Low Vacancy Rates: A Mixed Bag

Constraints in the industrial real estate market are well documented. Industrial vacancy rates in the U.S. fell to historic lows during 2022 and finished the year at a crippling 3.0 percent — half the normal range of 6–7 percent. Las Vegas exemplifies this challenge with a vacancy rate of 1.5 percent. Detroit (1.8 percent) and Boston (2.6 percent) provide additional acute examples of this current dynamic. Toronto’s massive industrial market (the fourth-largest market in North America) spent 2022 below 1.0 percent.

The forces that pushed vacancy rates lower during 2022 were positive. Consumers were spending money, and the private sector was investing heavily; these are generally signs of a healthy economy. To an extent, low vacancy rates are a good thing, as empty buildings do no one any good. But just like unemployment, ultra-low rates become an impediment to economic growth.

The industrial vacancy rate in the U.S. has fallen to a crippling historic low of 2.9 percent. How will industrial vacancy rates impact our future? First, let’s consider recent history. The years 2010 through 2019 represent an incredible, sustained period of economic growth supported by ample industrial vacancy rates that ranged from 5 percent to 10 percent. Despite strong demand aggressively consuming space during this time, speculative industrial development — which in recent years has accounted for more than two thirds of all industrial construction — played a critical role. Speculative developments provided enough industrial real estate to help the economy expand for a sustained period. Driven almost solely by this speculative activity, major markets added tens of millions of square feet to their industrial inventory each year during the latter part of this period. Without this availability, the economic successes of the 2010s would not have been possible.

While the topic is currently receiving limited attention, industrial vacancy rates will play a pivotal role in the economy’s ability to navigate the choppy waters ahead.

A Decline in Speculative Real Estate Projects

Speculative real estate development is driven by three items: anticipation of market demand, ability to finance, and predictable and enabling government policies.

The first and second items have taken a beating recently. While current vacancy rates are low, future demand and rent levels are difficult to pinpoint, making investments in speculative industrial projects riskier than during the past decade. In addition, interest rates provide a two-pronged disincentive to speculative investment.

First, higher interest rates mean debt is more expensive. This puts pressure on every project’s pro forma and makes profitability more difficult, especially when facing uncertain rent levels. The second prong is guided by the basic economic principle of risk/reward. Prior to recent interest rate rises, investors were unable to generate gains by parking their dollars on the sidelines and were anxious to find investments that offered positive returns. Today, that dynamic is flipping on its head. Higher interest rates motivate investors to hold onto their dollars and benefit from the accruing interest rather than betting on higher-risk speculative development.

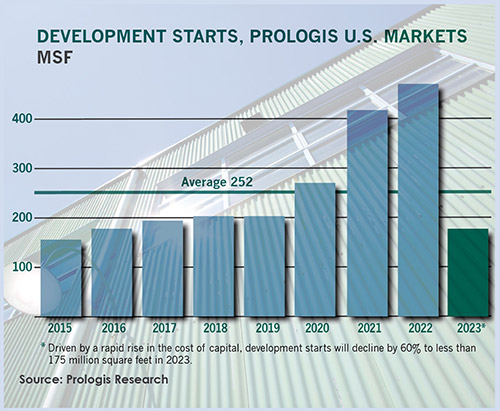

Future demand and rent levels are difficult to pinpoint, making investments in speculative industrial projects riskier than during the past decade. Due to these economic headwinds and higher interest rates, speculative industrial development is already retreating. For 2023, industrial construction starts are predicted to decline by 60 percent compared to 2022. The pipeline of in-process industrial speculative construction can’t solve this problem either; if all speculative projects became immediately available as vacant space (a purely theoretical scenario that is impossible in reality), the national vacancy rate would rise to 6.3 percent, barely into the healthy range. Historically low vacancy rates and an absence of robust industrial real estate development is a dangerous recipe for the U.S. economy.

Strategies for Overcoming Industrial Real Estate Challenges

Corporate leaders should consider the following approaches to achieve their growth objectives during this period of industrial real estate limitations:

- Build extra room into timelines. Corporate location and expansion processes have moved at breakneck speed over the past few years. While this velocity is unlikely to wane, it is important for executives to force discussions about their industrial real estate needs to the forefront. Adding 90–180 days to the front end of traditional timelines will help companies avoid roadblocks and create more successful outcomes.

- Cast a wider geographic net. As availability of modern industrial real estate continues to diminish, a preconceived location may not be viable. Even if a company finds a workable existing building, the lease/purchase costs may be prohibitive. By building extra room into timelines, executives can expand their search areas. This work should take two forms:

As availability of modern industrial real estate continues to diminish, a preconceived location may not be viable. First, investigate multiple regions of the country. While a certain area may be ideal, a few different regions across the country could be capable of achieving the company’s objectives. Evaluate and understand these different markets early in the process and maintain pathways to occupancy in at least two different regions until one of them is inked.

Second, consider secondary and tertiary locations. Tier 1 metros present a challenging combination of low industrial vacancy rates and the highest levels of demand. While there are many reasons to locate in a tier 1 area, it is not always necessary. The top 20 metros deservedly attract a lot of attention, but executives should challenge their teams to consider metros 21–50+, as there are lots of viable locations in that group for most operations.

Additionally, push the perimeters of the areas under consideration. Rather than constraining the search to 30 minutes from the airport or a key transportation asset, consider 45 or 60 minutes. The outer reaches of a metro area often provide solid options for industrial operations. Bonus: some of these tertiary communities undertake speculative industrial development on their own. This means they may provide more cost-effective solutions as they are less inclined to follow the market in ratcheting up lease/sale rates. - Have a plan B. In this case, B stands for build-to-suit. In the current economy, it is uncommon for companies to prefer a build-to-suit industrial real estate solution. Despite the preference for an existing building, a build-to-suit option should be prepared, especially if location is inflexible. Companies should use the extra few months added to the timeline to focus on this process. Having a build-to-suit plan with preliminary design, timelines, and cost estimates will help avoid a potential timing catastrophe if existing space cannot be procured. It is better to put the build-to-suit plan on the shelf if it proves unnecessary than to miss a mission-critical timeline. Proactive regions that find ways to deliver speculative industrial space in 2024 and 2025 will find themselves in a position to attract growth.

- Look for communities that prioritize partnerships. In the face of current market conditions, real estate developers are tempted to sit and wait. This makes public-private partnerships key to avoiding stagnation and spurring development. States, regions, and communities that choose to be aggressive and seek out engagement and investments with the real estate development community will separate themselves from the pack. Proactive regions that find ways to deliver speculative industrial space in 2024 and 2025 will find themselves in a position to attract growth while much of the country scrambles to recover from a period of development lethargy.

In most markets, speculative industrial development is grinding to a halt and many regions will face a severe shortage of industrial real estate in the near future. Some predict this shortage will materialize as early as 2024. As discussed here, corporate leaders must adjust strategies to ensure their companies can continue growing.

Likewise, the public sector must proactively seek out partnership with real estate developers to deliver industrial space that can facilitate the expansion of existing businesses and the attraction of new companies. These actions by business leaders, real estate developers, and public officials will have a significant impact on how successfully and efficiently the economy is able to weather the current storm and continue growing.