POPULATION: 9,992,727 (2014)

LABOR FORCE: 4,808,017 (July, 2014)

RIGHT TO WORK: Yes

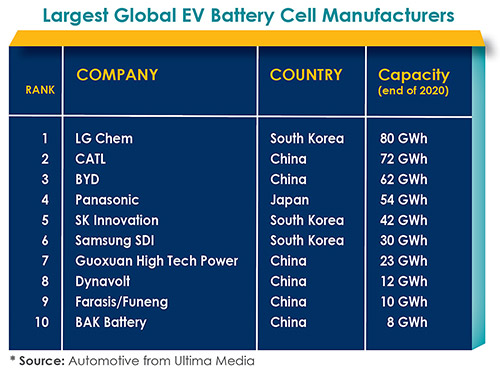

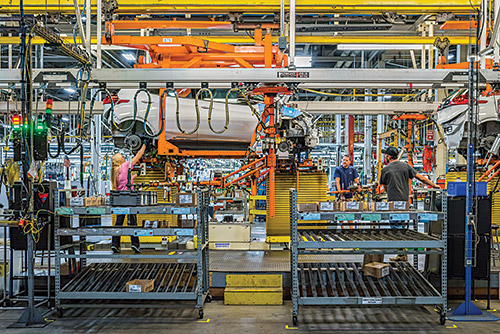

INDUSTRIES: Life sciences, advanced automotive technologies, advanced battery/electric vehicle mfg./development, homeland security/defense, LED (light emitting diode) lamps, alternative energy technologies, auto related R&D, advanced materials, telematics, tourism, agriculture, information technologies, micro- and nanotechnology, pharmaceuticals, medical devices, instrumentation and diagnostics, research and ancillary services

COLLEGE GRADUATES: (Age 25 and over) 25.3% (2014)

BASIC BUSINESS TAXES:

Corporate Income Tax: Michigan levies a flat 6% corporate income tax on firms structured as C corporations. Income for other business entities flows through to the owners' personal income taxes and is taxed at a flat personal income tax rate of 4.25%.

Sales and Use Tax: 6 percent; no local sales tax allowed; exemptions allowed for purchase of manufacturing equipment, energy used directly in manufacturing and pollution-control equipment.

Property Tax: Both real and personal property are assessed at 50% of current true cash value. Both real and personal property are assessed at 50% of current true cash value. The millage rate will depend on the taxing jurisdiction of the business site. Michigan's average non-homestead property tax rate was 49.20 mills, or $49.20 per $1,000, of assessed property. Commercial personal property is exempt from 12 mills. Available property tax abatements are negotiated locally. There is a 100% new personal property exemption available in specified communities. Also, 50% abatements for up to 12 years for real property are available to industrial processors and 50% abatements for up to 12 years for real and personal property for high tech companies. Rehabilitation projects can be abated 100%. As of August 5, 2014, Michigan began phasing out its Personal Property Tax (PPT) for qualifying personal property. More specifically, the term refers to all personal property located on real property where that personal property is used more than 50% of the time in industrial processes or in supporting industrial processes.

BUSINESS INCENTIVES:

Grants for business growth

Grants for downtown real estate redevelopment

Grants for downtown blight removal or public infrastructure expansion

Grants for small business development

Grants for technology R&D and commercialization

Loans for site assembly

Loans for business growth (senior debt, mezzanine debt)

Venture capital (angel, pre-seed, Series A+)

Tax abatement for real property development

Procurement assistance (defense contracts, federal contracts, business to business, first customer)

Site location and development assistance

Skills development

Administrative support for small businesses (pro-bono accounting, legal, HR and other services)

Business consulting

Export assistance

Employment matching (identifying and filling job openings)

Film and digital media incentives