

Overall, economic pressures remain at the forefront of corporate leaders’ minds. More than half of respondents cite economic uncertainty as the biggest factor influencing their 2025 expansion plans, mirroring sentiments from previous surveys.

Rising interest rates, supply chain realignments, and geopolitical concerns all contribute to a landscape of cautious investment.

However, there are also signals of optimism. Consumer confidence has rebounded, business sentiment is improving, and companies continue to explore opportunities for expansion.

With government incentives like the CHIPS and Science Act and the Inflation Reduction Act still shaping investment decisions, many businesses are leveraging federal support to move forward with strategic growth plans.

As 2025 unfolds, companies will need to balance cost efficiency, workforce availability, and sustainability priorities to remain competitive in an evolving business environment.

The 39th Annual Corporate Survey provides a snapshot of these priorities, reinforcing the enduring significance of labor access, incentives, and regulatory clarity in site selection strategies.