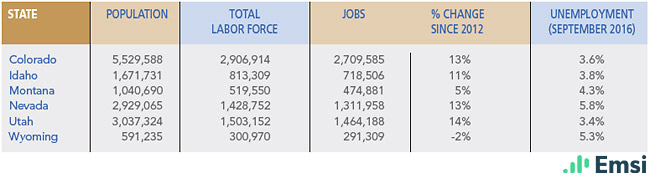

These trends are reflected by GDP and unemployment rates. Colorado’s first quarter 2016 GDP growth was 3 percent, followed by Utah (2.4 percent). However, negative growth for the Montana (-.90 percent) and Wyoming (-4.90 percent) economies is a reflection of low oil and gas prices, reduced coal mining, and depressed agriculture prices. This is also mirrored by the region’s unemployment figures — Colorado, Idaho, and Utah are in the 3.4–3.8 percent range for September 2016, well below the national average of 5 percent, but higher unemployment rates (4.3–5.8) persist in the other states.

Mountain Region Demographics and Industries

-

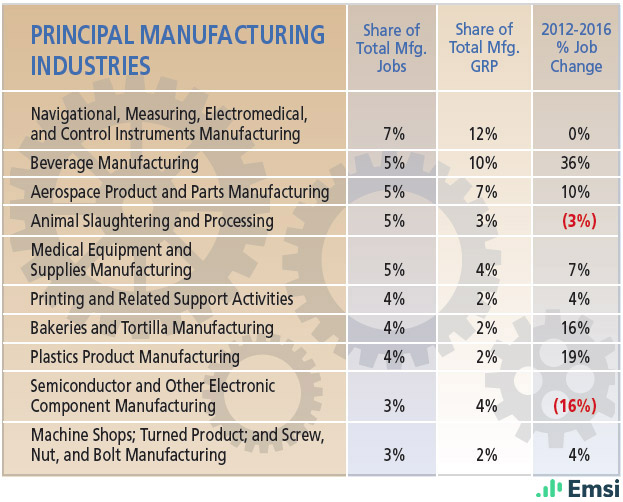

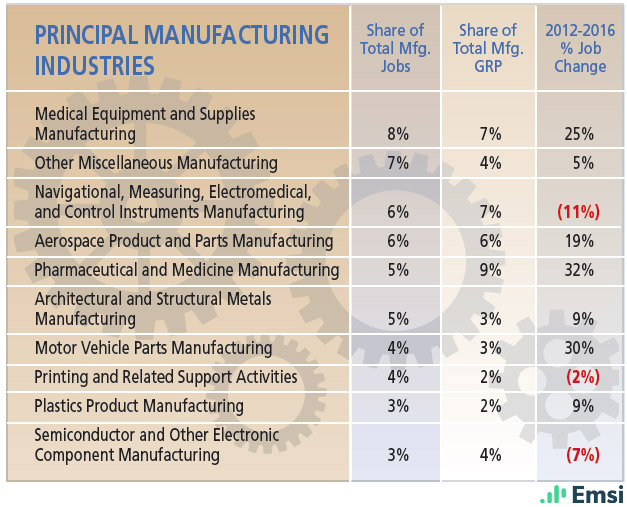

Colorado: Principal Manufacturing Industries

-

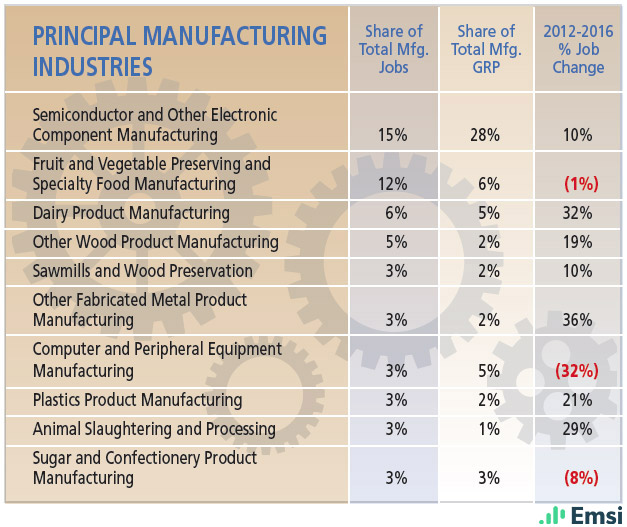

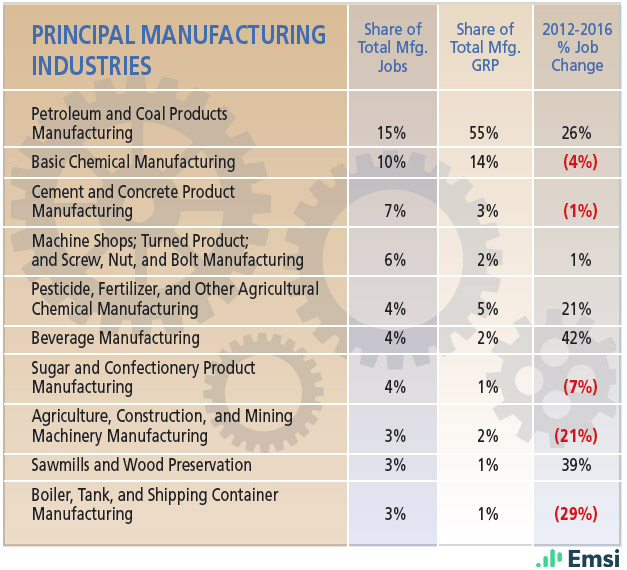

Idaho: Principal Manufacturing Industries

-

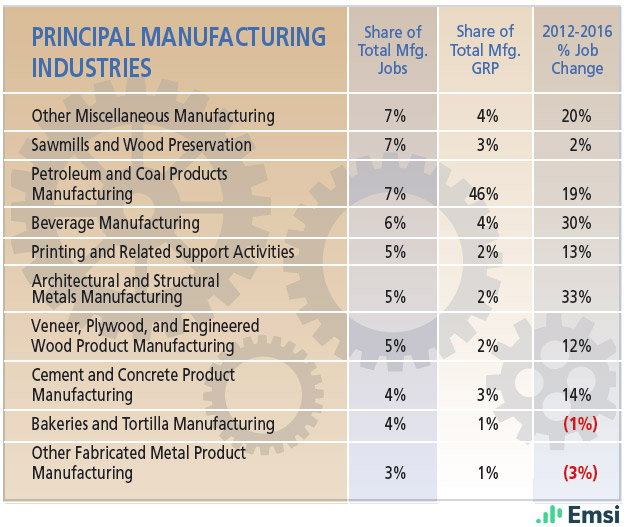

Montana: Principal Manufacturing Industries

-

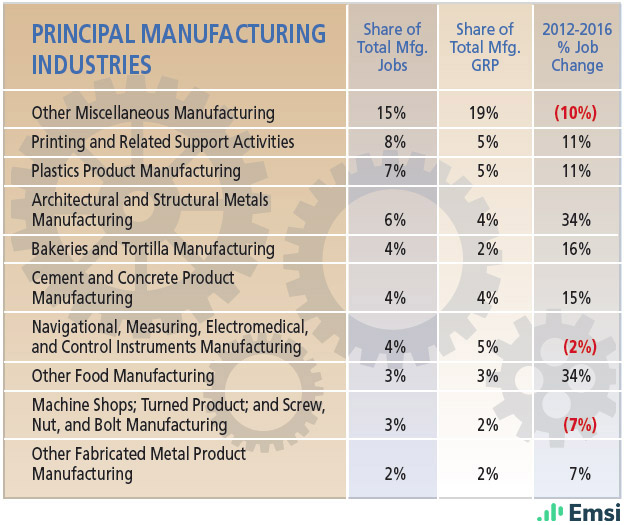

Nevada: Principal Manufacturing Industries

-

Utah: Principal Manufacturing Industries

-

Wyoming: Principal Manufacturing Industries

-

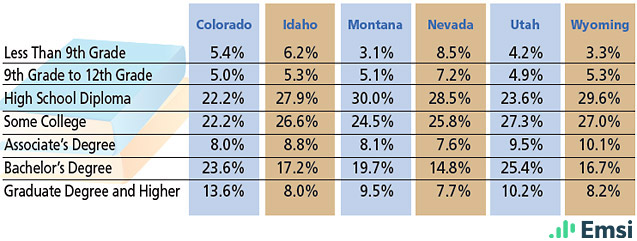

Mountain Region: 2016 Educational Attainment

-

Mountain Region: Demographics

-

Mountain Region: Top Industry Clusters

There is no doubt the economic leaders in the Mountain region are Colorado and Utah. In addition to their natural-resource–based industries, these states also have flourishing high-tech sectors, including clean technologies, cyber security, IT, telecommunications, life sciences, electronics, aerospace, food processing, and financial services. These robust economies attract high-quality workers. In a recent survey by CNBC, Colorado placed third for top workforce and enjoys one of the best net migration rates in the country. In 2015, Utah’s IT jobs grew at a healthy 7.7 percent rate, and financial services enjoyed a 3.5 percent increase in jobs.

Idaho and Nevada have also developed high-tech clusters. Although agriculture and food processing are major industries in Idaho, so is the advanced manufacturing of computers and other electrical equipment, with key player Micron Technology based in Boise. As of August 2016, Idaho was one of the top states for year-over-year job growth, many of those jobs reflecting good wages and benefits. Nevada is moving beyond mining and gaming into advanced manufacturing, with the massive, multi-billion dollar Tesla Motors project; the expansion of Switch, a large-scale data center with multibillion-dollar operations in Las Vegas and Reno; and Faraday Future, an electric car company that hopes to build a $1 billion factory in North Las Vegas, creating 4,500 jobs. eBay also plans to build its fourth data center at the Tahoe-Reno Industrial Center.

This positive economic growth does, however, pose a challenge — finding enough qualified workers to fill the new positions. Colorado’s Office of State Planning and Budgeting indicates the broad economic growth across a number of industries is resulting in a tight labor market, which is constraining business expansion and overall economic growth. This is especially true for positions that require higher-tech skills. For example, with the impressive IT growth in Utah, companies are desperate for more engineers and science, technology, engineering, and math (STEM)-educated workers to enable staff expansions.

Mountain States Recent Industry Announcements

Companies that have announced new and/or expanded facilities in the Mountain region.

-

Tesla Motors

Storey County, NVNevada is moving beyond mining and gaming into advanced manufacturing, with the massive, multi-billion dollar Tesla Motors project.

-

Switch

Storey County, NVSwitch operates large-scale data centers with multibillion-dollar operations in Las Vegas and Reno.

-

Faraday Future

North Las Vegas, NVFaraday Future, an electric car company, hopes to build a $1 billion factory in North Las Vegas, creating 4,500 jobs.

-

eBay

Storey County, NVeBay plans to build its fourth data center at the Tahoe-Reno Industrial Center.

-

SunPower

Mosca, COSunPower’s 64 MW Hooper Solar project in Mosca, Colorado, generates enough energy to power 13,500 households.

-

Anschutz Corporation

Carbon County, WYAnschutz Corporation’s 2,000-acre wind farm in Carbon County will be one of the largest wind power producers in North America, generating enough electricity to power one million homes (excess energy will be sent to Las Vegas and California via a 730-mile power line).

Depressed oil and gas production, coal mining, and agriculture are holding back economic recovery and new jobs in areas of the Mountain region, especially Montana and Wyoming. For example, nearly one third of Wyoming’s GDP comes from mining. Revenue shortfalls from oil and gas taxes are hurting state budgets. Elsewhere, livestock prices and farm earnings continue to drop from 2015 levels, in some places as much as 20 percent.

To make up for these losses and stabilize their long-term economies, Mountain States are investing in other abundant natural resources — sun and wind. The huge potential for solar- and wind-generated power is attracting significant domestic and foreign investments to these states. Numerous solar projects are already supplying electricity to the grid — for example, SunPower’s 64 MW Hooper Solar project in Mosca, Colorado, generates enough energy to power 13,500 households. In another example, 231 MW of solar electric capacity was installed in Utah in 2015, much of it in the utility and commercial sectors.

Wind energy is also getting plenty of attention. Wyoming has several big projects under way, including Anschutz Corporation’s 2,000-acre wind farm in Carbon County. When operational, it will be one of the largest wind power producers in North America, generating enough electricity to power one million homes (excess energy will be sent to Las Vegas and California via a 730-mile power line).

And Clearwater Energy’s Judith Gap Wind Farm near Forsyth will become Montana’s largest wind farm, generating enough electricity for 300,000 homes. “At 300 megawatts, it’s almost 50 percent of Montana’s current wind energy output of 665 megawatts,” says Jeff Fox, Montana policy manager for Renewable Northwest, a Portland, Oregon-based group that advocates the use of renewable energy sources. Fox points out that big companies like Wal-Mart and Google are investing in wind energy, either by purchasing power directly or buying the entire wind farm for their own use. “In 2015, almost 60 percent of all new generating capacity on the U.S. grid was wind power, and about half of that was built on contract with corporate purchasers,” Fox adds. “That’s the emerging trend.”