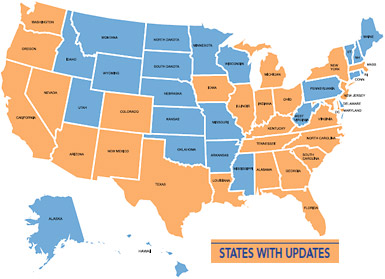

U.S. Legislative, Incentives, & Economic Development Policies Update

Growing companies need to be aware of the many changes states are making to their incentives policies.

Q1 2016

Alabama

Alabama passed the “Made in Alabama” incentives platform to attract companies investing and creating jobs in the state. The new incentives allow companies to offset certain taxes as they add jobs and build or expand in Alabama. The new “pay-as-you-go” approach is preferable to the state, which has had to take on debt in the past to pay for incentives. The new legislation provides for tax credit carry-forward provisions that are new to the state.

Arizona

Despite significant cuts from economic development programs, Arizona officials have utilized remaining funds for the successful Job Training Program to provide companies important resources for their new hires and incumbent employees.

California

Legislation passed the Senate to allow small businesses to convert a portion of R&D tax credits into cash grants. The law would allow up to 10 percent of the unused tax credit in 2015 and 2016 to be converted into grants in 2017. Up to 15 percent of the credits issued between 2017 and 2022 would be eligible to be converted into cash grants. However, Governor Jerry Brown ultimately vetoed the bill. The governor did sign another bill to allow cities to create local community improvement-focused property tax increment financing.

The California Tax Incentive Program for Renewable Technology Businesses reached its $100 million annual cap. The California Alternative Energy and Advanced Transportation Financing Authority may seek an increase to the annual cap on the incentive program.

Colorado

Governor John Hickenlooper signed legislation that would qualify companies for the Job Growth Credit if they partner with colleges and universities in the state. They would only need to create five jobs, meet the average county salary, and retain the jobs for one year. Another bill would qualify renewable energy projects to waive 20 percent of the enterprise zone investment tax credit value and instead get a refund of the remaining 80 percent.

Florida

Florida Department of Revenue extended the Community Contribution Tax Credit to June 2018 for sales and use tax and corporate income tax. The state has also elected to sunset the Enterprise Zone Incentive Program at the end of the calendar year. This ends a 33-year program that provided, as of this past budget year, $16 million in tax credits to a network of 65 zones statewide.

Governor Rick Scott has set a goal of $1 billion in tax cuts and a $250 million investment in a new Florida Enterprise Fund. His reductions would come primarily from eliminating income taxes for manufacturing and retail businesses. He also proposes permanently extending a sales tax exemption on manufacturing machinery and equipment valued at $76.9 million.

Georgia

Georgia’s Film Tax Credit has been extended to taxable years beginning on or after January 1, 2019. The aggregate amount of credits available for qualified interactive entertainment production companies must not exceed $12.5 million for each taxable year.

The Georgia Department of Revenue has added Historic Rehabilitation Tax Credits of 25 percent on certified rehabilitations expenditures completed on or after January 1, 2017. The program will also have an additional 5 percent if the historic home is located in target areas.

Illinois

Governor Bruce Rauner announced the immediate suspension of all future business attraction and retention incentives, the deferring of Film Tax Credit and high impact business designation approvals, and other administrative measures to cut spending as a result of the state’s nearly $4 billion budget deficit for fiscal 2016. An Illinois senator filed the legislation that would end the EDGE Credit Program until the budget is passed.

Indiana

Indiana started the Regional Cities Initiative in which the state partners with regions to develop economic development plans to attract investment and talents. In addition, a new act established a fund that’s authorized by the Indiana Economic Development Corporation to spend $84 million on competitive proposals from the applying regions throughout Indiana. The program is intended to fast track bold projects that improve quality of life, make regions more dynamic, and attract an evolving workforce.

Iowa

Governor Terry Branstad approved an expansion of the Solar Energy Tax Credit and expanded the per project cap to $5 million per year from $4.5 million but reduced the credit from 60 percent to 50 percent starting January 1, 2016. He also signed into law a 10-year property tax exemption for high-speed broadband infrastructure projects once approved by a local assessor.

Kentucky

The Kentucky Economic Development Office announced that it is accepting 2016 qualified investment applications for Angel Investment Tax Credits. Applicants must apply prior to making an investment and the Kentucky Economic Development Finance Authority must approve each application before credits are issued. The program will offer a maximum $3 million in tax credits limited to $200,000 per investor annually.

Louisiana

Louisiana has a new law limiting the Motion Picture Investment Tax Credit to $180 million for years 2016 to 2018, and includes a project cap of $30 million but lowers the investment requirement from $300,000 to $50,000.

Another law will lower the sales tax credit on thermal energy systems to the lesser of $2 per kilowatt, 50 percent of the cost, or $10,000 per system.

The state also extended the expiration date of the Angel Investor Tax Credit by two years to end on July 1, 2017.

Maryland

Governor Larry Hogan announced the reorganization of the Department of Business and Economic Development to be named the Department of Commerce. The new agency oversees several agencies, including Labor, Licensing and Regulation, Transportation, Environment, Planning, and Housing and Community Development. The Baltimore City Council’s tax committee approved legislation that would create an 80 percent tax credit against taxes applied to building materials. It caters mainly to supermarkets offering a full range of fresh meat, dairy products, fruits, and vegetables to impoverished areas of the city without such stores.

Massachusetts

Governor Charlie Baker legislated an increase to the Earned Income Tax Credit in the state and maintained the FAS-109 Deduction. They were both eliminated in the state’s fiscal year 2016 budget. Members of the Senate proposed a few changes to the budget. Some of the changes are an increase to the R&D Credit, the Historic Rehabilitation Tax Credit, and the Conservation Land Tax Credit.

Michigan

Michigan lawmakers have signed legislation to stop issuing any new film tax credits or extending existing credits in the state. This change in policy was driven by a disappointment in the economic impact generated from the estimated $475 million spent on the program over the last eight years.

Michigan signed into law a sales tax exemption for data center equipment sold to an operator of a qualified data center or a co-located business.

Nevada

Nevada has implemented a new law that allows a partial abatement of personal property and sales taxes of data center projects that expand or locate in the state. Depending on the investment, the abatement could extend to 20 years.

Another bill signed into law qualifies aircraft businesses for sales tax abatements if they have five or more employees and increase their employment by three jobs or 3 percent, whichever is greater. The state also passed an expansion of Nevada’s Film Tax Credit program that removes the $10 million per project cap.

New Jersey

The state considered proposed legislation that would offer businesses that operate within five designated areas with electric grid congestion issues a 15 percent incentive to install a solar system, and $1.50 per watt of energy produced by that system.

New Jersey also announced a bill that would limit tax incentives to be awarded to companies that defaulted on previous incentives.

New Mexico

Governor Susana Martinez signed a new law with several economic development provisions. The law restores a tax deduction for trade companies that locate within 20 miles of the U.S./Mexico border. It also expands the Angel Investment Credit to $2 million and removes certain requirements such as type and number of investments. The new legislation changes the Technology Jobs Tax Credit to Technology Jobs and Research and Development Tax Credit.

Governor Martinez has also unveiled a new state energy plan that calls for promoting New Mexico as a hub for renewable energy.

New York

Governor Andrew Cuomo announced the designation of 11 new Brownfield Opportunity Areas (BOAs) in New York State.

North Carolina

North Carolina Governor Pat McCrory signed into law the NC Competes Act. This legislation completes an extended debate in the state regarding public incentives and sets a path going forward to attracting businesses and creating jobs.

Ohio

Ohio introduced a bill to propose changes to the Job Creation Tax Credit (JCTC) and the Job Retention Tax Credit (JRTC). The bill will change the credit to be payroll-based, which will be calculated over a particular year. The change makes the credit subject to decrease and increase depending on employees’ salary. In addition, a clawback is added that could allow 100 percent return of the credit if the investment and job requirements are not met. The state also announced a bill that would limit tax incentives to be awarded to companies that defaulted on previous incentives.

Oregon

Governor Kate Brown signed an omnibus bill extending several tax credits while prohibiting credits from being used to offset the state’s corporate minimum tax. The bill imposes a six-year suspension on the use of tax credits to satisfy the minimum tax liability. The new bill doesn’t include a waiver or abatement of any interest on the consequent underpayment of estimated tax. Tax credits may again be used to satisfy the minimum tax liability for tax years beginning on or after January 1, 2021.

On July 1, 2015, the Jobs Development Act was discontinued, but companies qualified prior to that date would receive their reductions. The maximum tax credit under the program will be 20 percent of a project’s cost, although —under certain circumstances — an applicant can be eligible for an additional tax credit of up to 10 percent of the project cost. The maximum credit will be $15 million per project.

South Carolina

The Department of Revenue issued a letter that requires applications submitted for investments made in future years to be made by December 31st of the year the investment is made. Applications received after the deadline will not be considered.

Tennessee

Senator Jack Johnson proposed new legislation to stop local governments from sanctioning any charter provision, ordinance, resolution, referendum or regulation on companies that requires them to employ workers who reside within their jurisdiction.

Texas

During the biannual state legislative session, the Texas Moving Image Industry Incentive Program budget was cut by almost two thirds, which is more than $60 million with the program changes taking place starting September 1, 2015. This includes cuts to the popular Texas Enterprise Fund (TEF), as included in the H&A Spring Report.

Virginia

Governor Terry McAuliffe proposed a new R&D Tax Credit with an annual cap of $15 million. The credit is created to benefit companies with more than $5 million in annual research spending. He also proposed a $4 million increase in the cap on Virginia’s Angel Investor Tax Credit, from $5 million to $9 million.

Washington

A new law has been introduced that extends property tax exemption for new construction projects in targeted urban areas.

The state’s Department of Revenue announced an extension to the Commute Trip Reduction Tax Credit Program to be available until July 1, 2024 and increased the cap to $2.75 million.

Project Announcements

Kikkoman Foods Plans Jefferson, Wisconsin, Operations

04/26/2024

BWX Technologies Expands Cambridge, Ontario, Nuclear Production Operations

04/26/2024

Greenheck Group Plans Knoxville, Tennessee, Operations

04/26/2024

Local Bounti Plans Pasco, Washington, Indoor Agricultural Operations

04/26/2024

Innovative Construction Group Plans Siler City, North Carolina, Production Operations

04/26/2024

Crystal Window and Door Systems Plans Mansfield, Texas, Headquarters-Production Operations

04/25/2024

Most Read

-

2023's Leading Metro Locations: Hotspots of Economic Growth

Q4 2023

-

2023 Top States for Doing Business Meet the Needs of Site Selectors

Q3 2023

-

38th Annual Corporate Survey: Are Unrealized Predictions of an Economic Slump Leading Small to Mid-Size Companies to Put Off Expansion Plans?

Q1 2024

-

Making Hybrid More Human in 2024

Q1 2024

-

Manufacturing Momentum Is Building

Q1 2024

-

20th Annual Consultants Survey: Clients Prioritize Access to Skilled Labor, Responsive State & Local Government

Q1 2024

-

Public-Private Partnerships Incentivize Industrial Development

Q1 2024