The U.S. has historically maintained a competitive advantage over other countries in these areas to one degree or another. However, over time, other countries have adopted certain business-friendly measures, cutting into U.S.-based companies’ share of the global economy. These changes have certainly impacted the U.S. manufacturing sector, though there has been a rebound of late. But, to grow and strengthen it further, some policy changes are in order. Specifically, tax policy is one area of weakness for the U.S., which President Trump plans to rectify.

The Current U.S. Tax System for Business

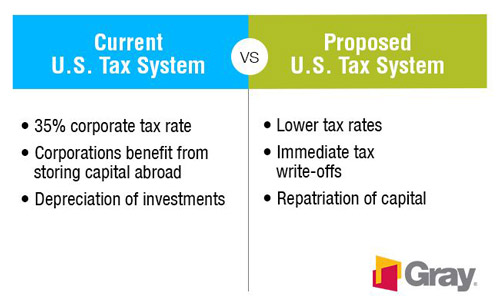

Under the current system, t he highest marginal federal corporate tax rate in the U.S. is 35 percent . It often surpasses 40 percent once state taxes are taken into account. This rate is the third highest in the world, with only the United Arab Emirates and Puerto Rico exceeding it. According to the Tax Foundation, the global average across 188 countries and tax jurisdictions is much lower, at 22.5 percent .

U.S.-based corporations owned by foreign companies are bound by the same corporate tax rules on the profits from their U.S. business activities as U.S.-owned corporations. A second level of taxation may also be applied at the shareholder level depending on the method of distributing profits.

To put it in a more specific perspective, here is how the U.S. federal corporate tax rate of 35 percent compares to other countries :

- Germany: 15 percent

- China: 25 percent

- Japan: 23.9 percent

- South Korea: 22 percent

- United Kingdom: 20 percent

- Taiwan: 17 percent

- Mexico: 30 percent

- Canada: 15 percent

- Singapore: 17 percent

- India: 30 percent

Proposed Corporate Tax Reform

President Trump campaigned on a promise to drastically reduce the tax burden on both businesses and individuals. In late April, his administration proposed an outline of the most comprehensive tax code overhaul since President Reagan, with the highlight being to reduce the top business tax rate to 15 percent. The fundamental basis for the overhaul is to stimulate economic growth, thus creating more jobs and expanding the nation’s GDP. While the timing and details of a new tax policy are still uncertain, it is clear that this new plan will significantly change the business landscape for U.S. companies of all sizes

It appears President Trump’s administration intentionally left out a lot of detail when it released its plan . It’s hoped this will allow the House and Senate to streamline the negotiation process to arrive at a final, detailed plan. The highlights of President Trump’s corporate tax reform plan include:

- A top individual income tax rate on pass-through businesses (such as partnerships) to 15 percent

- A repeal of the corporate alternative minimum tax and the 3.8 percent Affordable Care Act (ACA) tax

- A one-time opportunity to repatriate corporate profits earned (and held) overseas at a 10 percent tax rate

- Elimination of corporate loopholes that cater to special interests, as well as deductions made unnecessary or redundant by the new lower tax rate

- Immediate expensing of U.S. capital investments

- Adoption of a “territorial” tax system, which typically excludes most or all of the taxable income that businesses earn overseas

Secondly, the opportunity for businesses to immediately write off capital investments could free up significant dollars for new businesses and expansions. For example, if a company decided to invest $10 million into a new or expanding facility, all of this investment could be immediately written off as a deduction instead of depreciating it over many years. In practical terms, companies would reduce their tax bills in the year they make the investments, thus creating a powerful investment incentive for companies big and small. …the highest marginal federal corporate tax rate in the U.S. is 35 percent. It often surpasses 40 percent once state taxes are taken into account…the third highest in the world…

An area of particular controversy had been whether the Trump administration would propose a border adjustment tax, which, in short, is a tax on imported goods. By default, this gives a distinct advantage to those who make goods within the U.S., especially if those goods have U.S.-sourced raw materials. Many countries have incorporated similar concepts, though under different names and methodologies.

Some members of Congress have been strong supporters of this concept, both due to a belief that it would encourage businesses to produce more in the U.S. versus overseas, as well as to generate revenue to help pay for other parts of the tax plan. However, many goods currently sold to lower- and middle-income American consumers, most of which are made overseas, could see significant price increases. But the border adjustment tax was not included in the latest proposal from the Trump administration.

The Impact of Corporate Tax Reform on U.S. Business

A simplified tax policy has the possibility of reaping significant benefits for all U.S.-based businesses. For capital-intensive businesses such as manufacturers, it is vital to retain as much capital in the business as possible to help fund the cost of facilities and the associated machinery and equipment. When 35 percent of every dollar earned is sent to Washington, as the current tax policy requires, it reduces the pool of funds that could otherwise be used to expand and grow the business. Tax reform will likely eliminate the temptation for companies to look overseas for lower corporate tax rates to advance their business goals.

Historically, higher tax rates discourage work, investment, innovation, and savings — all of which play leading roles in advancing the economy. The caveat is that tax cuts often increases deficits and, thus, the national debt. However, one of the primary goals of the proposed tax code overhaul is to make it revenue-neutral, meaning that it would have no impact in terms of increases or reductions on federal tax revenue. In other words, reductions in corporate tax rates will have a heightened impact on smaller companies versus larger ones when it comes to decisions to invest in new capacities.

The beneficial impact of the proposed changes should really help small- to medium-sized businesses as they typically have more constraints on their sources and costs of capital. Also, small- to medium-sized businesses create the majority of new jobs in the U.S. year in and year out. In fact, according to the Small Business and Entrepreneurship Council: American business is overwhelmingly small business .

In other words, reductions in corporate tax rates will have a heightened impact on smaller companies versus larger ones when it comes to decisions to invest in new capacities. The average manufacturing project in the U.S. by a small- to medium-sized manufacturer is between $5 million and $10 million. These manufacturers have often struggled to obtain the capital needed to make the investment to grow their businesses, especially after the financial collapse in 2008 when banking regulations and credit availability tightened. These circumstances were particularly challenging for manufacturing companies that were growing or that didn’t have a strong balance sheet to present to a bank. Once a new tax code is in place, these types of companies would be able to take an immediate tax deduction to use as equity to justify their investment, thus encouraging further growth.

The Economic Domino Effect

The bottom line is this: It is an immense undertaking to balance out all of the pros and cons of radically changing U.S. tax policy. Whether at the business or individual level, special interest groups are involved, uncertainty exists to unintended consequences that are likely to occur on any one of the more significant changes, and the mere task of unwinding thousands of pages of tax rules and regulations is no small feat.

While the timing and details of a new tax policy are still uncertain, it is clear that this new plan will significantly change the business landscape for U.S. companies of all sizes. Once a formal plan has been defined, companies will start to react even before the plan is fully implemented. Ultimately, businesses will behave differently as a result of tax reform that will likely create a positive, domino effect on the economy.

Scott Parker, CFO of Gray Inc., contributed to this report. Read more about how corporate tax reform could have a huge effect on businesses' investments decisions. .