Framework: The Project Development Approach

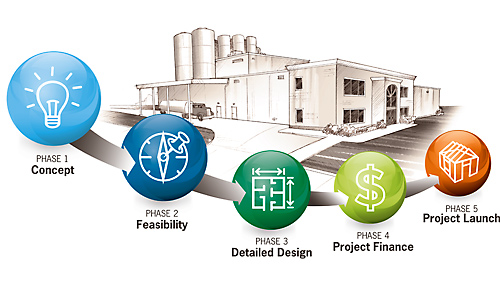

Every large capital spend project can be broken down into phases of execution. These phases combine to create a holistic approach for project development from the initial idea to a level of completion that facilitates funding and include (1) concept, (2) feasibility, (3) detailed design, (4) project finance, and (5) project launch.

It is extremely important that dedicated resources are identified up front, the approach is organized, and due diligence is performed during the early concept and feasibility phases. Subsequent phases will require increased engineering and funding, as well as significant executive-level resource dedication on what may be a point of no (or very expensive) return. The concept and feasibility phases address the foundation of the project’s business model upon which site location decisions are based.

- Clearly outline the business, strategic, and operating objectives of the owner or project stakeholders.

- Establish desired current and future product mix, packaging size, and production volume.

- Map capacity of the processing equipment, storage, utilities, and supporting infrastructure based on both supply side and demand side constraints.

- Define the risks attributed to supply, demand, subsidies programs, and commodity markets.

Often times in food processing, the most impactful drivers will be supply chain, labor cost and availability, and utility service cost and availability. Location Feasibility Analysis: Macro-Level

Depending on your company’s specific situation, the starting point for geography exploration can be anywhere from multi-national to [U.S.] county specific. It is imperative to understand the logistical and financial key drivers of the business to initiate this process. Oftentimes in food processing, the most impactful drivers will be supply chain (raw material in and finished goods out), labor cost and availability, and utility service cost and availability. The good news is that a significant portion of the data is available, and sophisticated tools to process that data exist to assist in narrowing down the macro site suitability effort to be in line with your business objectives.

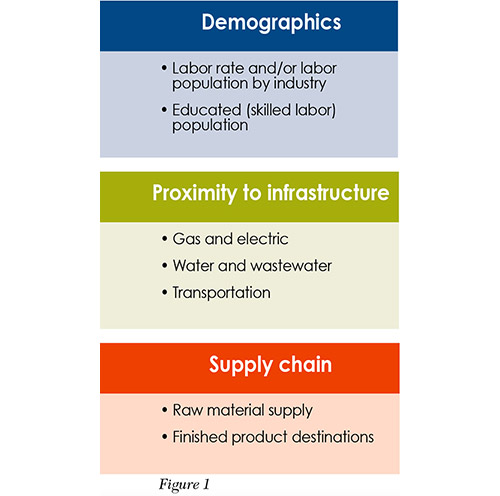

The first step is to construct a dynamic mapping tool which overlays the primary measurable drivers affecting a business. Various data inputs and geographic information systems can be used as tools to evaluate site suitability over a large geographic area. This approach uses criteria such as distance to electric and gas transmission, proximity to an existing wastewater treatment facility, manufacturing labor employment density, raw material transport cost, and potential credits and incentives for which the project qualifies. This data-mapping approach allows you to keep score on the factors that affect location decisions. Figure 1 illustrates the starting point using three primary driver categories that can be assessed over the desired geography.

Next, the management team needs to quantitatively assign weighted scoring to the common-sized criteria that matches the impact to the cash flow within your business model. This second cut provides a clearer picture to the few potential areas that meet operating objectives of the business.

A geographical “heat map” further narrows the search based on criteria that have been specified. The locations identified might not be perfect in the eyes of management, but the process is rooted in data and highlights where the current design basis will be most profitable. This process informs management that the location matters to make their business successful. Using available tools and advisors, it is important to identify sites that meet your business objectives. Collaborating with qualified commercial/industrial brokers, economic development organizations, and even utility representatives can guide you to available sites that meet your identified criteria, both on and off the MLS. The value of the macro-level analysis described above is even more pronounced if a lack of “listed” suitable sites shifts the approach toward finding a “farm field” or other property that can meet your needs.

Site Suitability Analysis: Micro-Level

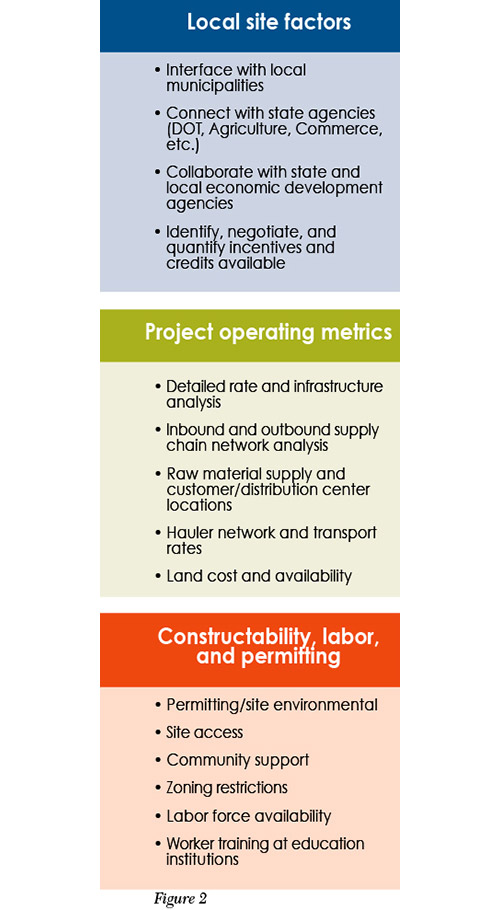

There is still significant due diligence to complete before an economical, buildable site can be selected with both the attributes that meet the logistical needs of your engineering team and the financial feasibility your stakeholders can accept. This next phase focuses on a drill down into the quantitative and qualitative information collected and develops a framework to measure each of the highlighted sites’ impact on the project in the areas described in Figure 2. The first objective is to check any gating qualifications that would cause immediate elimination of a site before advancing to further review, such as:

- Is there a sufficient rail, highway, and/or interstate road network nearby providing access to the site?

- Is it estimated that a qualified labor pool exists to support the number of new positions being created?

- Are gas and electric capacity requirements met with existing transmission infrastructure? If not, are upgrades to the system within reasonable customer contribution amount and timeframe feasible?

- Is there a potential outlet (surface or groundwater) for wastewater direct discharge? If not, is the existing municipal infrastructure (collection system and treatment system) capable of handling facility outflows? If not, are upgrades to the system within reasonable customer contribution amount and timeframe feasible?

- Is there a municipal water supply system to support the facility water needs? If not, is there a potential option for drilling high-capacity wells to provide water? If so, does the water quality meet the desired quality standards?

- Can a site with the desired number of contiguous acres be identified as “for sale” or “potentially for sale”?

- Are there any site characteristics that immediately preclude it from supporting a preferred facility design without major complications (wetlands, access points, proximity of higher density residential communities, etc.)?

- Supply chain (transport) costs

- Gas and electric cost of service based on rate calculations provided (or validated) by utility companies

- Wastewater treatment cost of service (OpEx and CapEx estimates)

- Water supply cost of service

- Geotechnical costs for site prep and foundation design

- Property purchase costs

- Incentives potential (state and local, federal)

While final decisions may not be solely based on calculated lowest cost (NPV), it is an objective analysis rooted in data. The subjective comparison is important to include, but much more difficult to defend in debate among stakeholders.

Finally: Selecting a Site

Building a new facility may be a once in a lifetime event for an organization. Even if you have been through it before, it can be an overwhelming distraction for executive management given the multi-disciplinarian input required to finalize project decisions. By maximizing the use of available data, completing a comprehensive due diligence package, and following a process whereby decision-making is traceable along the way, your company can follow a clear and measurable approach to yield the best return for the project.