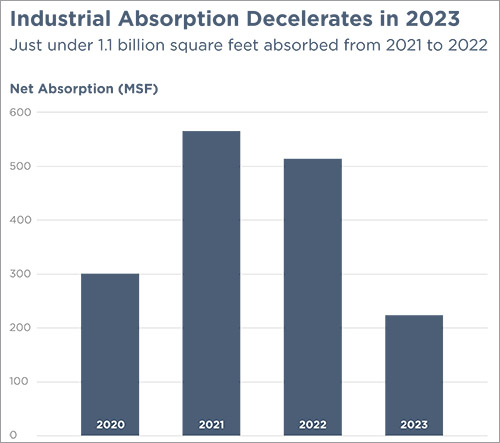

Changes are coming for absorption as driven by demand. Coming off frenetic years in 2021 and 2022, industrial net absorption downshifted in 2023. For context, in 2021 and 2022 combined, the market absorbed just under 1.1 billion square feet, which is about twice the norm — meaning that four years’ worth of demand occurred in just a two-year timeframe. We estimate that roughly half of this demand came from pull-forward impacts, as companies — namely those tied to online shopping — had to build out facilities networks sooner than planned.

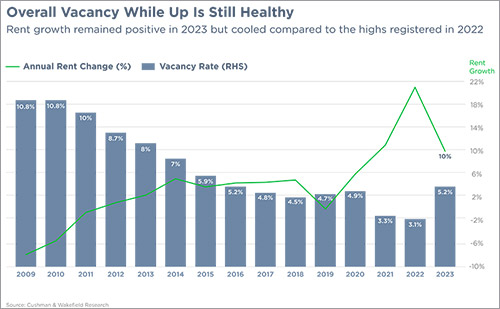

The flip side of this surge is that it “borrowed” demand from the future, which is one reason why we expected demand to moderate meaningfully this year and next. We’re forecasting vacancy to continue to edge higher in 2024, especially in the first half of the year. However, context matters. Cushman & Wakefield has been tracking industrial data going back to 1995, and from 1995 to 2019, the U.S. industrial vacancy rate averaged 8 percent. The industrial boom that we observed over the last few years brought vacancy down to 2.8 percent in Q2 2022, which is more than twice as tight as the market had ever been. Now, we’re observing the inverse effect as demand slows.

Coming off frenetic years in 2021 and 2022, industrial net absorption downshifted in 2023. Downward trends in goods consumption will also lessen the pace at which occupiers scale moving forward. While real incomes are now rising, consumers also face higher interest rates, a labor market in the early stages of softening, and an affordability crunch across the largest household budget line items. Given these formidable headwinds that will ultimately translate into weaker demand for goods, global trade flows will slow, and freight markets will remain oversupplied in the near-term.

Downward trends in goods consumption will also lessen the pace at which occupiers scale moving forward. There is a finite window of about 18 months in which occupiers may find a slightly easier market to navigate, but that will quickly fade in 2025 as vacancy begins to recompress. As we head to the second half of the decade, we forecast demand to return to its pre-pandemic pace (around 275 to 300 msf per year), while completions start to ramp back up. The current supply-demand imbalance will reverse, and vacancy will return to sub-5 percent.

Vacancy is our single most important predictor of where rent growth will head. Gearing down from just under 21 percent year-over-year (YOY) growth in 2022, we finished 2023 with rent growth at 10 percent YOY, and we expect that to be followed by approximately 4 percent in 2024.

Overall, expect absorption to moderate but remain positive, vacancy to rise but remain below long-term historical averages, and rents to tick higher — albeit at a slower rate. These are the signs of a normalizing market.