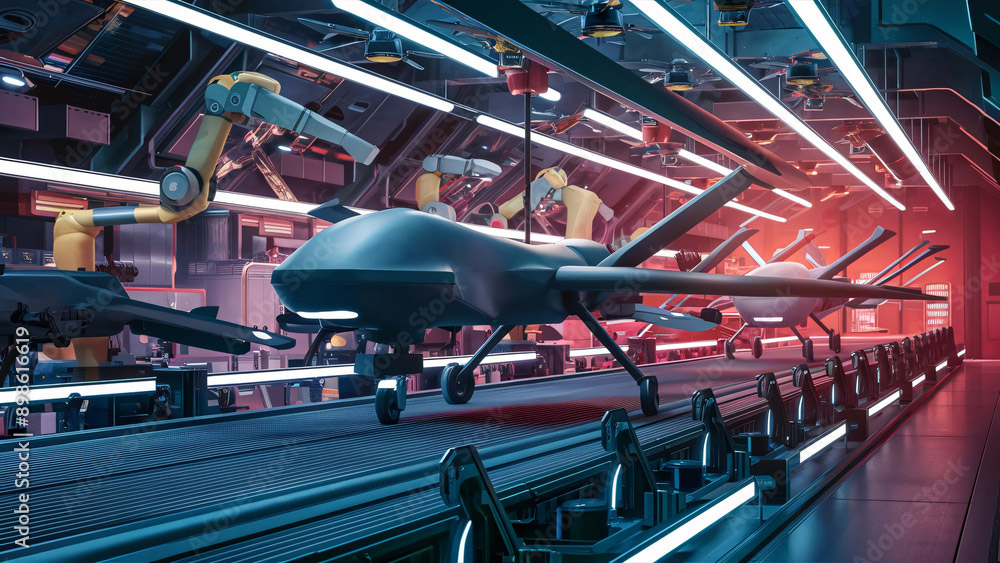

For much of the past decade, defense, aerospace, and maritime manufacturing were discussed as strategic priorities more often than they were treated as operational ones. In 2025, that changed.

Federal funding accelerated. Reshoring efforts gained urgency. Supply-chain security moved from talking point to mandate. Across the country, communities competed to position themselves as platforms for the next generation of defense production, aerospace components, and maritime infrastructure.

Yet as Area Development’s coverage made clear throughout the year, 2025 exposed a critical distinction: supporting a sector is not the same as being ready to build it .

What emerged was not a shortage of capital or intent, but a reckoning with execution — and with the uniquely unforgiving requirements of industries where timelines are rigid, margins are narrow, and failure carries national consequences.

The Return of Strategic Industry — and Strategic Risk

The resurgence of defense- and aerospace-related investment in 2025 was not accidental. Global instability, shifting alliances, and long-recognized vulnerabilities in domestic supply chains pushed production closer to home. Maritime infrastructure, long neglected, reentered the conversation as both an economic and security asset.

But unlike consumer-facing industries, these sectors offered little tolerance for improvisation . Facility design, land control, security protocols, and regulatory compliance were non-negotiable. Projects could not simply be “phased in” or value-engineered around constraints.

Industrial policy didn’t remove friction in 2025 — it exposed it.

Our reporting consistently showed that communities eager to attract these investments often underestimated the operational rigor required. Announcements moved quickly. Execution did not.

Funding Moved Faster Than Readiness

One of the clearest patterns of 2025 was the growing mismatch between federal momentum and local capacity.

Defense spending surged, but site readiness lagged . Aerospace suppliers found themselves navigating permitting processes designed for smaller, less sensitive projects. Maritime initiatives encountered aging port infrastructure and layered environmental reviews that stretched timelines well beyond expectations.

In many cases, the limiting factor was not political will or financial support, but coordination. Federal programs assumed a level of local preparedness — in land assembly, utility capacity, workforce pipelines, and environmental clearance — that often did not exist.

Industrial policy, it became clear, does not eliminate friction. It exposes it.

Workforce Clearance Became the Hidden Bottleneck

If one constraint quietly shaped outcomes across defense and aerospace in 2025, it was labor — not in volume, but in qualification.

Workforce availability wasn’t a volume problem. It was a clearance and qualification problem.

Security clearances, specialized certifications, and long training timelines narrowed the labor pool far more than headline unemployment figures suggested. Regions that appeared competitive on paper struggled to supply workers who could meet federal requirements without delay.

Our coverage revealed how often workforce assumptions collapsed under scrutiny. Training programs existed, but not at scale. Clearance pipelines were slow. Housing and transportation barriers further constrained recruitment.

Companies faced a difficult choice: wait, relocate, or redesign operations to match available talent. In many cases, expansion slowed not because demand softened, but because labor realities intervened.

Maritime Ambitions Collided With Physical Reality

Maritime development occupied a distinct but related space in 2025’s industrial resurgence. Ports, shipyards, and logistics hubs were increasingly framed as engines of economic growth and strategic resilience.

Yet here too, execution proved difficult.

Port-adjacent land was limited. Environmental permitting was complex. Infrastructure upgrades required coordination across agencies and jurisdictions. Projects that depended on synchronized investments — dredging, utilities, road and rail access — often stalled when even one element lagged.

1

What our reporting showed was a sector rediscovering its physical constraints. Maritime success depended less on branding and more on the unglamorous work of modernizing assets built for a different era.

Aerospace and Defense Suppliers Felt the Pressure First

While headline projects drew attention, it was often the supplier ecosystem that felt constraints most acutely.

Tier-two and tier-three manufacturers faced the same requirements as prime contractors, but with fewer resources to absorb delays. Power limitations , zoning challenges, and workforce gaps that might be survivable for a large firm became existential risks at smaller scales.

This dynamic reinforced a critical lesson of 2025: defense and aerospace competitiveness is ecosystem-dependent. A single facility cannot succeed if its suppliers are constrained by the same bottlenecks.

Defense and aerospace competitiveness proved to be ecosystem-dependent.

Regions that invested broadly — in utilities, training, and coordinated planning — proved more resilient than those chasing marquee wins without strengthening the underlying system.

Industrial Policy Is a Local Test

By the end of 2025, a sobering conclusion emerged from the year’s coverage: industrial policy succeeds or fails at the local level.

Federal funding can accelerate demand. National strategy can define priorities. But projects live or die based on land control, permitting capacity, infrastructure readiness, and workforce alignment — all of which are intensely local.

Defense, aerospace, and maritime manufacturing leave little room for improvisation. In 2025, they revealed which communities were prepared to execute under pressure — and which were not.

As these sectors continue to expand into 2026, the lesson is clear. Strategic industries require strategic readiness. Without it, even the strongest tailwinds cannot carry projects across the finish line.