The U.S. aerospace industry is once again in growth mode—but the drivers of that growth have changed, and so have the places best positioned to benefit. Spurred by defense modernization, space commercialization, and next-generation aviation technologies, a new era of aerospace site selection is taking shape. At the center of this transformation are states and regions that offer not just incentives, but speed to market, secure infrastructure, and deep talent pools tuned to the needs of advanced aerospace.

As the industry shifts from legacy hubs to emerging contenders, we take a closer look at the regional playbooks helping shape this new aerospace map—and what corporate real estate executives, supply chain leaders, and site selectors need to know now.

North Carolina: A Statewide Aerospace Platform That Delivers

North Carolina has emerged as a leading destination for aerospace investment, thanks to a combination of workforce customization, shovel-ready industrial sites, and a strong track record with both legacy and startup companies. GE Aerospace and Pratt & Whitney have both expanded in the state. Pratt & Whitney’s $285 million expansion in Asheville adds a new casting foundry and more than 300 new jobs to its Industry 4.0 turbine airfoil plant. This growth was made possible in part by tailored training partnerships with Asheville-Buncombe Technical Community College.

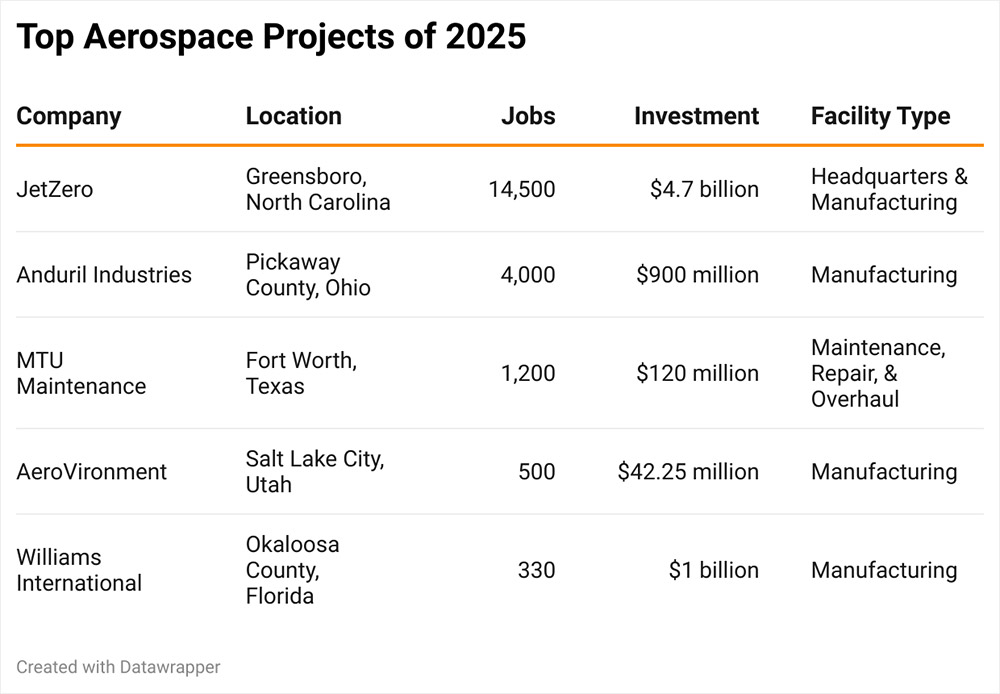

Meanwhile, startup JetZero chose Greensboro’s Piedmont Triad International Airport for its $4.7 billion Z4 aircraft program. The site beat out multiple national contenders. “More important than discretionary incentives, it’s knowing they have the workforce,” said John Loyack, VP of Economic Development at the North Carolina Community College System. Loyack added that the NCEdge initiative is helping aerospace employers rapidly onboard trained workers through customized credentialing programs developed in partnership with employers.

Chris Chung, CEO of the Economic Development Partnership of North Carolina, emphasized the state's coordinated effort: “It’s not by accident that North Carolina has become a magnet for aerospace and aviation investment. This is the result of sustained collaboration between education, government, and industry.”

What sets North Carolina further apart is its infrastructure planning. In the Triad region alone, more than 1,000 acres of aviation-adjacent industrial land are being actively developed, with utilities and road access funded through public-private partnerships. This planning translates into a measurable advantage: aerospace manufacturers can shave six to 12 months off construction timelines by locating at pre-certified sites.

Site selectors are also watching NC’s growing capacity for composites and advanced materials. The Composite Center of Excellence at NC State and partnerships with private OEMs have helped attract additional suppliers to the state.

Ohio: Building Hypersonic and Autonomous Defense Hubs

Ohio is capitalizing on its industrial legacy by pivoting into high-tech defense aerospace. The headline project is Anduril’s Arsenal-1 facility near Columbus—a hyperscale, vertically integrated site focused on autonomous systems and hypersonic production. Over 4,000 jobs have been announced so far. “The site itself could not be better,” said Christian Brose, Chief Strategy Officer at Anduril, in a company statement announcing the Arsenal-1 project. “It’s close to a talented labor market of upwards of a million people… many already working in automotive and aerospace.”

Ohio’s aerospace footprint is also growing through GE Aerospace’s investments in hypersonic propulsion R&D at its Evendale campus. These efforts reinforce the state’s unique combination of research capacity, retooled manufacturing skill, and logistics strength. Matt McCollister of One Columbus noted that the region has worked aggressively to build site-ready inventory and align workforce resources with companies like Anduril, which require fast, flexible solutions.

“The aerospace and defense cluster in Ohio is experiencing unprecedented growth,” said J.P. Nauseef, President and CEO of JobsOhio. “From our innovation districts to advanced logistics corridors, we are building a durable ecosystem that meets the speed and sophistication today’s aerospace firms demand.”

Of particular interest to site selectors is how Ohio is adapting its Tier 1 and Tier 2 automotive suppliers to serve aerospace primes. In Marysville and Dayton, companies like Honda Logistics and Inteva Products have announced crossover component contracts, highlighting the potential for shared supply chains. Dayton has rapidly emerged as a center for advanced aerospace production, according to Colliers' Q1 2025 Aerospace & Defense Report for Dayton, which notes the city’s strong momentum in defense supply chain real estate and demand for specialized industrial campuses near the Dayton aerospace cluster.

State and local incentive packages have further contributed to the region’s momentum, enabling faster site decisions through streamlined permitting processes and infrastructure guarantees. In recent deals, Ohio has committed to expedited approvals for clean room construction and long-term power delivery—key requirements for propulsion system testing and production.

Mississippi: Transforming Federal Assets into Commercial Launchpads

At the historic Stennis Space Center in Hancock County, Mississippi, a quiet transformation is taking place. NASA's longtime test stands are now being leased by private companies like Relativity Space and Rocket Lab. This marks a shift from publicly controlled to commercially activated infrastructure. “For the first time in history, we’re seeing a real commercial infusion into Stennis,” said Blaine LaFontaine, Executive Director of the Hancock County Port and Harbor Commission. “Companies are bringing in taxable assets and new jobs, and revitalizing infrastructure that had gone underutilized for decades.”

Relativity’s 3D-printing production and rocket testing at Stennis is just the beginning. “With a skilled workforce and world-class infrastructure, Hancock County is the perfect place for us to perform the wide variety of tests that are critical to develop our fully 3D printed Terran 1 orbital rocket and Aeon engines,” said Tim Ellis, CEO and co-founder of Relativity, in the company's public announcement of its expansion at Stennis.

For companies seeking large-format testing environments, Hancock County offers a compelling logistics advantage. The nearby Port Bienville and CSX rail service allow for oversized freight and hazardous material transport, often a requirement for launch providers and engine developers. Additionally, companies benefit from federal Opportunity Zone designations and energy rate discounts that improve long-term operational economics.

Georgia: Aerospace’s Quiet Giant Gets Louder

Georgia’s aerospace sector has long been a quiet giant, but recent investment waves are amplifying its role in both commercial and defense aviation. Aerospace is the state’s number one export—totaling $11.1 billion in 2023—and it ranks as Georgia’s second-largest manufacturing industry overall. This momentum is being led by a mix of legacy OEMs like Gulfstream and Delta TechOps, as well as new entrants investing in R&D, MRO, and electric aviation.

Savannah remains a linchpin for the sector. Gulfstream Aerospace has invested more than $150 million in facilities there, supporting the production and servicing of its G400, G500, and G600 aircraft. The company recently expanded its Customer Support service center and manufacturing footprint, bringing over 1,600 new jobs to the region.

“Savannah has been our home for decades, and the support we receive from state and local partners makes this growth possible,” said Gulfstream President Mark Burns in a company release. The expansion reinforces Savannah’s specialized workforce and infrastructure tailored to business aviation.

Savannah has become one of the fastest-growing aerospace and defense employment markets in the U.S., with job postings surging over 300 percent since 2020, according to a JLL report.

Elsewhere in the state, emerging technologies are driving new growth. Archer Aviation recently completed its 400,000-square-foot aircraft manufacturing facility in Covington, built adjacent to the Covington Municipal Airport. The plant is set to produce the company’s Midnight eVTOL aircraft and represents a major bet on Georgia’s logistics capacity and proximity to metro Atlanta’s engineering talent.

Georgia’s strength lies not just in marquee names but also in its second-tier markets. In Roswell, PBS Aerospace is investing $20 million in its new North American headquarters and manufacturing facility. Meanwhile, StandardAero is undergoing a $33 million MRO expansion in Augusta. These projects reflect the state’s ability to support small-to-mid-tier firms alongside global players.

Pat Wilson, Commissioner of the Georgia Department of Economic Development, noted the state’s edge: “Companies choose Georgia because we offer end-to-end support—from the initial site search to training the first employee. Our technical colleges, our logistics network, and our long-standing aerospace clusters all help reduce risk and speed up time to value.”

For site selectors and corporate real estate leaders, Georgia’s readiness is palpable. Aerospace sites near key airports—from Augusta to Columbus—offer large pad-ready tracts and established utility capacity. The state has also improved permitting timelines through partnerships with local authorities and invested in airspace and drone corridors to support future aerospace traffic.

“We're doing the gardening so companies can harvest,” said Bob Koseck, Division Director of Global Commerce at the Georgia Department of Economic Development. “That means infrastructure, talent pipelines, permitting—all the things that make it easier to hit milestones.”Virginia: National Security, Talent, and Coastal Assets Align

Virginia has cemented its place as a strategic aerospace hub by leaning into its defense footprint, world-class research institutions, and access to critical coastal infrastructure. While the state may not dominate in raw manufacturing volume, it punches above its weight in systems integration, testing, and launch services tied to national security and commercial innovation.

Wallops Island, home to NASA’s Wallops Flight Facility and the Mid-Atlantic Regional Spaceport (MARS), is quickly becoming a keystone for space access on the East Coast. Northrop Grumman has launched multiple Antares rockets from the facility, and Rocket Lab has committed to expanding launch operations at the site. In early 2024, Virginia-based Gravitics announced it would explore testing at Wallops for its commercial space station modules.

“The convergence of federal assets and state-backed innovation funding makes Virginia an incredibly attractive place to grow space-related operations,” said Dale Nash, former CEO and executive director of Virginia Space. State officials and economic developers have focused not only on launch capabilities but also on building out the surrounding aerospace supply chain along the Delmarva Peninsula.

Further inland, Northern Virginia continues to attract defense aerospace investment tied to secure communications, AI-integrated systems, and space-based defense technologies. The presence of major primes—BAE Systems, Leidos, Raytheon—and proximity to the Pentagon give the region a competitive advantage when it comes to workforce specialization in national security-related aerospace. A steady pipeline of graduates from Virginia Tech, George Mason, and the University of Virginia further bolsters technical hiring.

Real estate decision-makers are also watching the Danville region, where Virginia has piloted one of the country’s most advanced talent development models for precision machining and aerospace manufacturing. The Gene Haas Center for Integrated Machining, in partnership with Danville Community College and the Institute for Advanced Learning and Research, is turning out workers with four-axis CNC, metrology, and digital twin experience. These capabilities are in high demand as OEMs push further into additive manufacturing and complex part fabrication.

In Hampton Roads, Huntington Ingalls Industries continues to invest in unmanned systems and has launched new training programs in collaboration with Old Dominion University. These efforts reflect a state-level commitment to connecting traditional defense manufacturing with next-generation autonomous and aerospace capabilities.

JLL reports that federal lease demand in the National Capital Region has risen 12 percent since 2020, driven largely by expanded DoD contract volumes—totaling $489 billion in 2023—which continue to shape real estate needs for defense primes and R&D contractors in Virginia.

For corporate site selectors evaluating the East Coast, Virginia offers a rare combination of federal integration, innovation funding, and coast-adjacent launch and test infrastructure. The state’s regulatory environment is also becoming more streamlined, with recent permitting reforms designed to accelerate projects tied to federal contracts.

Texas: Dual Powers of Defense and Commercial Space Texas: Supersonic Ambition and Borderland Boldness

Texas has long loomed large in aerospace, with major federal installations like NASA’s Johnson Space Center, a thriving defense footprint, and a deep bench of engineering talent. But what’s pushing Texas to the forefront in this new aerospace cycle is its willingness to back commercial pioneers—especially those with bold, even controversial visions for the future of flight and space.

The state’s most visible project remains SpaceX’s Starbase in Boca Chica, where Elon Musk’s company has built and launched prototypes of its Starship vehicle, aimed at enabling interplanetary transport. While environmental permitting and community relations in the region remain tense, the sheer scale of investment is impossible to ignore. “This place is going to be the gateway to Mars,” Musk declared in a widely reported company update in 2024. Whether or not that proves true, the site has already attracted downstream suppliers and sparked logistical planning for a possible commercial spaceport corridor along the Gulf Coast.

Brownsville, the nearest city to Starbase, has embraced its new identity as a launch hub. The Greater Brownsville Incentives Corporation has invested in site development, technical training programs, and power infrastructure to meet aerospace tenants’ demands. While some permitting challenges persist at the state and federal levels, the region’s strategic location, large labor pool, and low cost of living remain attractive for companies working in propulsion, launch systems, and advanced materials.

Elsewhere in Texas, legacy players are also scaling up. Lockheed Martin continues to invest in its Fort Worth operations, including a new 500,000-square-foot facility supporting F-35 production and sustainment. The company cited strong workforce pipelines from local technical colleges and universities. Meanwhile, the Houston Spaceport—a project housed within Ellington Field—is emerging as a testbed for private space companies and research institutions. Axiom Space and Intuitive Machines have both opened major facilities there in the last 18 months, with support from the Houston Airport System and Space Center Houston.

The real estate implications are significant. Much of the aerospace growth in Texas is occurring in secondary and tertiary markets that offer large parcels of land and close access to transportation corridors, including major ports and dedicated airfields. State incentives can be generous, particularly under the Texas Enterprise Fund and Chapter 313-style local abatements, though these are undergoing legislative review.

Yet the rapid growth comes with headwinds. Permitting timelines, especially for projects near ecologically sensitive areas like the Gulf Coast, can be uncertain. Water access, power availability, and community resistance to large-scale testing activities have all surfaced as barriers in various parts of the state. Still, companies willing to navigate the complexity may find Texas unmatched in its enthusiasm for aerospace ambition.

“The resources and infrastructure we have here are truly world-class,” said Brent Kisling, Executive Director of the Texas Aerospace & Aviation Advisory Committee, in a recent industry roundtable. “But more importantly, we have a mindset in Texas that says: if you’re trying to do something no one’s done before, this is where you start.”

Colorado: A High-Altitude Hub for Space and Defense Innovation

Colorado has emerged as one of the country’s most concentrated aerospace clusters, blending space tech entrepreneurship with a deep bench of defense contractors and federal assets. The state now ranks first in the nation for private aerospace employment per capita, and its diverse ecosystem spans everything from satellite manufacturing and cybersecurity to AI-enabled space domain awareness.

At the heart of the action is the Denver metro, where companies like Lockheed Martin, Ball Aerospace, Sierra Space, and Maxar Technologies anchor a constellation of startups, labs, and integrators. The state is also home to Buckley Space Force Base, Schriever Space Force Base, and the U.S. Space Command—making it both a strategic operations center and a magnet for talent.

In 2024, Sierra Space took a major step forward with its Dream Chaser spaceplane program at its new “Spaceport Colorado” facility near Centennial Airport. Designed to ferry cargo (and eventually people) to low Earth orbit, the Dream Chaser initiative is emblematic of Colorado’s commercial space push. “Colorado gives us the talent, altitude, and regulatory environment we need to lead in space transportation,” said Sierra Space CEO Tom Vice during a public announcement.

The state’s appeal goes beyond its prestige players. Colorado’s startup culture has fostered next-gen companies in propulsion, robotics, and additive manufacturing—many of which have grown through contracts with the Department of Defense or NASA’s SBIR programs. Aerospace alleyways in Boulder, Littleton, and Colorado Springs now host dense networks of suppliers and specialists.

Real estate investors have responded by developing new flex and advanced manufacturing space near airports and research corridors. Several industrial parks in Jefferson and El Paso counties are now fully leased to aerospace tenants, with additional sites under development. Local economic developers have prioritized zoning reforms and infrastructure enhancements to speed up buildout for advanced users.

For workforce planners, Colorado’s university system is another draw. The University of Colorado Boulder and the Colorado School of Mines produce hundreds of graduates annually in aerospace engineering and space resources—many of whom go on to work in local firms. The state’s work-based learning model, led by the Colorado Workforce Development Council, also gives companies a mechanism to develop custom apprenticeship programs tied to mission-critical needs.

With its combination of altitude, assets, and ambition, Colorado is becoming the go-to location for aerospace firms needing close access to national defense infrastructure and a collaborative innovation culture. While real estate prices are rising in key metro areas, companies continue to prioritize proximity to Colorado’s unique institutional and federal resources.

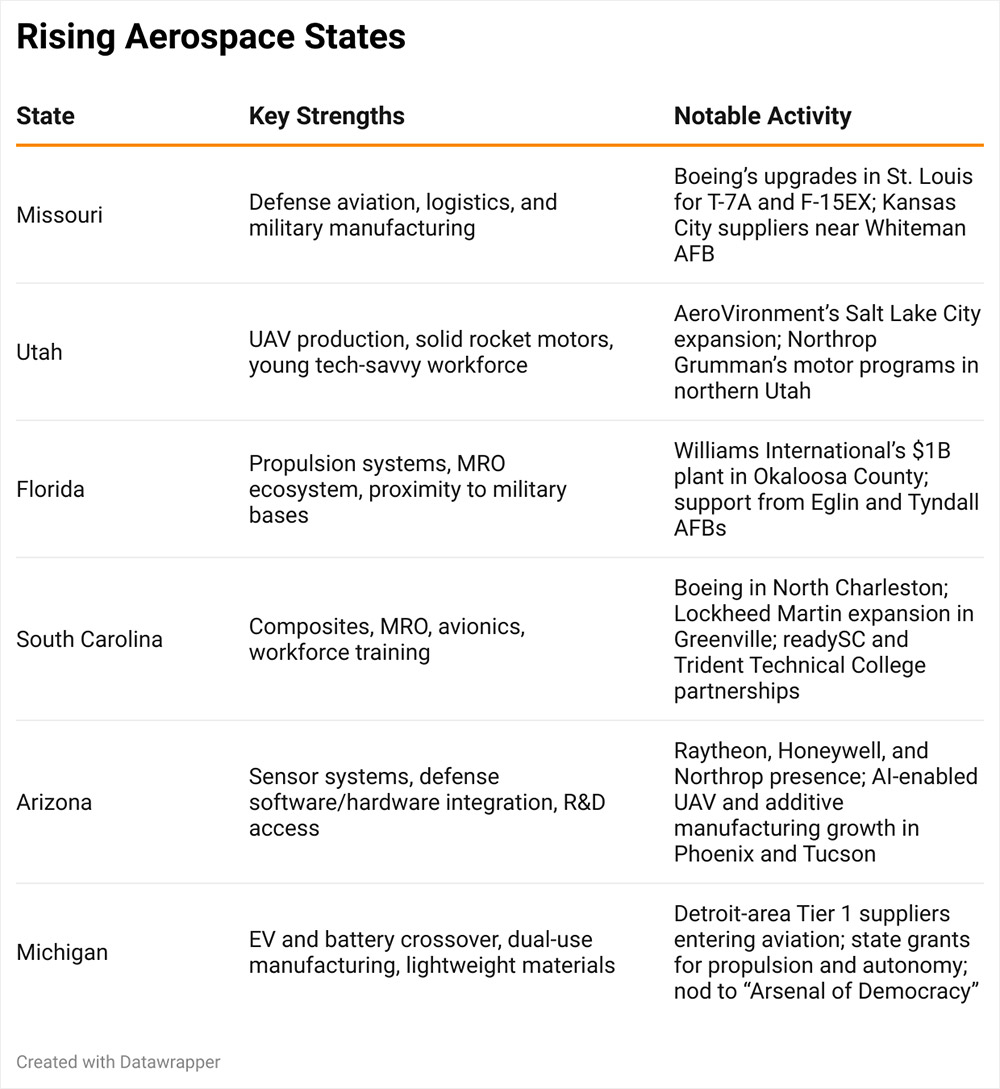

Rising Regions: New Contenders Emerge in Aerospace Site Selection

As aerospace primes and Tier 1 suppliers expand across the U.S., a set of emerging regions is making a compelling case for inclusion in future supply chains. These areas may not have the long-standing legacy of Ohio or North Carolina, but they are attracting attention for their specialization, infrastructure investment, and workforce potential.

Wrap Up: A New Flight Path for Aerospace Site Selection

As the U.S. aerospace industry reorients itself for a new era of defense priorities, commercial launch, and high-speed innovation, a corresponding shift is underway in how—and where—companies decide to build. The old rules no longer apply. Instead of clustering around legacy aerospace cities, today’s most ambitious companies are looking for states and regions that offer the trifecta of ready sites, rapid workforce deployment, and long-term strategic value.

From Mississippi’s reinvention of its NASA infrastructure to Ohio’s transformation into a hypersonic corridor, the industry’s most exciting developments are often happening in places that have deliberately aligned infrastructure, education, and permitting processes to aerospace’s fast pace. North Carolina’s statewide workforce platform, Georgia’s logistical dominance, and Colorado’s deep talent pipeline all point to a future where state competitiveness is defined less by who offers the biggest check—and more by who can deliver results, fast.

For site selectors, that means the competitive map of the U.S. is actively being redrawn. Aerospace firms that once followed predictable legacy patterns are now considering mid-sized cities, university towns, and multi-modal freight hubs. Meanwhile, real estate portfolio managers are navigating new demands for scale, security, and environmental performance as they build out next-gen production and testing facilities.

.jpg)