Texas — with its legendary recent job growth, four major metro areas, and accelerating economic diversity — remains the bellwether in this region. And despite the continued adversity now posed by three consecutive years of lower oil and gas prices, the Lone Star State continues to account for about 9 percent of all U.S. economic output. "If Texas were a country," Gov. Greg Abbott famously tweeted in 2016, "our economy would rank #10 … in the WORLD."

Clearly, Texas has been hit hard by an oil-price slump that slashed more than 91,000 jobs in its oil patch since 2014, nearly half the national job losses in that category. And so, after growing by 3.9 percent a year on average from 2010 through 2015, nearly twice the U.S. pace, the state's output barely grew in early 2016.

Houston, America's epicenter for oil and gas refining and petrochemical production, has suffered a jump in unemployment to nearly 6 percent from 4.9 percent in the fall of 2015, one of the largest jumps among big U.S. metro areas. And the vacancy rate in Houston skyscrapers rose to nearly 16 percent from 11 percent when oil prices began falling, according to NAI Partners, a commercial real estate firm.

The biggest impact on economic development may have been crimping revenues in the deal-closing Texas Enterprise Fund. There's also been a bit of a slowdown "because a lot of big deals have landed in the last couple of years," says King White, CEO of Site Selection Group.

Southwest Region Demographics and Industries

-

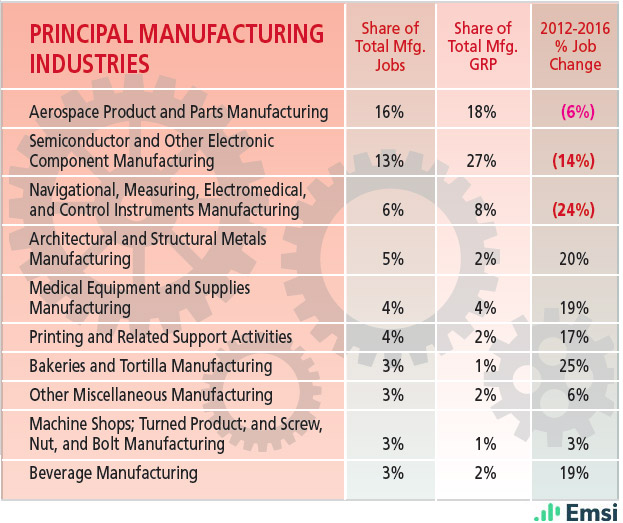

Arizona: Principal Manufacturing Industries

-

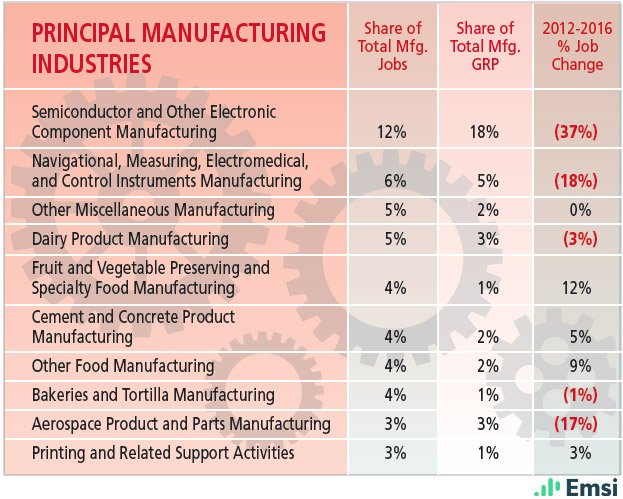

New Mexico: Principal Manufacturing Industries

-

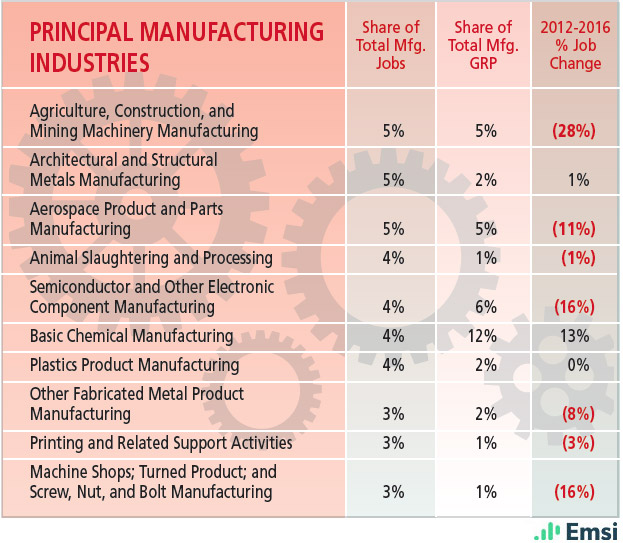

Oklahoma: Principal Manufacturing Industries

-

Texas: Principal Manufacturing Industries

-

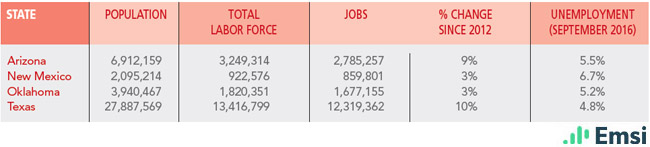

Southwest Region: Demographics

-

Southwest Region: Top Industry Clusters

But while Houston bears the brunt of the energy-industry recession, Texas's trio of other major metro areas — Dallas-Fort Worth, San Antonio, and Austin — are doing much better. Dallas, in particular, has been benefiting from its continually diversifying economy that draws lots of new corporate expansions and site locations attracted by its increasingly skilled workforce. The scaling up of local colleges and universities, such as the University of North Texas, has been a major boon to that effort.

One major new chunk of in-migration will come with the decision by Charles Schwab Corp. to develop a new $100 million regional campus in the Fort Worth suburb of Westlake. Its investment will add to that in nearby Plano by Toyota Motor USA, which has been in the process of relocating about 4,000 sales, marketing, administration, and other white-collar jobs from its former U.S. headquarters in Southern California.

"They still talk about the 'Toyota effect' here in Plano, but to me it's the 'Plano effect' on us," CEO Jim Lentz, who's already moved to the Dallas area, told Area Development. "We looked at almost 100 different locations before picking here, and there is no better corporate location in the country. We have a great campus, and there are great opportunities for our team members to live in all different types of settings. They've got it figured out here. And then on top of that you layer on a business-friendly environment."

Austin, too, is taking on a new dimension of dynamism, adding to the growth provided by its long-time status as a digital-technology hub because of the University of Texas campus. The capital city has become a sort of Silicon Valley of better-for-you food by leveraging its history as a center of youth and entrepreneurship along with purposeful nurturing by some early winners in the business — and its status as headquarters of Whole Foods Market.

A handful of notable startups have taken root including Epic Provisions, which recently was acquired by General Mills; Rhythm Superfoods; Pure Spoon; Daily Greens; and Snap Kitchen. "The city harnesses and builds an entrepreneurial spirit and the food and beverage industry is one that has really started to shine in the last several years," notes Dan Costello, CEO of one fast-growing Austin startup, Beanitos.

Expanding Professional, Financial Services

Oklahoma has suffered even more than Texas from the downturn in oil and gas prices, with plummeting employment in the energy sector, a hit to manufacturing of oil drilling and production equipment, and a decline in tax revenues that has created a severe state-budget squeeze.

But just as it has over the past decades, Oklahoma is fighting through the oil-related crunch with efforts to diversify its economy — a strategy that is paying off even as the state continues to cope with oil-price pressures. One major focus has been expanding the professional services sector, ranging from IT to financial services to architectural firms.

"What makes Oklahoma stand out in this sector is that we offer the whole package," Brien Thorstenberg, senior vice president at the Tulsa Regional Chamber, told Oklahoma's The State of Success magazine. "We have the education, we have the talented workforce, and we have a good quality of life and close proximity to markets, and Oklahoma becomes very attractive to companies doing business."

A case in point was the announcement in March that Paycom, a human-resources management software firm, would add a $16 million expansion of its current Oklahoma City headquarters, creating 123 new jobs over the next five years. Stacey Pezold, Paycom's chief operating officer, hailed the "diversity of talent" in Oklahoma City that is available to the city's largest tech company. Other major recent expansion announcements for Oklahoma City included those by Progrexion, Southwest Airlines, and Dell.

Southwest States Recent Industry Announcements

Companies that have announced new and/or expanded facilities in the Southwest region.

-

Charles Schwab Corp.

Westlake, TXCharles Schwab Corp. is developing a new $100 million regional campus in the Fort Worth suburb of Westlake.

-

Toyota Motor USA

Plano, TXToyota Motor USA has been in the process of relocating about 4,000 sales, marketing, administration, and other white-collar jobs from its former U.S. headquarters in Southern California to Plano, Texas.

-

Whole Foods Market

Austin, TXAustin has leveraged its history as a center of youth and entrepreneurship, along with its status as headquarters of Whole Foods Market.

-

Beanitos

Austin, TXDan Costello, CEO of one fast-growing Austin startup, Beanitos, notes that the city's food and beverage industry has really started to shine in the last several years.

-

Paycom

Oklahoma City, OKIn March 2016 Paycom, a human-resources management software firm, announced it would spend $16 million to expand its current Oklahoma City headquarters, creating 123 new jobs over the next five years.

-

Facebook

Los Lunas, NMThe announcement of a new Facebook data center was a huge prize for New Mexico.

-

Automated Data Processing

Tempe, AZRecent tech announcements in Arizona have included the addition of 1,500 jobs in Tempe, with the opening of a new facility there by Automated Data Processing.

-

McKesson

Phoenix, AZRecent tech announcements in Arizona have included the expansion of McKesson's existing facility in Phoenix.

-

Apple

Mesa, AZArizona is home to more than 50 major data centers including that operated by Apple in Mesa.

-

Charles Schwab

Phoenix, AZArizona is home to more than 50 major data centers including that operated by Charles Schwab in Phoenix.

-

PayPal

Scottsdale, AZArizona is home to more than 50 major data centers including that operated by PayPal in Scottsdale.

New Mexico has benefited from a business-friendly approach by Gov. Susana Martinez, who has been making a concerted effort to attract CEO attention and company locations since she took office in 2011. New Mexico cut business tax rates by 22 percent and strengthened its technology jobs tax credits. A new Rapid Workforce Development fund helps the state close recruitment deals that require highly specialized, trained workforces.

As a result, the state has recently landed facilities for Union Pacific, FedEx, Safelite, Fidelity, and other companies that were looking elsewhere, including Texas. The announcement of a new Facebook data center was a huge prize, too. Martinez also has led the state's export-boosting efforts, which have resulted in New Mexico producing big relative increases in export-related job growth.

Before Martinez took office, she said, CEOs noticed that New Mexico was "very punitive" toward business. This was an especially big problem because the state is heavily dependent on federal largesse through military bases and major research facilities such as the Los Alamos National Laboratory. And New Mexico's biggest business remains oil and gas. "Now CEOs are seeing a whole different environment," Gov. Martinez told Area Development. "They know we want their companies here."

"New Mexico has moved the needle tremendously in the last couple of years," agrees Larry Gigerich, managing director at Ginovus. "Prior to Gov. Martinez, it was a pretty high-tax state overall, and you had either highly skilled workers or very low-skilled workers. There weren't many semi-skilled workers."

Arizona has continued its strong recent economic performance. While the boom times fueled by the arrival of droves of snowbird retirees have leveled off, the state has managed to snare a new kind of growth — in tech facilities and employment.

In fact, Arizona is among national leaders in job growth in the sector that includes data centers and other tech work, as well as the finance-related sector, largely because of a prevalence of insurance company outposts. Recent tech announcements have included the addition of 1,500 jobs in Tempe, with the opening of a new facility there by Automated Data Processing, and the expansion of McKesson's existing facility in Phoenix.

Gov. Doug Ducey and the Arizona legislature also helped the state's pursuit of more tech jobs by streamlining laws that deal specifically with data centers. The state is home to more than 50 major data centers including those operated by PayPal, Charles Schwab, and Apple.

However, White of Site Selection Group warns that the decision by the state's voters in November to raise Arizona's minimum wage to $10 in 2017, and then incrementally to $12 by 2020, could slow employment growth in the data-center and other sectors.