Incentives Fund Wind Energy Projects

Federal and state incentives from the U.S. Department of Energy, American Recovery and Reinvestment Act, and Section 1603 cash grants are propelling wind energy projects forward.

Apr/May 10

The wind energy industry has especially benefited from these incentives. According to the U.S. Department of Energy, the wind industry finished 2009 with 34,863 megawatts of installed capacity, a 37 percent increase from 2008. Fourteen states reached 1,000 megawatts or more of installed capacity, as compared to only seven states that reached that mark in the previous year. Thanks to incentives, Texas and Iowa led the nation for installed capacity in 2009.

Federal Funding

The federal government has lent significant financial support to the wind industry. In a recent survey by the National Renewable Energy Laboratory, 73 percent of the respondents indicated that the new Section 1603 grants, in lieu of production and tax credits, were either "extremely important" or "very important" to renewable energy project development. The dollar figures provided support those responses. Since August, the U.S. Treasury has approved $2.6 billion of Section 1603 grants. Eighty-five percent of the grants have gone to the wind industry, with an average project award of $47 million.

Section 1603 provides cash grants equaling 30 percent of the basis of "specified energy property" (only 10 percent in certain instances). The term "specified energy property" generally includes two broad categories of property: renewable-based electricity production property (IRC Section 45) and qualifying alternative energy credit property (IRC Section 48). More specifically, "specified property" is depreciable (or amortizable in lieu of depreciation), tangible personal property, and other tangible property (excluding buildings) as defined in the Income Tax Regulations. The "tangible personal property" must be an integral part of the facility and must be located at the facility.

To determine the basis of the "specified energy property," the Treasury has adopted the general rules of determining the basis for federal income taxes. Typically, the basis is the cost of the property placed in service after 2008, "unreduced by any other adjustments to basis, such as that for depreciation, and includes all items properly included by the taxpayer in the depreciable basis."

While the Section 1603 grant program will expire on October 1, 2011, eligible projects must commence in 2009 or 2010, and the projects must be serviceable by various credit termination dates. "Placing the property in service" means that the specified energy property is ready and available for its specific use. Where a project contains used parts, the property still qualifies for "original use" if the cost of the used parts is not more than 20 percent of the total cost of the facility.

To be eligible for the Section 1603 Grant, the specified energy property must be originally placed in service by the owner or lessee. The four categories of persons who are not eligible for the Section 1603 Grant are:

• Any federal, state, or local government;

• Any organization described in IRC Section 501(c) and exempt from taxation under IRC Section 501(a);

• A clean, renewable energy bond dealer, or a cooperative electric company;

• Any partnership or pass-thru entity, any direct or indirect partner that is an organization or entity described above, unless the person only owns an indirect interest in the applicant through a blocker sub (i.e., a taxable C corporation).

To attract program beneficiaries, the Treasury has been paying the grants within 60 days of receiving a completed application for property that has been placed in service. The grant is not subject to federal income tax (with exceptions for certain leases), although it may be subject to state income and franchise or gross receipts taxes. Instead, the basis of the "specified energy property" is reduced by an amount equal to 50 percent of the cash grant.

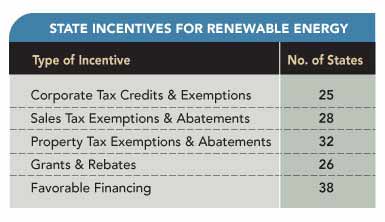

Since 1603 grants are available for projects in all 50 states, individual states compete to attract new wind projects by offering a full range of incentives, including exemptions, credits, grants and rebates, and abatements. According to the Database of State Incentives for Renewable Energy (DSIRE), at least half of states offer incentives. Many states offer a variety of incentives to support specific industries.

Project Announcements

Laser Isotope Separation Technologies Plans Oak Ridge, Tennessee, Uranium Enrichment Operations

01/22/2026

Novartis Plans Winter Park, Florida, Radioligand Manufacturing Operations

01/20/2026

Walmart Upgrades Opelousas, Louisiana, Distribution Operations

01/20/2026

Canada-Based Voltari Marine Electric Plans Bay County, Florida, Operations

01/20/2026

Japan-Based DENSO Expands Lebanon, Tennessee, Logistics Operations

01/20/2026

Infinity Global Expands Danville, Virginia, Headquarters Operations

01/17/2026

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025

-

The New Industrial Revolution in Biotech

Q4 2025