Birth of a Corridor: Developing a North American Intermodal Route

Intermodal traffic between the U.S. and Mexico is growing rapidly, helping to realize the promises of NAFTA after nearly two decades.

August 2012

The growth of manufacturing in Mexico, including nearshoring of manufacturers moving facilities from China to Mexico, has boosted U.S.-Mexico trade. Exports from the United States to Mexico totaled $198 billion in 2011, led by computer and electronic products at $36 billion, transportation equipment at $24 billion, and chemicals at $21.5 billion. Imports from Mexico to the United States totaled $263 billion, with transportation equipment being the largest category at $61 billion, followed by computer and electronic products at $52 billion, and oil and gas at nearly $40 billion.

Both imports from - and exports to - Mexico rose by 14 percent last year compared with 2010. The booming auto industry is fueling transportation equipment exports into Mexico (primarily parts) and also imports back into the U.S. (vehicles). Exports and imports continued to rise in the first quarter of this year, with exports to Mexico up by 15 percent and imports from Mexico up by 11.9 percent from the first quarter of 2011.

Rail Connections

Of the Class I railroads, Kansas City Southern (KCS) has staked its claim as the only line to own track in both the United States and Mexico, the latter through its subsidiary, Kansas City Southern de Mexico (KCSM). The company, on its website, says it offers the "primary components of a NAFTA Railway system, linking the commercial and industrial centers of the U.S., Mexico, and Canada."

With pre-clearance for Customs, the company offers quick service through the border crossing at Laredo/Nuevo Laredo, the largest gateway between the two countries. In Mexico, the line connects several ports, including the booming Pacific port of Lazaro Cardenas with industrial and population centers in the central and northeastern part of the country. In the United States, KCS connects multiple ports and cities including Houston, Dallas, Kansas City, St. Louis, and - through haulage rights or marketing agreements - Chicago, Omaha, and Minneapolis-St. Paul.

The railroad's facilities and service offerings have developed gradually over the past several years to the point where KCS is now beginning to tap the deep potential for intermodal growth between the two countries. In 2005 KCS completed the purchase of the TFM railroad in Mexico, establishing the first single-line rail routes between Mexico and the United States. Service expanded slowly in 2006 and 2007. In 2008 the company opened a new intermodal complex in Kansas City at the Richards-Gebaur Air Force Base, at the same time that Hutchison Port Holdings opened a container terminal in Lazaro Cardenas, feeding KCSM - the only line to serve the port - with international intermodal business. In 2009, the company completed 100 miles of new mainline track between Rosenberg and Victoria, Texas, shaving 10 hours off the running time for cross-border shipments. That same year, KCS opened a terminal in Houston, the largest cross-border origin and destination market. In 2010 and 2011, the company purchased or upgraded terminals in several Mexican cities, while establishing agreements with other rail companies to extend service into the upper Midwest, the South, and the Mid-Atlantic States - all important regions for auto production. With its trucking partners expanding in Mexico, KCS is finally set to capitalize on its multi-year network buildout.

According to Pat Ottensmeyer, executive vice president and chief marketing officer, Kansas City Southern is pursuing a wide range of industries. The largest cross-border commodity group is grain being shipped by covered hopper unit train from the upper Midwest - one of the world's largest breadbaskets - to the population centers in Mexico, mainly Mexico City, among the world's largest deficit regions for grain production versus consumption. Additionally, with auto production in Mexico expected to increase sharply in the next several years, autos, parts, and raw materials will be a large part of the railroad's business. Big increases are on tap for appliance production in Mexico to serve the growing Mexican middle class and the United States as well. These industries attract ancillary suppliers, boosting traffic on the railroad. Ottensmeyer notes, "I recently spoke with a Korean manufacturer that is doubling the size of its refrigerator plant and building a new plant to make kitchen appliances for export to the United States. This manufacturer alone has attracted 15 tier-one supplier plants in Mexico."

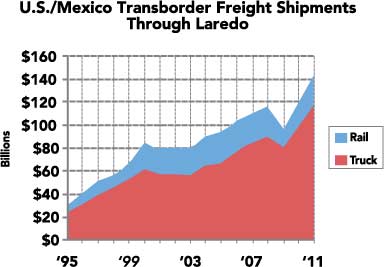

Cross-Border Truck Traffic

But the main opportunity for revenue growth at KCS over the next few years, reports Ottensmeyer, lies in the conversion of cross-border truck traffic to intermodal. Last year KCS moved about 26,000 containers across the border in both directions. Mature markets such as Chicago and Los Angeles have intermodal penetration of 40 percent or more of total traffic volume. Over the Laredo gateway, KCS cross-border intermodal traffic accounts for less than 2 percent of the total available market. KCS believes it has a wide-open field to convert more of that traffic to intermodal.

It's not just about carrying containers across the border, however. Shipping from Mexico City to Kansas City isn't all that interesting to a GM, Samsung, LG, or International Paper. But provide cost-effective links from Mexico to Detroit, Chicago, Atlanta, Charlotte, New York, and Baltimore, and major customers will take notice. To that end, Ottensmeyer and his team have been spending time with other railroads including Burlington Northern, Canadian Pacific, Union Pacific, CSX, and Norfolk Southern to develop interline service, and they have been partnering with trucking firms and IMCs including J.B. Hunt, Schneider National, Swift, Pacer, and Hub Group to jointly develop their intermodal business. In the past, the lack of this "connected system" for intermodal traffic that links Mexico with the entire United States has been the biggest barrier to growth.

Longer term, growth opportunities exist for intermodal traffic through the port of Lazaro Cardenas where KCSM is the only rail line. The port accommodated 953,497 inbound and outbound TEUs (20-foot equivalent units) in 2011, making it the 15th largest port in North America for containerized shipments. TEU traffic grew by 20 percent last year compared with 2010, the fastest growth rate among Mexican ports and one of the fastest rates among all North American ports. More than one million TEUs are projected to pass through the port in 2012.

KCS traffic through Lazaro Cardenas offers future growth potential but is more of a Mexican story. More than 90 percent of the containers unloaded at the port stay in Mexico, with most of the remainder unloaded in Houston. The port is growing fast because of its capacity to expand. Hutchison Port Holdings, which has the only terminal concession, is expanding its capacity from one million to 2.5 million TEUs. The port just awarded a second terminal concession to APM Terminals, which will add capacity for another 2.5 to 3 million TEUs over the next several years. Even when these projects are fully built out, there will remain enough land at the port to double the capacity.

Overcoming Challenges

Finally, what are the biggest obstacles to making intermodal work with Mexico? Ottensmeyer says that it's educating railroad interline partners, trucking/IMC partners, and customers on the major capital improvements that the railroad has made to upgrade the terminal infrastructure and speed of service into Texas and beyond. The network is in place, the service is competitive, and now it's about getting the word out so the American and Mexican people can reap the benefits dreamed of in the NAFTA agreement of lower transportation costs - with an added bonus of a significantly greener/reduced carbon footprint for every truck converted to rail intermodal.

Project Announcements

Ninth Avenue Foods Plans Longview, Texas, Production Operations

12/06/2025

LayerZero Power Systems Expands Streetsboro, Ohio, Manufacturing Operations

12/06/2025

BioStem Technologies Plans Boca Raton, Florida, Headquarters Operations

12/06/2025

Saronic Technologies Expands St. Mary Parish, Louisiana, Operations

12/05/2025

JGA Space and Defense Expands Huntersville, North Carolina, Operations

12/05/2025

SODECIA-AAPICO Plans Orangeburg, South Carolina, Manufacturing Operations

12/05/2025

Most Read

-

Rethinking Local Governments Through Consolidation and Choice

Q3 2025

-

First Person: Filter King’s Expansion Playbook

Q3 2025

-

Rethinking Auto Site Strategy in the Age of Tariffs and Powertrain Shifts

Q3 2025

-

Lead with Facts, Land the Deal

Q3 2025

-

How Canada Stays Competitive

Q3 2025

-

America’s Aerospace Reboot

Q3 2025

-

The Permit Puzzle and the Path to Groundbreaking

Q3 2025