The Monitor survey, which was conducted by McGladrey LLP, the leading provider of assurance, tax, and consulting services focused on the middle market, includes responses from more than 900 executives at small and mid-size U.S. manufacturers and distributors, and provides an annual update on the state of middle-market companies in the industrial sector.

Industrial sector executives report that they are already coming off a strong year but expect even better results over the next 12 months. While the majority of executives (69 percent) reported increases in domestic sales over the past year, 88 percent expect the next 12 months to bring further growth, with an average projected increase of 8 percent. In addition, two thirds (67 percent) reported that they expect their profit (before interest and tax) to rise over the next year, with nearly a quarter (24 percent) expecting increases of more than 10 percent.

The survey indicates that these expected bottom-line improvements will also mean good things for the job market. Two thirds of respondents (67 percent) indicated that they expect to hire more employees in the U.S. over the next year, up from 62 percent in 2013. The average expected increase in U.S. employees was 6 percent, up from 4 percent in 2013. Importantly, the number of executives expecting to cut back in U.S. employment dropped to 5 percent after hovering between 9 percent and 11 percent for the past three years.

Nearly three-quarters (73 percent) of manufacturers of furniture, fixtures, and building materials plan to increase their domestic workforces by a median of 3 percent. Domestic sales increased for 70 percent for this cohort by a median of 6 percent.

Barriers to Growth

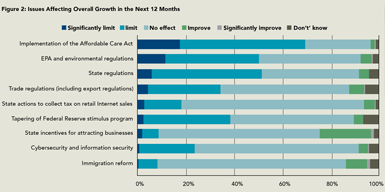

Generally, executives are encouraged by sales growth over the past year, and they expect growth and hiring to continue. However, stricter regulations, high corporate tax rates, increasingly aggressive state tax agencies, and not knowing what the federal government may deliver have all contributed to a continued uncertainty and frustration among executives trying to plan for the future. More than half of executives participating in the survey believe U.S. government taxes and regulations will limit or significantly limit their company’s growth in the next 12 months (Figure 2).

Manufacturers of furniture, fixtures, and building materials see taxation (72 percent) and regulations (74 percent) as greater threats to growth than competition (60 percent). Not surprisingly, more than half (55 percent) believe materials and component pricing will limit growth in the next 12 months.

Furniture, fixtures, and building materials manufacturers have made significant investments in a number of areas, including product and process innovations, where 79 percent have seen improvements in company performance.

Other investments have resulted in significant improvements for this group, including operations practices and capabilities, customer service. and product and marketing strategies.

Opportunities for Growth

A key differentiator for U.S. manufacturers continues to be their ability to drive innovation in their product development and process improvement activities. For example, more companies are using additive manufacturing, commonly referred to as 3D printing, to go beyond developing prototypes to producing component parts.

When reviewing their total cost of ownership, manufacturers are bringing production back to or near the U.S. This “onshoring” or “nearshoring” has a number of advantages that can help keep U.S. companies competitive. Certainly, it reduces the costs of shipping when you move your operations closer to home from an offshore location. Nearshoring reduces the risks associated with the supply chain, intellectual property, and regulatory compliance, and it allows for greater control over inventory and product quality. As overseas workforce costs have risen, the argument for moving operations offshore is less compelling than it once was.

This trend is seen in smaller, mid-size companies. These companies are finding that customers are not only willing to pay more for high precision and quality, but they prefer to buy products made in the U.S. Most furniture and fixture as well as building materials manufacturers participating in the Monitor survey (86 percent) noted that it is important to their brands to indicate that their products are made domestically. Some states are also providing incentives that make moving back to the U.S. more attractive to companies. Notably, one building materials manufacturer pointed out that products made in the United States enjoy a reputation for quality around the world. Depending on the market, the value that customers place on these products can translate into premium prices and profits.

Overall, operations improvements and process innovations — achieved through lean manufacturing processes and the use of technology — are allowing companies to maintain or even improve productivity.

Companies are integrating and aligning IT investments throughout their businesses, in areas such as customer relationship management, enterprise resource planning, and business analytic solutions. There is a high level of interest in mobility solutions and Web applications; in fact, thriving companies are more likely than other companies to invest in mobility solutions. Looking ahead, companies are preparing for the growing challenges of succession planning and attracting skilled personnel. Some companies are collaborating with local colleges, trade schools, and high schools on training programs. Others are enhancing or expanding roles beyond their traditional responsibilities in order to make the roles more meaningful and attractive to a younger generation.

How Companies Thrive

As the 2014 McGladrey Monitor shows, thriving companies follow a number of similar patterns:

Investments: Thriving companies lead others in a number of investment areas, including equipment, technology infrastructure, software, and acquisitions.

Continuous improvement: These companies lead in leadership and management development programs and employee training and well as operational initiatives and other improvements.

Effective strategies: Whether it’s addressing operational efficiencies, focusing on more profitable existing customers, or leveraging technology, these companies are taking the time to make these strategies work for them.

Managing relationships: Thriving companies are using information technology and other resources to share information with suppliers and internal personnel to understand and meet the needs of their customers.

Managing external challenges: Thriving companies are better able to minimize the financial impact of government regulations and taxation.