Proximity to market is especially important when considering sites for new distribution warehousing and fulfillment center operations. Keep in mind, however, that “proximity” is a relative term.

“Twenty years ago, proximity to major markets usually meant a one- or two-day transit from the warehouse or plant to the final customer,” says John Boyd, site consultant and principal with The Boyd Company in Princeton, N.J. “Today, however, due to the rise of e-commerce and omni-channel retailing, coupled with Amazon’s quest for same-day delivery, the term ‘proximity to major markets’ takes on a whole new meaning and underscores the importance of speed-to-market in today’s instant-gratification economy.”

For businesses serving international customers, proximity to major markets often translates into proximity to major U.S. deepwater ports. The recently expanded Panama Canal is already affecting port-proximate site selection planning. “Container shipments are projected to increase tremendously at U.S. East Coast ports over the next several years, creating port-proximate inland distribution enclaves in cities situated within a few hour’s truck drayage of deepwater port terminals like Miami, Savannah, Charleston, Norfolk, Baltimore, Newark/Elizabeth, Boston, and eastern Canadian cities served by the St. Lawrence Seaway,” Boyd adds.

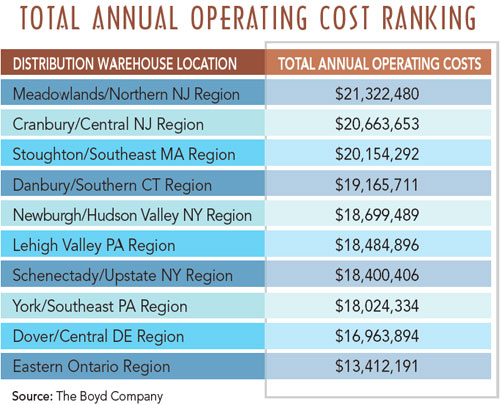

Operating Cost Ranking

Operating costs can vary drastically among sites that contend for proximity-to-market status.

The accompanying charts shows an overall cost ranking of 10 surveyed distribution locations prepared by The Boyd Company — all locations show superior access to major buying power concentrations within the rich Northeast U.S. and Eastern Canadian consumer market. Annual costs are based on a 500,000-square-foot distribution center employing 250 workers.

Due to the rise of e-commerce and omni-channel retailing, coupled with Amazon’s quest for same-day delivery, the term ‘proximity to major markets’ takes on a whole new meaning and underscores the importance of speed-to-market in today’s instant-gratification economy. John Boyd, site consultant and principal, Boyd Company Last-Mile Delivery

Probably the most dynamic link in the supply chain dealing with market proximity is “last mile” — that movement of goods from a distribution center to the final destination in the home.

“Amazon has done much to challenge and rewrite the rules of last-mile delivery,” notes Boyd. “Today, proximity to major markets and speed of delivery are trumping many of the more conventional site selection drivers related to taxes, labor, and real estate costs. Witness the surge of new fulfillment centers being constructed by Amazon in market-rich states like California and New Jersey, despite their high costs and challenging business climates.”

Last-mile delivery has also produced a new “residence-proximate” warehousing subsector: the locker. Studies show that online shoppers not only want their packages immediately, but they also want them delivered to places other than their homes.

“Lockers are already common in densely populated and highly urbanized Europe,” says Boyd. “We anticipate lockers will become a growth sector within the retail site selection field over the next few years. Amazon already has automated lockers in major markets in six states.”