Expensive and competitive real estate markets are making life sciences companies look carefully when evaluating their real estate options. For the most highly sought-after locations, fierce competition for space and talent is leading to both new development and creative renovations of first-generation space.

But not every need for life sciences space can be met in the more established and larger clusters such as Greater Boston, San Francisco’s Bay Area, and Raleigh-Durham. As these markets experience a scarcity of laboratory and other life sciences real estate, tenants seeking options are discovering second-tier markets such as Seattle, Denver, and Chicago. These cities are seeing an uptick in leasing activities, attracting brand-name tenants from other markets as life sciences companies look for viable alternatives to the “all full at the inn” traditional hubs.

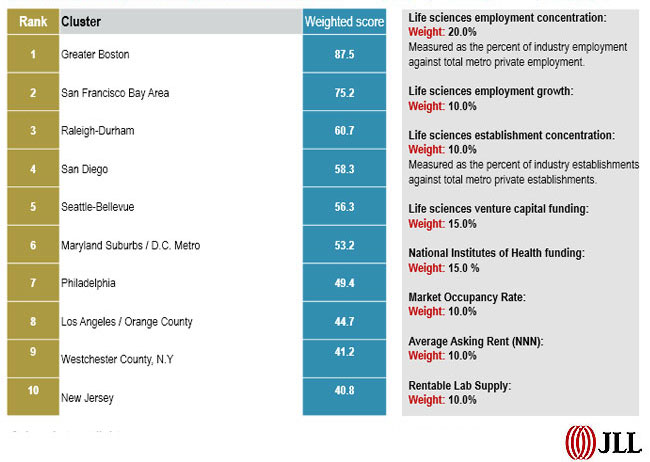

The cities most rich in resources for life sciences companies, and the right industry talent, find themselves in the top-10 U.S. life sciences clusters in 2016. Shaping this list is a complex web of macroeconomic and industry trends including global consolidation through acquisitions and strategic divestment, the influx of institutional capital, new development and innovative real estate use, and adaptive re-use. These themes, along with the obstacles of high cost and the shortage of available laboratory space, weigh heavily into real estate decisions and fundamentally impact growth and success.

2016 U.S. Life Sciences Outlook

-

U.S. life sciences cluster rankings

-

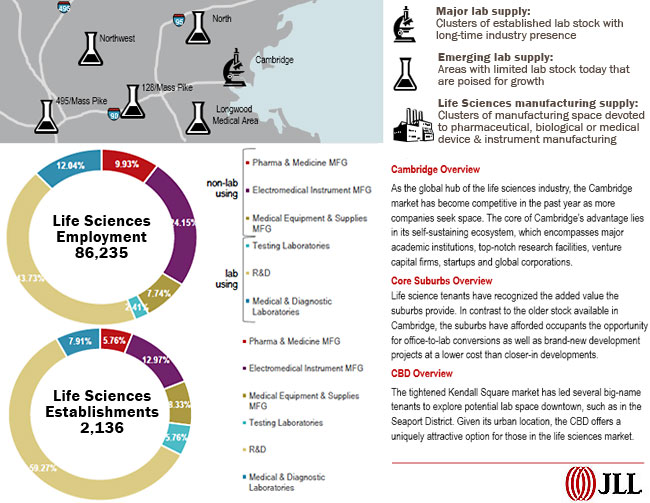

Greater Boston (Cluster Score: 87.5)

-

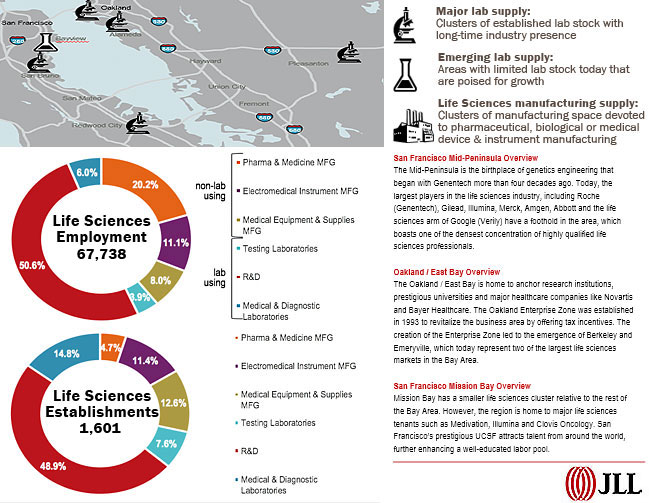

San Francisco (Cluster Score: 75.2)

-

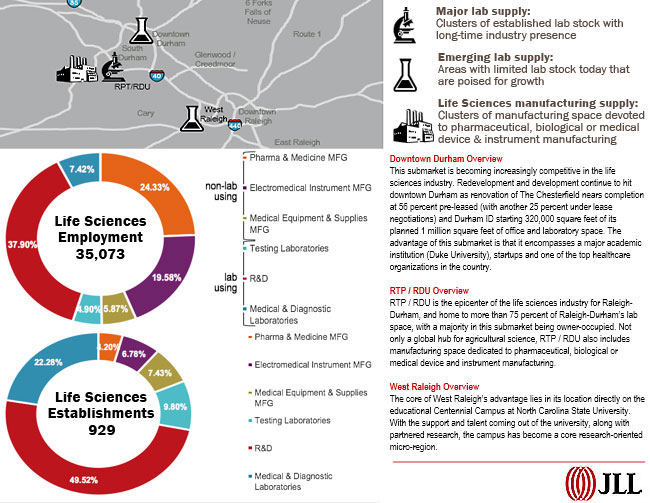

Raleigh – Durham, N.C. (Cluster Score: 60.7)

-

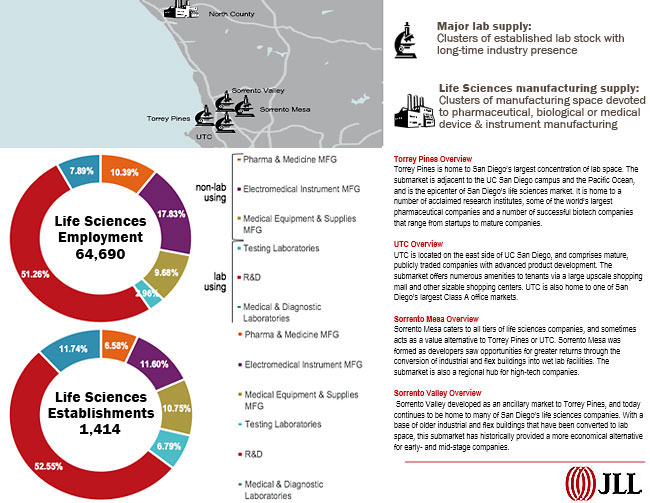

San Diego (Cluster Score: 58.3)

-

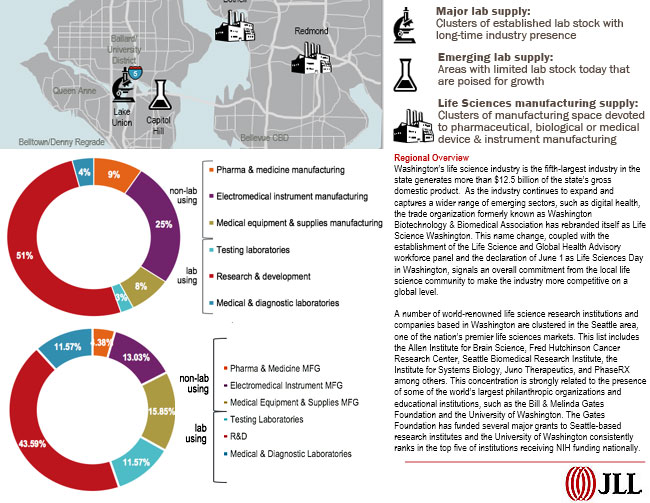

Seattle – Bellevue (Cluster Score: 56.3)

-

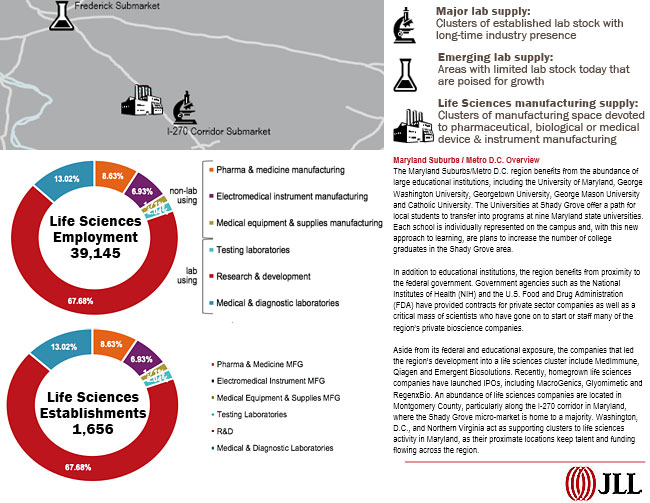

Maryland Suburbs/ D.C. Metro (Cluster Score: 53.2)

-

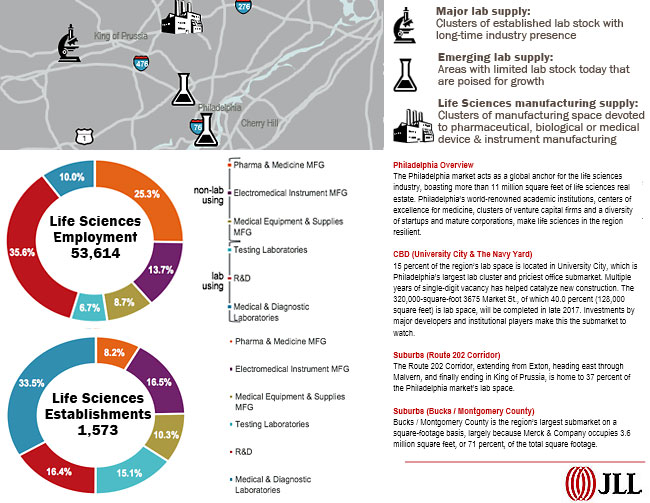

Philadelphia (Cluster Score: 49.4)

-

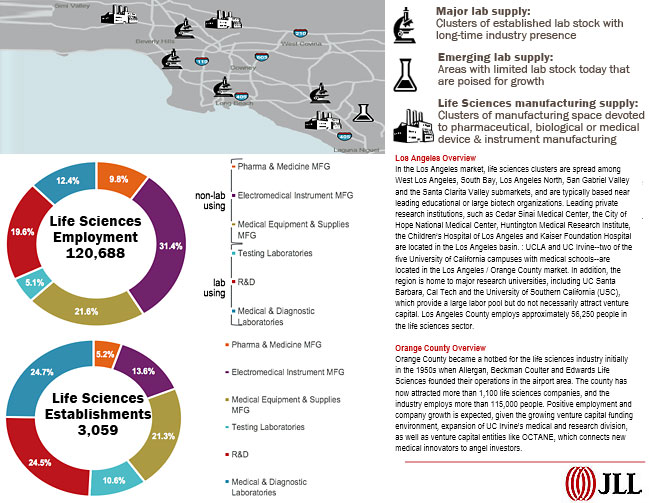

Los Angeles / Orange County (Cluster Score: 44.7)

-

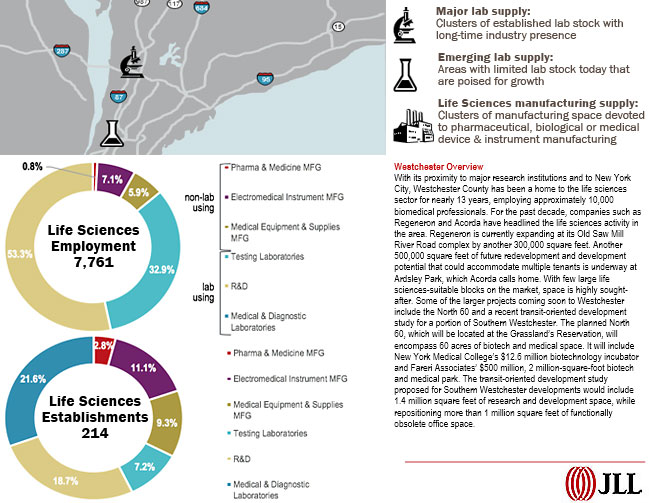

Westchester County (Cluster Score: 41.2)

-

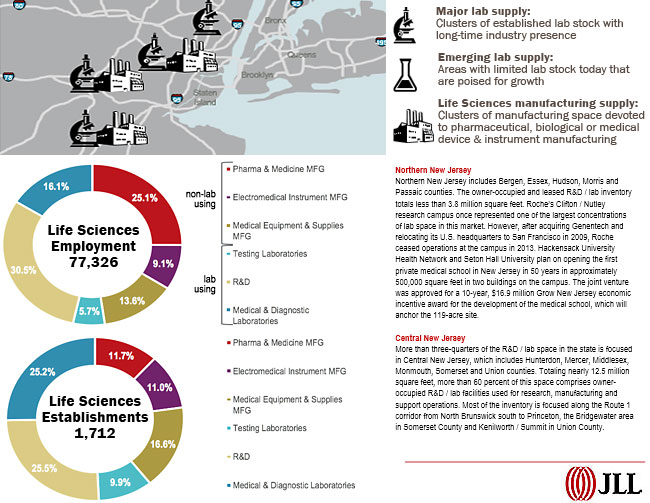

New Jersey (Cluster Score: 40.8)

Many cities are making a push to increase the presence of real-life sciences companies in their markets; life sciences companies are known for bringing high-quality jobs and economic development investment into communities. For those communities seeking that economic boost, the following trends will shape life sciences company location decision-making in 2017:

- Life sciences tenants will continue to seek out affordable options in top clusters, resulting in the emergence of secondary submarkets within primary clusters where a moderate number of space options and development opportunities still remain.

- Continued acquisition and consolidation will offer opportunities for small- and mid-sized firms to secure space in tightening primary clusters.

- Business swaps will result in an increase in vacant space in secondary markets and lead to the renovation of older space to meet the needs of tenants.

- Advances in medicine and global demographic trends point to an overall expansion of the life sciences industry.

- Second-tier clusters will exhibit more interest from developers as institutional capital floods top markets, leading more established companies to entertain the cost-savings benefits of rising markets.