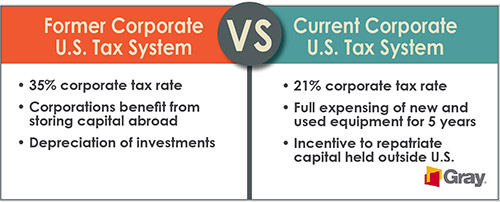

Fortunately, the landscape has changed with Congress passing, and President Trump signing, the Tax Cuts and Jobs Act. Some key provisions of this bill include:

- Federal corporate income tax rate of 21 percent, effective Jan. 1, 2018

- Reduced income tax rate on pass-through business entities’ qualifying business income

- No corporate alternative minimum tax

- Territorial tax system

- Full expensing of new and used equipment for five years

- Encouragement of repatriation of cash held outside the U.S. through a 15.5 percent tax rate

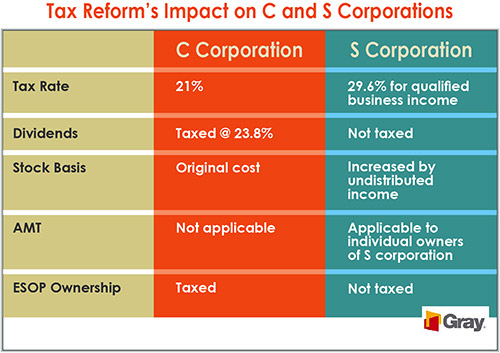

For pass-through entities such as S corporations, LLCs, and partnerships, the Tax Cuts and Jobs Act establishes a 20 percent exclusion of qualified business income, subject to certain caps, from an individual’s taxable income, providing a reduction of up to 10 percentage points in the highest effective rate in many cases.

The new law also permits immediate expensing of the cost of “qualified property” — whether new or used — acquired and placed in service after Sept. 27, 2017 and before Jan. 1, 2023. For example, a manufacturing company that purchases new machinery would be able to immediately write off its cost, and then further benefit from the lower 21 percent federal tax rate on profits earned from products generated by that equipment.

In short, businesses will now have more incentive to expand in the U.S. as well as provide employees with better equipment and training, in turn leading to increased competitive performance on the global economic stage. For capital-intensive businesses such as manufacturers, it is vital to retain as much cash in the business as possible to help fund the cost of facilities and associated machinery and equipment.

An Idea Whose Time Has Come

Like all legislation, the new tax law is not perfect. However, it is clear that comprehensive tax reform is good for skills, wages, and jobs, all of which feed into a strong economy. The recommendation from the National Association of Manufacturers (NAM) for the government to conduct a study every three years to examine how the U.S. tax code compares to the tax codes of other countries is an excellent idea — as opposed to waiting another 30 years to revisit this topic.

In 2015, Clemens Food Group broke ground on a 650,000-square-foot fresh pork processing facility in Coldwater, Michigan, in response to growing demand for its products. Upon becoming operational in 2017, the highly automated, state-of-the-art facility has been able to double its fresh pork business.

Doug Clemens, president and CEO of Clemens Food Group, points out that the company would have invested another $30 million two years ago to put in a second production line, if immediate expensing had been an option. “As a 122-year-old privately held company, capital expenditures are extremely important to us,” he said. “We need to have as quick a return as possible.”

For Clemens Food Group, Gray Construction’s fresh pork processing customer, this would have created at least 25 percent more jobs. From Gray’s perspective, construction workers would have increased by 15 percent. Moving forward, in our case, the new tax law has created the opportunity and incentive for Gray to hire more team members, specifically engineers.

The broad intent of the business side of tax reform was to simplify and equalize the tax code in ways that leveled the playing field for U.S. businesses, especially those that manufacture in America. The U.S. has been losing tax revenue with every business and every job that otherwise would have expanded or been created (or retained) over the past 30 years. While the tax law has a “price” in terms of the lower corporate tax revenue stream, overall growth in the economy is projected to more than offset this cost. For this to happen, businesses need to act responsibly with their tax savings by reinvesting in their workforce, equipment, and facilities — and not just passing everything through to the executives or shareholders.

Since the law was enacted, many companies, including manufacturers, have responded in these responsible ways. For example, Boeing announced a $300 million investment into its workers, including $100 million going toward workforce development in the form of training, education, and other capabilities to help the company effectively compete in the evolving sector.

Businesses will now have more incentive to expand in the U.S. as well as provide employees with better equipment and training, in turn leading to increased competitive performance on the global economic stage. “For Boeing, the reforms enable us to better compete on the world stage and give us a stronger foundation for the investment in innovation, facilities, and skills that will support our long-term growth,” said Dennis Muilenburg, chairman, president, and CEO of Boeing in a statement.

AT&T and Comcast responded to tax reform with news that they would give thousands of their employees special bonuses. FedEx, which has been vocal in its support of tax reform, has also promised to invest in its workforce through hiring, as well as purchasing new equipment and technology. Wells Fargo and Fifth Third Bancorp also announced they would raise their minimum wage and provide bonuses and further employee investment.

Just before the North American International Auto Show, Fiat Chrysler Automobiles (FCA U.S. LLC) said it would move production of RAM Heavy Duty trucks from Mexico to Michigan. This is part of a $1 billion investment that will result in 2,500 jobs. The company also said it would pay $2,000 bonuses to 60,000 employees.

“These announcements reflect our ongoing commitment to our U.S. manufacturing footprint and the dedicated employees who have contributed to FCA’s success,” said Sergio Marchionne, the CEO of FCA, in a media release. “It is only proper that our employees share in the savings generated by tax reform and that we openly acknowledge the resulting improvement in the U.S. business environment by investing in our industrial footprint accordingly.”

More recently, Apple announced that it would repatriate billions in cash leading to a total investment of $350 billion in the U.S. economy over the next five years, including the creation of some 20,000 jobs. Walt Disney Co. also said it would give its 125,000 employees a one-time cash bonus as a result of federal tax reform.

It is clear that comprehensive tax reform is good for skills, wages, and jobs, all of which feed into a strong economy. Increased Economic Activity

It is exciting and encouraging to see these companies and others stepping forward in such meaningful ways so quickly after the new law has been enacted. If executed effectively, this tax reform has the potential to increase economic activity by creating a more competitive global business environment; opening the door for manufacturing companies to reinvest into the economy through new capital investments or expansions; and by putting more money in the pockets of every employee, including through newly created jobs.

Robert Barro, professor of economics at Harvard University, predicts the tax reform overhaul will create an additional 1.1 percent of GDP growth through 2019. This is how tax reform was sold to the American public and is how it should be delivered. The truth is, an improved business tax code benefits everyone. For example, all Americans with money in the stock market have seen substantial gains driven by the new tax law, many through their 401k plan investments, which will allow for a better retirement.

As business owners, we have three choices with these tax savings:

- Distribute to the shareholders.

- Hold the savings in cash in the business.

- Create new jobs and invest in new equipment and/or projects.