This growing pressure, coupled with rising expenses and inventory struggles plaguing many verticals, is cause for pause. While some in the industry may celebrate a leading market, such as the U.S. topping $1 trillion in e-commerce sales for the first time last year, now more than ever before, the smartest players are developing innovative strategies to fuel all aspects of their operations. Today, to stay competitive, industry leaders must think ahead of challenges in space constraints, supply chain management, and more. Four focal areas for e-commerce-focused retailers are explored below.

The Battle for Space in an E-Commerce World

As fiercely competitive price wars and customer acquisition competition play out online in the e-commerce arena, physical space is a fast-growing battleground among the major players. Fortune 500 companies and powerhouses are vying for prime real estate to place distribution facilities or last-mile locations. According to JLL’s Q1 Industrial Outlook, this has led to an increase in industrial rental rates and annual escalations, particularly in densely populated regions, such as New York, Chicago, and Los Angeles, where opportunities for growth are limited.

Higher costs, scarcity in available inventory, and the intense competition among mega-site users have a ripple effect on second- and third-tier retailers. Higher costs, scarcity in available inventory, and the intense competition among mega-site users have a ripple effect — and one that is particularly adverse — on second- and third-tier retailers, who may struggle to achieve a sufficient return on investment (ROI) in this challenging environment. As a result, these retailers find themselves caught chasing profit margins to offset securing space at a higher cost or sacrificing market share if they stand pat with a current footprint. Add the economic climate and rising interest rates to the equation, and many second- and third-tier players are erring on the side of caution and adopting a holding pattern.

Shifts to Secondary Markets

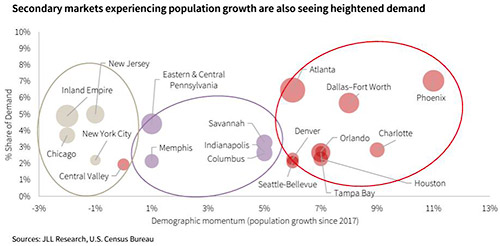

According to JLL’s Industrial Tenant Demand Study, secondary markets are exploding in popularity as attractive alternatives for e-commerce providers and retailers. Nontraditional areas like Little Rock, Arkansas, and Pensacola, Florida, have witnessed a growing need for “last-mile” e-commerce to meet the increased demand from consumers for fast shipping. These markets come with their own set of challenges, which may include inefficient infrastructure and construction delays as they’re removed from major metropolitan areas.

There is also an increased focus on Sunbelt markets, such as Atlanta, Georgia; Orlando, Florida; Phoenix, Arizona; and even Dallas, Texas, as opportunities for expansion due to land availability and explosive population growth.

These markets are expected to remain bright spots in the industrial market as e-commerce brands prioritize the availability of space, cost-effectiveness, and the ability to deliver workplaces that can have staffing needs met by the nearby labor pool.

Strain on Operational Network Capacity

The impact of construction slowdowns or halts is likely to result in a shortage of industrial deliveries in the near future. Many companies had a strategy for building out their e-commerce infrastructure spanning a decade or more. However, the pandemic disrupted even the best-laid plans and continues to have lasting ripple effects.

During the initial stages of the pandemic, there was a surge in customer demand, leading to a rapid acceleration in network optimization efforts. However, as the demand has slowed down and the economy faces strains, these networks remain incomplete, and, in some cases, they have become even more inefficient than before, resulting in a patchwork network for many retailers. In response to these challenges, retailers turned to third-party logistics providers (3PLs) as a temporary solution to alleviate the strain on their operations.

Secondary markets are exploding in popularity as attractive alternatives for e-commerce providers and retailers. Improving building efficiency, maximizing sales space, and streamlining operations are key business fundamentals for e-commerce retailers. Now, many companies have come to the realization that they must take control of their destiny rather than relying solely on 3PLs. The pandemic shifted the focus from a “just-in-time” mentality to a “just-in-case” approach, and now the industry is seeking an equilibrium that emphasizes the need for diversified supplier bases and regionalized networks to meet global demand.

Having the right real estate, suppliers, fulfillment facilities, and stores — and constantly evaluating if the mix of locations is being used in an optimal way — is central to driving the efficiency of supply chains.

Creative Use of Space (Constraints)

Consumers’ expectations of near-immediate click-to-door delivery have made the proximity of fulfillment centers to customers’ homes of the utmost importance. Retailers are rapidly exploring solutions to the issue, including repurposing existing buildings such as vacant malls, parking lots, and old retail stores. Movie theaters, in particular, due to their size, have been transformed into distribution centers due to their proximity to major population centers.

In densely populated areas, where the construction of a 50,000-square-foot building is not feasible, the conversation around the conversion of aging and vacant office spaces into vertical service distribution centers is gaining momentum.

Consumers’ expectations of near-immediate click-to-door delivery have made the proximity of fulfillment centers to customers’ homes of the utmost importance. While both approaches offer advantages, they also present challenges, such as limited dock doors, floor slab concerns, zoning issues, and potential political opposition. To encourage more conversions, increased investments from landlords and tenants, along with community understanding and support, are vital. By addressing these challenges, retailers can better serve their customers and solve the “last-mile problem.”

What Comes Next?

A comprehensive strategy that strikes a balance between immediate space requirements and long-term sustainability should be top of mind for any e-commerce and retail brand decision-makers. Retailers must invest in innovative technologies, foster collaborations, and maintain open lines of communication to adapt to the evolving landscape.

The best are embracing creativity in their real estate holdings while continuing to take a customer-centric approach in the age of online shopping. Ultimately, the battlefield may be intense but, with the right strategies and resources, retail can thrive.