CBRE has consulted many FinTech firms as they navigate the site location process, providing unique insight into the priorities that drive them. As with location decisions across other industries, cost, talent, and infrastructure play primary roles. But, while many financial start-ups were once tethered to a few dominant clusters of tech and banking expertise, smaller, less costly options have gained viability, facilitated largely by innovations to worker connectedness and information sharing, as well as a reshuffling of financial talent between markets.

For example, in 2015, the concentration of finance and insurance firms with fewer than 20 employees in Salt Lake City and Oklahoma City exceeded the national average by more than 30 percent, according to the most recent data from the U.S. Census Bureau’s Statistics of U.S. Businesses (SUSB). Denver, Kansas City, Phoenix, and Las Vegas each showed concentrations that were more than 20 percent higher than the national average.

Today’s growing FinTech markets are smaller cities that tend to share a vibrant professional services economy, advanced telecommunications infrastructure, growing pool of college-educated and tech-focused millennials, limited regulatory landscapes, and low taxes. These markets often provide business amenities and opportunities similar to the nation’s largest metropolitan areas, while offering lower costs and greater alignment with the growth patterns of today’s millennial workforce, such as affordable housing and plentiful outdoor recreation options in the Sunbelt and Mountain/West. The most successful markets for FinTech will largely be dependent on the types of skill sets businesses are targeting. Whether it be customer service, sales, tech or executive talent, the strongest markets will have a workforce that aligns to best serve all distinctive skill set and cost requirements, largely irrespective of overall size.

In fact, many of the nation’s largest banking centers, including New York, Chicago, Boston, and San Francisco, still have not returned to pre-recession financial employment, despite a national net increase of 88,000 jobs in the sector between 2006 and 2017, according to annual averages from the U.S. Bureau of Labor Statistics (BLS).

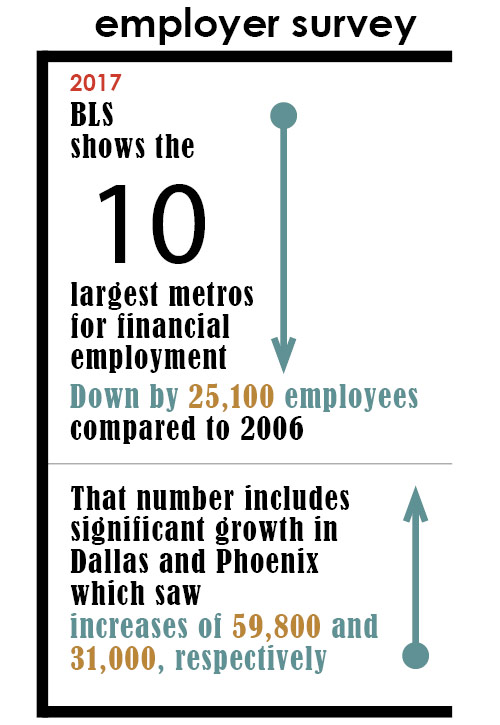

In the most recent data from its employer survey, the BLS shows that the 10 largest metros for financial employment in 2017 were down by 25,100 employees, collectively, compared to 2006 — and that number includes significant growth in Dallas and Phoenix, which saw increases of 59,800 and 31,000, respectively.

Conversely, the next 40 largest metros showed collective growth of 102,700 financial jobs between 2006 and 2017, indicating that much of the post-recession activity in this sector has been redistributed to moderately sized metros like Nashville (+17,600) and Columbus, Ohio (+10,800), and away from the largest markets that historically dominated the industry.

Thriving FinTech Markets

Charlotte, Detroit, and Salt Lake City are well positioned to benefit as FinTech grows as a major economic driver in the years to come.

-

AvidXchange

Charlotte, NCCharlotte has leveraged its financial strength to support more than 70 local FinTech firms, including AvidXchange.

-

LendingTree, Inc.

Charlotte, NCAccording to the Charlotte Chamber, 71 financial institutions based in the metro, including LendingTree, Inc.

-

Quicken Loans Inc.

Detroit, MIOnline mortgage provider Quicken Loans Inc. is headquartered in Detroit and is among other FinTech companies that are calling the Motor City home.

-

Benzinga

Detroit, MILast year, the Detroit-based financial media company Benzinga partnered with the Michigan Economic Development Corporation (MEDC) to form the Detroit FinTech Association, a trade group to promote the city’s budding FinTech ecosystem and provide resources to local entrepreneurs.

-

Goldman Sachs

Salt Lake City, UTSalt Lake City is home to the fourth-largest global location of Goldman Sachs, according to the Economic Development Corporation of Utah (edcUTAH).

While the ideal location for every project or firm will differ, the core attributes of successful, nontraditional FinTech centers can be categorized between “active” and “next-generation” markets. Active markets show large volumes and concentrations of financial services employment paired with significant growth, according to a 2016 CBRE report on the U.S. financial services industry. These markets have excellent supply and quality of talent, but success may also rely heavily on competitive positioning amid upward pressure on wages and high demand for talent. By comparison, next-generation markets show similar signs of financial services growth but are smaller and less costly than their active counterparts. According to the CBRE report, next-generation markets like Kansas City, Indianapolis, and Boise have a stronger-than-traditional base of financial services employment but offer a more “off-the-radar” opportunity to be a preferred employer, typically at lower costs.

Charlotte

Charlotte has long been a financial center. In fact, with 71 financial institutions based in the metro and total assets hitting $2.27 trillion, Charlotte is the third-largest banking center in the U.S., surpassed only by New York City and San Francisco. Today, it also has a burgeoning tech economy that has leveraged its financial strength to support more than 70 local FinTech firms, including AvidXchange and LendingTree, Inc., according to the Charlotte Chamber.

Between 2011 and 2016, Charlotte’s tech occupations grew by an astounding 77.1 percent and millennials in their 20s grew by 13.3 percent, according to CBRE’s 2017 Scoring Tech Talent Report. Despite all this growth, Charlotte’s relative business costs remained 11 percent below the national average, according to the CBRE report — a striking statistic. However, it should be noted that although Charlotte remains one of the nation’s strongest financial centers — and at a significant discount to more mature markets like Manhattan, Los Angeles, and Boston — a successful operation may see significant competition from the dominant presence of existing financial services and FinTech firms.

Detroit

In a region still working to retool its industrial economy for the Information Age, Detroit is emerging as an unlikely counterpoint to the Rust Belt cliché that it once epitomized.

Between 2012 and 2017, Detroit added 16,800 jobs across the financial and “information” industries, which include software companies and data processing firms, according to the BLS. This is 1,600 more jobs than Chicago, a metro with twice Detroit’s population, added in the same industries over the same period — and more than the corresponding job growth in Cleveland, Kansas City, Milwaukee, Minneapolis, Pittsburgh, and St. Louis combined.

Online mortgage provider Quicken Loans Inc. is headquartered here, among other FinTech companies that are calling the Motor City home. Last year, the Detroit-based financial media company Benzinga partnered with the Michigan Economic Development Corporation (MEDC) to form the Detroit FinTech Association, a trade group to promote the city’s budding FinTech ecosystem and provide resources to local entrepreneurs.

Salt Lake City

In recent years, Salt Lake City has harnessed a strong mix of low costs, millennial magnetism, and tech expertise to spur significant growth — both demographically and economically.

Between 2011 and 2017, employment in Salt Lake City’s financial and information industries grew by 20.6 percent, nearly three times the corresponding national increase of 7.6 percent, according to the BLS. Census data show that during this same period, the total population of the Salt Lake City MSA increased by more than 100,000 residents (10.6 percent vs. 5.5 percent nationally) and nearly a quarter of that growth came from migrants — both international and domestic — who have flocked to the metro since 2010.

Salt Lake City is home to the fourth-largest global location of Goldman Sachs, according to the Economic Development Corporation of Utah (edcUTAH), and it also serves as a hub for other major financial institutions.

In CBRE’s 2017 Scoring Tech Talent report, Salt Lake City’s relative business costs are 12 percent below the national average. Additionally, Utah has one of the best tax climates in the nation, ranking #8 in the Tax Foundation’s most recent State Business Tax Climate Index. BLS data show that, among the 50 largest metros by employment, Salt Lake City has the second-lowest median annual salary in business/finance occupations ($58,870) and 15th-lowest salary in computer/math occupations ($77,080). Both figures compare favorably to the corresponding national median salaries of $67,720 and $84,560, respectively.

However, there are signs that Salt Lake City is starting to become more competitive. Historically, costs have remained lower than the national average, but demand for talent is at an all-time high, driven by large expansions of technology and financial services throughout the metro and Lehi Valley. A smaller metro with a labor force of 650,000 and unemployment hovering at 3 percent for the last year, Salt Lake City’s ability for growth is naturally capped and starting to put pressure on existing businesses and new entrants alike.

The metros above are among many showing recent strength in FinTech. As this field has evolved, so too have the markets that support and nurture it. These cities, and metros like them, are well positioned to benefit as FinTech grows as a major economic driver in the years to come.