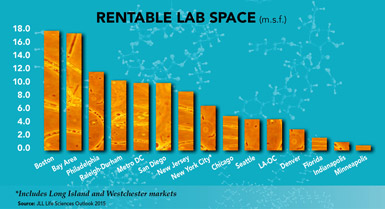

In this industry — and not just in Boston — the best locations are expensive, but worth their weighty price tags in innovation results. Beyond Boston, this year’s top five life sciences markets are Raleigh-Durham, San Francisco, San Diego, and New York City, according to JLL’s fourth annual Life Sciences Outlook Report, which ranks the U.S.’ top life sciences clusters and analyzes global industry trends.

The top five cities on the list haven’t changed much since 2014, except in order. That said, despite consistent interest in these premier markets, the playing field is anything but stagnant. To keep up with today’s fast-changing global economic trends, life sciences organizations shopping for new R&D space are taking a much more strategic approach to site selection than simply “let’s go where we’ve always gone.” Life sciences companies are looking for new locations, to breath life into their innovation and development programs. To do so, they are using data to look at possible new sites in an unbiased manner.

Familiar Locations, New Motivations: Four Trends Influencing Site Selection

Powerful forces are dominating biopharmaceutical operations and R&D location decisions today and shaping site selection priorities. Think patent cliff and the rise of generics, biologics and biosimilars, startups and M&A, globalization and talent wars.

Top Ten Life Sciences Markets

-

Greater Boston Area

Rank 1

Total Employees 82,075

# of Establishments 1,895

# of patents generated 1,879 -

Raleigh-Durham

Rank 2

Total Employees 31,984

# of Establishments 2,112

# of patents generated 259 -

San Francisco Bay Area

Rank 3

Total Employees 63,158

# of Establishments 1,514

# of patents generated 1,972 -

San Diego

Rank 4

Total Employees 63,730

# of Establishments 1,373

# of patents generated 1,134 -

New York City

Rank 5

Total Employees 14,180

# of Establishments 1,006

# of patents generated 1,713 -

Los Angeles/Orange County

Rank 6

Total Employees 117,284

# of Establishments 2,998

# of patents generated 1,651 -

Long Island

Rank 7

Total Employees 29,405

# of Establishments 535

# of patents generated 1,713 -

Minneapolis

Rank 8

Total Employees 44,016

# of Establishments 732

# of patents generated 1,408 -

Philadelphia

Rank 9

Total Employees 54,627

# of Establishments 1,578

# of patents generated 1,091 -

Seattle

Rank 10

Total Employees 23,922

# of Establishments 887

# of patents generated 500

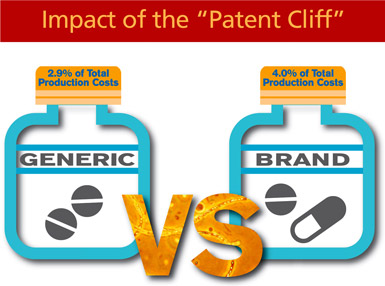

1. Balancing affordable vs. profitable products — The loss of patent protection for numerous branded medications, popularly dubbed the “patent cliff,” continues to have a major impact on product development and revenue. Generic products have quickly emerged to replace such best-selling branded drugs as Lipitor® and Plavix®. The global appetite for generics is also being driven by new policies, including the Patient Protection and Affordable Care Act in the United States, and cost concerns among national health systems.

Generic medicines are not only cheaper for consumers to buy, but cheaper to produce than branded drugs. In the United States, rents for generics R&D and production facilities comprise only 2.9 percent of the total production cost, in contrast to 4 percent of the total production cost for branded drugs. Real estate is partially responsible for this efficiency: generics companies don’t need large, highly customized laboratories or proximity to academic centers of research discovery. They require more office space than laboratory facilities, since their business focus is on manufacturing, commercialization, and marketing — not innovation and primary research.

California dominates U.S. generics manufacturing, commanding 17.9 percent of the total domestic volume. Large population centers in Texas, New York, Pennsylvania, North Carolina, and Florida are also popular generics locations.

In the face of rising demand for generics, large pharmaceutical companies are increasingly moving manufacturing to low-cost land and labor markets like China, Indonesia, and Central and Latin America. These markets also offer the opportunity to reach expanding middle-class populations with growing access to healthcare.

To fill the new-product pipeline, companies large and small are racing to create, license, or acquire new, specialized products with the patent protection that helps assure profit margins. Production of “biologics,” or biological medicines, based on mammalian cells, has become a booming sector requiring very specialized, tightly controlled facilities. The “orphan drug” sector, focused on rare diseases, is also attracting new attention.

2. Rising M&A drives consolidation at the top, creates opportunity for startups — In response to the patent cliff, big companies have rapidly consolidated to achieve greater operational efficiencies. Innovation is being driven by start-ups and mid-sized companies, and investors have flocked to promising products and companies. On the ground, these smaller companies are driving most facility development and leasing transactions in premier markets, swooping into R&D and production space vacated by the largest companies.

3. Choosing people-focused, modern laboratory design over outdated concepts — Traditionally, lab space has been all about focused, heads-down work. Today’s young scientists — millennials fresh out of the nation’s leading research institutions — are more productive when they have the opportunity to engage and collaborate, as well as work solo at the still-essential lab bench. Laboratory layouts are evolving to reflect this collaborative, people-focused approach while incorporating state-of-the-art equipment.

4. Investing in talent — Since high-level researchers are most likely to make high-impact discoveries, the top U.S. life sciences clusters have generally emerged around elite universities. Rising wages reflect this priority. Between 2011 and 2014, annual wages for life sciences Ph.Ds. in the United States jumped 6 percent, from an average of roughly $66,000 to just over $70,000.

Talent, Infrastructure, and Modern Space Mark the Spot

Despite the onslaught of low-cost generic products, the life sciences industry is growing in terms of company values and product sales. According to a Deloitte study, the net present value of the life sciences sector jumped 46 percent between 2012 and 2013. That growth continues, but not without high-priced laboratories. Consider the three top U.S. life sciences markets:

Boston: Establishment has its perks. Access to elite research institutions, established R&D infrastructure, and the largest concentration of life science researchers in the world plays a huge role in Boston’s appeal. Boston-generated life sciences innovations secured 1,879 patents in 2014, which explains the market’s premium rents. Rents for laboratory space have soared to a whopping $47.40 per square foot, almost double the national average of $24.30 for laboratory space.

Raleigh-Durham: Startups shake up innovation-as-usual. Ousting San Francisco for the number-two spot this year, the hot Raleigh-Durham market boasts a vibrant life sciences startup sector emerging from the region’s renowned research institutions and the local operations of global biotech companies.

San Francisco: A patent parade occurs through modern lab space. Northern California’s Bay Area leads the nation in life sciences patents, with 1,972 approved just last year. Innovation-friendly laboratory space is in high demand, with a focus on flexible workspace that includes open areas for collaboration, and amenities to improve quality of life for employees.

What do all of these markets have in common? Flexible, modern research facilities that attract top professionals, foster collaboration, and can accommodate cutting-edge research and production.

Feeling the Squeeze: Too Many Scientists, Too Little Elbow Room

Talent, state-of-the-art laboratory space, and life sciences infrastructure are the perks of the key markets, but that doesn’t mean there’s enough room for everyone. Across the country, rising rents reflect a growing shortage of high-quality laboratory space. Average rents for laboratory space rose by only 3 percent in the last year nationally — but skyrocketed in the top-tier markets: 16.9 percent in San Francisco, 15.5 in San Diego, and 12.4 in Raleigh-Durham. Los Angeles is seeing occupancy rates around 100 percent. With capacity stretched in premier areas, companies are shifting their attention beyond the premium sites in the top-tier markets. While cities without a well-established life sciences field may lack the deep and longstanding life sciences infrastructure of Boston or San Francisco, they provide access to major research institutions without the sky-high real estate costs — leaving more budget on the table for talent investment.

For most companies, site selection is a balancing act. Take Cambridge, Massachusetts, vs. Bothell, Washington, for example. The Boston submarket is clearly rich with academic star power, but Bothell has access to the strong talent pool in nearby Seattle, an emerging life sciences cluster ranked tenth on JLL’s list. The price tag says it all: The going rate for lab space in Cambridge is a blistering $51.60 per square foot. In Bothell? Only $19 per square foot.

Where Will the Market Grow?

While established markets are still the crowd favorite in life sciences, forward-looking site selection is more complicated than rents and vacancy trends alone. The smart companies are on the hunt for the right combination of two not-so-secret ingredients: access to talent and great space for cutting-edge research.