Ohio Resources Page

2023 Top States for Doing Business Meet the Needs of Site Selectors

The states considered the best locations for doing business according to an expert panel of location consultants are the highest performers in more than a dozen categories upon which companies make their site selection decisions.

Boosting Semiconductor Manufacturing in America

Often referred to as “fabs,” the plants producing semiconductors are all big-money investments promising big job counts.Charging Up the Electric Vehicle and Battery Sector

More than half a dozen of this year’s Project of the Year awards are related to EVs or the batteries that will power them.EV and Semiconductor Projects Stand Out in States Receiving Area Development’s 18th Annual Shovel Awards

With concerns about climate change now supplanting pandemic fears, projects to produce EVs — and the semiconductors used by vehicles and other high-tech goods — come to the forefront in this year’s Shovel Awards report.

Area Development’s 17th Annual Shovel Awards Recognize State and Local Economic Development Efforts — First Two Platinum Shovels Awarded

Area Development’s annual Shovel Awards highlight the nation’s swift post-pandemic economic recovery in 2021 with many projects being initiated that represent billions of dollars in investment and thousands of new jobs.

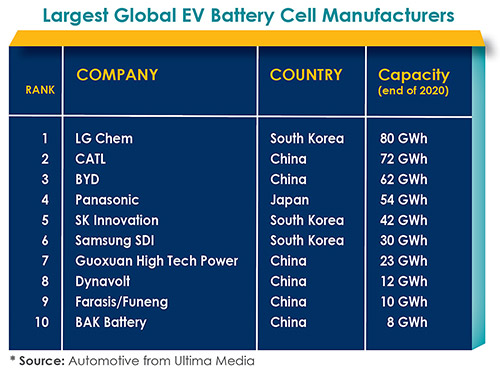

Auto Giants Race to Build U.S. EV Battery Assembly Plants

More than $20 billion worth of new EV battery assembly facilities are being built in the U.S., but 90 percent of battery components are imported, and Tesla is busy preparing for a global shortage of lithium battery cells

Innovation Corridors Have Economic Assets Driving Business Growth

By actively putting together the resources needed for innovative companies to survive and thrive, innovation districts and corridors have found a recipe for success.

The 2021 Top States for Doing Business Reflect Their Locational Advantages

Despite the economic uncertainty of the last year, plenty of companies continue to grow, and with growth comes the need to expand and explore new locations. The “Top States” in which to locate represent the general views of our expert panel of site consultants, with Georgia ranking #1 for the eighth year in a row.2021 Gold & Silver Shovel Awards Project of the Year: Ultium Cells to Mass-Produce Lithium Ion Batteries in Ohio

A joint venture between General Motors and LG Chem, Ultium Cells’ plant will help fulfill GM’s promise of an all-electric lineup by 2035.2021 Gold & Silver Shovel Awards Recognize State and Local Economic Development Efforts

Although 2020’s global pandemic resulted in some projects being stalled or canceled, the annual Shovel Awards recognize many other new and expanded facilities plans that are on track and expected to created thousands of jobs and billions in investment.

Front Line: Vocational Training Alliances in Tough Times

Companies and communities must continue to invest in and destigmatize vocational training in order to bridge the manufacturing skills gap.

2020 Top States for Doing Business Showcase Their Pro-Business Environments

Despite changes brought by the COVID-19 pandemic, the states across the South seem to have all their ducks in a row when it comes to attracting business.In Focus: FDI Will Signal Better Days

The value and impact of FDI will remain an important part of the economic recovery from the coronavirus pandemic.2020 Gold & Silver Shovel Awards Recognize State and Local Economic Development Efforts

While the current COVID-19 crisis may put some development on “pause,” our annual Shovel Awards recognize states that garnered large job-creating and investment projects over the course of the previous year.