Higher Borrowing and Construction Costs Impacting Industrial Users

As interest rates rise, industrial developers are prepping for a ramp-down of new projects.

Q4 2022

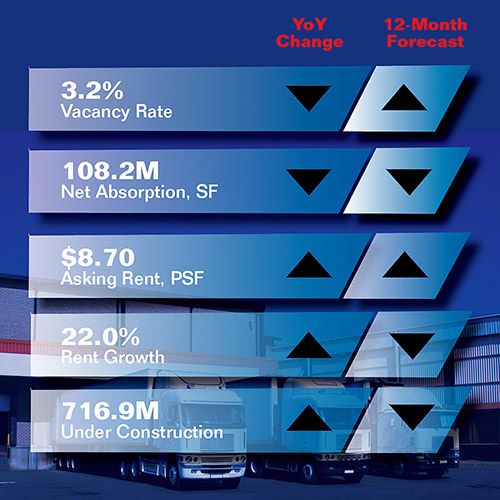

Although owners are erring on the side of caution, the industrial construction pipeline remains at record levels, reaching an all-time high of 716.9 million square feet, according to a recent report by Cushman & Wakefield. Despite this, current low vacancy rates (3 percent +/- in most markets) and limited space availability are compounding to make the leasing environment less than ideal for industrial tenants. While developers are right to be careful to avoid overextending their pipelines in an evolving environment, the wait-and-see approach could aggravate an already tight market for industrial users that are looking to expand their existing portfolio of space and locate in emerging industrial hubs.

Shifts in consumer demand have prompted many retailers and third-party logistics providers to improve supply chain processes by leasing additional warehouse facilities to store more goods and to develop more efficient operations. However, they’re finding higher rents and fewer space options that meet their specific needs are limiting their choices. It’s a challenging environment on both sides of the equation, with industrial developers ramping down on activity in the face of an expected recession and industrial users trying to navigate supply chain complications and consumer demand that may change with a slowing economy.

Vacancy Rates Trigger Higher Rents

With vacancy rates remaining at historically low levels — which are holding steady at around 3 percent, substantially below the five-year historical average of 4.7 percent as reported by Cushman and Wakefield — rental rates will remain elevated as demand for space surges and supply remains tight.

Current low vacancy rates and limited space availability are compounding to make the leasing environment less than ideal for industrial tenants. In Atlanta, where growth is being fueled by strong market fundamentals including significant population jumps in the metro area and transportation accessibility along three interstates (I-75, I-85, and I-20), average rental rates are up 33 percent year-over-year, marking the first time in history asking rents have tallied above $6. Even so, leasing activity remains robust, with more than 70 percent of speculative facilities delivered in the first half of the year being claimed by an expanding mix of 3PL providers, manufacturers, and retailers.

As interest rates continue to climb and construction costs swell, rental rates will continue to make headlines, as developers try to stabilize their returns to make projects pencil. While most developers aren’t slamming on the brakes given the strong market fundamentals, the threat of fewer starts will also drive upward pressure on rents, at least in the short-term.

The market continues to see strong demand for one-million-square-foot or larger facilities. The Rise of the One-Million-Square-Foot Facility

The market continues to see strong demand for one-million-square-foot or larger facilities. To put this size footprint in perspective, 20 football fields (50 yards wide by 100 yards long) could fit inside one of these buildings. They are massive facilities. Much of this demand for large boxes is being powered by traditional retailers, e-commerce, and 3PL tenants, which are increasingly requiring more space to keep up with demand.

In Q1 2022, the market saw a record 37 warehouse transactions of one million square feet or more, up from 24 year-over-year, according to a CBRE report. While these large facilities will continue to be developed, there will also continue to be demand for all size increments, and industrial developers should focus on building-size niches that aren’t being provided. Industrial users may find limited choices for smaller-size increments and should be mindful of this when planning their future space needs.

Rising interest rates and volatile construction costs will surely affect the pace, size, and supply of industrial facilities for the near term. Build-to-Suits Are Challenging

Tenants looking for specialized industrial buildings (build-to-suits) that address their unique needs may be hard pressed in this environment to find a developer to accommodate their request. Build-to-suits, by their specialized nature, take longer to plan and execute. In a rising interest rate and construction cost environment, it is very difficult to lock in final pricing and deal terms that both developer and tenant can agree on. There is just too much economic risk to absorb for most build-to-suits to make sense.

Further complicating the issue is the aging warehouse stock in the country, with the average age around 40 years old. Many users need more modern warehouse facilities with higher ceilings, larger truck courts, and added parking for vehicles and trailers. As a result, industrial developers are focusing on speculative facilities (buildings that do not have a signed tenant when construction begins) that can be brought to market more quickly. Cushman & Wakefield reports that speculative warehouses made up 70.3 percent of facilities that came to market as of Q3 2022. But with the market for build-to-suits so challenging, plans for these advanced facilities are hindered.

Although certain construction materials are beginning to stabilize, such as the price of steel and lumber, the rising interest rate environment and looming recession are causing more industrial developers to be less aggressive in this current climate. We can anticipate continued, yet fewer starts as development pipelines are recalibrated to address these cost challenges. While the full impact on tenants remains to be seen, rising interest rates and volatile construction costs will surely affect the pace, size, and supply of industrial facilities for the near term.

Project Announcements

Germany-Based KettenWulf Plans Auburn, Alabama, Production Operations

01/28/2026

Frontieras North America Plans Mason County, West Virginia, Operations

01/28/2026

North Wind Plans Rosemount, Minnesota, Research Operations

01/27/2026

DSV Global Transport and Logistics Plans Mesa, Arizona, Headquarters Operations

01/24/2026

Poland-Based JGB Brothers Plans Bamberg County, South Carolina, Production Operations

01/23/2026

Electric Research and Manufacturing Cooperative Plans Waddell, Arizona, Transformer Production Operations

01/23/2026

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025