Impact of Economic Stimulus on Corporate Location Decisions

The federal government has assumed an expanded role in economic development in an attempt to stimulate the economy, and its actions will affect business investment and site selection decisions.

Aug/Sep 09

There is a wide range of programs that have been - and continue to be - implemented to stimulate investments. Volumes could be written about each, so for purposes of this article, we will broadly focus on four that are expected to be particularly influential:

1. The Energy Improvement and Extension Act (EIEA)

2. Department of Energy Loan Programs

3. The Economic Stimulus Package

4. Troubled Asset Relief Program (TARP)

Energy Improvement and Extension Act (EIEA)

The Energy Improvement and Extension Act of 2008 is a component of the Emergency Economic Stabilization Act of 2008 (better known for one of its other major components, TARP). Although lesser known than TARP or the Stimulus Package, the EIEA may currently be doing the most to encourage domestic investment among all the recent programs. The EIEA has helped accelerate alternative energy investment in the United States through a series of new tax incentives, changes to existing incentives, and bond funding for renewable energy projects. Some of the specific programs associated with this act include:

• An eight-year extension, through 2016, of investment credits for solar energy, as well as breaks for wind, geothermal, and other alternative energy sources

• A 30 percent tax credit for businesses to offset the development costs of solar and other clean energy projects

• Authorization of $800 million of new clean renewable energy bonds to finance facilities that generate electricity from wind, closed-loop biomass, open-loop biomass, geothermal, small irrigation, qualified hydropower, landfill gas, marine renewable, and trash combustion facilities

• Tax credits for retrofitting existing structures to increase energy efficiency

• $1.5 billion in new tax credits for the creation of advanced coal electricity projects

• Elimination of the $2,000 monetary cap for residential solar electric installations, creating a true 30 percent tax credit

• New tax credits of $2,500 to $7,500 for plug-in electric-drive vehicles

The EIEA generally does not provide incentives directly to manufacturers of renewable energy products; however the "demand-side" inducements it creates may be a more effective long-term solution. Germany, for example, adopted a feed-in-tariff (a subsidy which effectively pays homeowners to install solar panels on their rooftops) in 2000, and now has roughly five times the solar installations of the United States despite consuming only 15 percent as much electricity.

While the United States is playing catch-up to Europe (and parts of Asia) in the alternative energy arena, the projected increase in U.S. demand for clean energy products has already led to heightened activity among domestic and international manufacturers considering U.S. investment. Companies that can easily ship their products from overseas may continue to do so, as high labor costs and corporate income taxes remain a disincentive for producing in the United States. However, for large or fragile products - such as solar panels and wind turbines - logistics dictate the need to deploy production closer to the end customer and are increasingly steering manufacturing toward the growing U.S. market.

Department of Energy (DOE) Loan Guarantee Program

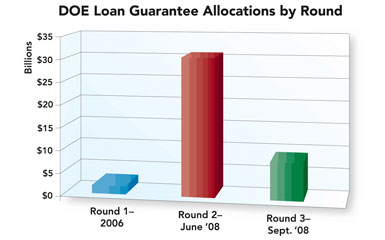

The U.S. Department of Energy (DOE) loan guarantee program is designed to encourage investment and commercialization of energy-efficient or renewable-energy technologies. DOE announced the first round of loan solicitations in August 2006, targeting a broad portfolio of environmentally friendly, energy-related technologies, including advanced fossil fuel technology, industrial energy efficiency, solar energy, electricity delivery, alternative fuel vehicles, and biomass projects. This initial solicitation offered up to $2 billion in loan guarantees, for which DOE received 143 pre-applications for loans totaling $27 billion.

DOE has since complemented the initial solicitation with two more, in June and September 2008. The second solicitation targeted renewable energy and nuclear applications and offered $30.5 billion in loan guarantees, while the third offered $8 billion and targeted innovative clean coal technologies.

The act responsible for the DOE Loan Guarantee program has been in effect since 2005, however progress was slow to materialize due primarily to the time necessary to craft the legislation and screen the first round of applicants. It received a boost in early 2009, when Energy Secretary Steven Chu announced a "sweeping reorganization" of the program. Activity has increased significantly in recent months, exemplified by additional solicitation rounds and progression for round-one participants. The first loan was approved by Secretary Chu in March 2009, and offered $535 million to Solyndra for use in construction of a commercial-scale manufacturing facility for its cylindrical solar photovoltaic panels. Solyndra is one of 16 organizations invited to submit full applications that are now in the final stages of the process.

Scores of active U.S. site selection projects involve a DOE funding component, and the recent acceleration of the program has moved many of these projects off the sidelines. DOE requirements for "shovel-ready" sites that meet a long list of environmental and other development criteria have many companies scrambling to quickly navigate the site selection process to secure (or maintain) their place in the queue. And companies have learned the hard way that switching sites can be a cumbersome endeavor, potentially delaying the DOE application review process by many months.

The DOE loan program offers a powerful, if targeted, stimulus to investment for young companies. It will be important for companies considering round two and three applications, as well as any future rounds that may be announced, to be prepared to launch a site selection project concurrent with preparation of the pre-application to avoid challenges later in the process.

Project Announcements

Modular Closets Plans Kernersville, North Carolina, Production Operations

12/07/2025

QMP Plans Walterboro, South Carolina, Operations

12/06/2025

Ninth Avenue Foods Plans Longview, Texas, Production Operations

12/06/2025

LayerZero Power Systems Expands Streetsboro, Ohio, Manufacturing Operations

12/06/2025

BioStem Technologies Plans Boca Raton, Florida, Headquarters Operations

12/06/2025

Saronic Technologies Expands St. Mary Parish, Louisiana, Operations

12/05/2025

Most Read

-

Rethinking Local Governments Through Consolidation and Choice

Q3 2025

-

First Person: Filter King’s Expansion Playbook

Q3 2025

-

Rethinking Auto Site Strategy in the Age of Tariffs and Powertrain Shifts

Q3 2025

-

Lead with Facts, Land the Deal

Q3 2025

-

How Canada Stays Competitive

Q3 2025

-

America’s Aerospace Reboot

Q3 2025

-

The Permit Puzzle and the Path to Groundbreaking

Q3 2025