Owning and operating a data center is capital-intensive. A CBRE study published in late 2015 showed that the average cost to build and operate a 5 MW data center over a 10-year period was nearly $270 million.As the world moves forward in a digital age, the number of third-party regulations and certifications enterprises must achieve and maintain is growing. Faced with all of these challenges, enterprises are quickly realizing that their core competencies do not lie within the data center and they are better served through outsourcing.

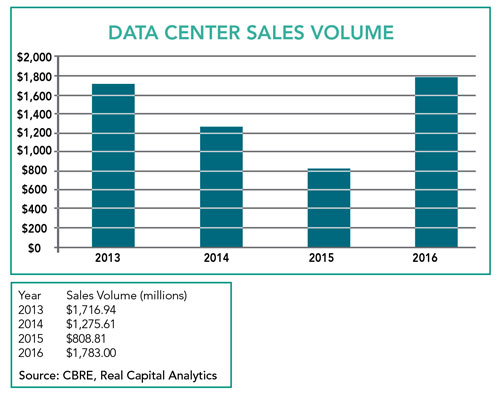

Reducing costs, improving operational efficiency, and increasing reliability across the enterprise are the core drivers pushing enterprise users toward monetization strategies to divest themselves of their owned data center facilities. As a result, the next 12 months will likely see an increase in the number of corporate data center dispositions. As companies divest these assets and move from owned to lease models, the importance of evaluating the right disposition strategy to minimize write down, maximize value, and provide the solution of greatest value to the organization will be of the highest importance. This trend has already taken a foothold; total sales volume for data center assets increased dramatically to nearly $1.78 billion in 2016, up from roughly $800 million in 2015. All signs point to an even greater transaction volume in 2017.

Third-Party Locations

While some of the growth is organic, much can be attributed to the migration of previous enterprise owned and operated data centers into third-party locations.

Ten or 15 years ago, when companies often made the decision to build, own, and operate their own data center facilities, they did not have the depth of solutions available in today’s market to evaluate. Cloud services solutions didn’t fully exist and colocation was viewed as new, potentially risky, and applicable for smaller requirements only. As wholesale colocation — the leasing of larger chunks of space and power, oftentimes in fully dedicated suites with isolated infrastructure — became more readily available, the adoption of outsourced and colocation solutions slowly began to increase. Over time, colocation has become a prevailing mainstream and normalized trend, with cloud services solutions becoming accepted as the new frontier.

Today, the cost for an enterprise to build and operate a data center is significantly higher than that of a third-party developer. Developers capitalize on economies of scale by building out tens of megawatts at a time. The total fixed costs are then spread over a greater number of megawatts, thus lowering the effective cost per megawatt built. Some operators claim they can develop operational capacity near or below $10 million per megawatt, whereas enterprise costs typically average more than double that total. Developer/operators also typically benefit from lower operational costs as facilities managers, security, engineers, and other technical staff can be shared across several users and/or facilities. End-users, leasing from said developers/operators, benefit by paying a fraction of what their own cost would be for a modern, state-of-the-art solution.

While the goal of migrating to a fully outsourced, third-party solution is easy to imagine, the path for most corporate users to achieve that goal is not always so clear. First a company must determine what their underlying requirements are:

- What are the most critical applications?

- What is the most effective go-forward cost and security solution?

- What are the business implications of shifting from an in-house to outsourced environment?

- As it relates to the data center facility itself, what strategy achieves the best end result?

Minimizing Impact/Maximizing Value

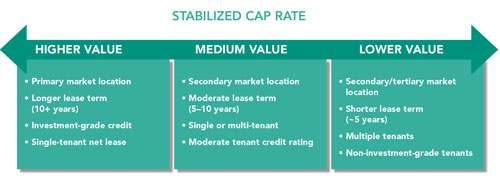

As companies look to monetize data center assets, they must evaluate the optimum structure to minimize write-down and balance sheet impact, maximize value, and optimize operations based on their own specific long-term goals. The formula for each asset can vary significantly based on the location, age, and credit of the tenant. The leaseback term and structure also impacts the anticipated logical investor pool and sales price quite dramatically. Once the optimum structure has been decided, CBRE advises engaging in a formal marketing campaign with a competitive, managed bid process to solicit all interested users, developers, and investors for optimum results.

Generally, dispositions with varying levels of vacancy are viewed more favorably in primary markets with strong end-user demand and favorable market fundamentals. Data center operators prefer these types of “value-add” opportunities as they can utilize their development and operational efficiencies to drive higher long-term returns than the pure income-driven investment opportunities previously noted, where returns are fixed over a longer investment horizon.

Vacant capacity in secondary or tertiary markets, however, is oftentimes less desirable. In these markets, end-user demand is likely to be much lower compared to primary markets. Leasing excess capacity will be more difficult and a riskier proposition for any potential investor.

For assets with a mixture of leased and vacant capacity, market pricing varies dramatically based on the strength of the local market demand profile. For these partially leased assets in secondary or tertiary markets, striking the right balance between maximizing the sales price and minimizing the rental exposure can be a difficult and arduous process.

Developing and executing a strategy to maximize data center asset value is best achieved by working with an integrated team of experts in data center construction, facilities management, capital markets, and leasing. Project/construction managers will analyze the cost to replace existing aging improvements as well as develop additional capacity. Facilities managers underwrite the operational cost to maintain the data center over time. Leasing experts accurately forecast tenant demand, expected time to lease up, as well as market rent and concessions. All of these key data points drive the underlying analysis to determine forecasted cash flows over time. The capital markets expert then provides the appropriate guidance on anticipated investor and/or operator/developer interest, projected sales price, as well as gain or loss from the transaction (pending book value).