26th Annual Survey of Corporate Executives Results

How has the recent relatively positive economic news affected companies' facility plans and priorities? Area Development's annual Corporate Survey of our readers, which was conducted in late October/early November just as these economic events were unfolding, might provide an answer to that question. Let's take a look.

Winter 2012

The latest data shows that, in December 2011, factory production had advanced 15 percent above its low of two and a half years prior, and the November to December gain of 0.9 percent represented the largest monthly increase since December 2010. The Consumer Confidence Index also jumped to 64.5 in December from November's 55.2. And In the latter half of 2011, consumers spent more on automobiles; businesses increased spending on industrial machinery and computers - perhaps spurred on by a federal tax credit that was set to expire at year's end - and companies restocked supplies. The Institute for Supply Management's factory index thus climbed higher into positive territory in December, registering 53.9.

There were signs of improvement in the employment picture too: the Bureau of Labor Statistics' December household survey showed sizeable employment gains for the fifth straight month, reducing the unemployment rate to 8.5 percent. Importantly, manufacturers added 5,000 workers to their payrolls in December, following the addition of 2,000 workers in November 2011.

How has all this relatively positive news affected companies' facility plans and priorities? Area Development's annual Corporate Survey of our readers, which was conducted in late October/early November just as these economic events were unfolding, might provide an answer to that question. Let's take a look.

Who's Making the Decision?

Of those individuals responding to our 2011 Corporate Survey, nearly half are with manufacturing companies, and another fifth are with distribution and logistics or warehouse services firms (Slideshow, Figure 1), twice the number represented by the 2010 Corporate Survey respondents.

Nearly half are also the highest-ranking persons in their companies, i.e., owner, chairman, or CEO. Another 17 percent are their firms' chief financial officer, and a similar percentage is responsible for directing their companies' real estate or facilities (Slideshow, Figure 2).

Not surprisingly, therefore, 80 percent of the 2011 Corporate Survey respondents are involved in their companies' final or preliminary location decisions (Slideshow, Figure 3). Based on the caliber of the respondents, we can safely judge the responses to our 2011 Corporate Survey to be a good indication of where - and how - our corporate readers' firms are making their location and/or expansion decisions. In addition to executive management, also involved in these decisions, to a lesser extent, are individuals from the responding firms' real estate and tax and finance departments, as well as their supply chain/logistics and human resources departments. Importantly, 31 percent of the respondents say other operations or business unit management at their companies are also involved in the location decision (Slideshow, Figure 4).

How Big Are Their Firms?

Nearly half of the 2011 Corporate Survey respondents are with firms that operate five or more domestic facilities. Only 34 percent say they operate foreign facilities, but 60 percent of those that do claim to operate five or more (Slideshow, Figure 5). And almost half the respondents (45 percent) are with mid-size firms in terms of employment (100-499 employees), while 30 percent say their companies have 1,000 or more workers (Slideshow, Figure 6).

Sixty percent of the 2011 Corporate Survey respondents did not make a change in their companies' number of facilities over the 12 months prior to taking the survey. However, the good news is that 30 percent of the respondents claim to have increased their number of facilities and only 10 percent to have decreased their number of facilities over that period (Slideshow, Figure 7). This is an improvement over last year's Corporate Survey results, when only 22 percent of the 2010 Corporate Survey respondents said they had increased their number of facilities over the 12 moths prior to taking the survey.

Forty-seven percent of the 2011 Corporate Survey respondents who had increased their number of facilities say they did so to gain better access to new or existing markets; 38 percent also say the increase in number of facilities was a result of increased sales/production (Slideshow, Figure 8). Nearly all (92 percent) of the respondents who claim to have decreased their number of facilities over the 12 months prior to the survey say they needed to lower operating and/or labor costs (Slideshow, Figure 9).

What Is Their Outlook?

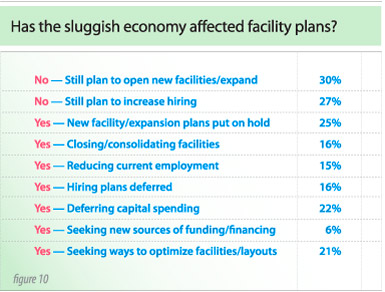

The editors of Area Development magazine also asked those taking the 2011 Corporate Survey if the sluggish economic recovery is affecting their facility plans. Again, the responses are more optimistic than those we received when we posed this question in 2010. Thirty percent of the 2011 Corporate Survey respondents say they still plan to open new facilities and/or expand (up from 22 percent who made that projection in 2010), and 27 percent still plan to increase hiring (up from 20 percent in 2010). Only 16 percent are deferring hiring (as opposed to 19 percent in 2010), and 22 percent are deferring capital spending (as compared with 30 percent reluctant to spend in 2010) (Slideshow, Figure 10). Nonetheless, only 19 percent of the 2011 Corporate Survey respondents expect the economy to improve significantly this year. More than a third of the respondents do not expect the economy to improve significantly until 2013, and 43 percent are holding out hope for 2014 (Slideshow, Figure 11).

Do They Have New Facility Plans?

When asked specifically about their plans for new facilities, 25 percent of the 2011 Corporate Survey respondents say they have plans to open new facilities within one year. This is comparable to the 2010 Corporate Survey results. Another quarter have new facility plans for two to three years out (Slideshow, Figure 12).

Of those with new facility plans, 41 percent of the 2011 Corporate Survey respondents say they plan to open two new facilities, and 30 percent expect to open just one (Slideshow, Figure 13).

Interestingly, there's been a heightened interest in the Southwest region (Arizona, New Mexico, Oklahoma, and Texas). The largest percentage of new facilities (15 percent) is slated for this region, up from 10 percent as reported by the 2010 Corporate Survey respondents. The Mid-Atlantic (Delaware, Maryland, New Jersey, New York, and Pennsylvania), Mid-South (Arkansas, Kentucky, Missouri, and Tennessee), and Midwest (Illinois, Indiana, Michigan, Ohio, and Wisconsin) regions will each garner 11 percent of the new facilities planned by the 2011 respondents. There is also and even spread of projects among the South Atlantic (North Carolina, South Carolina, Virginia, and West Virginia), Southern (Alabama, Florida, Georgia, Louisiana, and Mississippi), and Western (California, Nevada, Oregon, and Washington) regions, with each expected to receive 10 percent of the respondents' new facilities (Slideshow, Figure 14).

Most of these new domestic facilities will house manufacturing (32 percent) or warehouse/distribution (28 percent) operations (Slideshow, Figure 15). Unfortunately, more than four fifths of these facilities are expected to create fewer than 100 jobs (Slideshow, Figure 16), and 88 percent will account for only up to $50 million in investment (Slideshow, Figure 17).

The disbursement of new foreign facilities shows a continuing interest in Asia: 33 percent of the new foreign facilities planned by our 2011 Corporate Survey respondents are slated for this region of the world. However, that is down from 48 percent of the new foreign facilities that were planned for Asia by those responding to our 2010 Corporate Survey (Slideshow, Figure 18). And more than a third of the 2011 Corporate Survey respondents who are planning new facilities for Asia expect to place them in China; a fifth have their sights on India (Slideshow, Figure 19).

Mexico is looking good to our 2011 respondents as well. Our neighbor to the south is projected to garner 10 percent of the new foreign facilities planned by the 2011 respondents, up from only 6 percent of those planned by the 2010 Corporate Survey respondents. And Canada is holding steady with 10 percent of the projects slated for our neighbor to the north.

There's also been a surge in interest in Western Europe - 20 percent of the foreign facilities planned by the 2011 Corporate Survey respondents will go here, as compared with just 8 percent of those planned by the 2010 Corporate Survey respondents. This result is surprising in light of the European debt crisis that may adversely affect multinational firms with FDI in Europe.

Similar to the domestic breakdown of operations, a third of the new foreign facilities are expected to be manufacturing operations, and a quarter to be warehouse/distribution centers (Slideshow, Figure 20). Three quarters of the new foreign facilities will represent less than $50 million in investment. However, 16 percent will account for between $100 million and $500 million in investment (Slideshow, Figure 21) - more than is being spent on new domestic facilities.

Project Announcements

US Forged Rings Plans Hertford County, North Carolina, Steel Component Operations

03/02/2026

South Korea-Based Hanjung America Plans Huntington, Indiana, Manufacturing Operations

03/02/2026

Faith Technologies Plans Opelika, Alabama, Manufacturing Operations

03/01/2026

TaylorMade Golf Expands Vanderburgh County, Indiana, Distribution Operations

03/01/2026

Sediver USA Expands West Memphis, Arkansas, Operations

03/01/2026

Carpenter Pole and Piling Expands Wiggins, Mississippi, Operations

03/01/2026

Most Read

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

The New Industrial Revolution in Biotech

Q4 2025

-

Strategic Industries at the Crossroads: Defense, Aerospace, and Maritime Enter 2026

Q1 2026

-

The Skilled Trades Are Ready for a Digital Future

Q4 2025

-

Amazon’s First Mass Timber Delivery Station Tests the Future of Low-Carbon Logistics

Q4 2025